Design Agencies Market Outlook:

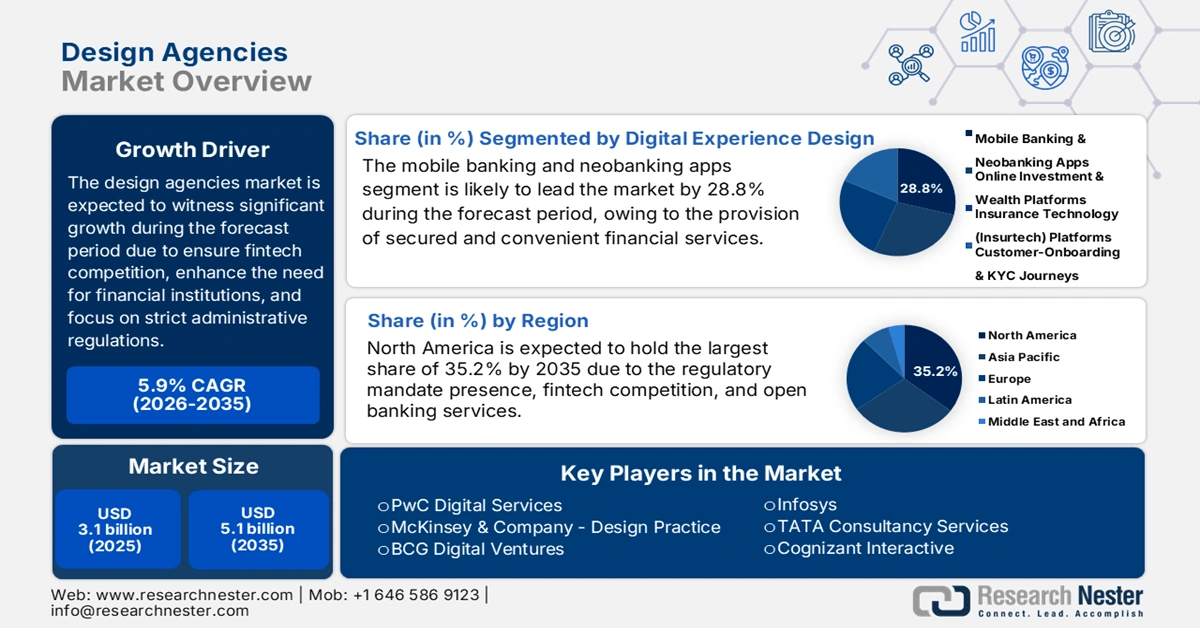

Design Agencies Market size was over USD 3.1 billion in 2025 and is estimated to reach USD 5.1 billion by the end of 2035, expanding at a CAGR of 5.9% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of design agencies is assessed at USD 3.2 billion.

The international design agencies market is continuously undergoing a fundamental transformation, and design is no longer considered a peripheral service for aesthetic enhancement, but the ultimate tactical function, which is crucial for growth and survival. The transition is highly driven by the mixture of intensified fintech competition, urgent demand for established institutions, and strict regulations to offer customer-centric and digital-first experiences. According to an article published by the BIS Organization in May 2024, the aspect of digitalizing finance is continuing to escalate across different fronts, and investments in fintech organizations amounted to USD 865 billion, which is over twice the amount invested in previous years. Besides, in 2023, 136 financial institutions proactively participated in the open banking system, with an estimated 35 million subscribers, thus suitable for the market’s growth.

Furthermore, artificial intelligence (AI)-based hyper-personalization, embedded financial ecosystem integration, compliance by design, accessible and inclusive design, along with strategic service design, are also driving the design agencies market globally. As per an article published by the World Economic Forum in January 2025, financial services, as of 2023, readily spent USD 35 billion on AI. This eventually resulted in generous investments across payments businesses, capital markets, insurance, and banking, which is projected to reach USD 97 billion by the end of 2027. In addition, the generative AI development led to a 32% to 39% in work performance across banking businesses, insurance, and capital markets, constituting a huge potential to be completely automated, while 34% to 37% has captured increased augmentation potential, thus bolstering the market’s exposure across various nations.

