- An Outline of the DNA Digital Data Storage Market

- Market Definition

- Market Segmentation

- Product Overview

- Assumptions and Abbreviations

- Research Methodology & Approach

- Research Process

- Primary Research

- Service/ Solution Providers

- End Users

- Secondary Research

- Market Size Estimation

- Summary of the Report for Key Decision Makers

- Forces of the Market Constituents

- Factors/Drivers Impacting the Growth of the Market

- Market Trends for Better Business Practices

- Key Market Opportunities for Business Growth

- Based on the sequencing

- Based on the application

- Based on the deployment

- Based on the geographical presence

- Major Roadblocks for the Market Growth

- Decarbonization Strategy and Carbon Credit Benefits for Market Players

- Global Government Decarbonization Plans/Goals by Each Country under 2015 Agreement Agreed by 200 Countries

- Measures taken by Countries to Reduce Carbon Footprints

- Carbon Credits and Subsidy Plans/Benefits Rolled out by the Government for Market Players

- Effective Ways to Harness Carbon-Credits and Impact on Profit Margins

- Demand Impact on the Companies Opting for Carbon Credit

- Government Regulations

- Industry Risk Analysis

- Demand Risk Analysis

- Supply Risk Analysis

- Global Economic Outlook: Challenges for Global Recovery and its Impact on Global DNA Digital Data Storage Market

- Ukraine- Russia Crisis

- Potential US Economic Slowdown

- Analysis on Recent Developments in DNA Digital Data Storage Market

- High-speed microchip by Georgia Tech Research Institute (GTRI)

- Molecular-level similarity search brings computing to DNA data storage

- Scaling up DNA storage by efficiently predicting DNA hybridization using deep learning

- Others

- Industry Supply Chain Analysis

- Investment Analysis

- End User Analysis

- Product Key Feature Analysis

- Competitive Positioning: Strategies to Differentiate a Company from its Competitors

- Competitive Model: A Detailed Inside View for Investors

- Market share of major companies profiled, 2023

- Business Profiles of Key Enterprises

- Illumina, Inc.

- Microsoft Corporation

- GenScript Biotech Corporation

- Ansa Biotechnologies, Inc.

- Catalog Technologies, Inc.

- Twist Bioscience Corporation

- Western Digital Corporation

- Quantum Corporation

- Iridia, Inc.

- imec

- Biomemory SAS

- Molecular Assemblies Inc.

- Other major players

- Global DNA Digital Data Storage Market Outlook & Projections, Opportunity Assessment, 2023-2036

- Market Overview

- Market Revenue by Value (USD million) and Compound Annual Growth Rate (CAGR)

- Global DNA Digital Data Storage Market Outlook & Projections, Opportunity Assessment by Segment

