Digiceuticals Market Outlook:

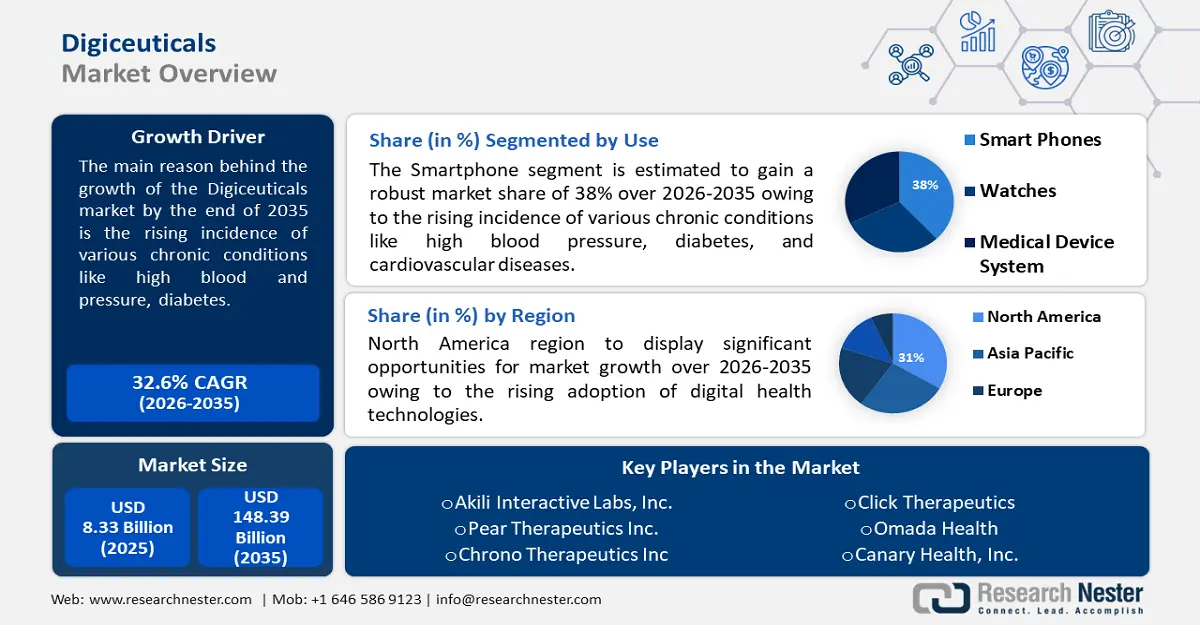

Digiceuticals Market size was over USD 8.83 billion in 2025 and is poised to exceed USD 148.39 billion by 2035, growing at over 32.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of digiceuticals is estimated at USD 11.42 billion.

The market expansion can be attributed to the rising incidence of various chronic conditions like high blood pressure, diabetes, and cardiovascular diseases.

Digiceuticals are used for continuous monitoring and management of diseases by keeping track of vital signs, such as blood pressure, heart rate, and glucose levels, and providing personalized advice on managing chronic diseases. According to World Health Organization, diabetes and renal disease caused an estimated 2 million deaths in 2019. As these numbers continue to rise there, it has created a demand for digital healthcare technology such as digiceuticals to conveniently access healthcare professionals, which can help ensure that patients receive timely advice and care.

Digiceuticals provide individualized treatment regimens and treatments based on personal health information. Rising consumer awareness and need for individualized healthcare have boosted demand for Digiceuticals. Consumers are taking a more proactive approach to maintaining their health and looking for individualized solutions.

Key Digiceuticals Market Insights Summary:

Regional Highlights:

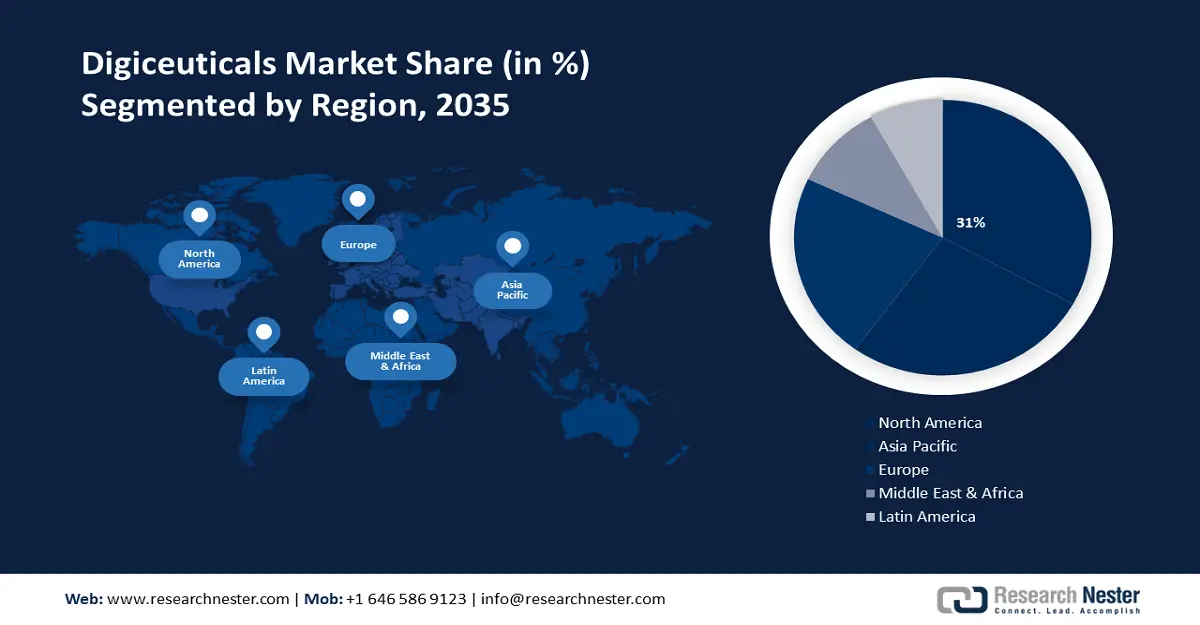

- North America digiceuticals market will hold more than 31% share by 2035, driven by the adoption of digital health technologies.

- Asia Pacific market will achieve a 27% share by 2035, driven by rising lifestyle-related diseases and preventive healthcare awareness.

Segment Insights:

- The smartphones segment in the digiceuticals market is expected to hold a 38% share by 2035, driven by the increasing number of smartphone users equipped with health monitoring sensors.

- The diabetes management (digiceuticals) segment in the digiceuticals market is projected to hold a 29% share by 2035, attributed to the rising prevalence of diabetes and awareness about preventive healthcare measures.

Key Growth Trends:

- Increasing adoption of wearable technology

- Rise in use of mobile health apps

Major Challenges:

- Increasing adoption of wearable technology

- Rise in use of mobile health apps

Key Players: Pear therapeutics Inc., Akili Interactive Labs, Inc., Chrono Therapeutics Inc., Click Therapeutics, Omada Health, Canary Health, Inc., Glooko, Inc., Propeller helath, Welldoc, Voluntis.

Global Digiceuticals Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 8.83 billion

- 2026 Market Size: USD 11.42 billion

- Projected Market Size: USD 148.39 billion by 2035

- Growth Forecasts: 32.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (31% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, United Kingdom, Japan, France

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 16 September, 2025

Digiceuticals Market Growth Drivers and Challenges:

Growth Drivers

-

Increasing adoption of wearable technology - Wearable technology have revolutionized the healthcare industry by providing real-time health monitoring and tracking capabilities. These devices, such as smart watches and fitness trackers, enable individuals to monitor their vital signs, activity levels, and sleep patterns, empowering them to take control of their health and well-being.

According to a study over 22% of Americans make use of smart watches or wearable fitness trackers. In the year 2019 consumers in the United States purchased, over 52 million units of fitness trackers, including both smart watches and fitness bands. - Rise in use of mobile health apps - Mobile health apps have become increasingly popular as a tool for managing health and wellness. As of 2019 over 2.6 billion individuals across the globe possessed smartphones, with a staggering 52% of them having mobile health applications installed on their devices. These apps allow users to track their exercise, monitor their diet, and receive personalized health recommendations. They also provide access to a wealth of health information and resources, making it easier for individuals to make informed decisions about their health.

As people are increasingly relying on their mobile devices for health information, there has been a rise in the use of mobile health apps. This has enabled the development of digital therapeutics, which are apps that are designed to help people with chronic illnesses manage their symptoms. - The rising popularity of remote patient monitoring (RPM) systems - Remote patient monitoring systems enables healthcare providers to remotely monitor and manage patients' health conditions. A thorough study revealed that patient involvement increased when using remote patient monitoring (RPM). The study involved than 7,000 patients from 42 different states and the results indicated that patient engagement, with digital RPM tools reached an impressive rate of 82%.

