Digital Intraoral Sensors Market Outlook:

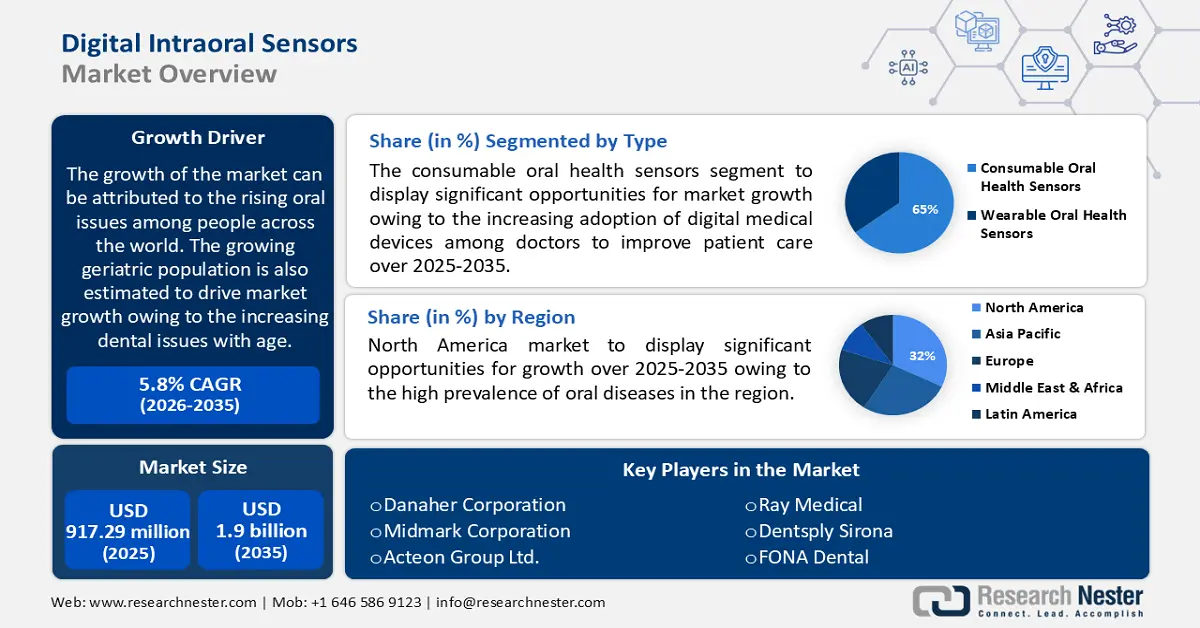

Digital Intraoral Sensors Market size was over USD 317.52 million in 2025 and is poised to exceed USD 642.34 million by 2035, witnessing over 7.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of digital intraoral sensors is estimated at USD 338.38 million.

The growth of the market can be attributed to the rising oral issues among people across the world. The growing geriatric population is also estimated to drive market growth owing to the increasing dental issues with age. According to the estimations, about 1 in 5 adults with age 65 and above lost all their teeth, and it was twice as prevalent in people with 75 and above in 2021 U.S. Dental sensors help to maintain accuracy, efficiency, and versatility for doctors, and provide convenience, cost-effectiveness, and ease for the patient.

The increasing demand for digital sensors in the healthcare sector owing to the benefits over conventional radiography X-rays is estimated to drive market growth in the coming years. The increasing number of oral disorders and other tooth diseases are estimated to fuel the market across the world. The high consumption of sugary foods and beverages leads to tooth decay and cavities and is also estimated to hike the growth of the market. The number of people suffering from caries in their permanent teeth around the globe is estimated to be over 1.8 billion as of 2023 as per the data of the World Health Organization. The increasing number of people suffering from tooth decay, formation of plaque, and irregular brushing habits are rising the risk of dental issues thereby propelling the market growth in the coming years.

Key Digital Intraoral Sensors Market Insights Summary:

Regional Highlights:

