- An Outline of the Asia Pacific Building Information Modeling Market

- Market Definition

- Market Segmentation

- Assumptions and Abbreviations

- Research Methodology & Approach

- Primary Research

- Secondary Research

- SPSS Methodology

- Data Triangulation

- Executive Summary

- Market Drivers

- Major Roadblocks

- Market Opportunities

- Prevalent Trends

- Government Regulation

- Growth Outlook

- Risk Scenario

- Pricing Benchmarking

- SWOT Analysis

- Supply Chain

- Current Technologies

- Upcoming Technologies

- Growth Forecast of Global Construction Market

- Integration of Advanced Technology

- Mergers and Acquisitions (M&A)

- End-User Analysis

- Recent Development

- Use-Cases in-Civil Engineering

- Comparative Positioning

- Competitive Landscape

- Competitive Model

Market Share of Major Companies Profiled, 2023

Business Profiles of Key Enterprises

- Autodesk Inc

- Aesthetic Designs LLP

- Bentley Systems, Incorporated

- Harmony AT

- Hexagon AB

- MaRS BIM Solutions

- Pinnacle Infotech Private Limited

- Rib Software

- Taiwan BIM Technology

- Trimble Inc.

- Graphisoft

- Global Building Information Modeling Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), and Compound Annual Growth Rate (CAGR)

Building Information Modeling Market Segmentation Analysis (2024-2037)

- By Type

- Software, Market Value (USD Million), and CAGR, 2024-2037F

- Operation Software, Market Value (USD Million), and CAGR, 2024-2037F

- Maintenance Software, Market Value (USD Million), and CAGR, 2024-2037F

- Facility Management Software, Market Value (USD Million), and CAGR, 2024-2037F

- Service, Market Value (USD Million), and CAGR, 2024-2037F

- By Application

- Residential, Market Value (USD Million), and CAGR, 2024-2037F

- Apartments, Market Value (USD Million), and CAGR, 2024-2037F

- High-Rise Apartments, Market Value (USD Million), and CAGR, 2024-2037F

- Low-Rise Apartments, Market Value (USD Million), and CAGR, 2024-2037F

- Condominiums, Market Value (USD Million), and CAGR, 2024-2037F

- Detached Houses, Market Value (USD Million), and CAGR, 2024-2037F

- Commercial, Market Value (USD Million), and CAGR, 2024-2037F

- Office Buildings, Market Value (USD Million), and CAGR, 2024-2037F

- Healthcare Facilities, Market Value (USD Million), and CAGR, 2024-2037F

- Retail Spaces, Market Value (USD Million), and CAGR, 2024-2037F

- Recreational Facility, Market Value (USD Million), and CAGR, 2024-2037F

- Industrial, Market Value (USD Million), and CAGR, 2024-2037F

- Others, Market Value (USD Million), and CAGR, 2024-2037F

- By End-User

- Architects, Market Value (USD Million), and CAGR, 2024-2037F

- Contractors, Market Value (USD Million), and CAGR, 2024-2037F

- Facility Manager, Market Value (USD Million), and CAGR, 2024-2037F

- Others, Market Value (USD Million), and CAGR, 2024-2037F

- Regional Synopsis

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

- North America Building Information Modeling Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), and Compound Annual Growth Rate (CAGR)