Key Design Agencies Market Insights Summary:

Regional Highlights:

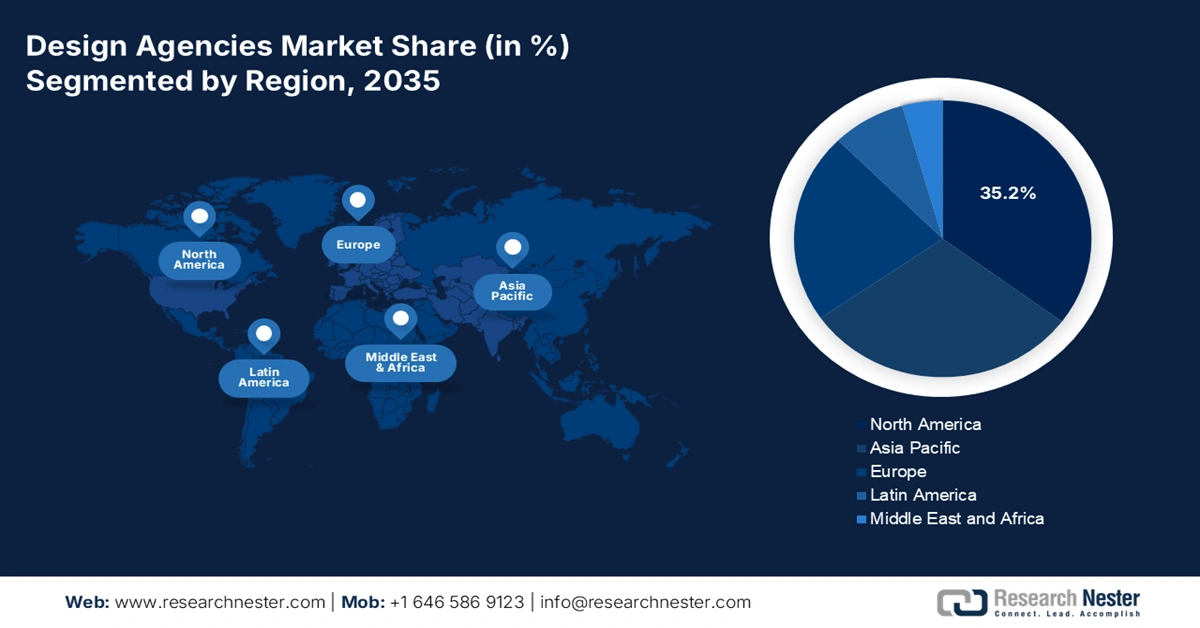

- North America is anticipated to hold a 35.2% share by 2035 in the design agencies market, impelled by strict regulatory mandates, intense fintech competition, AI-based personalization, and focus on financial inclusion.

- Europe is expected to emerge as the fastest-growing region during the forecast period, owing to rapid digitalized financial integration and the rising demand for specialized design services.

Segment Insights:

- The mobile banking and neobanking apps segment is projected to account for 28.8% share by 2035 in the design agencies market, propelled by the provision of 24/7, secured, and convenient accessibility to financial services.

- The corporate rebranding (M&A) segment is anticipated to secure the second-largest share during the forecast period, driven by the need to identify tactical deal value and minimize consumer attrition.

Key Growth Trends:

- Intense competition between fintechs and neobanks

- The digitalized transformation imperative

Major Challenges:

- Fragmented regulatory and stringent compliance

- Organizational inertia and legacy system integration

Key Players: Accenture Interactive (Ireland), Publicis Sapient (France), IBM iX (U.S.), Deloitte Digital (U.S.), EY-Seren (U.K.), PwC Digital Services (U.K.), McKinsey & Company - Design Practice (U.S.), BCG Digital Ventures (U.S.), Wipro (India), Infosys (India), TATA Consultancy Services (India), Cognizant Interactive (U.S.), Capgemini Invent (France), Fjord (U.S.), R/GA (U.S.), IDEO (U.S.), Wunderman Thompson (U.S.), Dentsu (Japan), AKQA (U.S.), Virtusa (U.S.).

