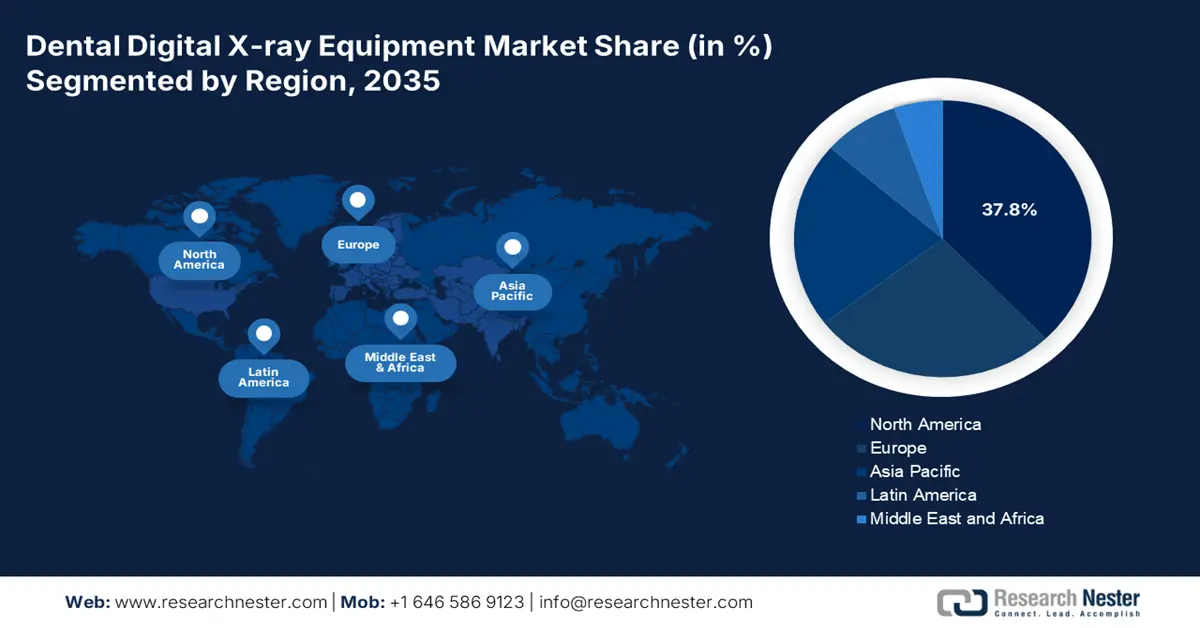

Dental Digital X-ray Equipment Market - Regional Analysis

North America Market Insights

The North America dental digital X-ray equipment market is expected to hold a market share of 37.8% at a CAGR of 8.2% by 2035. The dental digital X-ray equipment market is fueled by superior healthcare infrastructure, elevated dental service usage, favorable reimbursement practices, and substantial federal and provincial investment. The Centers for Medicare & Medicaid Services (CMS) improved reimbursement avenues for cone-beam computed tomography (CBCT) and 3D digital X-rays, fueling adoption in dental clinics. The synergy of solid institutional funding, patient-led demand, and policy promotion places North America in a mature, innovation-led market for dental digital X-ray systems until 2034.

Canada’s dental digital X-ray equipment market is expanding actively with increased provincial and federal investments and improved access to dental diagnostic infrastructure. As per the report by the government of Canada on the dental care plan in December 2023 depicts that the government has planned to invest $13 billion in the first five years and $4.4 billion annually to implement the Canadian Dental Care Plan (CDCP), focusing on affordable and accessible dental care services for people in Canada. Further, Innovative Medicines Canada and BioteCanada surge their focus on domestic R&D investments, mainly in AI-enabled digital imaging systems.

Export Data Instruments and Appliances in Dental Sector

|

Country |

Exported To |

Trade Value |

Year |

|

Germany |

U.S. |

409,828.84 |

2023 |

|

Israel |

U.S. |

104,602.00 |

2023 |

|

European Union |

Canada |

61,096.17 |

2021 |

|

Austria |

Canada |

11,426.11 |

2021 |

Sources: WITS

APAC Market Insights

The Asia Pacific is the fastest-growing region in the dental digital X-ray equipment market and is projected to lead the dental digital X-ray equipment market by 2035. The region is driven by the expanding healthcare infrastructure, rising patient demand for preventive dental care, and increased government spending. The region has experienced a significant boost in public health funding, focusing on digitizing diagnostic capabilities. As per the International Trade Administration article released in March 2025 states that 70% of the private dental clinics demand the market in Malaysia. On the other hand, South Korea is the leading exporter of dental X-ray machines, reaching USD 194 million in 2023, stated to the OEC report in 2023. The rising adoption of digital health technologies is driving the market in the region.

India's dental digital X-ray device market is expected to capture a maximum share by 2035 and is fueled by increasing oral health consciousness and government investment in diagnostic equipment. As per the OEC 2023 report, India imported USD 16.9 million of dental X-ray machines in 2023. In 2024, more than 32.80 crore patients received oral screening under the government-funded program, as stated in the Ministry of Health & Family Welfare report in 2024. Further, the Digital India Health program encourages digitization in primary health centers, surging the usage of digital imaging technologies in urban and rural healthcare facilities.

Europe Market Insights

The dental digital X-ray equipment market in Europe is expected to expand rapidly. The market is driven by the rising dental awareness, national-level reimbursement improvements, and early diagnostic initiatives. The UK, Germany, and France have increased investments for dental imaging and moving forward towards digital transformation in the healthcare sector. The Europe government has funded via EU4Health with €4.4 billion for health innovation, including dental diagnostics. Further, the regulations under the Medical Device Regulation have ensured widespread equipment adoption and enhanced safety protocols across clinics.

Germany's dental digital X-ray devices in Europe to hold a considerable amount of market share by 2035. The federal government has spent €3 billion in hospital funds to upgrade digital diagnosis, modern infrastructure, and IT security, as per the bundesgesundheitsministerium report in June 2024, including dental radiology. The device adoption in the nation is further fueled by rising outpatients in dental clinics and insurance reimbursement. On the trade side, Germany is the leader in exporting dental X-ray machines and have exported USD 110 million in 2024, as stated in OEC report in 2023. Germany's streamlined regulatory process under the MDR facilitates market entry for manufacturers.

Top Exporters of Dental X-ray Machines to Germany in 2023

|

Country |

Year |

Exports |

Share |

ECI |

|

Italy |

2023 |

USD 954 K |

3.96% |

1.29 |

|

France |

2023 |

USD 1.15 M |

4.78% |

1.34 |

|

Finland |

2023 |

USD 3.81 M |

15.8% |

1.46 |

Source: OEC, 2023