Diesel Genset Market Outlook:

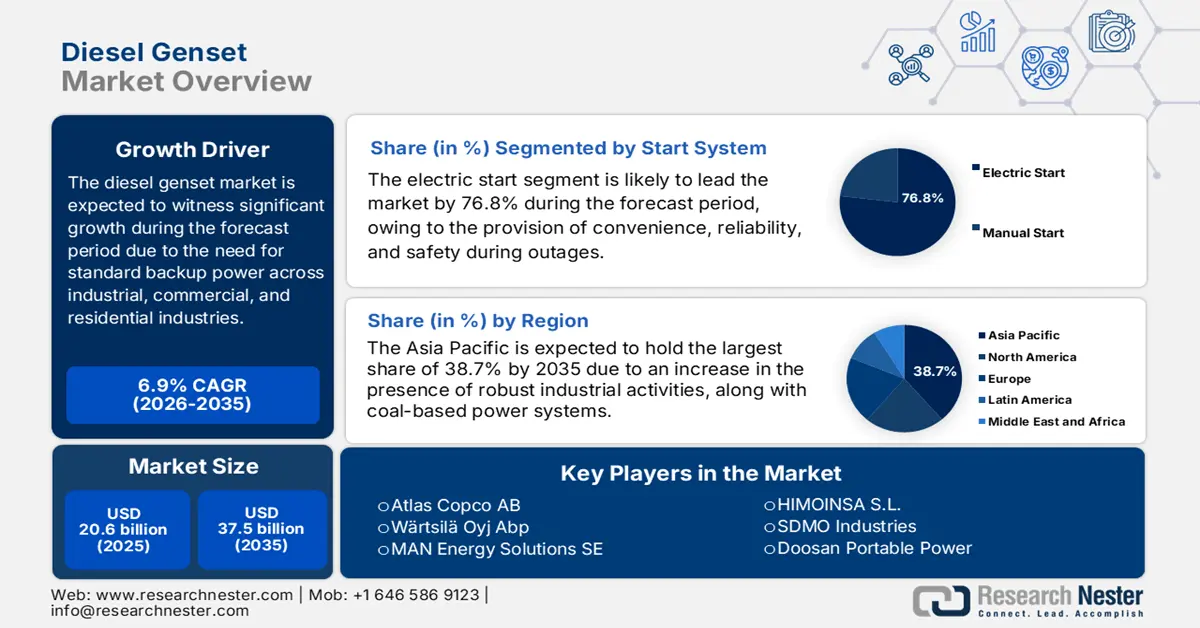

Diesel Genset Market size was over USD 20.6 billion in 2025 and is estimated to reach USD 37.5 billion by the end of 2035, expanding at a CAGR of 6.9% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of diesel genset is evaluated at USD 22 billion.

The international diesel genset market is growing steadily, and this demand is highly fueled by the requirement for reliable backup power across residential, commercial, and industrial sectors. This is readily possible with evolving sustainability and technology regulations that are reshaping product offerings. According to an article published by the World Nuclear Association in January 2025, the United Nations has estimated that the world’s population is poised to grow from almost 8 billion in 2024 to almost 9.8 billion by the end of 2050. Therefore, the challenge lies in rapidly increasing the energy demand. Regarding this, the global energy-based carbon dioxide emissions surged to 37.4 Gt, which is more than 60% above the overall growth. Besides, nearly 9.6% of the world’s population, which is almost 760 million people, reside in rural locations, thereby enhancing the need for power.

Furthermore, the hybrid power systems integration, Internet of Things (IoT) and digitalization monitoring, emission compliance, market diversification, and improvements regarding efficiency and noise are other factors that are driving the diesel genset market internationally. As per an article published by the Journal of Energy Storage in February 2025, there has been an enormous expansion of the global renewable energy industry, comprising installed capacities as of 2023, with an increase of 405.5 GW for solar power, 24.0 GW for hydropower, 123.1 GW for wind, and 150.3 GW for bioenergy. Additionally, nearly 97% of the world’s energy storage is presently provided by pumped hydro storage. Therefore, with an increase in the continuous energy supply and capacity facilities, there is a huge growth opportunity for the market across different nations globally.