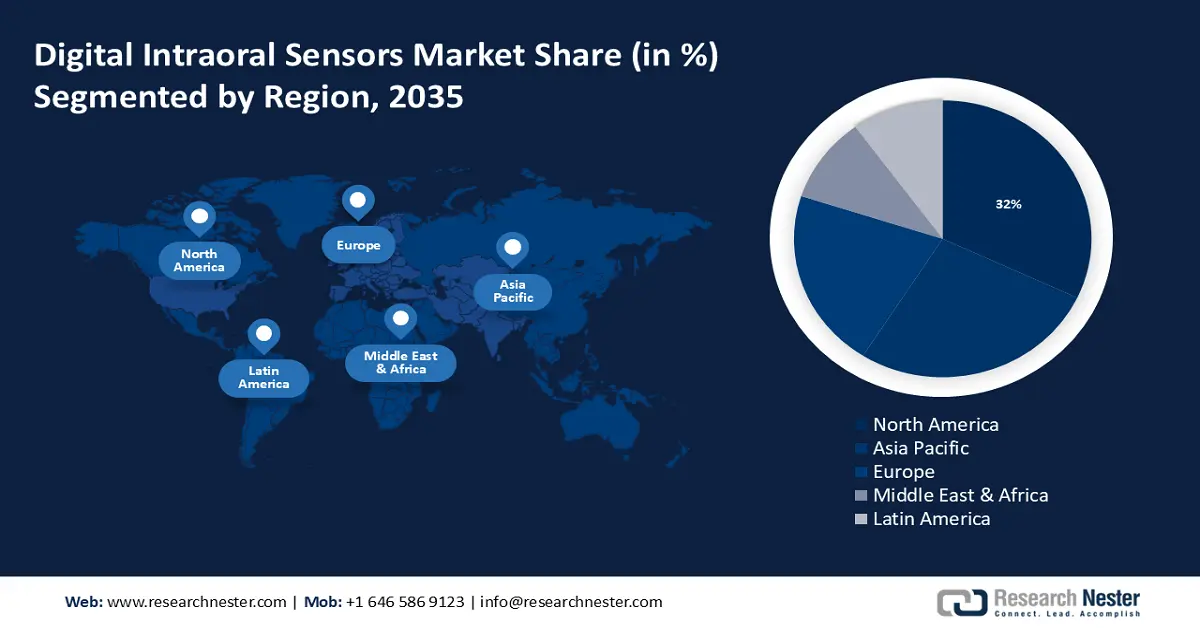

- North America’s digital intraoral sensors market will hold around 32% share by 2035, driven by high oral disease prevalence and dental professional density.

- Asia Pacific market will capture a 27% share by 2035, fueled by high oral cancer rates and improving healthcare infrastructure.

Segment Insights:

- The dental clinics segment in the digital intraoral sensors market is expected to achieve a 39% share by 2035, driven by the rise in dental procedures and growing number of dental practitioners.

- The consumable oral health sensors segment in the digital intraoral sensors market is expected to secure a 35% share by 2035, attributed to the increasing adoption of digital dental devices and rising dental issues.

Key Growth Trends:

- Rising Dental Issues among People Owing to Poor Oral Hygiene

- High Incidence of Severe Periodontal Diseases across the World

Major Challenges:

- High Initial Cost of Investment

- Maintenance of Software and Hardware of the System

Key Players: KaVo Dental GmbH, Carestream Dental, LLC, Danaher Corporation, Midmark Corporation, Acteon Group Ltd., Ray Medical, Dentsply Sirona, FONA Dental, Suni Medical Imaging, Inc., DÃœRR DENTAL SE.

Global Digital Intraoral Sensors Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 317.52 million

- 2026 Market Size: USD 338.38 million

- Projected Market Size: USD 642.34 million by 2035

- Growth Forecasts: 7.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (32% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, China

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 9 September, 2025

Digital Intraoral Sensors Market Growth Drivers and Challenges:

Growth Drivers

- Rising Dental Issues among People Owing to Poor Oral Hygiene – The lack of awareness of people about the impact of oral hygiene on the physical health and a growing number of people suffering from teeth diseases are estimated to fuel the market growth. The growing number of people eating sugary foods and spicy foods causes the damaged tooth to create further complications. The increasing elderly population with tooth loss and unable to eat is estimated to rise the market growth. It is reported that 1 in 4 adults in the U.S. is suffering from dental cavities which is more than 25% of the US population as of 2022.

- High Incidence of Severe Periodontal Diseases across the World – The incidence of severe periodontal diseases in adults around the world is estimated to affect over 18% of the people which is over 1 billion cases as of 2023.

- Rising Number of People with Changed Lifestyles and Food Habits – More than 35% of American adults are estimated to consume ready-to-eat meals as of 2020.

- Increased Consumption of Tobacco and Accumulation of Bacteria in Teeth – The number of people consuming tobacco or smoking cigarettes was estimated to be over 38 million in the U.S. as of 2022.

- Increasing Road and Sports Injuries Leading to Tooth Breaking – The prevalence rate of tooth fractures to permanent teeth across the world is reported to be over 6 to 57% as of 2020.

Challenges

- High Initial Cost of Investment – The initial cost of digital equipment is estimated to be the major disadvantage of the market. Dental imaging equipment requires software, hardware, and digital imaging sensors that are highly expensive. Also, the repair, maintenance, and software updates are high in cost.