- By Sequencing

- Synthesis, Market Value (USD million), CAGR, 2023-2036F

- Ion Semiconductor, Market Value (USD million), CAGR, 2023-2036F

- Chain Termination, Market Value (USD million), CAGR, 2023-2036F

- Ligation, Market Value (USD million), CAGR, 2023-2036F

- Nanopore Sequencing, Market Value (USD million), CAGR, 2023-2036F

- By Application

- Quality Control, Market Value (USD million), CAGR, 2023-2036F

- Archival, Market Value (USD million), CAGR, 2023-2036F

- Research & Prototyping, Market Value (USD million), CAGR, 2023-2036F

- By Deployment

- Cloud, Market Value (USD million), CAGR, 2023-2036F

- On-premise, Market Value (USD million), CAGR, 2023-2036F

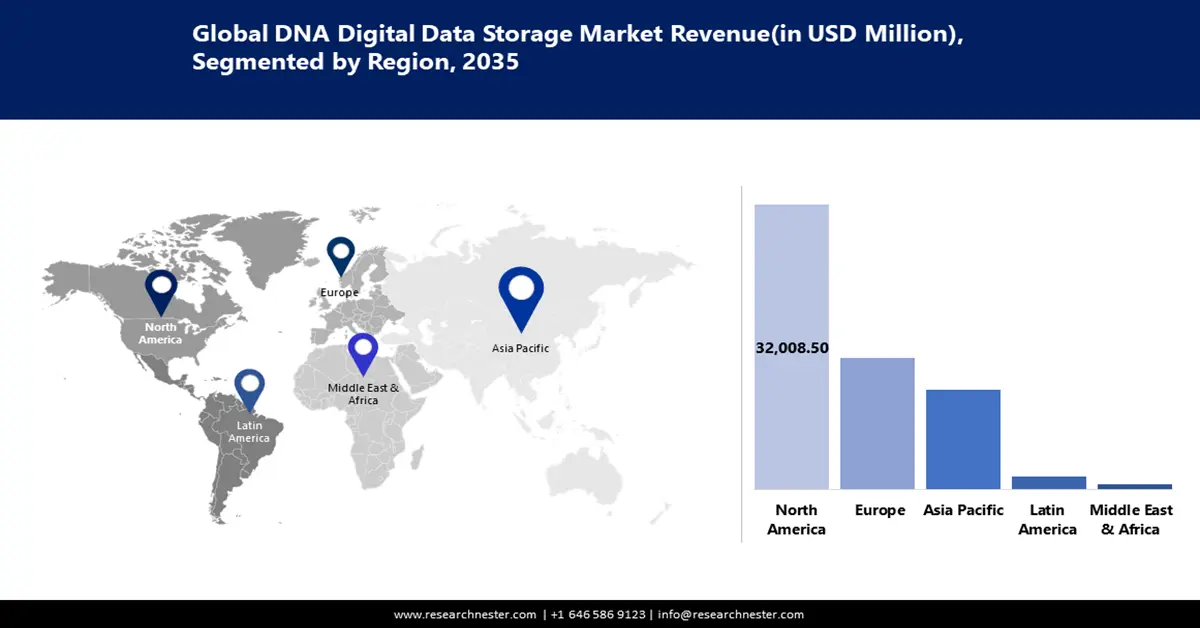

- By Geography

- Market Overview

- Market Revenue by Value (USD million) and Compound Annual Growth Rate (CAGR)

- North America, Market Value (USD million), CAGR, 2023-2036

- Europe, Market Value (USD million), CAGR, 2023-2036F

- Asia Pacific, Market Value (USD million), CAGR, 2023-2036F

- Latin America, Market Value (USD million), CAGR, 2023-2036F

- Middle East & Africa, Market Value (USD million), CAGR, 2023-2036F

- By Sequencing

- Cross Analysis of Application w.r.t. Deployment (USD Million), 2023

- North America DNA Digital Data Storage Market Demand Outlook & Projections, 2023-2036: A Comprehensive Study for Stakeholders

- Market Overview

- Analysis on Recent Advancements in the Region & Impact on Y-O-Y Revenue

- Market Revenue by Value (USD million) and Compound Annual Growth Rate (CAGR)

- North America DNA Digital Data Storage Market Valuation, Business Viewpoint and Forecast by Segment, 2023-2036

- By Sequencing

- Synthesis, Market Value (USD Million), CAGR, 2023-2036F

- Ion Semiconductor, Market Value (USD Million), CAGR, 2023-2036F

- Chain Termination, Market Value (USD Million), CAGR, 2023-2036F

- Ligation, Market Value (USD Million), CAGR, 2023-2036F

- Nanopore Sequencing, Market Value (USD Million), CAGR, 2023-2036F

- By Application

- Quality Control, Market Value (USD Million), CAGR, 2023-2036F

- Archival, Market Value (USD Million), CAGR, 2023-2036F

- Research & Prototyping, Market Value (USD Million), CAGR, 2023-2036F

- By Deployment

- Cloud, Market Value (USD Million), CAGR, 2023-2036F

- On-premise, Market Value (USD Million), CAGR, 2023-2036F

- By Country

- United States, Market Value (USD Million), CAGR, 2023-2036F

- Canada, Market Value (USD Million), CAGR, 2023-2036F

- By Sequencing

- Europe DNA Digital Data Storage Market Demand Outlook & Projections, 2023-2036: A Comprehensive Study for Stakeholders

