Digital Logistics Market Outlook:

Digital Logistics Market size was over USD 48.2 billion in 2025 and is projected to reach USD 298.7 billion by 2035, witnessing a CAGR of 20% during the forecast period, i.e., between 2026-2035. In 2026, the industry size of digital logistics is estimated at USD 57.8 billion.

The global digital logistics industry is experiencing considerable shifts, influenced by changes in trade patterns and supply chain structures. The World Trade Organization (WTO) has noted that the emerging economies around the world are expanding participation in global value chains by importing raw materials and exporting finished goods. The shift in trade forces highlights the surging interdependence of international trade networks.

The rising research and development is a prominent catalyst for digital logistics by fostering technological innovations. Continuous research and development in AI and ML have enabled logistics service providers to streamline routes and mitigate project disruptions. Additionally, the amalgamation of IoT sensors and blockchain has increased real-time traceability. Collectively, these innovations are revolutionizing logistics into an advanced data-enabled ecosystem, aiding them in propelling productivity and increasing resilience.

Key Digital Logistics Market Insights Summary:

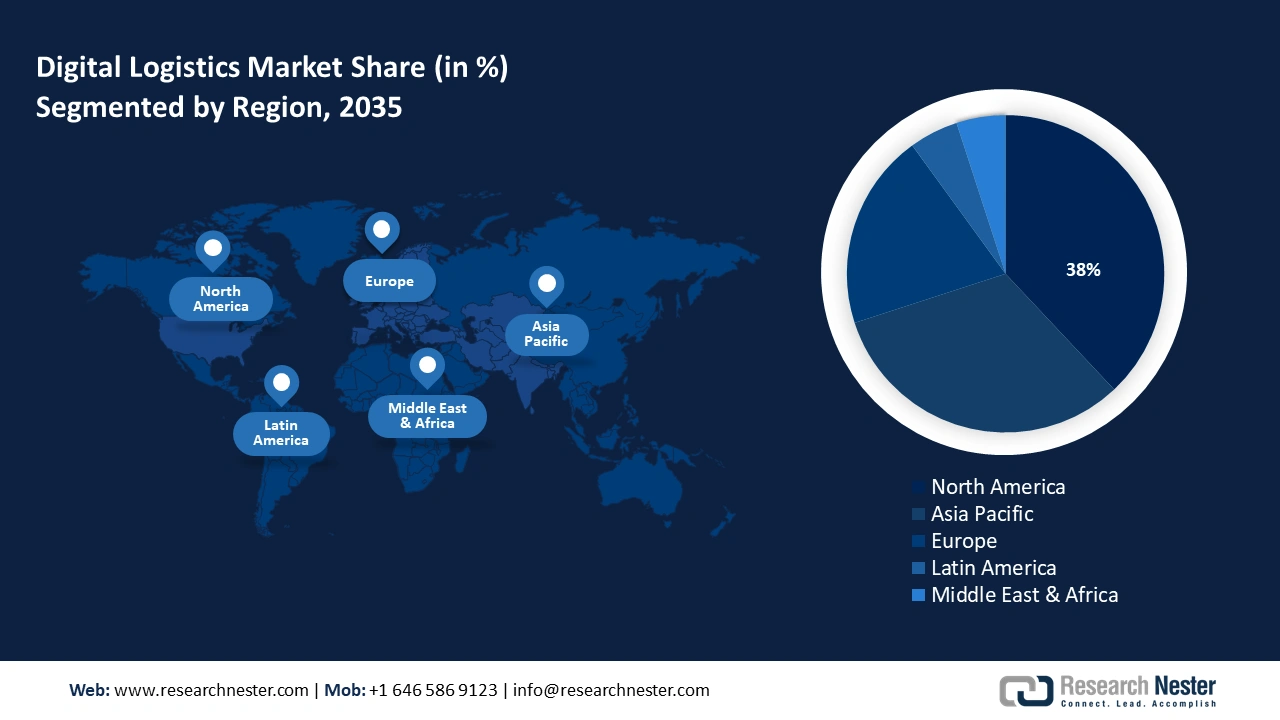

Regional Highlights:

- By 2035, North America is expected to command a 38% revenue share in the Digital Logistics Market, attributable to high adoption of advanced digital solutions.

- Throughout 2026–2035, APAC is poised to grow at a 13.6% CAGR, underpinned by the expanding e-commerce sector.

Segment Insights:

- By 2035, the IoT segment in the Digital Logistics Market is anticipated to achieve a 55.4% revenue share, propelled by improved supply chain visibility.

- By 2035, the third-party logistics segment is set to capture a 40.3% revenue share, sustained by the rise of e-commerce and globalization.

Key Growth Trends:

- Increase in e-commerce driving digital logistics adoption

- Adoption of autonomous freight technologies

Major Challenges:

- Inadequate infrastructure and addressing systems in developing regions

- Fragmentation in information flow

Key Players: FedEx Corporation, United Parcel Service (UPS), Deutsche Post DHL Group, DB Schenker, Kuehne + Nagel International AG, XPO Logistics, DSV Panalpina, Maersk Group, Toll Group, Blue Dart Express Limited, TCI Express, CJ Logistics, Samsung SDS, Yusen Logistics Co., Ltd., Pos Malaysia Berhad.