- Maintenance of Software and Hardware of the System

- Thickness and Rigidity of Digital Detector Causing Discomfort

Digital Intraoral Sensors Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.3% |

|

Base Year Market Size (2025) |

USD 317.52 million |

|

Forecast Year Market Size (2035) |

USD 642.34 million |

|

Regional Scope |

|

Digital Intraoral Sensors Market Segmentation:

Type Segment Analysis

The global digital intraoral sensors market is segmented and analyzed for demand and supply by type into wearable and consumable oral health sensors. Out of these, the consumable oral health sensors segment is estimated to gain the largest market share of about 35% in the year 2035. The growth of the segment can be attributed to the increasing adoption of digital medical devices among doctors to improve patient care. Also, the rising number of people suffering from dental problems including cavities, plaque, tooth decay, loose teeth, and wisdom issues are estimated to drive the market segment growth. The increasing use of consumable oral health sensors owing to the increasing preference of people to get straight and aligned teeth to look beautiful is estimated to hike the market growth. The growing use of oral care products such as prostheses, biomaterials, endo, ortho, and periodontic products is anticipated to drive market growth in the coming years. The value of oral care products in the year 2021 as per the estimations was over USD 30 billion.

End-user Segment Analysis

The global digital intraoral sensors market is also segmented and analyzed for demand and supply by end-user into dental clinics, laboratories, and others. Amongst these three segments, the dental clinics segment is expected to garner a significant share of around 39% in the year 2035. As per the estimations, there are more than 185,800 dentists in the U.S. in the year 2023 with an increase of over 1% from the year 2022. The increasing number of dental doctors to solve various dental and oral disorders is estimated to fuel market growth. The market segment growth is attributed to the escalating number of teeth replacements and root canal surgeries to reduce the infection of tooth decay. The growing population suffering from a lack of vitamins, and minerals in their diet causing early tooth loss in adults less than 40 years is also propelling the segment growth. The lack of fluoride in water and the rising elderly population is also the reason for market segment growth during the forecast period.

Our in-depth analysis of the global market includes the following segments:

|

By Type |

|

|

By Sensor Type |

|

|

By Application |

|

|

By End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Digital Intraoral Sensors Market Regional Analysis:

North American Market Insights

North America industry is predicted to account for largest revenue share of 32% by 2035. The growth of the market can be attributed majorly to the high prevalence of oral diseases, including oral cancer in countries, such as the United States, and Canada. According to the American Cancer Society, about 54,010 new cases of oral cavity cancer were reported in 2021, with over 10,850 deaths caused by oral cancer. This is one of the prominent growth drivers for the market in the region. Moreover, the high number of dentists present in the United States is estimated to further boost the market growth. The United States has more than 6o dentists per 100,000 people, presently. Furthermore, the fast adoption of advanced technology in the healthcare sector in developed countries is also estimated to be a major growth driver for the market. The increasing awareness among people of physical attire and self-grooming is estimated to drive market growth.

APAC Market Insights

The Asia Pacific digital intraoral sensors market is estimated to be the second largest, registering a share of about 27% by the end of 2035. The growth of the market can be attributed majorly to the high cases of oral cancer and other diseases in the region. India, Pakistan, Bangladesh, and China are among the top 5 countries with the highest rate of oral cancer, owing to the high consumption of tobacco in the region. Moreover, improving the healthcare sector in developing countries is estimated to fuel market growth in the upcoming years. The increasing educational awareness regarding oral disorders and the impact of oral health on the whole body is estimated to fuel market growth. The increasing number of dental clinics in the region with the growing economic standards of the nation and the people is also expected to propel the market growth in the coming years. Moreover, the market growth is attributed to the rising beauty standards of people across Asia and especially in South Korea raises the demand for good teeth. Also, Koreans believe that everyone deserved to look good and attractive and spend a lot of money on beauty corrections including their smile and teeth alignment.

Europe Market Insights

Europe region is likely to register significant growth till 2035. The market growth can be attributed majorly to the high number of dentists in the region. As per the reports, Sweden has the world’s highest number of dentists which was over 17 dentists for every 10,000 people as of 2020. The rising number of people suffering from oral health issues such as periodontitis, especially in the elderly population is estimated to propel the market growth during the forecast period. The increasing number of people having oral cancer most common in men of the region is propelling the market growth. The market growth is also attributed to the incidence of oral diseases such as tooth decay, plaque formation, and excessive fluoride-causing tooth damage. Europe is estimated to have the worst oral care among people with children under 12 with missing teeth, or decayed teeth.

Digital Intraoral Sensors Market Players:

- KaVo Dental GmbH

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Carestream Dental, LLC

- Danaher Corporation

- Midmark Corporation

- Acteon Group Ltd.

- Ray Medical

- Dentsply Sirona

- FONA Dental

- Suni Medical Imaging, Inc.

- DÜRR DENTAL SE

Recent Developments

-

Midmark Corporation launched a new Extraoral Imaging System (EOIS) product with an add-on option of 2D panoramic, 3D CBCT imaging X-ray devices and cephalometric features. This helps the dentists to create a 3D moment of their own whenever needed.

-

Carestream Dental, LLC introduced a portable generator CS 2400P* that is small and portable with a battery-free innovation. This was estimated to provide a powerful X-ray beam with high-quality images and easy handling.

- Report ID: 3529

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Digital Intraoral Sensors Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.