Digital Printing Market Outlook:

Digital Printing Market size was over USD 33 billion in 2025 and is estimated to reach USD 63.2 billion by the end of 2035, expanding at a CAGR of 7.5% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of digital printing is assessed at USD 35.4 billion.

The international digital printing market is witnessing a transformative extension, which is propelled by a fundamental shift from massive production to personalization. This transformation is about speed, cost, and an increase in the demand for data-driven, sustainable, and agile manufacturing solutions across commercial, textiles, and packaging print. For instance, in November 2024, the Bionics Research Center team at the Korea Institute of Science and Technology (KIST) collaborated with researchers to develop a bio-ink-based inkjet print head. This has been possible by utilizing the piezoelectric material PMN-PZT to print hydrogels, with a 32μm diameter. In addition, the printing speed is 1.2 m/s, which is approximately 60 times rapid than conventional methods, thus making it suitable for bolstering the overall digital printing market globally.

Furthermore, the rise in sustainable printing, integration of the Internet of Things (IoT) and artificial intelligence (AI), along with the expansion of functional printing, growth of on-demand manufacturing, and the integration of single-pass technology, are other factors driving the digital printing market. According to an article published by NLM in August 2024, 3D printing technology has the capability to save more than 60% of on-site duration and diminish labor by over 70%. Besides, this particular technology in China has been successfully utilized to develop 10 villas within 24 hours with reduced construction waste in comparison to conventional building methods. Meanwhile, the construction sector produces more than 1 billion tons of waste, which is projected to double by the end of 2025, resulting in 2 billion tons waste. Therefore, this denotes a surge in the market’s demand to reduce waste and effectively manage resources.

Key Digital Printing Market Insights Summary:

Regional Insights:

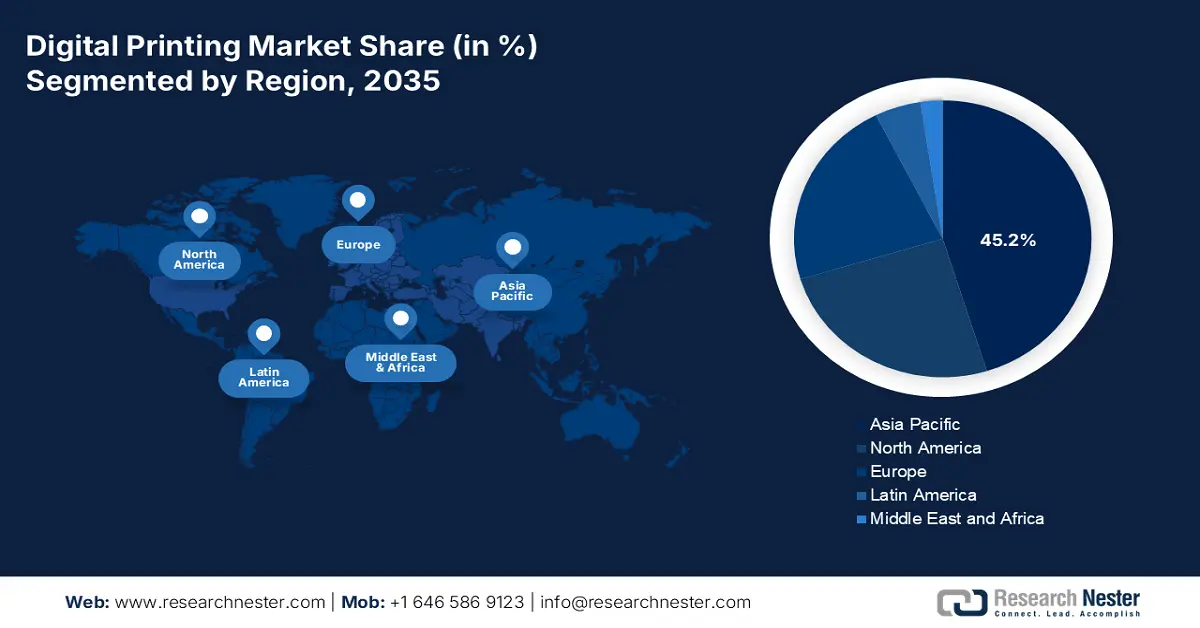

- By 2035, the Asia Pacific region in the digital printing market is forecast to command a 45.2% share, underpinned by rising domestic consumption, industrial reforms, and accelerating e-commerce activity.