Global Digital Logistics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 48.2 billion

- 2026 Market Size: USD 57.8 billion

- Projected Market Size: USD 298.7 billion by 2035

- Growth Forecasts: 20% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38% Share by 2035)

- Fastest Growing Region: APAC

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, United Arab Emirates, South Korea, Singapore, Brazil

Last updated on : 7 October, 2025

Digital Logistics Market - Growth Drivers and Challenges

Growth Drivers

- Increase in e-commerce driving digital logistics adoption: The market is impacted by the exponential growth of e-commerce across the world, fueled by post-pandemic ease of restrictions, which shifted consumer behavior, leading to heightened purchases through e-commerce. The growth of e-commerce sales globally requires logistics to ensure there is no disruption in operations. In that regard, companies such as Amazon have remained at the forefront of investments in logistics supported by AI to cut down delivery times. Additionally, an analysis of the market trends highlights that the logistics providers that are proactive in leveraging digital technologies assist in improving supply chain visibility. According to the International Trade Administration, global B2C e-commerce is projected to garner USD 5.5 trillion by 2027.

- Adoption of autonomous freight technologies: The market is favorably influenced by the amalgamation of autonomous vehicles into freight transport. The trend has ensured that constraints plaguing logistics, such as labor shortages, are fixed. Moreover, companies such as Volvo and DHL Supply Chain are at the forefront of initiating driverless trucks in the U.S. by utilizing advanced sensors to ensure 360-degree detection of obstacles. To ensure sustained growth and benefit from the expansion of the digital logistics sector, firms are continuing investments in autonomous vehicle technologies to further eradicate labor challenges.

- Rapid integration of IoT for real-time tracking and monitoring: The inclusion of IoT is emerging as a prominent growth driver, facilitating upgradation in the logistics market globally. For example, in June 2024, the Chhattisgarh Medical Services Corporation Ltd. declared the successful implementation of a GPS-based tracking system to facilitate a smooth delivery of medicines across the state in India. The successful use cases highlight a reduction in operational risks, as well as improvements in supply chain transparency, both of which are significant requirements in achieving ESG goals. Cumulatively, these factors are augmenting the growth of the market.

Challenges

- Inadequate infrastructure and addressing systems in developing regions: In numerous developing countries, the lack of a well-established infrastructure, such as addressing systems and high-quality roadways for logistics, can impair the expansion of the digital logistics sector. For instance, UNCTAD’s assessments have highlighted that in nations such as Nepal and Samoa, urban areas make up the bulk of e-commerce activities due to limitations in transport infrastructure. Despite the challenge, the growth of infrastructure in emerging economies, such as India, is expected to negate the challenge by opening the avenues for new regional markets.

- Fragmentation in information flow: A key feature of digital logistics is its reliance on information exchange across various stakeholders. Concerning the reliance, SBIR.gov has noted that logistical information and processes are dispersed, causing limitations in sharing between groups. Additionally, the lack of standardized data formats has exacerbated the constraint, causing widespread inefficiencies. Due to the persistence of this challenge, key players tend to prefer operating in economies with an established information flow, although the push to create standardization in emerging economies is expected to successfully negate the challenge.

Digital Logistics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

20% |

|

Base Year Market Size (2025) |

USD 48.2 billion |

|

Forecast Year Market Size (2035) |

USD 298.7 billion |

|

Regional Scope |

|

Digital Logistics Market Segmentation:

Technology Segment Analysis

The IoT segment is slated to hold a dominant 55.4% revenue share by the end of 2035. The integration of IoT in logistics has ensured a paradigm shift in operations. IoT assists in improved supply chain visibility, along with greater operational efficiency. Additional challenges plaguing the global digital logistics market are successfully mitigated by the application of IoT, such as ushering in improvements in supply chain efficiency. In 2023, a bibliometric analysis on PubMed Central highlighted the prominence of IoT applications in solving logistics challenges such as shipment delays. The cloud-based IoT providers are predicted to experience a surge in demand to improve logistics by the end of 2035. Other than this, data published by the European Government in 2021, 29% of the enterprises in the EU use IoT systems or devices.

Service Type Segment Analysis

The third-party logistics segment of the digital logistics market is anticipated to account for 40.3% of the revenue by the end of 2035. The 3PL companies are to utilize technologies such as AI, IoT, and blockchain. The digital tools are allowing for real-time tracking and data-enabled aiding businesses to lower operational costs. With the rise of e-commerce and globalization, companies are turning to 3PL partners to handle warehousing and transportation. Moreover, the 3PL segment is rising as a key enabler of seamless and tech-driven logistics ecosystems. This is further positioning the segment as the dominant contributor to the market’s growth by 2035.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Technology |

|

|

Service Type |

|

|

End-use industry |

|

|

Deployment Model |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Digital Logistics Market - Regional Analysis

North America Market Insights

The North America digital logistics market is slated to hold a 38% revenue share by the end of 2035 and maintain its position as a leading market. The regional market’s dominance is attributed to high adoption rates of advanced digital solutions. Additionally, North America’s market is characterized by the presence of industry leaders, impacting the overall growth curve. The regional market is also impacted by the advent of AI, IoT, and blockchain in logistics operations. The opportunities are expected to be rife due to initiatives such as the Smart City Challenge of the U.S. Department of Transportation. Among major companies, FedEx has inculcated AI to facilitate demand forecasting, whilst UPS utilizes IoT devices for real-time tracking.

