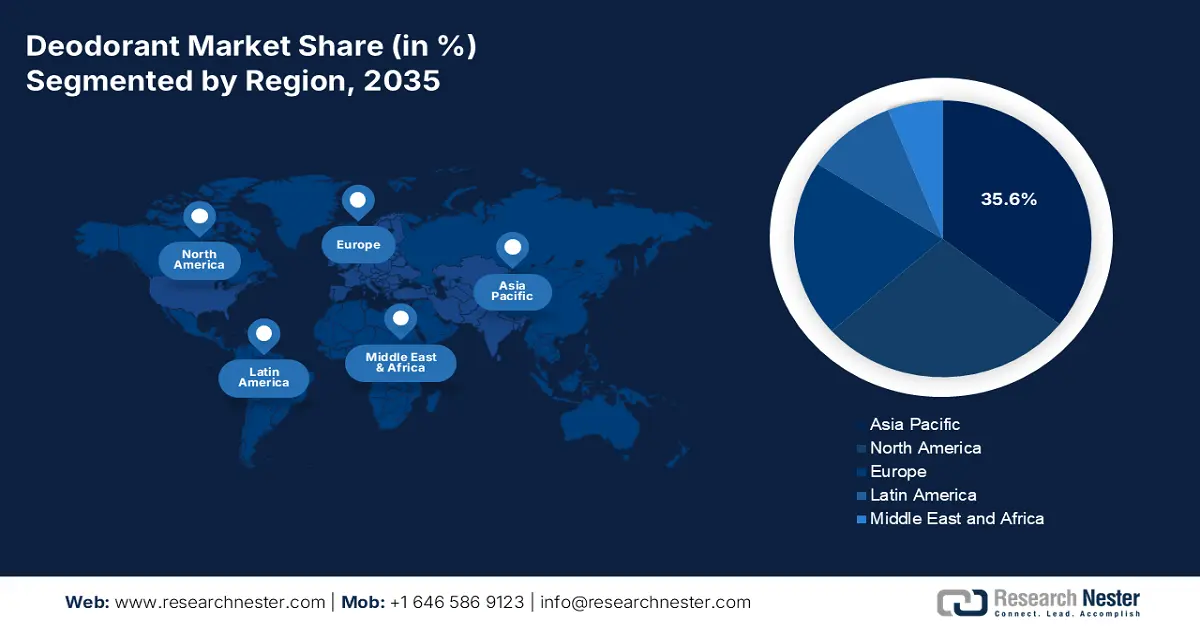

Deodorant Market - Regional Analysis

APAC Market Insights

Asia Pacific is set to be the dominant in the deodorant market and is expected to hold the market share of 35.6% by 2035. One of the main characteristics of the market growth is the rising influence of Western culture. The main factor leading the market is the increasing disposable incomes, tracked by entities like China's National Bureau of Statistics, which reports steady growth in consumer goods retail sales, expanding the consumer base. Urbanization and Western influences are changing the way people take care of themselves and thus generating demand for deodorants used daily. The deodorant market is very diverse, with the range of trends going from the consumer preference of natural ingredients in South Korea to value-oriented products targeting price-sensitive regions. E-commerce is a critical distribution channel, enabling brands to reach vast, geographically dispersed populations efficiently.

China is leading the APAC deodorant market and is experiencing rapid growth fueled by the rising awareness of personal grooming specially among the younger population. The country is surging quickly as global domestic brands invest heavily in marketing and education. The primary driver is the expansion of modern retail and e-commerce, making products widely accessible. According to the OEC data in 2023, China imported USD 32.9 million worth of personal deodorants, highlighting the demand for the market. Further, the People’s Republic of China data in January 2022 depicts that the total retail sales of consumer goods hit 44.08 trillion yuan in 2021. This data demonstrates the strong consumer spending power that highlights this market expansion. This robust import and domestic spending data stimulates a mature and rapidly expanding deodorant market with significant opportunities for both international and local brands.

The deodorant market in India is one of the rapidly expanding markets and is propelled by a massive youth population, rising middle-class affordability, and the transition from traditional substitutes to branded products. The deodorant market is highly competitive and price sensitive during the innovation in value-sized and mass market segments. Growth is further accelerated by the deep penetration of organized retail and e-commerce into tier-2 and tier-3 cities. India has exported over USD 50.4 million worth of personal deodorants and antiperspirants, based on the OEC data in 2023. This export data shows India's growing role as a major manufacturing hub for personal care products. This production capability aids in both domestic brand growth and international market access, further driving the market expansion.