- North America is projected to emerge as the fastest-growing region over 2026–2035, sustained by advanced manufacturing adoption, stringent regulatory frameworks, and expanding demand for short-run packaging.

Segment Insights:

- By 2035, the piezoelectric inkjet segment in the digital printing market is expected to account for a 75.8% share, strengthened by its high-precision, heat-free operation and long-lasting printhead performance across diverse materials.

- Inkjet is projected to secure the second-largest share by the end of the forecast period, supported by its fluid-versatile, non-contact architecture and suitability for short-run, high-value printing applications.

Key Growth Trends:

- Proliferation of the e-commerce industry

- Resiliency in the supply chain system

Major Challenges:

- Increased ROI uncertainty and initial capital investment

- Performance and material compatibility restrictions

Key Players: Canon Inc. (Japan), Epson Corporation (Japan), DuPont de Nemours, Inc. (U.S.), BASF SE (Germany), Huntsman Corporation (U.S.), DIC Corporation (Japan), Siegwerk Druckfarben AG & Co. KGaA (Germany), Flint Group (Luxembourg), Sakata INX Corporation (Japan), Toyo Ink SC Holdings Co., Ltd. (Japan), Wikoff Color Corporation (U.S.), Sensient Technologies Corporation (U.S.), Nazdar Company (U.S.), Kornit Digital Ltd. (Israel), FUJIFILM Holdings Corporation (Japan), ALTANA AG (Germany), Marabu GmbH & Co. KG (Germany), Bordeaux Digital PrintInk Ltd. (Israel), JK Group Srl (Italy).

Global Digital Printing Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 33 billion

- 2026 Market Size: USD 35.4 billion

- Projected Market Size: USD 63.2 billion by 2035

- Growth Forecasts: 7.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (45.2% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Indonesia, Mexico

Last updated on : 25 November, 2025

Digital Printing Market - Growth Drivers and Challenges

Growth Drivers

- Proliferation of the e-commerce industry: The seamless growth of online retail has fueled the demand for flexible, short-run, and high-quality packaging to develop a billboard effect during unboxing, which is positively impacting the digital printing market. According to an article published by NLM in November 2022, the environmental impact of e-commerce and conventional in-store shopping has demonstrated that in-store shopping can diminish carbon dioxide emissions by nearly 70% or 84%. Besides, in terms of packaging waste, cardboard and paper wastage account for 10% in South Asia, which is followed by 8% for plastic. Additionally, the majority of waste is discarded in India without segregation, with 75% openly dumped, 4% landfilled, 16% composted, and 5% recycled. Therefore, to overcome increased wastage, the digital printing market’s demand is increasing across different countries.

- Resiliency in the supply chain system: The nearshoring trends, along with the need for rapid time-to-market, are readily encouraging brands to bridge the gap between production and home. This is possible by highly favoring the speed and agility of the digital printing market over offshore and slow analog methods. As stated in an article published by the Blue Intelligence Organization in July 2024, it is expected that the international valuation across overall printed and printed technologies will reach USD 843 billion by the end of 2026. Moreover, the digital twins adoption is also upsurging the printing technology, in connection with cloud-based software and sensors. Based on these, there is continuous export and import of industrial printers, which is also uplifting the overall digital printing market across all nations.

2023 Industrial Printers Export and Import Analysis

|

Countries/Components |

Export (USD Billion) |

Import (USD Billion) |

|

Japan |

10.3 |

- |

|

China |

10.1 |

- |

|

Germany |

5.0 |

4.9 |

|

U.S. |

- |

7.9 |

|

Netherlands |

- |

3.2 |

|

Global Trade Valuation |

48.5 |

|

|

Global Trade Share |

0.2% |

|

|

Product Complexity |

0.7 |

|

Source: OEC

- Increased demand for product personalization: Customers are increasingly expecting customized products, from personalized beverage bottles to unusual apparel. This is a suitable trend that is economically feasible through digital printing. Critically, this transformation is viable, owing to the digitalized printing technology. Besides, conventional analog-based printing methods, such as flexography or offset, heavily depend on expensive physical plates as well as lengthy setup processes. Moreover, digital printing eliminates short production runs and demands no platers, and instead comprises near-instantaneous setup, permitting variable data printing. Based on this, the packaging line can uninterruptedly switch from printing one usual design to the upcoming one without any barrier, thus suitable for bolstering the digital printing market.

