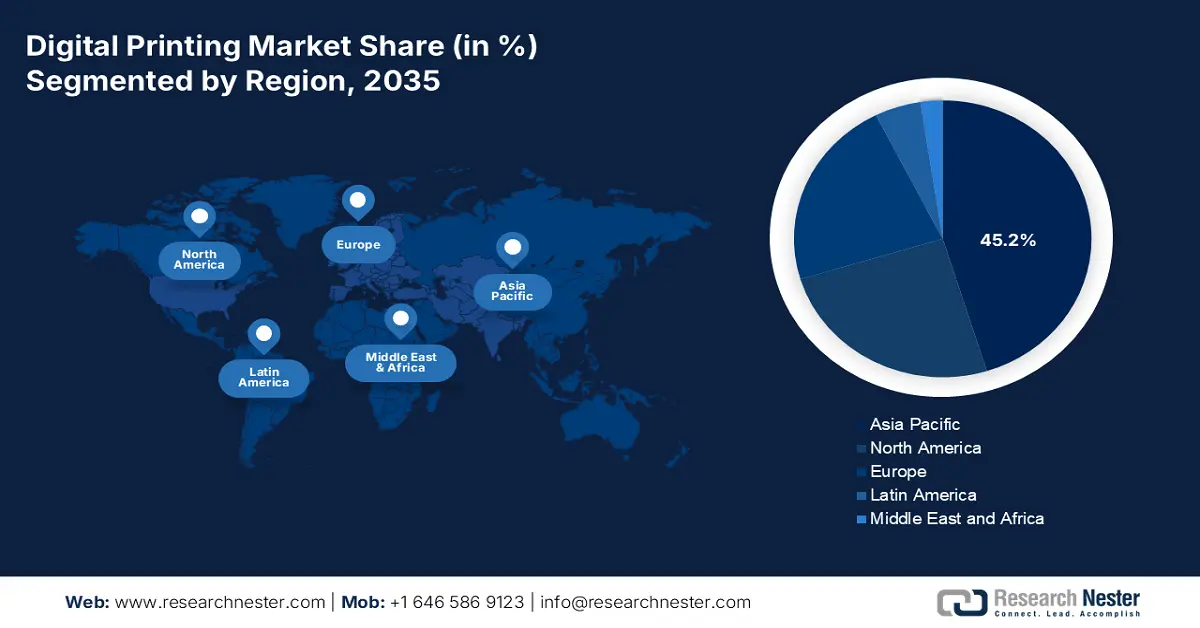

Digital Printing Market - Regional Analysis

APAC Market Insights

The Asia Pacific in the digital printing market is anticipated to hold the largest share of 45.2% by the end of 2035. The market’s growth in the region is highly attributed to the burgeoning domestic consumption, active governmental industrial reforms, and the presence of the world’s manufacturing center. Additionally, the rapid expansion of e-commerce, particularly in India and China, has demanded massive amounts of short-run and versioned packaging. According to a report published by the Asia Development Bank Organization in November 2023, the region accounts for the highest share in retail e-commerce and business-to-consumer (B2C) sector, which is projected to cater to 61.0% of the international total by the end of 2025. Besides, approximately 2.1 billion people in the region utilize e-commerce, which is predicted to surge to 3.1 billion by the end of 2025, thus creating an optimistic outlook for the market’s expansion.

The China-specific digital printing market is growing significantly, owing to the presence of a huge and digitally-savvy domestic consumer base, as well as the topmost industrial policy mandating technological upgradation. Besides, the Ministry of Industry and Information Technology (MIIT) has proactively promoted the integration of digitalized technologies, such as industrial inkjet, into conventional manufacturing through the Made in China 2025 and subsequent policy frameworks. As per an article published by the State Council in March 2024, the industrialization rate about invention patents held by domestic enterprises readily surpassed 50%. This particular rate reached 51.3%, which denotes a 3.2%-point increase from the previous year, as of 2023. Meanwhile, an upsurge in electronic printed circuits supply chain facilities is also responsible for boosting the overall digital printing market in the country.

2023 Electronic Printed Circuits Export and Import Facility

|

Countries |

Export |

Import |

|

China |

USD 22.9 billion |

USD 5.4 billion |

|

Japan |

USD 3.8 billion |

USD 1.3 billion |

|

South Korea |

USD 3.4 billion |

USD 2.1 billion |

|

Thailand |

USD 1.7 billion |

USD 1.9 billion |

|

Vietnam |

USD 1.2 billion |

USD 2.8 billion |

|

Malaysia |

USD 705 million |

USD 2.8 billion |

|

Singapore |

USD 612 million |

USD 938 million |

|

Hong Kong |

USD 1.7 billion |

USD 7.3 billion |

Source: OEC

The India-specific digital printing market is also growing due to the mixture of suitable demographics, a boom in the domestic market, and robust governmental strategies that have aimed at increasing manufacturing as well as formalizing the overall economy. Meanwhile, the government's Production Linked Incentive (PLI) scheme for sectors, such as food processing and textiles, is directly enhancing the need for branded and high-quality packaging, which is usually provided by digital printing. Besides, as per a data report published by the PIB Government in December 2024, micro, small, and medium enterprises (MSMEs) have deliberately exported an outstanding rise from ₹3.9 lakh crore to ₹12.3 lakh crore between 2024 and 2025. This has readily underscored the critical role in bolstering the country’s economy, as well as strengthening the international trade, which in turn is positively impacting the overall digital printing market.