- Market Overview

- Analysis on Recent Developments in the Region & Impact on Y-O-Y Revenue

- Market Revenue by Value (USD million) and Compound Annual Growth Rate (CAGR)

- Europe DNA Digital Data Storage Market Valuation, Business Viewpoint and Forecast by Segment, 2023-2036

- By Sequencing

- By Application

- By Deployment

- By Country

- United Kingdom, Market Value (USD million), CAGR, 2023-2036F

- Germany, Market Value (USD million), CAGR, 2023-2036F

- France, Market Value (USD million), CAGR, 2023-2036F

- Italy, Market Value (USD million), CAGR, 2023-2036F

- Spain, Market Value (USD million), CAGR, 2023-2036F

- Russia, Market Value (USD million), CAGR, 2023-2036F

- Netherlands, Market Value (USD million), CAGR, 2023-2036F

- Rest of Europe, Market Value (USD million), CAGR, 2023-2036F

- Asia Pacific DNA Digital Data Storage Market Demand Outlook & Projections, 2023-2036: A Comprehensive Study for Stakeholders

- Market Overview

- Analysis on Recent Developments in the Region & Impact on Y-O-Y Revenue

- Market Revenue by Value (USD million) and Compound Annual Growth Rate (CAGR)

- Asia-Pacific DNA Digital Data Storage Market Valuation, Business Viewpoint and Forecast by Segment, 2023-2036

- By Sequencing

- By Application

- By Deployment

- By Country

- China, Market Value (USD million), CAGR, 2023-2036F

- India, Market Value (USD million), CAGR, 2023-2036F

- Japan, Market Value (USD million), CAGR, 2023-2036F

- South Korea, Market Value (USD million), CAGR, 2023-2036F

- Singapore, Market Value (USD million), CAGR, 2023-2036F

- Australia, Market Value (USD million), CAGR, 2023-2036F

- Rest of Asia Pacific, Market Value (USD million), CAGR, 2023-2036F

- Latin America DNA Digital Data Storage Market Demand Outlook & Projections, 2023-2036: A Comprehensive Study for 2023-2036

- Market Overview

- Analysis on Recent Developments in the region & Impact on Y-O-Y Revenue

- Market Revenue by Value (USD million) and Compound Annual Growth Rate (CAGR)

- Latin America DNA Digital Data Storage Market Valuation, Business Viewpoint and Forecast by Segment, 2023-2036

- By Sequencing

- By Application

- By Deployment

- By Country

- Brazil, Market Value (USD million), CAGR, 2023-2036F

- Mexico, Market Value (USD million), CAGR, 2023-2036F

- Argentina, Market Value (USD million), CAGR, 2023-2036F

- Rest of Latin America, Market Value (USD million), CAGR, 2023-2036F

- Middle East & Africa DNA Digital Data Storage Market Demand Outlook & Projections, 2023-2036: A Comprehensive Study for Stakeholders

- Market Overview

- Analysis on Recent Developments in the Region & Impact on Y-O-Y Revenue

- Market Revenue by Value (USD million) and Compound Annual Growth Rate (CAGR)

- Middle East and Africa DNA Digital Data Storage Market Valuation, Business Viewpoint and Forecast by Segment, 2023-2036