Challenges

- Increased ROI uncertainty and initial capital investment: The substantial upfront expense of industrial-based digital printing equipment remains a primary gap to entry, especially for small and medium-sized enterprises (SMEs). While the per-unit expense for short runs is beneficial, the capital outline for a high-speed digital press can be several times that of a conventional press. This has created a huge barrier for printers and converters, for which investments need to be carefully justified. Besides, the ROI aspect is not always immediate and guaranteed; instead, it relies on the ability to gain a continuous volume of high-margin, personalized, and short-run work to utilize the expensive asset. For the majority of businesses, there is a need for a fundamental shift in their client acquisition strategy and business model, shifting away from competing on price for the long run, which negatively impacts the digital printing market.

- Performance and material compatibility restrictions: Despite efficient innovations, the digital printing market continues to witness risks in matching the raw material versatility and absolute performance of a few conventional methods, particularly in industrial and packaging applications. The performance of digital inks is extremely dependent on the substrate, which frequently requires suitable primers, coated, and pre-treatment materials to ensure proper durability, color gamut, and adhesion. In addition, this also adds cost and complication to the production process, and can ensure limitation in employment opportunities. Moreover, for a few high-volume applications, including metal decorating or commodity folding cartons, the absolute printing durability and speed of a complete digital print might not be similar to that of an established analog process.

Digital Printing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.5% |

|

Base Year Market Size (2025) |

USD 33 billion |

|

Forecast Year Market Size (2035) |

USD 63.2 billion |

|

Regional Scope |

|

Digital Printing Market Segmentation:

Printhead Segment Analysis

The piezoelectric inkjet segment, which is part of the printhead, is anticipated to garner the largest share of 75.8% by the end of 2035 in the digital printing market. The segment’s upliftment is highly driven by its capability to deliver high-precision and high-resolution prints without heat, enabling a comprehensive range of materials and inks, along with a long-lasting lifespan for print heads. According to an article published by NLM in October 2023, the Epson I3200-A1 piezoelectric printhead constitutes an inkjet pulse width of 3.5 μs, along with an ink supply pulse width of 4.5 μs, and also a jet frequency, which ranges between 5,000 to 19,000 Hz. This readily ensures suitable print accuracy and better droplet patterns, as well as an increase in the ejection efficiency. Besides, the manufacture of piezoelectric printheads is extremely based on piezoelectric ceramic materials, which is positively impacting the overall segment.

Technology Segment Analysis

By the end of the projected period, inkjet in the technology segment is expected to cater to the second-largest share in the digital printing market. The inkjet’s growth is highly attributed to its unparalleled versatility, permitting it to readily deposit a wide range of fluids, from UV-curable and aqueous links to functional materials, such as conductive polymers. This particular technology is categorized into two essential methodologies, including drop-on-demand, comprising piezoelectric and thermal, along with continuous inkjet. Besides, key growth drivers for inkjet are its non-contact nature, preventing damage to sensitive materials, as well as its suitability for short-run and high-value applications. Meanwhile, ongoing advancement has focused on enhancing speed through single-pass systems that enhance printhead resolution for photographic quality, thereby creating an optimistic outlook for the segment.

Application Segment Analysis

Based on application, the packaging segment in the digital printing market is predicted to hold the third-largest share during the forecast period. The segment’s development is highly propelled by the explosive extension of e-commerce, which requires versioned, short-run, and high-graphic packaging, especially at the time of unboxing. In addition, the overarching trend towards increased personalization and customization, from seasonal packaging designs to limited-edition beverage labels, is feasibly economical through digital printing’s variable data capabilities and plate-less process. Moreover, the existence of strong sustainability mandates is a severe driver, based on which digital printing rapidly diminished waste in obsolescence, overstock, and setup in comparison to conventional analog methods, thus suitable for bolstering the segment’s exposure internationally.