These systems use connected devices to collect and transmit patient data, allowing healthcare professionals to track vital signs, detect early warning signs, and intervene when necessary. With the rising cost of healthcare, mobile remote patient monitoring systems are becoming increasingly popular as they allow for remote monitoring of patients, reducing the need for in-person visits and allowing for more cost-effective care. This rise in the use of mobile remote patient monitoring systems is driving the growth of the digiceuticals market.

Challenges

-

Regulatory challenges - The digiceuticals industry is heavily regulated, with strict guidelines governing the development and marketing of digital health products. This can create significant barriers to entry for new companies and limit innovation in the industry.

- The lack of standardization and interoperability between different digital platforms

- Data security and privacy concerns are also set to impeding the digiceuticals market growth in the forecast period.

Digiceuticals Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

32.6% |

|

Base Year Market Size (2025) |

USD 8.83 billion |

|

Forecast Year Market Size (2035) |

USD 148.39 billion |

|

Regional Scope |

|

Digiceuticals Market Segmentation:

Use Segment Analysis

In digiceuticals market, smartphones segment is poised to hold more than 38% share by 2035. The segment growth is on the account of the increasing number of smartphone users in the world. For instance, in 2021, the number of mobile users worldwide stood at 7.1 billion. Smartphone users are increasingly using their phones to get health information, track their data, and plan appointments.

Furthermore, smartphones are rapidly being outfitted with health sensors such as accelerometers, gyroscopes, heart rate monitors, and even pulse oximeters, allowing users to monitor vital indications like heart rate and blood pressure. The segment’s rapid expansion is on the account of these factors.

Application Segment Analysis

In digiceuticals market, diabetes management segment is estimated to capture over 29% revenue share by 2035. The segment growth can be attributed to the increasing prevalence of diabetes, growing awareness about preventive measures, and rising government initiatives to provide better healthcare facilities for diabetic patients. According to IDF projections it is estimated that by 2045 around 783 million adults, which is one in eight individuals will live with diabetes. This represents a 46% increase. It is interesting to note that over 90% of diabetes patients are specifically diagnosed with type 2 diabetes.

Diabetes management requires regular monitoring of blood sugar levels and adjustment of medication accordingly. Digiceuticals allow people with diabetes to track their blood sugar levels remotely and alert them if they need to adjust their medication.

Our in-depth analysis of the digiceuticals market includes the following segments:

|

Use |

|

|

Application |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Digiceuticals Market Regional Analysis:

North America Market Insights

North America industry is expected to account for largest revenue share of 31% by 2035. The market growth in the region is also expected on account of the rising prevalence of chronic diseases, the rising adoption of digital health technologies, the increasing investments by venture capitalists in healthcare innovation, and the growing acceptance of digital therapeutics by healthcare professionals.

Moreover, the Food and Drug Administration has approved a growing number of digiceuticals, as treatments that doctors can prescribe. This also enables these treatments to be covered by health plans. An example of an FDA approved app is reSET O which offers therapy sessions for individuals struggling with opioid addiction. These sessions are conducted under clinician supervision. ReSET O is currently used in substance abuse facilities throughout the country.

APAC Market Insights

By 2035, Asia Pacific region in digiceuticals market is anticipated to capture over 27% revenue share. Rising prevalence of lifestyle-related diseases, growing awareness about the importance of preventive healthcare, and increasing government initiatives to promote the use of digital health solutions are the main factors driving the growth of the Asia Pacific market.

For instance, in May 2020 the National Health Commission (NHC) of the People's Republic of China urged governments to create their own online regulatory systems. These platforms would monitor and supervise online healthcare providers as well as expedite the entry of internet-based hospitals into the digiceuticals market.

Digiceuticals Market Players:

- Pear therapeutics Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Akili Interactive Labs, Inc.

- Chrono Therapeutics Inc.

- Click Therapeutics

- Omada Health

- Canary Health, Inc.

- Glooko, Inc.

- Propeller helath

- Novartis AG

- Welldoc

- Voluntis

- Takeda Pharmaceutical Company Limited

- Astellas Pharma Inc.

Recent Developments

- Akili Interactive, a company in the field of digital medicine that focuses on developing cognitive treatments using innovative technologies has recently announced its plans to go public. This will be achieved through a merger, with Social Capital Suvretta Holdings Corp., which's a special purpose acquisition company.

- Omada Health Inc. introduced two resources designed to support individuals, with chronic conditions by providing personalized care options and reducing their financial burden.

- Report ID: 5540

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Digiceuticals Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.