27.3 Building Information Modeling Market Segmentation Analysis (2024-2037)

27.3.1 By Type

- Software, Market Value (USD Million), and CAGR, 2024-2037F

- Operation Software, Market Value (USD Million), and CAGR, 2024-2037F

- Maintenance Software, Market Value (USD Million), and CAGR, 2024-2037F

- Facility Management Software, Market Value (USD Million), and CAGR, 2024-2037F

- Service, Market Value (USD Million), and CAGR, 2024-2037F

- By Application

- Residential, Market Value (USD Million), and CAGR, 2024-2037F

- Apartments, Market Value (USD Million), and CAGR, 2024-2037F

- High-Rise Apartments, Market Value (USD Million), and CAGR, 2024-2037F

- Low-Rise Apartments,, Market Value (USD Million), and CAGR, 2024-2037F

- Condominiums, Market Value (USD Million), and CAGR, 2024-2037F

- Detached Houses, Market Value (USD Million), and CAGR, 2024-2037F

- Commercial, Market Value (USD Million), and CAGR, 2024-2037F

- Office Buildings, Market Value (USD Million), and CAGR, 2024-2037F

- Healthcare Facilities, Market Value (USD Million), and CAGR, 2024-2037F

- Retail Spaces, Market Value (USD Million), and CAGR, 2024-2037F

- Recreational Facility, Market Value (USD Million), and CAGR, 2024-2037F

- Industrial, Market Value (USD Million), and CAGR, 2024-2037F

- Others, Market Value (USD Million), and CAGR, 2024-2037F

27.3.3 By End-User

- Architects, Market Value (USD Million), and CAGR, 2024-2037F

- Contractors, Market Value (USD Million), and CAGR, 2024-2037F

- Facility Manager, Market Value (USD Million), and CAGR, 2024-2037F

- Others, Market Value (USD Million), and CAGR, 2024-2037F

27.3.4 By Country

- U.S., Market Value (USD Million), and CAGR, 2024-2037F

- Canada, Market Value (USD Million), and CAGR, 2024-2037F

- Europe Building Information Modeling Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), and Compound Annual Growth Rate (CAGR)

28.3 Building Information Modeling Market Segmentation Analysis (2024-2037)

28.3.1 By Type

- Software, Market Value (USD Million), and CAGR, 2024-2037F

- Operation Software, Market Value (USD Million), and CAGR, 2024-2037F

- Maintenance Software, Market Value (USD Million), and CAGR, 2024-2037F

- Facility Management Software, Market Value (USD Million), and CAGR, 2024-2037F

- Service, Market Value (USD Million), and CAGR, 2024-2037F

- By Application

- Residential, Market Value (USD Million), and CAGR, 2024-2037F

- Apartments, Market Value (USD Million), and CAGR, 2024-2037F

- High-Rise Apartments, Market Value (USD Million), and CAGR, 2024-2037F

- Low-Rise Apartments,, Market Value (USD Million), and CAGR, 2024-2037F

- Condominiums, Market Value (USD Million), and CAGR, 2024-2037F

- Detached Houses, Market Value (USD Million), and CAGR, 2024-2037F

- Commercial, Market Value (USD Million), and CAGR, 2024-2037F

- Office Buildings, Market Value (USD Million), and CAGR, 2024-2037F

- Healthcare Facilities, Market Value (USD Million), and CAGR, 2024-2037F

- Retail Spaces, Market Value (USD Million), and CAGR, 2024-2037F

- Recreational Facility, Market Value (USD Million), and CAGR, 2024-2037F

- Industrial, Market Value (USD Million), and CAGR, 2024-2037F

- Others, Market Value (USD Million), and CAGR, 2024-2037F

28.3.3 By End-User

- Architects, Market Value (USD Million), and CAGR, 2024-2037F

- Contractors, Market Value (USD Million), and CAGR, 2024-2037F

- Facility Manager, Market Value (USD Million), and CAGR, 2024-2037F

- Others, Market Value (USD Million), and CAGR, 2024-2037F

28.3.4 By Country

- UK

- Germany

- France

- Italy

- Spain

- NORDIC

- Russia

- Rest of Europe

- Asia Pacific Building Information Modeling Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), and Compound Annual Growth Rate (CAGR)

- Building Information Modeling Market Segmentation Analysis (2024-2037)