Global Design Agencies Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.1 billion

- 2026 Market Size: USD 3.2 billion

- Projected Market Size: USD 5.1 billion by 2035

- Growth Forecasts: 5.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35.2% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, United Kingdom, Germany, Canada, France

- Emerging Countries: India, China, Brazil, Singapore, Australia

Last updated on : 17 November, 2025

Design Agencies Market - Growth Drivers and Challenges

Growth Drivers

- Intense competition between fintechs and neobanks: The robust development of digital-specific challenger banks has pressured conventional BFSI organizations to increasingly modernize their respective digital services and brand recognition to retain their consumer base. According to an article published by the MDPI in May 2024, the capital adequacy ratio (CAR) has been recognized as the efficiency determinant, and neobanks in Indonesia have increased CARs, which are above the 8% regulatory requirement. Therefore, banks need to maintain a minimum level of equity in terms of reserves to effectively support their ultimate role in combating financial and operational risks. Additionally, the neobank-based CAR in the country has been in the 27.8 to 118.2 range, while liquidity levels ranged from 51.7 to 150.7, ensuring increased loan exposure.

- The digitalized transformation imperative: The presence of legacy core systems is being readily replaced with modernized cloud-specific platforms, developing a foundational demand for redesigning all internal and customer-facing applications for the digital age. As per an article published by the World Bank Organization in April 2025, nearly 1/3rd of the global population, accounting for 2.6 billion people, has remained offline as of 2023. Meanwhile, over 90% of the population in high-income nations utilized the internet as of 2022, and only 1 in 4 across low-income nations used the internet, while 850 million people effectively lack any kind of identification. Therefore, with the increased internet utilization, there is a huge growth opportunity for the design agencies market.

- Open banking framework adoption: The existence of administrative regulations, such as PSD2 in Europe, along with open banking strategies in Australia and Canada, is creating the latest ecosystems that demand user-friendly and secure data consent screens, along with third-party application interfaces. According to a data report published by the OECD Organization in 2023, over 90% of banks have successfully concluded an application programming interface (API) with more than 1 electronic payment service provider. This has resulted in the development of the Banking Law amendment, which requires banks to significantly enable API connections in a stipulated time period, which is positively impacting the design agencies market internationally.

Challenges

- Fragmented regulatory and stringent compliance: The single greatest challenge in the design agencies market is designing user experiences that are simultaneously compliant and intuitive, with an ever-shifting and complicated international regulatory landscape. Besides, financial products are significantly governed by stringent mandates regarding accessibility and anti-money laundering. In addition, a design that is user-friendly and clear within a single jurisdiction might be non-compliant in another jurisdiction. For instance, a simplified loan application process may inadvertently combat a legally needed disclosure, thereby developing liability for the financial institution.

- Organizational inertia and legacy system integration: The design agencies market frequently witnesses the cultural, technical, and monumental challenges of incorporating user-centric and modernized digital products with the financial organizations’ decade-old legacy core banking systems. These platforms are typically poorly and rigidly documented, and the API absence has successfully necessitated seamless integration with the sleek front-end interface designed by the agency. This has eventually created a clunky user experience, wherein a designed mobile application can evidently process a transaction and display real-time data, owing to backend limitations, thereby causing a hindrance in the market’s expansion.

Design Agencies Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.9% |

|

Base Year Market Size (2025) |

USD 3.1 billion |

|

Forecast Year Market Size (2035) |

USD 5.1 billion |

|

Regional Scope |

|

Design Agencies Market Segmentation:

Digital Experience Design Segment Analysis

The mobile banking and neobanking apps segment in the design agencies market is anticipated to garner the largest share of 28.8% by the end of 2035. The segment’s upliftment is highly attributed to the provision of 24/7, secured, and convenient accessibility to financial services. This readily diminishes operational expenses for banking institutions and offers customer advantages, such as streamlined experiences, personalized insights, and lowered fees. According to an article published by the Financial Services Government in November 2024, there has been continuous fluctuation in digital payment transactions, with volumes ranging from 1,684 crore to 1,762 crore, 1,738 crore, 1,783 crore, 1,768 crore, and 1,767 crores between April to September. In addition, the valuation resulted in ₹238 crore to ₹476 crore, ₹243 crores, ₹443 crores, ₹287 crores, and ₹251 crores, within similar months.