North America Market Insights

North America in the digital printing market is expected to emerge as the fastest-growing region during the forecast period. The market’s development in the region is highly fueled by the rapid implementation of innovative manufacturing technologies, along with the presence of strict regulatory policies. In addition, the huge e-commerce industry's existence, which demands short-run and versioned packaging, robust sustainability mandates, and a mature manufacturing base, are also responsible for the market’s upliftment. As per an article published by the U.S. Department of War in October 2022, manufacturers in the region generously contribute USD 2.3 trillion to the U.S. economy, along with an additional USD 2.7 million. Besides, the Defense Department is focused on maintaining capability for which an investment of USD 372 million as a part of the President’s fiscal 2023 budget to strengthen the region’s supply chains, thereby making it suitable for the market.

The U.S.-based digital printing market is gaining increased traction, owing to the environmental regulations, sustainability funding, generous investment for next-generation materials and advanced manufacturing, and readily promoting workplace safety, as well as technological transition. As per a report published by the EPA Government in August 2025, recognition has been given to technologies for eliminating 830 million pounds of harmful solvents and chemicals, which is sufficient to fill nearly 3,800 railroad tank cars. In addition, 21 billion gallons of water have been saved each year, which has been utilized by 980,000 people yearly. Moreover, 7.8 billion pounds of carbon dioxide equivalents have been eliminated as well, which resulted in taking 770,000 automobiles from the road. Therefore, with such developments in technologies, there is a huge growth opportunity for the market.

The Canada-based digital printing market is also developing due to federal plastic waste regulations, uplifting the circular economy drive, the presence of tactical trade agreements and the Nearshoring opportunity, along with targeted investment in progressive manufacturing and clean technology. For instance, as per the April 2022 Government of Canada article, Canada’s Strengthened Climate Plan invested USD 300 million for more than 5 years, with the intention of ensuring remote, rural, and indigenous communities presently utilizing diesel, which is to be powered by reliable and clean energy by the end of 2030. Additionally, there has been a USD 40.4 million budget provision for more than 3 years to readily support planning and feasibility of grid interconnection. This ensures digital transformation through technologies, such as high-performance computing, 3D printing applications, and digital twins, all of which cater to the market’s upliftment in the country.

Europe Market Insights

Europe in the digital printing market is predicted to witness steady growth by the end of the projected duration. The market’s upliftment in the region is highly driven by emerging as the ultimate hub for regulatory advancement, along with the presence of the Green Deal, which acts as the primary market catalyst. In addition, other policies, including the EU Industrial Strategy and the Circular Economy Action Plan, have pressured an increased transition away from linear production and wasteful models. As stated in the December 2022 UNIDO Organization article, the latest German Supply Chain Due Diligence Act came into force in January 2023. This demanded that German-based organizations recognize and assess environmental violations and rights within the supply chain system, and report and monitor strategies, along with creating risk management approaches. Moreover, the continuous export and import of print production machinery within the region is also boosting the overall market.

2023 Print Production Machinery Export and Import in Europe

|

Countries |

Export (USD Million) |

Import (USD Million) |

|

Germany |

269.0 |

107.0 |

|

Switzerland |

79.0 |

26.4 |

|

Italy |

67.8 |

40.9 |

|

Belgium |

41.2 |

21.7 |

|

Netherlands |

32.5 |

43.9 |

|

UK |

31.2 |

31.7 |

|

France |

28.7 |

45.7 |

|

Poland |

24.9 |

22.9 |

Source: OEC

The digital printing market in Germany is gaining increased exposure, owing to the existence of strict enforcement of regional sustainability directives, domination through premium packaging and automotive sectors, and the presence of the advanced manufacturing industry, with increased focus on Industry 4.0. Besides, the country's Federal Ministry for Economic Affairs and Climate Action has proactively fostered this shift through strategies, such as the Zukunftsfeld Chemie, for funding sustainable industrial processes development. According to the June 2025 BKV report, the German Chemical Industry Association in Frankfurt focused on investment in research and development (R&D), which is projected to surge to €16.5 billion by the end of 2025. Besides, spending by the Chemical Industry Fund (FCI) amounted to €14 million, comprising an estimated €2 million in funding for data science, which in turn, is suitable for the market’s growth.

The digital printing market in Poland is also growing due to the recovery funding provision, regional cohesion, huge nearshoring of manufacturing from west-based locations, along with a cost-competitive and skilled labor force. Besides, according to the 2022 Europe Commission report, the organization has provided an optimistic assessment of the country’s resilience and recovery plan by readily disbursing €23.9 billion in grants, along with €11.5 billion in loans under the Recovery and Resilience Facility (RRF). Additionally, as stated in the October 2025 Europe Parliament article, the Polish national recovery and resilience plan (NRRP) has provided €59.8 billion, of which €25.3 billion is in grants and €34.5 billion in loans. Besides, the €24.5 billion amount, which is more than 69% higher than the initially approved amount, takes into consideration the financial contribution, thereby bolstering the market successfully.