29.3.1 By Type

- Software, Market Value (USD Million), and CAGR, 2024-2037F

- Operation Software, Market Value (USD Million), and CAGR, 2024-2037F

- Maintenance Software, Market Value (USD Million), and CAGR, 2024-2037F

- Facility Management Software, Market Value (USD Million), and CAGR, 2024-2037F

- Service, Market Value (USD Million), and CAGR, 2024-2037F

- By Application

- Residential, Market Value (USD Million), and CAGR, 2024-2037F

- Apartments, Market Value (USD Million), and CAGR, 2024-2037F

- High-Rise Apartments, Market Value (USD Million), and CAGR, 2024-2037F

- Low-Rise Apartments,, Market Value (USD Million), and CAGR, 2024-2037F

- Condominiums, Market Value (USD Million), and CAGR, 2024-2037F

- Detached Houses, Market Value (USD Million), and CAGR, 2024-2037F

- Commercial, Market Value (USD Million), and CAGR, 2024-2037F

- Office Buildings, Market Value (USD Million), and CAGR, 2024-2037F

- Healthcare Facilities, Market Value (USD Million), and CAGR, 2024-2037F

- Retail Spaces, Market Value (USD Million), and CAGR, 2024-2037F

- Recreational Facility, Market Value (USD Million), and CAGR, 2024-2037F

- Industrial, Market Value (USD Million), and CAGR, 2024-2037F

- Others, Market Value (USD Million), and CAGR, 2024-2037F

29.3.4 By End-User

- Architects, Market Value (USD Million), and CAGR, 2024-2037F

- Contractors, Market Value (USD Million), and CAGR, 2024-2037F

- Facility Manager, Market Value (USD Million), and CAGR, 2024-2037F

- Others, Market Value (USD Million), and CAGR, 2024-2037F

29.3.5 By Country

- China

- Japan

- India

- Indonesia

- Australia

- South Korea

- Vietnam

- Malaysia

- Rest of Asia Pacific

- Latin America Building Information Modeling Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), and Compound Annual Growth Rate (CAGR)

3o.3 Building Information Modeling Market Segmentation Analysis (2024-2037)

30.3.1 By Type

- Software, Market Value (USD Million), and CAGR, 2024-2037F

- Operation Software, Market Value (USD Million), and CAGR, 2024-2037F

- Maintenance Software, Market Value (USD Million), and CAGR, 2024-2037F

- Facility Management Software, Market Value (USD Million), and CAGR, 2024-2037F

- Service, Market Value (USD Million), and CAGR, 2024-2037F

- By Application

- Residential, Market Value (USD Million), and CAGR, 2024-2037F

- Apartments, Market Value (USD Million), and CAGR, 2024-2037F

- High-Rise Apartments, Market Value (USD Million), and CAGR, 2024-2037F

- Low-Rise Apartments,, Market Value (USD Million), and CAGR, 2024-2037F

- Condominiums, Market Value (USD Million), and CAGR, 2024-2037F

- Detached Houses, Market Value (USD Million), and CAGR, 2024-2037F

- Commercial, Market Value (USD Million), and CAGR, 2024-2037F

- Office Buildings, Market Value (USD Million), and CAGR, 2024-2037F

- Healthcare Facilities, Market Value (USD Million), and CAGR, 2024-2037F

- Retail Spaces, Market Value (USD Million), and CAGR, 2024-2037F

- Recreational Facility, Market Value (USD Million), and CAGR, 2024-2037F

- Industrial, Market Value (USD Million), and CAGR, 2024-2037F

- Others, Market Value (USD Million), and CAGR, 2024-2037F

30.3.3 By End-User

- Architects, Market Value (USD Million), and CAGR, 2024-2037F

- Contractors, Market Value (USD Million), and CAGR, 2024-2037F

- Facility Manager, Market Value (USD Million), and CAGR, 2024-2037F

- Others, Market Value (USD Million), and CAGR, 2024-2037F

30.3.4 By Country

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Middle East and Africa Building Information Modeling Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), and Compound Annual Growth Rate (CAGR)