North America Market Insights

By 2035, North America is expected to be the fastest-growing deodorant market and is projected to grow at a significant CAGR during the forecast period. The market is defined by the high penetration rate and the shift towards premiumization and ingredient transparency. The growth is driven by consumer demand for natural and aluminum-free formulations, which is propelled by health consciousness and FDA regulatory frameworks. The market is highly consolidated, with innovation focused on skin sensitivities, multifunctional benefits, and sustainable packaging. E-commerce remains a significant growth channel with robust logistics that are supported by established infrastructure in Canada and the U.S. The market maturity in the region results in incremental growth to emerging economies, with brand loyalty and efficacy being key purchase drivers.

The U.S. deodorant market is characterized by a strong consumer shift towards the rising awareness of ingredients in the products and a search for aluminum-free and natural formulations. The growth in the country is propelled by the dominance of e-commerce, which has consistently outpaced the total retail sales, indicating a permanent shift in the purchasing channels. The FDA's regulatory regulation of antiperspirants as over-the-counter medications, which controls component safety and labeling claims and promotes consumer confidence in product efficacy, highlights this development. Recently, in June 2025, PAPATUI Men’s Care introduced a full-body deodorant spray that is paraben-free and aluminum-free. This new product offers long-lasting odor protection in the brand’s signature scents. Further, the deodorant is available in three different scents, such as Lush Coconut, Cedar Sport, and Sandalwood Suede.

In Canada, the deodorant market trends are highly influenced by the robust regulatory frameworks and national emphasis on environmental sustainability. The government initiative from the Environment and Climate Change Canada, such as the Zero Plastic Waste Agenda, is pushing manufacturers to adopt sustainable packaging solutions that accelerate the development of refillable and plastic-free deodorant formats. Further, a multicultural demographic is driving the demand for diverse fragrance profiles for various skin types. The powerful NIVEA Men Deodorant, which launched in March 2024, is coming to Canada. It is a revolutionary roll-on format that is the first of its type for Canadian men. This invention is expanding the grooming for men's market and addresses the need for efficient, skin-friendly, and practical application formats.

Europe Market Insights

The deodorant market in Europe is expanding rapidly and is driven by the rising consumer base seeking sustainability, health, and ingredient transparency. The growth is mainly driven by the premiumization and innovation in organic and natural formulations, as people increasingly look for products that are free from synthetic ingredients and aluminum salts. This trend is further integrated by robust EU-wide regulations overseen by the European Medicines Agency, which classifies the antiperspirants as cosmetics with safety and labeling requirements. The deodorant market faces pressure to develop sustainable packaging in alignment with the EU’s Circular Economy Action Plan, and surging investment in recycled and refillable materials. The overall growth is modest compared to other regions. Further, the demand is stable and driven by the product innovation that caters to specific customers' concerns such as sin sensitivity and environmental impact.

Germany is projected to hold the highest share in Europe and is driven by its focus on ingredient safety, product efficacy and environmental sustainability. Consumers in the country determine high sensitivity to product composition which is a trend aided by the robust work of the German Federal Institute for Risk Assessment which provides scientific evaluations on the safety of cosmetic ingredients, including deodorants. This further boosts the deodorant market with clinically approved products gaining a significant traction. Germany imported more over USD 296 million worth of personal goods, indicating the country's growing need for deodorant products, according to the OEC 2023 data. Germany's well-established discount and drugstore channels, such as DM and Rossmann, provide massive distribution for these premium mass-market products, ensuring widespread availability and consumer access.

The UK is going to be at the forefront and is mainly driven due to the energetic retail environment, brand innovation, and consumer engagement with health trends. In spite of Brexit, the UK's Cosmetics Regulation largely mirrors EU regulations relevant regulatory authority being the UK Health and Safety Executive. The total export share of the UK’s deodorant in 2023 is 11.7%, highlighting the rising customer base. One of the important growth drivers is the dynamic Direct-to-Consumer and online beauty sector that enables agile brands to launch innovative formats such as cream and paste deodorants, quickly and market them. The UK's Office for National Statistics regularly reports on the strong growth in online retail sales, which is one of the important channels for the discovery and purchase of deodorants.