- By Sequencing

- By Application

- By Deployment

- By Country

- Israel, Market Value (USD million), CAGR, 2023-2036F

- GCC, Market Value (USD million), CAGR, 2023-2036F

- South Africa, Market Value (USD million), CAGR, 2023-2036F

- Rest of Middle East & Africa, Market Value (USD million), CAGR, 2023-2036F

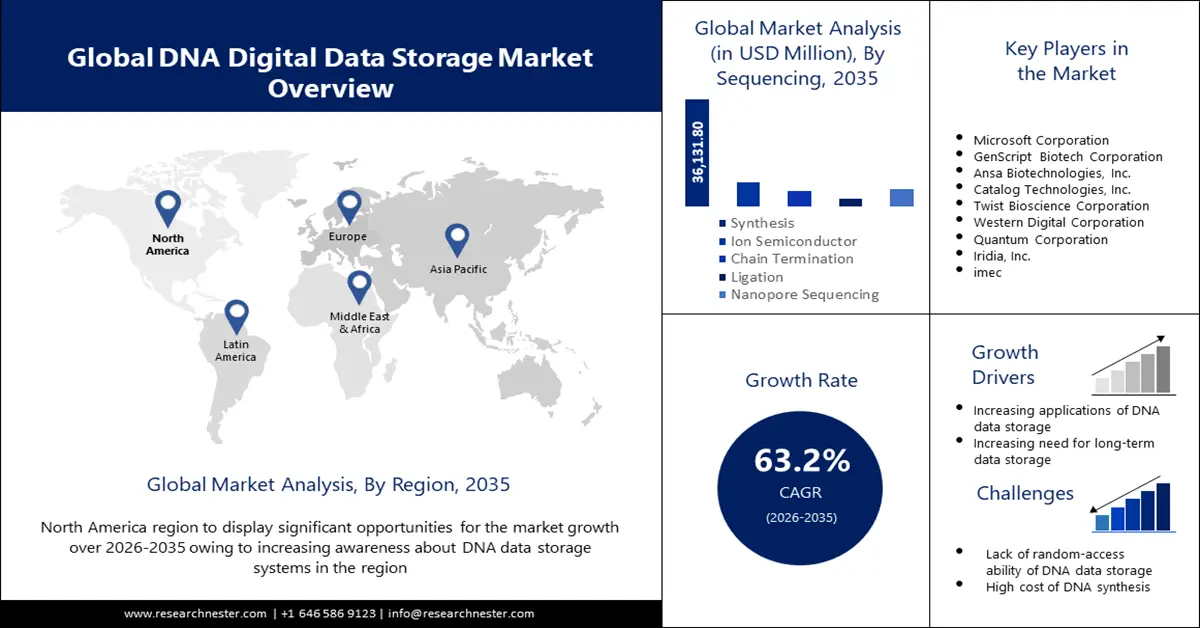

DNA Digital Data Storage Market Outlook:

DNA Digital Data Storage Market size was valued at USD 385.06 million in 2025 and is expected to reach USD 51.61 billion by 2035, expanding at around 63.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of DNA digital data storage is assessed at USD 604.08 million.

The growth of the market can be attributed to the benefits of DNA data storage and the growing investment by organizations to enhance data storage capacity. A surge in the volume of data globally is also expected to drive market growth in the coming years. DNA rapidly expands as it is a scalable, random-access, and error-free data storage method. The data storage crisis will be solved in the following years as a result of DNA's ability to store enormous amounts of data in a very dense medium. In addition, next-generation sequencing improvements have made it possible to read the data encoded in DNA quickly and accurately. For instance, one cubic inch of synthetic DNA can store more than 11 trillion terabytes of data.

In addition to these, factors that are believed to fuel the market growth of DNA digital data storage include presence of service providers for DNA digital data storage and the active participation of market players from all over the world. Moreover, owing to the DNA digital data storage is becoming more popular and used, people in the industry are also looking for new business opportunities by using organic and inorganic business strategies. For instance, in June of 2019, a Boston-based business named Catalog Technologies set a record for DNA data storage by encoding all of Wikipedia (16 gigabytes of data) utilizing inkjet printer-like technology and a novel coding technique that uses various combinations of pre-built DNA molecules (similar to a printing press with movable typefaces).

Key DNA Digital Data Storage Market Insights Summary:

Regional Highlights:

- North America DNA digital data storage market will hold around 30% share by 2035, driven by increasing awareness about DNA data storage systems, advancements in next-generation IT technologies, government initiatives, and strong presence of market players.

- Europe market will exhibit significant growth during the forecast timeline, driven by increased investments in efficient data storage technologies and renowned research institutions in the region.

Segment Insights:

- The synthesis segment in the dna digital data storage market is expected to secure a 28% share by 2035, driven by growing adoption of next-gen sequencing and gene editing technologies.

- The archival segment in the dna digital data storage market is anticipated to experience rapid growth during 2026-2035, fueled by rising global demand for archival DNA data storage.