31.3 Building Information Modeling Market Segmentation Analysis (2024-2037)

31.3.1 By Type

- Software, Market Value (USD Million), and CAGR, 2024-2037F

- Operation Software, Market Value (USD Million), and CAGR, 2024-2037F

- Maintenance Software, Market Value (USD Million), and CAGR, 2024-2037F

- Facility Management Software, Market Value (USD Million), and CAGR, 2024-2037F

- Service, Market Value (USD Million), and CAGR, 2024-2037F

- By Application

- Residential, Market Value (USD Million), and CAGR, 2024-2037F

- Apartments, Market Value (USD Million), and CAGR, 2024-2037F

- High-Rise Apartments, Market Value (USD Million), and CAGR, 2024-2037F

- Low-Rise Apartments,, Market Value (USD Million), and CAGR, 2024-2037F

- Condominiums, Market Value (USD Million), and CAGR, 2024-2037F

- Detached Houses, Market Value (USD Million), and CAGR, 2024-2037F

- Commercial, Market Value (USD Million), and CAGR, 2024-2037F

- Office Buildings, Market Value (USD Million), and CAGR, 2024-2037F

- Healthcare Facilities, Market Value (USD Million), and CAGR, 2024-2037F

- Retail Spaces, Market Value (USD Million), and CAGR, 2024-2037F

- Recreational Facility, Market Value (USD Million), and CAGR, 2024-2037F

- Industrial, Market Value (USD Million), and CAGR, 2024-2037F

- Others, Market Value (USD Million), and CAGR, 2024-2037F

31.3.3 By End-User

- Architects, Market Value (USD Million), and CAGR, 2024-2037F

- Contractors, Market Value (USD Million), and CAGR, 2024-2037F

- Facility Manager, Market Value (USD Million), and CAGR, 2024-2037F

- Others, Market Value (USD Million), and CAGR, 2024-2037F

31.3.4 By Country

- GCC

- Israel

- South Africa

- Rest of Middle East & Africa

- About Research Nester

Building Information Modeling Market Outlook:

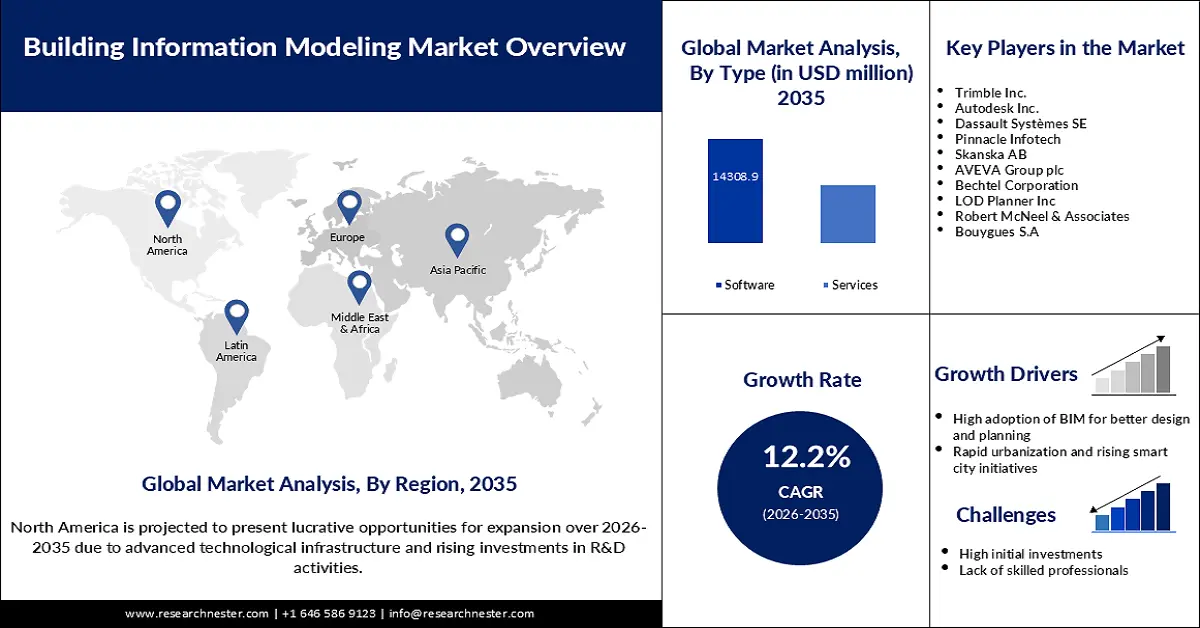

Building Information Modeling Market size was valued at USD 9 billion in 2025 and is expected to reach USD 28.46 billion by 2035, expanding at around 12.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of building information modeling is assessed at USD 9.99 billion.

The market growth is owing to steady adoption of smart buildings across the globe. Building information modeling (BIM) helps in better designing complex urban infrastructures such as transportation systems, buildings, and utilities. The integration of digital twins, AI, and real-time data in BIM solutions to enhance sustainability and efficiency in smart cities is further expected to improve urban development. Several key players in the market are developing software and solutions with these advanced technologies to help with the design and development of smart cities, offices, and architecture.

In addition, governments and private sectors globally are investing heavily in several large-scale infrastructure plans such as smart cities, green buildings, and transportation networks. Governments particularly in the emerging economies are providing substantial budgets for urban infrastructure development. This is also expected to increase the demand for different advanced BIM software and hardware products, supporting the market expansion.

Key Building Information Modeling Market Insights Summary:

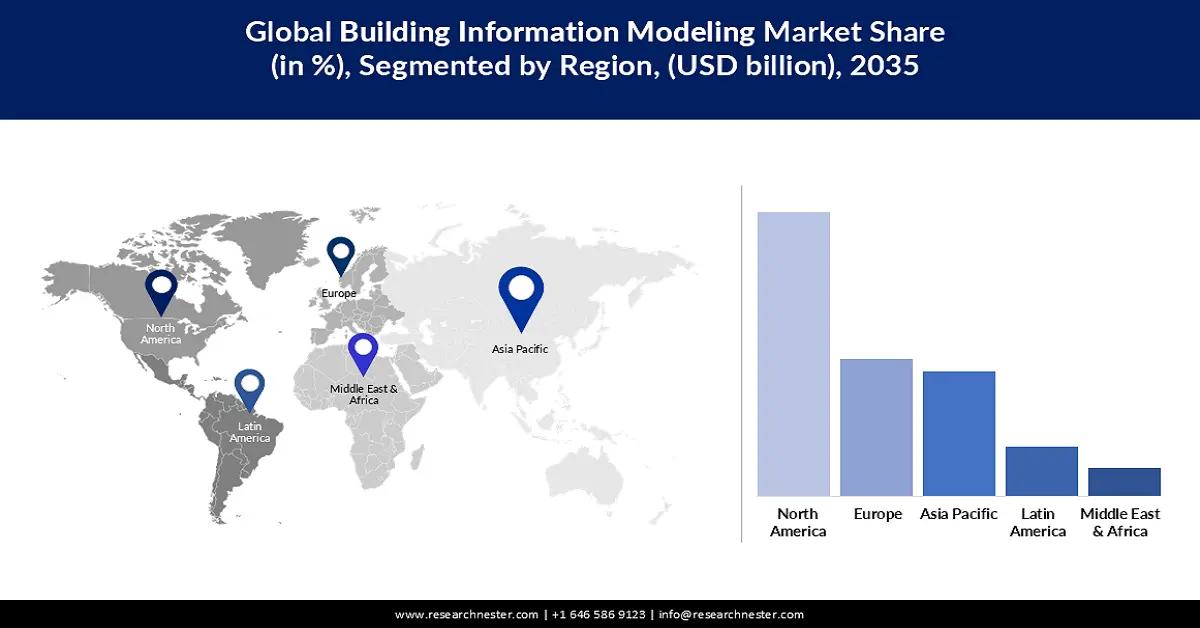

Regional Highlights:

- North America building information modeling market will hold around 45.5% share by 2035, driven by technological adoption and mandatory BIM regulations.