The U.S. market growth is attributed to the proactive adoption of advanced digital solutions to curb impediments in the supply chains and logistics operations. A notable factor contributing to the growth is the adoption of humanoid robots in logistics operations. Prominent companies such as Agility Robotics have included robots for logistics and warehouse roles, in a bid to eradicate labor shortages in physically demanding jobs. In Canada, policy reports are making regulatory reforms to encourage the establishment of the digital infrastructure. The report published by the C.D. Howe Institute in 2024 on the National Supply Chain Action Plan for Canada emphasizes promoting the usage of advanced technology and automation across the supply chain.

APAC Market Insights

The APAC digital logistics market is estimated to register the fastest growth throughout the forecast period at a CAGR of 13.6%. Countries such as China, India, and Japan have been at the forefront of growth in APAC. Major drivers of the regional market are the boom of e-commerce along with rapid urbanization. In terms of lucrative regional markets, China leads. The Made in China 2025 initiative emphasized the adoption of smart logistics technologies, whilst in India, the Digital India campaign has actively promoted the use of digital platforms across multiple sectors. Another lucrative market in APAC is Japan, where national digitalization efforts are slated to create opportunities for key players in the market. China is leading the market and offering lucrative opportunities with the rising e-commerce market in the country. According to the International Trade Administration, a country’s e-commerce market reached USD 2.2 trillion. Furthermore, a major USD 5 billion China-UAE partnership announced in 2025 anchors AI, cloud, and logistics initiatives, accelerating the sophistication of supply chains.

The India digital logistics market is poised to expand its revenue share throughout the forecast period. Additionally, the government has implemented exemplary schemes to develop connectivity across the country, propelling the overall logistics operation. With the service economy and e-commerce sector thriving in the country, digital logistics solutions are projected to experience greater demand. Moreover, in September 2022, the National Logistics Policy was launched to transform the country’s logistics. A Unified Logistics Interface Platform is designed to include 30 existing logistics systems, and as of August 2025, the platform has facilitated over 160 crore digital transactions, bolstered transparency, and streamlined logistics operations.

Europe Market Insights

The market in Europe is propelled by the swift integration of technological advancements and widespread e-commerce expansion. According to the World Bank’s Logistics Performance Index (LPI) Indicator in 2022, the region has a high Logistics Performance Index (LPI) infrastructure score of 3.6. This score highlights the region's impeccable and resilient trade and transport-associated infrastructure, including ports, roads, and information technology systems. In the UK, the market growth is propelled by significant infrastructure investments. For instance, DHL has invested USD 290 million in February 2025, in novel e-commerce in the near by vicinity of Coventry Airport. The new state-of-the-art e-commerce hub is projected to create more than 600 jobs for the local community.

Germany is favored with its central position and resilient road and rail infrastructure. According to data published by the government in 2022, inland waterways carried goods of worth 182 million tonnes while volume of goods loaded through German sea ports reached 279.1 million tonnes. By utilizing digital logistics tools, various companies are trying to manage capacity, and remain equipped to adapt to altered transport patterns, and enhance overall supply chain efficiency, reinforcing Germany’s position as a leading logistics hub in Europe.

Key Digital Logistics Market Players:

- FedEx Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- United Parcel Service (UPS)

- Deutsche Post DHL Group

- DB Schenker

- Kuehne + Nagel International AG

- XPO Logistics

- DSV Panalpina

- Maersk Group

- Toll Group

- Blue Dart Express Limited

- TCI Express

- CJ Logistics

- Samsung SDS

- Yusen Logistics Co., Ltd.

- Pos Malaysia Berhad

The global digital logistics sector remains competitive, with prominent players embracing proactive strategies to expand revenue share. Companies such as FedEx, UPS, and DHL are industry leaders, due to well-established logistics networks and extensive customer bases. Among recent developments, FedEx’s use of autonomous delivery vehicles and UPS's investment in smart routing highlight the growth of the overall digital logistics sector. The table below highlights the major players in the market. Here is a list of major market players:

Recent Developments

- In April 2025, FedEx launched FedEx Surround® Monitoring & Intervention. This is a real-time monitoring system with an AI-powered dashboard that provides customers with enhanced visibility and control over their shipments.

- In October 2025, DHL unveiled a new Innovation Center in Bonn to develop and apply technologies that make supply chains smarter, more sustainable, and more resilient. DHL’s latest advancements – including artificial intelligence (AI), robotics, Internet of Things (IoT), and technologies that drive sustainability – and serves as a cornerstone in DHL Group’s Strategy 2030.

- Report ID: 3286

- Published Date: Oct 07, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Digital Logistics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.