Brand Strategy & Identity Segment Analysis

The corporate rebranding (M&A) segment in the design agencies market is predicted to constitute the second-largest share during the projected period. The segment’s exposure is highly fueled by its importance in identifying the deal’s tactical value and overcoming consumer attrition. The process is usually a high-stakes exercise in stakeholder management, demanding alignment between conflicting legacies that identifies a current cohesive narrative to the overall market. Besides, a poorly executed rebrand can develop confusion, lead to customer churn, and erode trust. Moreover, the segment’s growth is also dependent on the objective to create a powerful and single brand that readily assures current consumers to achieve ongoing service excellence, while attracting the latest ones, thus converting a period of operation-based uncertainty into a tactical opportunity for design agencies market development and consolidation.

Regulatory & Compliance Communication Design Segment Analysis

The financial product and risk explanation tools segment in the design agencies market is predicted to cater to the third-largest share by the end of the forecast duration. The segment’s development is highly fueled by its capability to address the severe challenge of converting legally mandated and complicated financial information into actionable, accessible, and clear communication for customers. The segment’s growth is propelled by strict regulations from administrative bodies, such as the FCA and CFPB, which require conspicuous and clear disclosures, and these design tools are crucial for combating institutional risk and fostering informed consent. Besides, there is the involvement of sophisticated information facilities, plain-linguistic writing, and intuitive data visualization to develop layered disclosures, visual aids, and interactive calculators for guiding consumers.

Our in-depth analysis of the design agencies market includes the following segments:

|

Segment |

Subsegments |

|

Digital Experience Design |

|

|

Brand Strategy & Identity |

|

|

Regulatory & Compliance Communication Design |

|

|

Marketing & Advertising Campaigns |

|

|

Research & Service Design |

|

|

Packaging & Collateral Design |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Design Agencies Market - Regional Analysis

North America Market Insights

North America in the design agencies market is anticipated to account for the highest share of 35.2% by the end of 2035. The market’s upliftment in the region is highly fueled by the presence of strict regulatory mandates and compliance, intense competition from fintechs and neobanks, the transition to data-sharing frameworks and open banking, AI-based personalization at scale, and intense focus on accessibility and financial inclusion. According to a report published by the U.S. Department of the Treasury in December 2024, almost 8 in 10, which is 78% of financial firms, have implemented generative AI, while 86% of financial organizations in the region deliberately expect a moderate or significant increase in model inventory, owing to this particular AI technology. Besides, as per an article published by the NEA Organization in May 2024, a survey-based study was conducted on 1,000 teenagers, of which 95% agreed to undertake a personal finance class during high school, thus denoting a huge growth opportunity for the market.

Number of States Requiring Students to Undertake an Economic Course for Financial Knowledge

|

State Type |

2020 |

2022 |

|

States with economic standards |

51 |

51 |

|

States required to implement economic standards |

46 |

46 |

|

States required to provide an economics course |

25 |

25 |

|

States requiring economics to graduate |

25 |

25 |

|

Standardized testing of economic concepts |

10 |

9 |

Source: NEA Organization

The design agencies market in the U.S. is growing significantly, owing to AI-specific personalization within digitalized banking platforms to bolster consumer retention and engagement. In addition, the aspect of regulatory mandate, the Consumer Financial Protection Bureau (CFPB) proactively issuing circulars and rules for demanding easy-to-understand non-discriminatory terms and algorithms, which are also boosting the market in the country. According to a data report published by the NCSES Organization in September 2025, national patterns of research and development resources indicated that experimental and federally funded research amounted to USD 139 billion as of 2022, and it further increased to USD 141 billion as of 2023. In addition, of the USD 139 billion, USD 85 billion, which is 61% caters to research, which positively impacts the market’s exposure in the overall country.

The design agencies market in Canada is also growing due to the deliberate shift towards a more consumer-centric and competitive financial ecosystem, primarily fueled by federal government strategies. Additionally, the implementation and design of services led by Canada's Open Banking framework, driven by Innovation, Science and Economic Development Canada (ISED) for creating a huge need for user-friendly fintech applications and data-sharing platforms. According to an article published by the U.S. Department of State in 2024, the U.S. is considered the country’s largest investor, accounting for 46% of the overall FDI. In this regard, the FDI amount in Canada amounted to USD 438 billion, while the country’s FDI stock in the U.S. constituted USD 683 billion. Therefore, with such contributions from the neighboring nation, there is a huge growth opportunity for the overall market in the country.