- Asia Pacific market projects lucrative growth during the forecast timeline, driven by urbanization and BIM mandates in public projects.

Segment Insights:

- The residential segment in the building information modeling market is expected to capture a significant share by 2035, driven by rapid residential construction and government mandates for BIM usage.

- The software segment in the building information modeling market is expected to experience robust growth during 2026-2035, fueled by rising urban development needs and digital transformation in construction.

Key Growth Trends:

- High adoption of BIM for better design and planning

- Government initiatives supporting the adoption of BIM

Major Challenges:

- High initial investments and cost of BIM software

- Lack of skilled professionals

Key Players: Autodesk Inc, Aesthetic Designs LLP, Bentley Systems, Incorporated, Harmony AT, Hexagon AB, MaRS BIM Solutions, Pinnacle Infotech Private Limited, Rib Software, Taiwan BIM Technology, Trimble Inc., Graphisoft, Dassault Systèmes SE, Skanska AB, AVEVA Group plc, Bechtel Corporation, LOD Planner Inc, Robert McNeel & Associates, Bouygues S.A.

Global Building Information Modeling Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 9 billion

- 2026 Market Size: USD 9.99 billion

- Projected Market Size: USD 28.46 billion by 2035

- Growth Forecasts: 12.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (45.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 8 September, 2025

Building Information Modeling Market Growth Drivers and Challenges:

Growth Drivers

-

High adoption of BIM for better design and planning: BIM is rapidly gaining popularity in modern infrastructure projects as it helps in better planning, real-time collaboration, and simulation of project phases. This is a key factor expected to boost BIM sales during the forecast period. BIM provides detailed, multi-dimensional visualizations that surpasses 2D blueprints. This can help stakeholders to see how the project will look and function. For instance, in May 2024, WiseBIM, a French software startup announced the launch of WiseBIM AI for Autodesk Revit which turns 2D plans into Revit elements.

-

Government initiatives supporting the adoption of BIM: Governments across the globe are recognizing the transformative potential of BIM in enhancing the efficiency and transparency of construction projects. As BIM projects worldwide are expected to increase drastically over the coming years, governments are enforcing standards, offering financial initiatives, and integrating BIM into national strategies. Among all the countries, the UK government was one of the first to mandate BIM adoption for construction and urban development.

Challenges

-

High initial investments and cost of BIM software: Though BIM is rapidly gaining traction worldwide, the high initial investments required to develop BIM software and services is expected to hamper overall market growth during the forecast period. For instance, BIM tools like Autodesk Revit or ArchiCAD are expensive to purchase and also require ongoing licensing fees. In addition, advanced hardware, including high-performance computers and servers needed to run the BIM software increases the total upfront costs. This is expected to hamper the overall adoption of BIM software and services to a certain extent going ahead.

-

Lack of skilled professionals: As these products are complex, they often require skilled technicians and experts for development and operations. Thus, small and medium-scale companies with limited funds, may not be able to hire skilled professionals or train existing staff is expected to restrain the BIM market growth during the forecast period.

Building Information Modeling Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

12.2% |

|

Base Year Market Size (2025) |

USD 9 billion |

|

Forecast Year Market Size (2035) |

USD 28.46 billion |

|

Regional Scope |

|

Building Information Modeling Market Segmentation:

Type Segment Analysis

Based on type, the software segment in building information modeling market is likely to expand at a robust revenue CAGR through 2035, owing to rising need for advanced BIM software in urban development, high adoption of digital transformation in construction, and increasing investments in developing software with advanced technologies. One of the key developments in this sector is the launch of an industrial solution by AVEVA and Wood in June 2021. Wood standardized its use of AVEVA Enterprise Resource Management for connected build to its industrial clients globally.