Key Growth Trends:

- Increasing Applications of DNA Data Storage

- Increasing Investment to Enhance Data Storage Capacity

Major Challenges:

- Lack of Random-Access Ability of DNA Data Storage

- High Cost of DNA synthesis

Key Players: Illumina, Inc., Microsoft Corporation, GenScript Biotech Corporation, Ansa Biotechnologies, Inc., Catalog Technologies, Inc., Twist Bioscience Corporation, Western Digital Corporation, Quantum Corporation, Iridia, Inc., imec, Biomemory SAS, Molecular Assemblies Inc.

Global DNA Digital Data Storage Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 385.06 million

- 2026 Market Size: USD 604.08 million

- Projected Market Size: USD 51.61 billion by 2035

- Growth Forecasts: 63.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (30% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: China, Japan, India, South Korea, Singapore

Last updated on : 8 September, 2025

DNA Digital Data Storage Market Growth Drivers and Challenges:

Growth Drivers

-

Increasing Applications of DNA Data Storage – In end-use industries such as media and entertainment, healthcare and pharmaceuticals, government and defense, financial services and insurance, banking, and others, DNA data storage has become increasingly popular. DNA storage has the potential to be more affordable, energy-efficient, and durable. The need for data storage is growing quickly every day, and it is expected to surge the growth of the market. According to the International Data Corporation, 64 zettabytes of data would have been generated globally in 2020. The demand for storage is increasing by 50% each year.

-

Increasing Investment to Enhance Data Storage Capacity – It is predicted that increasing organizational spending on expanding data storage capacity will spur market growth in the upcoming years. For instance, to solve the problems of traditional electronic media, a Boston-based firm called Catalog was established in 2016 by MIT researchers. Catalog is working to produce an energy-efficient, cost-competitive, and more secure data storage and computation platform utilizing synthetic DNA. Similarly, in November 2022, a seed investment of USD 5.2 million was made in Biomemory, a start-up specializing in synthesizing and storing DNA data, advancing its technology.

-

Increasing Need for Long-Term Data Storage – The world's storage capacity is now unable to keep up with the demand for data storage. A reliable, resource-efficient, energy-efficient, and environmentally friendly data storage solution is provided by the DNA. According to International Data Corporation, the need for data storage will reach around 9 zettabytes (ZB) by 2025.

-

Growing Environmental Benefits of DNA Storage – DNA-based storage methods are less harmful to the environment than servers in data centers. It uses zero energy once the information has been transformed into DNA. In addition, data stored in DNA might theoretically persist for more than 500,000 years. In contrast, traditional magnetic hard drives must be replaced after about ten years because of wear and tear.

-

Increasing Product Launches and Development – Rising partnerships and product development also increase the market. For instance, Los Alamos National Laboratory researchers have developed a critical enabling technology for molecular storage. Adaptive DNA Storage Codex (ADS Codex) is a software that converts data files from the four-letter code biology knows to the binary language of zeros and ones that computers comprehend.

Challenges

- Lack of Random-Access Ability of DNA Data Storage - Owing to its drawbacks, such as high cost, lengthy processing, and lack of random-access capability, DNA data storage is currently restricted. Unlike conventional media such as discs and tape, oligo DNAs lack logical addressing information. Consequently, it is challenging to address the distinct encoded DNA sequence we anticipate having. Meanwhile, random access to DNA-based data storage is crucial, despite oligo DNAs lack this capability, and it is expected to hamper the growth of the market.

- High Cost of DNA synthesis

- Reliance of DNA synthesis in chemical chemistry

DNA Digital Data Storage Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

63.2% |

|

Base Year Market Size (2025) |

USD 385.06 million |

|

Forecast Year Market Size (2035) |

USD 51.61 billion |

|

Regional Scope |

|

DNA Digital Data Storage Market Segmentation:

Sequencing Segment Analysis

The synthesis segment is estimated to gain the largest market share of 28% by the end of 2035. The growth of the segment can be attributed to the increasing application and success of next-generation sequencing and gene editing technologies. In addition, rising demand from the research industry will propel the demand for the segment forward. For instance, genome-wide editing techniques can be interpreted as methods where DNA sequences are changed by deletions, mRNA processing, and post-transcriptional modifications to result in altered gene expression, leading to the functional behavior of proteins. Common to these methods are three basic steps, including mechanisms for genetic tool entry into the cell and later nucleus; altering gene transcription and onward processing functions; and, finally, the end-output in the shape of a suppressed, overexpressed, or simply altered protein product.