Europe Market Insights

Europe in the design agencies market is expected to emerge as the fastest-growing region during the projected period. The market’s development in the region is highly fueled by the presence of a complicated landscape, along with a rapid push for digitalized financial integration, readily uplifting the need for specialized design services. As per a report published by the EIB Organization in 2023, 53% of organizations in the region have become fully digitalized and offer online services. In addition, 30% of microenterprises undertook strategies to optimize digitalization in 2022, in comparison to 62% of large-scale firms. Moreover, the regional firms’ share of implementing innovative digitalized technologies increased from 2021 to 2022, reaching 59% in comparison to 71% in the U.S. Therefore, this has created a huge opportunity for the market to gain increased importance in the overall region.

The design agencies market in the UK is gaining increased traction, owing to the dominating fintech hub, as well as the existence of an outstanding proactive regulatory regime. Besides, the Financial Conduct Authority (FCA) is also driving the market in the country, with its unique Consumer Duty rules mandating that it successfully delivers suitable outcomes, particularly for retail consumers, to ensure support services, communications, and top-to-bottom redesign of consumer journeys. As per a data report published by the ITA in November 2023, the country continues to be the most attractive destination for the fintech industry, comprising more than 1,600 organizations, which is predicted to double by the end of 2030. Additionally, the industry also contributes approximately USD 13.4 billion and more than 76,000 employment opportunities to the country’s economy.

The design agencies market in Germany is also developing due to the presence of compulsory digital monetization of the conventional and massive conservative banking industry, along with the regional regulations implementation. In addition, the country’s PSD2 adoption and a subsequent rise in Finanzwende, which is regarded as a financial turnaround, wherein customers require transparent and digital banking from established institutions, such as Volksbanken and Sparkassen, are also driving the market’s exposure in the country. According to an article published by the ITA in August 2023, the country’s fintech is projected to grow and has reached a 64% adoption rate as of 2023. Factors such as an increased gross domestic product (GDP) of USD 48,432 per capita as of 2022, along with USD 21,704 consumption-based expenditure, are bolstering the industry’s exposure within the domestic market.

APAC Market Insights

Asia Pacific in the design agencies market is predicted to grow steadily by the end of the forecast timeline. The market’s growth in the region is highly driven by the existence of the unprecedented digital adoption, a boom in the fintech ecosystem, and financial inclusion strategies. Moreover, the presence of a tech-savvy and massive underbanked and unbanked population, enforcing private and governmental entities to introduce mobile-first financial products. According to an article published by the We Forum Organization in February 2022, more than 6 in 10 population in the region are considered to remain unbanked or underbanked. Besides, in Indonesia, almost 75% of the population readily owns a mobile phone, while there has been negligence in credit card ownership, and nearly ½ of the population has a bank account. Meanwhile, almost half of the population in Southeast Asia is under 30 years of age, which has resulted in online payment adoption.

The design agencies market in China is gaining increased exposure, owing to the digital payment ecosystem dominance, along with state-based digitalized currency approaches. In addition, the People's Bank of China (PBOC) has been significantly instrumental in successfully rolling out the Digital Currency Electronic Payment (DCEP) system. Besides, the aspect of corporate and governmental investment in fintech design has also catered to the market’s upliftment in the country. According to an article published by the Computer Law & Security Review in April 2025, the country’s stock market is usually fueled by individual investors, with a generous 210 million people constituting more than 99% of investors as of 2022. Meanwhile, design agencies in the country play an essential role in creating interfaces for creating the world’s largest and centralized bank digital currency, thereby making it suitable for the market’s growth.

