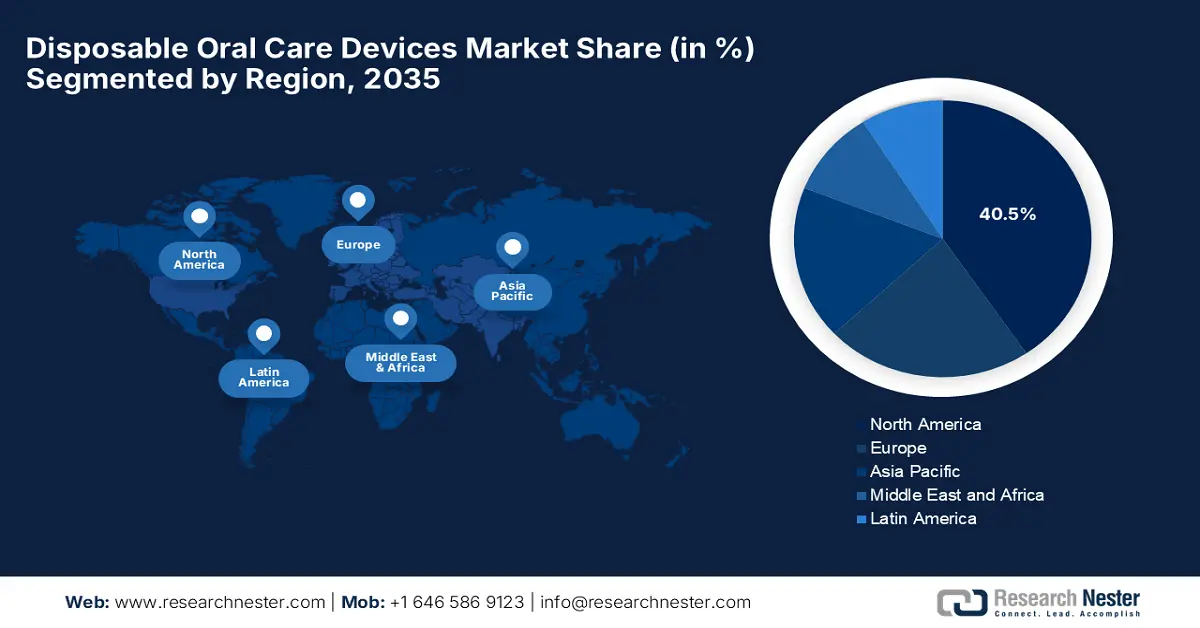

Disposable Oral Care Devices Market - Regional Analysis

North America Market Insights

The North America market is anticipated to garner the largest revenue share of 40.5% of the global disposable oral care devices market by the end of 2035. The growth in the region is backed by robust strategies implemented in hospitals for infection control and long-term care provisions. Testifying to this, the CDC in May 2024 emphasized the importance of single-use or disposable devices in dental care, which are designed for use on one patient during a single procedure and should not be cleaned or reused due to their limited heat tolerance and cleaning concerns.

There is a sustained trajectory for the disposable oral care devices market in the U.S., backed by the presence of robust funding grants and key global pioneers. In 2024, MCHB reported that it funded nine four-year cooperative agreements, which are aimed at improving access to integrated preventive oral health care, especially for high-risk maternal and child health. The funding includes a total grant of USD 1.4 million to the National Maternal and Child Oral Health Resource Center for providing technical assistance across the country, and up to USD 425,000 annually to demonstration projects in seven states and one territory.

In Canada, the disposable oral care devices market is portraying steady growth owing to the combination of factors such as sustainability trends and substantial funding grants. As of the August 2024 Health Canada article, the Oral Health Access Fund is a grants and contributions program designed to complement the country’s dental care plan by expanding access to oral health care for targeted populations facing non-financial barriers. The total budget commitment for the plan is USD 250 million over three years, beginning in 2025, wherein funding is provided through two streams for both treatment and prevention of oral diseases.

APAC Market Insights

The Asia Pacific disposable oral care devices market is anticipated to thrive and register the fastest growth rate during the timeline between 2026 and 2035. The growth of the market is driven by a surge in healthcare infrastructure and rising awareness of infection control practices. China leads the market in the region, and growth is fueled by government initiatives, and there has also been a launch of various education campaigns, fostering the market growth. Furthermore, the old age population is rising in the country and is more susceptible to issues associated with gums and tooth decay, making disposable products highly appealing.

China is displaying huge dominance over the regional disposable oral care devices market owing to the government initiatives and an aging population that is increasingly susceptible to oral health issues. In September 2024, Hongshengyuan (Liaoning) Technology Co., Ltd., developed by CY International, announced that it had inaugurated its new factory in Dandong, which spans around 10,000 square meters and specializes in high-quality direct and indirect restoration materials. Therefore, this milestone marks the company’s global presence in the dental industry, making it suitable for standard market growth.

India has become the central player in the Asia Pacific’s disposable oral care devices market, due to the rising awareness about oral hygiene and the government's focus on improving healthcare infrastructure. As of September 2025, data from the country’s government shows that it has launched the National Oral Health Programme to provide integrated oral health care through existing healthcare facilities. It also stated that the programme aims to equip dental units with skilled professionals and necessary equipment at district and sub-district levels, with support for consumables and training to enhance oral health services.

Utilization of Dental Health Services and Associated Factors Among Adults in Ernakulam District, Kerala 2024

|

Parameter |

Statistic |

Value/Details |

|

Sample Size |

Total participants |

544 |

|

Dental Healthcare Utilization |

Percentage who visited the dentist within ≤1 year |

15.4% ± 2.9% |

|

Age Groups |

18–35 years |

24.3% (132) |

|

36–60 years |

48.2% (262) |

|

|

61+ years |

27.6% (150) |

|

|

Gender |

Male |

42.6% (232) |

|

Female |

57.4% (312) |

Source: Journal of Oral Biology and Craniofacial Research

Europe Market Insights

Europe is anticipated to garner a considerable share of the disposable oral care devices market by the end of 2035, propelled by strict regulations for infection prevention. The amalgamation of factors such as digital interoperability, government funding, and plastic bans is acting as a catalyst for market growth. In September 2021, GSK Consumer Healthcare reported that it had launched the first-ever carbon-neutral toothbrush called Dr.BEST GreenClean, which comprises a handle made from renewable cellulose and tall oil, and bristles that are derived from 100% renewable castor oil, thus a wider market scope.

Germany’s disposable oral care devices market is positioned as the largest revenue-sharing in Europe due to supported reimbursement policies by the German Medical Association. The combination of various factors, such as robust funding mechanisms and sustainability mandates, ensures the dominance of the country in the market in the coming years. In August 2025, DÜRR DENTAL SE notified that it has been named the country’s innovation Champion 2025, taking first place in WirtschaftsWoche’s ranking of the country’s most innovative medium-sized companies. The award, based on an evaluation of over 4,000 firms, recognized the firm for its strong R&D investment and a huge commitment to sustainable technologies.

The U.K. has a huge potential to capitalize on the disposable oral care devices market, effectively fueled by consumer preferences for convenience and hygiene. Besides the products, such as single-use toothbrushes, pre-pasted toothbrushes, and disposable flossers, are extensively utilized in travel, hospitality, and emergency settings. Furthermore, the key pioneers in the country are focusing on innovation and sustainability to meet the rapidly emerging demands of consumers seeking eco-friendly and convenient oral care solutions.