Key Diesel Genset Market Insights Summary:

Regional Highlights:

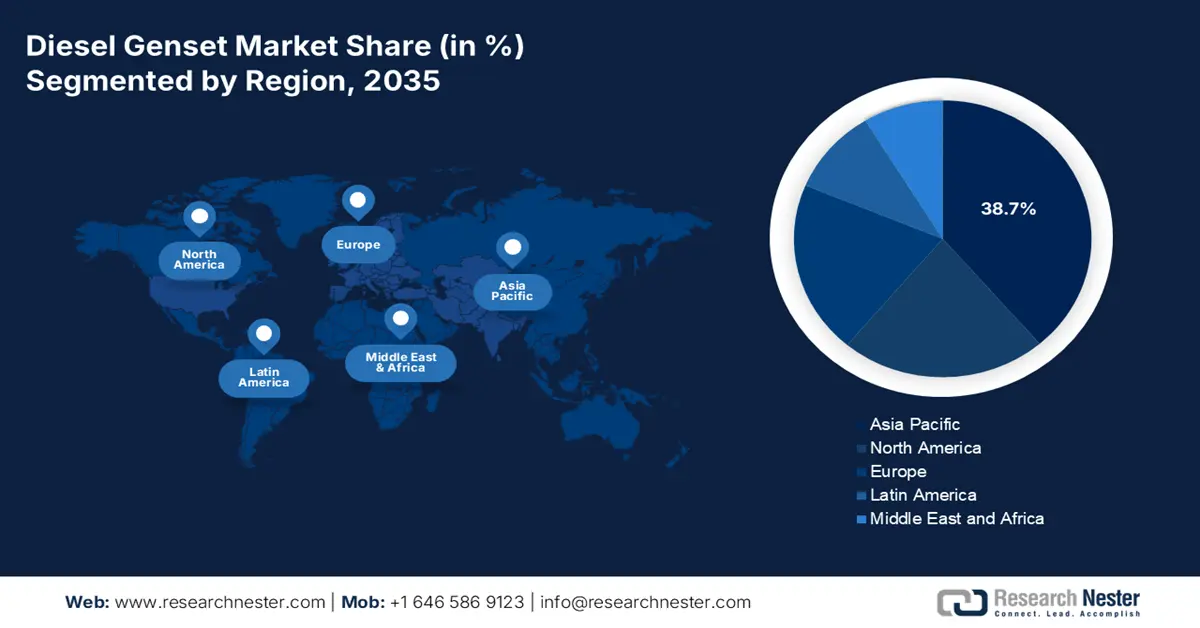

- Asia Pacific is projected to dominate with a 38.7% share by 2035 in the diesel genset market, reinforced by coal-dependent power infrastructure and strong industrial activity across India and China sustaining demand for high-reliability standby power.

- Europe is anticipated to emerge as the fastest-growing region during the forecast period 2026–2035, stimulated by rising requirements for dependable backup power across chemical, healthcare, data center, and industrial operations.

Segment Insights:

- The electric start segment is expected to secure a commanding 76.8% share by 2035 in the diesel genset market, underpinned by enhanced safety, reliability, and operational convenience enabling automatic startup and seamless system integration.

- The stationary segment is projected to capture the second-largest share during the forecast period 2026–2035, supported by its extensive deployment in industrial, commercial, and utility-scale facilities demanding uninterrupted and high-capacity power supply.

Key Growth Trends:

- Increased demand for uninterrupted power needs

- Surge in urbanization

Major Challenges:

- Presence of stringent environmental regulations

- Volatility in fuel prices

Key Players: HIMOINSA S.L., SDMO Industries, Doosan Portable Power, Kirloskar Oil Engines Limited, Mahindra Powerol.

Global Diesel Genset Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 20.6 billion

- 2026 Market Size: USD 22 billion

- Projected Market Size: USD 37.5 billion by 2035

- Growth Forecasts: 6.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (38.7% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, India, Germany, Japan

- Emerging Countries: Indonesia, Vietnam, Saudi Arabia, Brazil, Mexico

Last updated on : 24 December, 2025

Diesel Genset Market - Growth Drivers and Challenges

Growth Drivers

-

Increased demand for uninterrupted power needs: The rising demand for backup power in telecom towers, hospitals, and data centers is readily uplifting the diesel genset market internationally. According to an article published by the IEA Organization in July 2025, the electricity demand is projected to rise by 3.3% by the end of 2025, which is more than twice the overall energy growth. In addition, this particular growth is a deceleration from the 4.4% increase as of 2024, which remains well above the 2023 average of 2.6%. Besides, renewables are predicted to overtake coal, which is considered the largest electricity and power source, by 2025. Based on this, India and China are projected to drive 60% of the surge in international electricity consumption by the same year, thus suitable for boosting the market’s exposure.