Application Segment Analysis

The residential segment is expected to register significant revenue share in building information modeling (BIM) market during the forecast period. This growth can be attributed to rapidly increasing residential buildings across the globe, growing need for housing in urban areas, high usage of BIM for residential design, and rising investments in smart cities and sustainable constructions. Many governments are mandating BMI use in residential constructions to improve the quality and compliance. Along with this, the development of advanced BIM for the residential sector will boost segment revenue. For instance, in September 2024, Hitachi, Ltd announced the launch of BuilMirai building IoT solution for small and medium-sized residential buildings.

Our in-depth analysis of the building information modeling market includes the following segments:

|

Type |

|

|

Application |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Building Information Modeling Market Regional Analysis:

North America Market Insights

North America region is poised to dominate around 45.5% market share by 2035, due to technological adoption and mandatory BIM regulations. In addition, governments in the U.S. and Canada are supporting the market growth by implementing regulations that require BIM usage in public and private infrastructure projects.

In the U.S., the building information modeling (BIM) market is expected to account for a significant share by 2035. This growth can be attributed to the presence of well-developed infrastructure, increasing funding from various public and private sectors, and the high usage of BIM to design and build energy-efficient buildings. Manufacturers in the U.S. are focused on integrating advanced technologies such as AI, IoT, and digital twins.

The Canada market will expand at a rapid growth rate owing to rising government investments to support urban growth and sustainability goals, high focus on green building, and increasing adoption of advanced technologies for better project and risk management.

Asia Pacific Market Insights

Asia Pacific building information modeling (BIM) market is expected to register lucrative CAGR through 2035, led by rising investments in building and construction activities across the region, rapid urbanization, and the implementation of BIM mandates by governments for public projects to enhance building efficiency and transparency. China, India, Japan, and South Korea are some of the largest revenue-generating countries in the APAC.

In India, building information modeling (BIM) market is likely to generate a significant revenue share throughout the forecast period owing to rising investments by the government in urban infrastructure and initiatives such as the Smart Cities Mission, Housing for All by 2022, and the National Infrastructure Pipeline.

The building information modeling market in China is expected to register robust revenue growth due to massive infrastructure initiatives, the presence of robust key players, and government mandates to support the adoption of BIM in recent infrastructure projects. Shanghai and Beijing heavily rely on BIM to optimize urban planning and resource management.

Building Information Modeling Market Players:

- Bentley Systems

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Trimble Inc.

- Autodesk Inc.

- Dassault Systèmes SE

- Pinnacle Infotech

- Skanska AB

- AVEVA Group plc

- Bechtel Corporation

- LOD Planner Inc

- Robert McNeel & Associates

- Bouygues S.A

The global building information modeling (BIM) market is extremely competitive, with regional and international players driving BIM software and services innovations. Companies such as Bentley Systems, Trimble Inc., Dassault Systems, and Nemetschek SE are integrating advanced technologies such as AI, digital twin technology, and cloud-based solutions. These key players are focused on adopting strategies such as mergers and acquisitions, partnerships, product launches, joint ventures, and license agreements to enhance their product portfolio and sustain their market position. Here is a list of key players operating in the global building information modeling market:

Recent Developments

- In June 2023, OpenSpace, a global leader in 360-degree reality capture and AI-powered analytics, announced the launch of OpenSpace BIM+, an easy-to-use 3D tool to help field teams and virtual design and construction teams and empower them to solve problems faster.

- In March 2023, Trimble announced the launch of its latest versions of Tekla software, Tekla Tedds 2023, Tekla Structures 2023, Tekla Structural Designer 2023, and Tekla PowerFab 2023 for constructible BIM, structural engineering, and steel fabrication management. These products are expected to improve construction productivity, quality, and efficiency significantly.

- Report ID: 3219

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.