Our in-depth analysis of the digital printing market includes the following segments:

|

Segment |

Subsegments |

|

Printhead |

|

|

Technology |

|

|

Application |

|

|

Ink Type |

|

|

Substrate |

|

|

End user Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Digital Printing Market - Regional Analysis

APAC Market Insights

The Asia Pacific in the digital printing market is anticipated to hold the largest share of 45.2% by the end of 2035. The market’s growth in the region is highly attributed to the burgeoning domestic consumption, active governmental industrial reforms, and the presence of the world’s manufacturing center. Additionally, the rapid expansion of e-commerce, particularly in India and China, has demanded massive amounts of short-run and versioned packaging. According to a report published by the Asia Development Bank Organization in November 2023, the region accounts for the highest share in retail e-commerce and business-to-consumer (B2C) sector, which is projected to cater to 61.0% of the international total by the end of 2025. Besides, approximately 2.1 billion people in the region utilize e-commerce, which is predicted to surge to 3.1 billion by the end of 2025, thus creating an optimistic outlook for the market’s expansion.

The China-specific digital printing market is growing significantly, owing to the presence of a huge and digitally-savvy domestic consumer base, as well as the topmost industrial policy mandating technological upgradation. Besides, the Ministry of Industry and Information Technology (MIIT) has proactively promoted the integration of digitalized technologies, such as industrial inkjet, into conventional manufacturing through the Made in China 2025 and subsequent policy frameworks. As per an article published by the State Council in March 2024, the industrialization rate about invention patents held by domestic enterprises readily surpassed 50%. This particular rate reached 51.3%, which denotes a 3.2%-point increase from the previous year, as of 2023. Meanwhile, an upsurge in electronic printed circuits supply chain facilities is also responsible for boosting the overall digital printing market in the country.

2023 Electronic Printed Circuits Export and Import Facility

|

Countries |

Export |

Import |

|

China |

USD 22.9 billion |

USD 5.4 billion |

|

Japan |

USD 3.8 billion |

USD 1.3 billion |

|

South Korea |

USD 3.4 billion |

USD 2.1 billion |

|

Thailand |

USD 1.7 billion |

USD 1.9 billion |

|

Vietnam |

USD 1.2 billion |

USD 2.8 billion |

|

Malaysia |

USD 705 million |

USD 2.8 billion |

|

Singapore |

USD 612 million |

USD 938 million |

|

Hong Kong |

USD 1.7 billion |

USD 7.3 billion |

Source: OEC

The India-specific digital printing market is also growing due to the mixture of suitable demographics, a boom in the domestic market, and robust governmental strategies that have aimed at increasing manufacturing as well as formalizing the overall economy. Meanwhile, the government's Production Linked Incentive (PLI) scheme for sectors, such as food processing and textiles, is directly enhancing the need for branded and high-quality packaging, which is usually provided by digital printing. Besides, as per a data report published by the PIB Government in December 2024, micro, small, and medium enterprises (MSMEs) have deliberately exported an outstanding rise from ₹3.9 lakh crore to ₹12.3 lakh crore between 2024 and 2025. This has readily underscored the critical role in bolstering the country’s economy, as well as strengthening the international trade, which in turn is positively impacting the overall digital printing market.

North America Market Insights

North America in the digital printing market is expected to emerge as the fastest-growing region during the forecast period. The market’s development in the region is highly fueled by the rapid implementation of innovative manufacturing technologies, along with the presence of strict regulatory policies. In addition, the huge e-commerce industry's existence, which demands short-run and versioned packaging, robust sustainability mandates, and a mature manufacturing base, are also responsible for the market’s upliftment. As per an article published by the U.S. Department of War in October 2022, manufacturers in the region generously contribute USD 2.3 trillion to the U.S. economy, along with an additional USD 2.7 million. Besides, the Defense Department is focused on maintaining capability for which an investment of USD 372 million as a part of the President’s fiscal 2023 budget to strengthen the region’s supply chains, thereby making it suitable for the market.