- Surge in urbanization: The rapid development in the Asia Pacific is driving the diesel genset market’s adoption for commercial and construction facilities. As stated in a data report published by Global ABC Organization in 2025, the construction and building sector’s emissions were at 34%, and meanwhile, energy consumption accounted for nearly 34% of the international demand. Additionally, green building certifications surged significantly, with 20% of the newest commercial buildings across the Organization for Economic Cooperation and Development. Besides, circular construction practices, including modular building and material reutilization, are also contributing ground with recycled materials, catering to 18% of construction inputs, particularly in Europe, thereby denoting a positive outlook for the market’s upliftment.

- Focus on residential adoption: The increase in the frequency of power outages in developing countries has boosted the small-capacity genset demand, which is fueling the diesel genset market globally. As per an article published by the U.S. Department of Energy in November 2023, almost 81% of reported major power outages, especially in the U.S., are attributed to weather-based incidents. In addition, the average yearly number of weather-driven power outages has upsurged by nearly 80%. Besides, there have been over 1,500 weather-based power outages, and an average business or home is expected to go without power for almost 7 hours per year. However, the DOE has declared almost USD 3.5 billion for 58 projects across 44 states, with the intention of strengthening electric grid reliability and resilience, thereby driving the market’s development.

Challenges

- Presence of stringent environmental regulations: One of the most pressing challenges for the diesel genset market is compliance with increasingly strict environmental regulations. Governments worldwide are tightening emission standards to reduce greenhouse gases, particulate matter, and nitrogen oxides. For example, the U.S. Environmental Protection Agency (EPA) enforces Tier 4 Final standards, while the European Union applies Stage V regulations, both requiring advanced after-treatment technologies. These mandates significantly increase manufacturing costs, as companies must invest in research and development to produce cleaner gensets. Smaller manufacturers often struggle to keep pace, leading to market consolidation, which in turn is negatively impacting the market’s expansion.

- Volatility in fuel prices: Operations in the diesel genset market are highly sensitive to fluctuations in global fuel prices. Diesel fuel accounts for a significant portion of the total cost of ownership, especially in applications requiring continuous or prime power. Price volatility, driven by geopolitical tensions, supply chain disruptions, and OPEC production decisions, directly impacts operating expenses for end-users. For instance, spikes in crude oil prices can make diesel gensets less economically viable compared to gas-based or renewable alternatives. In emerging markets, where gensets are often used for extended hours due to unreliable grids, rising fuel costs can severely strain budgets for industries such as mining, construction, and manufacturing. This volatility also complicates long-term planning for both manufacturers and customers, as cost projections become uncertain.

Diesel Genset Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.9% |

|

Base Year Market Size (2025) |

USD 20.6 billion |

|

Forecast Year Market Size (2035) |

USD 37.5 billion |

|

Regional Scope |

|

Diesel Genset Market Segmentation:

Start System Segment Analysis

The electric start segment, which is part of the start system, is anticipated to garner the largest share of 76.8% in the diesel genset market by the end of 2035. The segment’s upliftment is highly attributed to its provision of safety, reliability, and convenience, which has enabled automatic startup during outages, diminishing physical strain, and effectively integrating with control panels for seamless backup power. According to an article published by the Ministry of Power in June 2023, the installed generation capacity within India’s central sector accounts for 1,00,055 MW, which is 24%. This is followed by 1,05,726 MW and 25.3% in the state sector, and 2,11,887 and 50.7% in the private sector. Besides, the overall fossil fuel generation capacity constitutes 589 MW and 0.1% of diesel, thereby creating an optimistic outlook for the segment’s development in the diesel genset market.