Application Segment Analysis

The quality segment is expected to garner a significant share by the end of the year 2035 owing to the growing implementation of DNA, which utilizes data storage for cryptography, stenography, and solving complex computational problems. Moreover, it has been increasing adopted for creating a product and testing the product itself to ensure that the correct parameters are met. The Archival segment, on the other hand, is expected to grow at a rapid pace during the forecast period, owing to the increasing use of DNA for archival storage and rising global demand for archival data storage.

Our in-depth analysis of the global market includes the following segments:

|

By Sequencing |

|

|

By Application |

|

|

By Deployment |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

DNA Digital Data Storage Market Regional Analysis:

North American Market Insights

North America industry is anticipated to dominate majority revenue share of 30% by 2035, The growth of the market can be attributed majorly to the increasing awareness about DNA data storage systems, growing advancements to develop sophisticated next-generation technologies associated with the IT sector, government initiatives to promote end-to-end DNA data storage systems, and the strong presence of market players in the region. The products and launches are also accelerating the growth of the market. For instance, in June 2021, the SYNTAX system, the first benchtop nucleic acid printer utilizing Enzymatic DNA Synthesis (EDS) technology, was the first product DNA Script produced to launch the SYNTAX platform commercially. The 96 DNA oligos produced in parallel by the fully automated, integrated SYNTAX technology are about 60 nucleotides long and delivered prepared for use in molecular biology and genomics workflows.

Europe Market Forecast

Europe region is expected to register significant growth till 2035. The Europe market was valued at USD 24.0 Million in 2023 and is projected to reach USD 14,835.3 million at the end of 2035.The growth of the market can be attributed majorly to the increase in investments in the creation of efficient data storage technologies and the existence of renowned research institutions in the region. Additionally, market participants are investigating cutting-edge techniques and technologies for diagnostic applications. For instance, in April 2021, Imagene, an artificial medical intelligence (AI) firm based in Paris, accelerated the development and commercialization of ArtFun+, an AI program and its predictive biomarkers for cardiovascular imaging, and obtained funding of EUR 1.2 million for the same.

APAC Market Insights

Asia Pacific region is anticipated to observe substantial growth through 2035. The Asia Pacific market was valued at USD 19.4 Million in 2023 and is projected to reach USD 11,226.1 million at the end of 2035. Growing demand for long-term data storage and expanding applications of DNA digital data storage are the main drivers of the Asia-Pacific DNA digital data storage market. As a result, many market players are investing in DNA data storage technologies. The APAC market is driven by firms' active involvement in developing DNA digital data storage through investments, innovation, research, and development.

DNA Digital Data Storage Market Players:

- Illumina, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Microsoft Corporation

- GenScript Biotech Corporation

- Ansa Biotechnologies, Inc.

- Catalog Technologies, Inc.

- Twist Bioscience Corporation

- Western Digital Corporation

- Quantum Corporation

- Iridia, Inc.

- imec

- Biomemory SAS

- Molecular Assemblies Inc.

- Others

Recent Developments

-

CATALOG and Seagate announced a collaboration to investigate DNA-based computing and storage. The collaboration is centered on using Seagate's "lab on a chip" technology to reduce the volume of chemistry required for DNA-based storage and computation.

-

GenScript launched new GMP-grade GenExact single-stranded DNA (ssDNA) and GenWand closed-end linear double-stranded DNA (dsDNA) services. These services were announced with the objective of enabling next-generation gene and cell therapy R&D programmes to advance to IND filing and clinical trials faster and more efficiently.

- Report ID: 3082

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

DNA Digital Data Storage Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.