The design agencies market in India is also growing due to the development of the government’s Digital India initiative, along with the RBI's supportive regulatory sandbox. In addition, the aspect of expenditure on digital infrastructure and financial UX has effectively grown, which is highly fueled by the demand for designing to provide the newest internet users with access to increased UPI payments as well as mobile banking. As per a data report published by the ITA in September 2024, the digital landscape in the country is gradually thriving, with more than 650 million smartphone users, and an upsurge in internet subscribers by 950 million. Additionally, the presence of large-scale players, such as Infosys, has resulted in a USD 19 billion valuation as of 2024, along with a USD 29 billion by Tata Consultancy Services, and a USD 11 billion valuation from Wipro, which denotes an optimistic approach for the overall design agencies market.

Key Design Agencies Market Players:

- Accenture Interactive (Ireland)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Publicis Sapient (France)

- IBM iX (U.S.)

- Deloitte Digital (U.S.)

- EY-Seren (U.K.)

- PwC Digital Services (U.K.)

- McKinsey & Company - Design Practice (U.S.)

- BCG Digital Ventures (U.S.)

- Wipro (India)

- Infosys (India)

- TATA Consultancy Services (India)

- Cognizant Interactive (U.S.)

- Capgemini Invent (France)

- Fjord (U.S.)

- R/GA (U.S.)

- IDEO (U.S.)

- Wunderman Thompson (U.S.)

- Dentsu (Japan)

- AKQA (U.S.)

- Virtusa (U.S.)

- Accenture Interactive has leveraged its international scale and in-depth technology by integrating its expertise to provide end-to-end digitalized transformation for the majority of insurers and banks. It is well-known for orchestrating large-scale and complicated programs that can redesign core consumer journeys. Based on these, its 2024 annual report indicated that the company has successfully generated USD 64.9 billion in revenue, USD 11.9 in diluted earnings per share, USD 81.2 billion in new bookings, and 15.5% as adjusted operating margin.

- Publicis Sapient readily acts as a tactical digitalized business transformation partner, assisting legacy financial institutions in modernizing their technological core and consumer-centric services. The organization’s contribution lies in developing data-driven and agile platforms that ensure customized insurance and banking experiences at scale.

- IBM iX readily combines its enterprise technology with deep design to successfully solve complicated operational and consumer experience risks within the overall BFSI sector. It deliberately focuses on developing secure and AI-based interfaces for areas such as regulatory compliance, trade finance, and corporate banking. Besides, as per its 2024 annual report, the company generated USD 62.8 billion in revenue, denoting a 3% increase at constant currency, along with USD 12.7 billion in free cash flow, further demonstrating a USD 1.5 billion year-over-year (YoY) increase.

- Deloitte Digital has distinguished itself by seamlessly blending next-generation creative design with its foundational strengths in business approach, regulatory advisory, and risk. This has permitted it to design suitable BFSI solutions that are not only user-centric but also completely compliant and commercially viable from the outset.

- EY-Seren has significantly applied a human-based design approach to carefully tackle fundamental strategic risks for financial services clients, including advancement in customer trust and sustainable finance. Its overall activity frequently comprises designing the newest service models and ethical consumer experiences that readily align with societal expectations and evolving regulations.

Here is a list of key players operating in the global design agencies market:

The international design agencies market is intensely bifurcated and competitive between large-scale consulting and technological firms, along with sophisticated boutique studios. Notable players, such as Publicis Sapient and Accenture Interactive, evidently leveraging their in-depth IT integration capabilities and international scape to provide end-to-end digitalized transformation, especially from a core system modernization to customer experience design. Additionally, their initial approach is to gain top-tier creative boutiques to boost their design talent. Besides, in May 2024, the Reserve Bank of India successfully introduced PRAVAAH, RBI Retail Direct mobile application, and FinTech repository. The purpose is to ensure regulatory approvals for any online-based financial application, along with offer investors with convenient accessibility, and facilitate appropriate design, thus driving the design agencies market globally.

Corporate Landscape of the Design Agencies Market:

Recent Developments

- In February 2025, the Ladies Professional Golf Association (LPGA) and Hero Digital declared the launch of its renowned mobile application to deliver seamless technology for consumers, while displaying players as a part of the company’s growth strategy.

- In November 2023, Accenture Song has been readily appointed by PEUGEOT, with the intention of deliberately creating a record agency, which is considered as a part of a competitive pitch.

- Report ID: 8242

- Published Date: Nov 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Design Agencies Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.