Product Type Segment Analysis

Based on the product type, the stationary segment in the diesel genset market is expected to garner the second-largest share during the forecast period. The segment’s growth is readily driven by its widespread utilization in industrial, commercial, and utility-scale applications. Unlike portable gensets, stationary units are permanently installed and designed to provide high-capacity, reliable backup or continuous power. They are critical in facilities such as data centers, hospitals, manufacturing plants, and chemical complexes, where uninterrupted electricity is essential for safety and productivity. The stationary segment benefits from increasing investments in infrastructure and industrial expansion, particularly in Asia-Pacific and the Middle East, where grid reliability remains inconsistent, thereby making it suitable for bolstering the segment’s growth and expansion.

Cooling System Segment Analysis

By the end of the stipulated timeline, the liquid-cooled sub-segment, part of the cooling system segment, is predicted to hold the third-largest share in the diesel genset market. The sub-segment’s development is highly fueled by its preference in medium-to-large capacity applications due to its superior thermal management and operational efficiency. Unlike air-cooled systems, liquid cooling allows gensets to sustain higher power outputs for extended durations, making them ideal for industrial plants, mining operations, and large commercial complexes. Its ability to maintain stable operating temperatures reduces wear and tear, enhances engine longevity, and ensures compliance with stringent emission and noise regulations. This sub-segment is particularly important in urban and industrial environments where performance reliability and environmental standards are critical.

Our in-depth analysis of the diesel genset market includes the following segments:

|

Segment |

Subsegments |

|

Start System |

|

|

Product Type |

|

|

Cooling System |

|

|

End use |

|

|

Standby |

|

|

Power Rating |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Diesel Genset Market - Regional Analysis

APAC Market Insights

The Asia Pacific in the diesel genset market is anticipated to garner the highest share of 38.7% by the end of 2035. The market’s upliftment in the region is highly attributed to coal-reliant power systems and strong industrial activity in India and China, ensuring the sustained demand for high-reliability standby power. For instance, according to an article published by the IEA Organization in 2024, China grew by 1% in coal demand within the region and reached 4.9 billion tons. Likewise, India also demonstrated a demand growth of more than 5% to 1.3 billion tons. Besides, as per the 2023 MITI Government data report, the chemical sector in Southeast Asia was worth USD 238 billion as of 2022, which is predicted to grow, amounting to USD 448 billion by the end of 2030. Therefore, with all these developments, the market in the overall region is gradually growing.

China in the diesel genset market is growing significantly, owing to the upscaling of heavy industry, refining, and chemicals, along with the manufacturing industry, necessitating strict power quality as well as resilience, especially for ongoing processes with environmental and safety controls. As per an article published by the National Bureau of Statistics of China in December 2025, there has been an acceleration in coal production within the country, increasing to 440 million tons by industrial enterprises. This denoted a rise by 4.2% year-over-year (YoY), along with 2.4% points and resulting in an average daily output of 14.1 million tons. Besides, coal import accounts for 52.3 million tons, displaying an increase by 10.9% YoY. Besides, as of 2024, 4.7 billion tons of coal have been produced by industrial enterprises, leading to a 3% YoY, thereby catering to the market’s upliftment.

India in the diesel genset market is also growing due to a coal-based power mix, an increase in industrial expansion, which has intensified the demand for dependable backup across logistics, metal processing, pharmaceuticals, and chemicals. As stated in an article published by the IBEF Organization in August 2025, the manufacturing industry contributes almost 16% to 17% of the gross domestic product (GDP) and employs more than 27 million workers. Additionally, the presence of governmental strategies, such as Make in India, along with production-linked incentive (PLI) schemes, the country has targeted manufacturing, further accounting for 25% of GDP in the near future. Besides, the country also has the potential to cater to 10% of the world’s wind energy requirement by the end of 2030 through its increased capacity in wind, which in turn, is positively impacting the diesel genset market.

Europe Market Insights

Europe in the diesel genset market is expected to emerge as the fastest-growing region during the forecast period. The market’s development in the region is significantly driven by the demand for high-reliability backup across commercial, healthcare, data center, and industrial sites. According to an article published by the Cefic Organization in 2024, 74% capacity utilization is considered the norm in the European-27 chemical industry. In addition, this particular chemical sector operates at 9.5% below pre-crisis capacity, along with its output also remaining 10% below. Besides, the overall chemical production growth accounted for 2.4% as of 2024, with Poland demonstrating 7.0% growth, 8.3% in Belgium, 1.9% in France, 3.0% in Germany, and 3.3% in Spain. Therefore, with such growth in the overall region, there is a huge growth opportunity for the market.