The U.S.-based digital printing market is gaining increased traction, owing to the environmental regulations, sustainability funding, generous investment for next-generation materials and advanced manufacturing, and readily promoting workplace safety, as well as technological transition. As per a report published by the EPA Government in August 2025, recognition has been given to technologies for eliminating 830 million pounds of harmful solvents and chemicals, which is sufficient to fill nearly 3,800 railroad tank cars. In addition, 21 billion gallons of water have been saved each year, which has been utilized by 980,000 people yearly. Moreover, 7.8 billion pounds of carbon dioxide equivalents have been eliminated as well, which resulted in taking 770,000 automobiles from the road. Therefore, with such developments in technologies, there is a huge growth opportunity for the market.

The Canada-based digital printing market is also developing due to federal plastic waste regulations, uplifting the circular economy drive, the presence of tactical trade agreements and the Nearshoring opportunity, along with targeted investment in progressive manufacturing and clean technology. For instance, as per the April 2022 Government of Canada article, Canada’s Strengthened Climate Plan invested USD 300 million for more than 5 years, with the intention of ensuring remote, rural, and indigenous communities presently utilizing diesel, which is to be powered by reliable and clean energy by the end of 2030. Additionally, there has been a USD 40.4 million budget provision for more than 3 years to readily support planning and feasibility of grid interconnection. This ensures digital transformation through technologies, such as high-performance computing, 3D printing applications, and digital twins, all of which cater to the market’s upliftment in the country.

Europe Market Insights

Europe in the digital printing market is predicted to witness steady growth by the end of the projected duration. The market’s upliftment in the region is highly driven by emerging as the ultimate hub for regulatory advancement, along with the presence of the Green Deal, which acts as the primary market catalyst. In addition, other policies, including the EU Industrial Strategy and the Circular Economy Action Plan, have pressured an increased transition away from linear production and wasteful models. As stated in the December 2022 UNIDO Organization article, the latest German Supply Chain Due Diligence Act came into force in January 2023. This demanded that German-based organizations recognize and assess environmental violations and rights within the supply chain system, and report and monitor strategies, along with creating risk management approaches. Moreover, the continuous export and import of print production machinery within the region is also boosting the overall market.

2023 Print Production Machinery Export and Import in Europe

|

Countries |

Export (USD Million) |

Import (USD Million) |

|

Germany |

269.0 |

107.0 |

|

Switzerland |

79.0 |

26.4 |

|

Italy |

67.8 |

40.9 |

|

Belgium |

41.2 |

21.7 |

|

Netherlands |

32.5 |

43.9 |

|

UK |

31.2 |

31.7 |

|

France |

28.7 |

45.7 |

|

Poland |

24.9 |

22.9 |

Source: OEC

The digital printing market in Germany is gaining increased exposure, owing to the existence of strict enforcement of regional sustainability directives, domination through premium packaging and automotive sectors, and the presence of the advanced manufacturing industry, with increased focus on Industry 4.0. Besides, the country's Federal Ministry for Economic Affairs and Climate Action has proactively fostered this shift through strategies, such as the Zukunftsfeld Chemie, for funding sustainable industrial processes development. According to the June 2025 BKV report, the German Chemical Industry Association in Frankfurt focused on investment in research and development (R&D), which is projected to surge to €16.5 billion by the end of 2025. Besides, spending by the Chemical Industry Fund (FCI) amounted to €14 million, comprising an estimated €2 million in funding for data science, which in turn, is suitable for the market’s growth.

The digital printing market in Poland is also growing due to the recovery funding provision, regional cohesion, huge nearshoring of manufacturing from west-based locations, along with a cost-competitive and skilled labor force. Besides, according to the 2022 Europe Commission report, the organization has provided an optimistic assessment of the country’s resilience and recovery plan by readily disbursing €23.9 billion in grants, along with €11.5 billion in loans under the Recovery and Resilience Facility (RRF). Additionally, as stated in the October 2025 Europe Parliament article, the Polish national recovery and resilience plan (NRRP) has provided €59.8 billion, of which €25.3 billion is in grants and €34.5 billion in loans. Besides, the €24.5 billion amount, which is more than 69% higher than the initially approved amount, takes into consideration the financial contribution, thereby bolstering the market successfully.

Key Digital Printing Market Players:

- HP Inc. (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Canon Inc. (Japan)

- Epson Corporation (Japan)

- DuPont de Nemours, Inc. (U.S.)