Germany in the diesel genset market is gaining increased traction, owing to the presence of a massive industrial base, including logistics, automotive, machinery, and chemicals for operating high-value and continuous processes that need strict resilience and power-quality measures. Besides, as per an article published by Clean Energy Wire Organization in December 2025, renewable energy sources cover almost 56% of the country’s gross electricity consumption as of 2025. Additionally, the renewables share grew by 0.7% points in comparison to previous years, owing to a surge in the installed solar power capacity. Moreover, onshore turbines with a 5.2 GW capacity have been added to the electricity grid, marking an increase from 3.3 GW in the previous year. Therefore, with all these renewable energy source capacities, the market is continuously gaining increased importance and expansion in the overall nation.

Spain in the diesel genset market is also developing due to urban development, logistics centers, and tourism-based infrastructure that fuels the standby need for data connectivity, retail, hospitals, and hotel sites. As per an article published by the UN-Habitat in 2025, 80.8% of the population dwells in urban locations, accounting for 37.5 million people, and this is gradually increasing by 0.2% every year. Besides, of the 8,125 Spanish municipalities, 6 cities comprise over 500,000 inhabitants, while 4,955 have less than 1,000. In addition, 25% of the urban population resides in big cities, while rural areas readily occupy more than 2/3 of the territory. Moreover, the domestic housing stock comprises 25.2 million dwellings, with 22.9% of the population under rental arrangements. Therefore, with an upsurge in urbanization, there is a huge growth opportunity for the market in the country.

North America Market Insights

North America's diesel genset market is projected to witness suitable growth by the end of the stipulated timeline. The market’s growth in the region is highly driven by resilience and generous investments across healthcare, data centers, chemicals, and manufacturing, along with tight power quality specifications and industrial reliability demands. According to an article published by the EIA Government in December 2025, the regular gasoline prices in the U.S. range between USD 2,98 per gallon, USD 2,94 per gallon, and USD 2.8 per gallon throughout the month. Besides, on-highway diesel fuel prices have been ranging from USD 3.7 per gallon, USD 3.6 per gallon, and USD 3.60 per gallon within the same month. Moreover, based on crude oil, refining, distribution and marketing, as well as taxes, the regular gasoline and diesel prices vary, which is positively creating an optimistic outlook for the market’s growth in the region.

Differentiation Between Regular Gasoline and Diesel (2025)

|

Components |

Regulator Gasoline |

Diesel |

|

Crude Oil |

49% |

41% |

|

Refining |

14% |

23% |

|

Distribution and Marketing |

21% |

20% |

|

Taxes |

17% |

16% |

Source: EIA Government

The diesel genset market in the U.S. is gaining increased exposure, owing to the presence of quality, environmental, and safety standards, along with chemical refineries and plants continuously operating high-hazard processes that need dependable backup power. As per a data report published by the AFPM Organization in July 2024, activities in the country’s petroleum refineries generously contributed USD 688 billion of gross domestic product (GDP) or economic output. These activities effectively support almost 3 million employment offers USD 284 billion in labor income. Therefore, this particular activity generated USD 162 billion in local tax, state, and federal revenues. Thereby, based on all these activities and outputs, there is a huge growth opportunity for the market to gain increased exposure in the overall country.

Petroleum Refineries Economic Impacts in the U.S. (2022)

|

Components |

GDP |

Labor Income |

Employment |

|

Direct |

USD 169.4 billion |

USD 21.5 billion |

USD 645,000 |

|

Indirect |

USD 359.9 billion |

USD 175.0 billion |

1,551,000 |

|

Induced |

USD 158.7 billion |

USD 87.8 billion |

1,351,900 |

|

Overall |

USD 688.0 billion |

USD 284.3 billion |

2,967,400 |

Source: AFPM Organization

The diesel genset market in Canada is also growing due to expansion in the resource and industrial sector, infrastructure and construction growth, remote area power reliability, emission standards, government regulations, along with data center and commercial growth. According to an article published by the IGF Mining Organization in November 2023, the Government of Canada initiated an allocation of CAD 5.4 million for more than 4 years. The ultimate objective is to provide support to the Secretariat of the Intergovernmental Forum on Mining, Minerals, Metals and Sustainable Development. Besides, as stated in a data report published by the Environmental Defense in April 2025, the country’s government also offered nearly USD 29.6 billion to provide financial support to petrochemical and fossil fuel organizations. This fund comprises USD 21 billion for the TransMountain expansion pipeline, and USD 7.5 billion as public financing, thus creating an optimistic outlook for the market’s growth.

Key Diesel Genset Market Players:

- Caterpillar Inc. (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Cummins Inc. (U.S.)

- Generac Holdings Inc. (U.S.)

- Kohler Co. (U.S.)

- Perkins Engines Company Limited (U.K.)

- FG Wilson (U.K.)

- Rolls-Royce Holdings plc – MTU Onsite Energy (U.K.)

- Atlas Copco AB (Sweden)

- Wärtsilä Oyj Abp (Finland)

- MAN Energy Solutions SE (Germany)

- Mitsubishi Heavy Industries Ltd. (Japan)

- Yanmar Holdings Co. Ltd. (Japan)

- HIMOINSA S.L. (Spain)

- SDMO Industries (France)

- Doosan Portable Power (South Korea)

- Kirloskar Oil Engines Limited (India)

- Mahindra Powerol (India)

- Aggreko plc (U.K.)

- Weichai Power Co., Ltd. (China)

- Denyo Co., Ltd. (Japan)

- Caterpillar Inc. is one of the largest global suppliers of diesel gensets, with strong penetration in heavy-duty industrial and infrastructure projects. Its focus on high-capacity gensets and integration of digital monitoring systems keeps it a leader in mission-critical applications.

- Cummins Inc. dominates the mid-to-large genset segment, leveraging its expertise in engine technology and emissions compliance. The company invests heavily in hybrid and low-emission gensets, aligning with global sustainability regulations while maintaining reliability.

- Generac Holdings Inc. is a major player in residential and commercial standby gensets, particularly in North America. Its competitive edge lies in offering cost-effective, scalable solutions and expanding into smart energy management systems.

- Kohler Co. has a strong presence in premium gensets for the commercial and hospitality sectors. The company emphasizes durability and design, with a growing portfolio of fuel-efficient and low-noise gensets tailored for urban environments.

- Perkins Engines Company Limited specializes in small-to-medium diesel gensets, widely used in agriculture, construction, and light industrial applications. Its global distribution network and reputation for reliable engines make it a preferred choice in emerging markets.

Here is a list of key players operating in the global diesel genset market:

The international diesel genset market is effectively competitive, with Europe and U.S.-based players dominating high-capacity segments, while Asian manufacturers capture mid- and low-capacity demand. Strategic initiatives include product innovation in low-emission gensets, hybrid solutions integrating renewables, and digital monitoring for predictive maintenance. Companies such as Caterpillar, Cummins, and Mitsubishi Heavy Industries invest heavily in R&D to meet tightening emission norms, while Kirloskar and Doosan expand into emerging markets with cost-efficient models. Besides, in February 2025, Toyota Motor Corporation declared that it has readily created a new fuel cell system, which is its very own third-generation fuel cell system. This is considered a part of its ongoing efforts toward the realization of a hydrogen society, thereby driving the diesel genset market globally.

Corporate Landscape of the Diesel Genset Market:

Recent Developments

- In October 2025, GeoPura, Barclays, and EIFO successfully secured £27 million in a green loan facility for expanding its hydrogen-driven energy services in the UK, along with an established Danish center for electrolyzer support.

- In April 2025, Generac Holdings, Inc. has strengthened its own portfolio with the latest generators that are designed for the data center industry. These particular products have rolled out the organization’s energy solutions portfolio, comprising natural gas and diesel.

- In December 2024, Sany Silicon’s Zambia Reida Mine Photovoltaic Energy Storage Microgrid Power Generation Project effectively accomplished its initial grid connection, marking the commissioning of Africa’s first and largest single-unit photovoltaic energy storage diesel.

- Report ID: 3539

- Published Date: Dec 24, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Diesel Genset Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.