- BASF SE (Germany)

- Huntsman Corporation (U.S.)

- DIC Corporation (Japan)

- Siegwerk Druckfarben AG & Co. KGaA (Germany)

- Flint Group (Luxembourg)

- Sakata INX Corporation (Japan)

- Toyo Ink SC Holdings Co., Ltd. (Japan)

- Wikoff Color Corporation (U.S.)

- Sensient Technologies Corporation (U.S.)

- Nazdar Company (U.S.)

- Kornit Digital Ltd. (Israel)

- FUJIFILM Holdings Corporation (Japan)

- ALTANA AG (Germany)

- Marabu GmbH & Co. KG (Germany)

- Bordeaux Digital PrintInk Ltd. (Israel)

- JK Group Srl (Italy)

- HP Inc. is regarded as the foundational player that has fundamentally shaped the market by pioneering its HP Thermal Inkjet technology as well as proprietary ink portfolios. The organization has leveraged its international hardware domination to develop integrated ecosystems, drive recurring consumables revenue, and ensure performance. Besides, as stated in its 2024 annual report, the organization generated USD 2.8 in fiscal 2024 GAAP diluted net earnings per share, along with USD 53.6 billion in net revenue, and USD 3.7 billion in net cash.

- Canon Inc. is regarded as one of the topmost technology leaders, well-known for its Piezo printhead technology, as well as the OEM manufacturer of printheads for other industrial companies. Its generous contributions are significant in advancing the application and reliability range of industrial inkjet printing, especially in packaging and graphics.

- Epson Corporation is considered a notable innovator, recognized for perfecting its very own PrecisionCore MicroTFP printhead technology, which offers high-quality and high-speed output. The firm’s focus is on developing high-capacity and durable ink systems, which have made it the dominating force in the textile, label, and commercial printing segments. Therefore, based on these achievements, the firm, as per its 2024 annual report, generated USD 8.6 million in revenue, USD 463,171 in profitability before tax, USD 722,403 as overall wide-ranging income, along with 6.8% as return on equity.

- DuPont de Nemours, Inc. is a notable material science expert, readily supplying critical components, such as innovative polymers and films, which are suitable for functional and durable prints. Its contribution in creating specialty inks and substrates has enabled applications in high-performance industrial printing and flexible electronics.

- BASF SE is one of the international chemical giants, along with a notable supplier of high-performance pigments, additives, and resins that form the foundation of digital printing inks. The organization has driven advancement in sustainability, developing environmentally and bio-based compliant ink solutions for the textile and packaging sectors.

Here is a list of key players operating in the global market:

The international digital printing market is intensely competitive and highly fragmented, which is further characterized by technological advancements and tactical consolidation. Notable players, such as Epson, Canon, and HP, have leveraged their respective hardware domination to effectively develop proprietary ink ecosystems and have ensured recurring revenue generation. Meanwhile, chemical giants, including DIC and BASF, readily compete through extended R&D in high-performance and sustainable ink formulations, such as water-based and UV-curable inks. Besides, in October 2024, Ricoh Company, Ltd. declared the establishment of the latest organization, which is Ricoh Printing Solutions Europe Limited. This particular section is poised to monitor the industrial printing business in Europe, and will significantly consolidate notable functions that are related to industrial printing, thus suitable for the digital printing market globally.

Corporate Landscape of the Digital Printing Market:

Recent Developments

- In November 2024, Global Inkjet Systems Ltd notified its newest alliance with 360 Digital Printing Innovations India, with the intention of introducing the latest inkjet technology to businesses and successfully converting inkjet distribution across the whole of India.

- In September 2024, Seiko Epson Corporation significantly declared that it has entered into a strategic deal with affiliates of Siris Capital Group, LLC, which include Electronics for Imaging, Inc., for achieving the interests of Fiery, LLC.

- In March 2024, HP Inc. announced a new evolution for digital printing, with the current lineup of HP-based digital printing presses as well as intelligent solutions, which have been designed to cater to the current production risks in commercial printing, packaging, and labels sectors.

- Report ID: 3720

- Published Date: Nov 25, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Digital Printing Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.