Defense Tactical Computers Market Outlook:

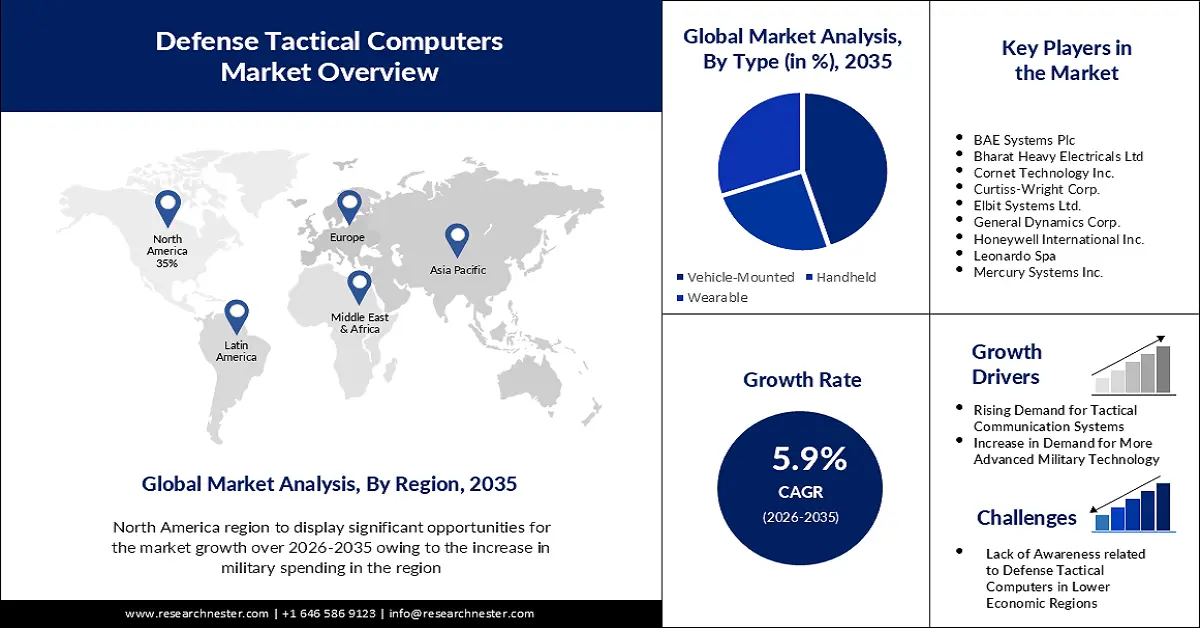

Defense Tactical Computers Market size was over USD 6.14 billion in 2025 and is projected to reach USD 10.89 billion by 2035, witnessing around 5.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of defense tactical computers is assessed at USD 6.47 billion.

The reason behind the growth is due to an increasing count of military vehicles across the world. To meet the security needs military forces around the globe are increasingly adopting military vehicles, which in turn rises the demand for defense tactical computers to manage huge amounts of data generated by these vehicles. For instance, in 2023, the aggregate number of ground combat vehicles among North Atlantic Treaty Organization (NATO) allies was over 1 million, with armored vehicles accounting for the majority of these. Also, more than 12,400 main combat tanks were built. The growing demand for rugged, high-performance, and dependable computing devices is believed to fuel the market growth. For instance, owing to the rising need for reliable and durable computing solutions in dynamic environments the market is set to grow in the near future.

Key Defense Tactical Computers Market Insights Summary:

Regional Highlights:

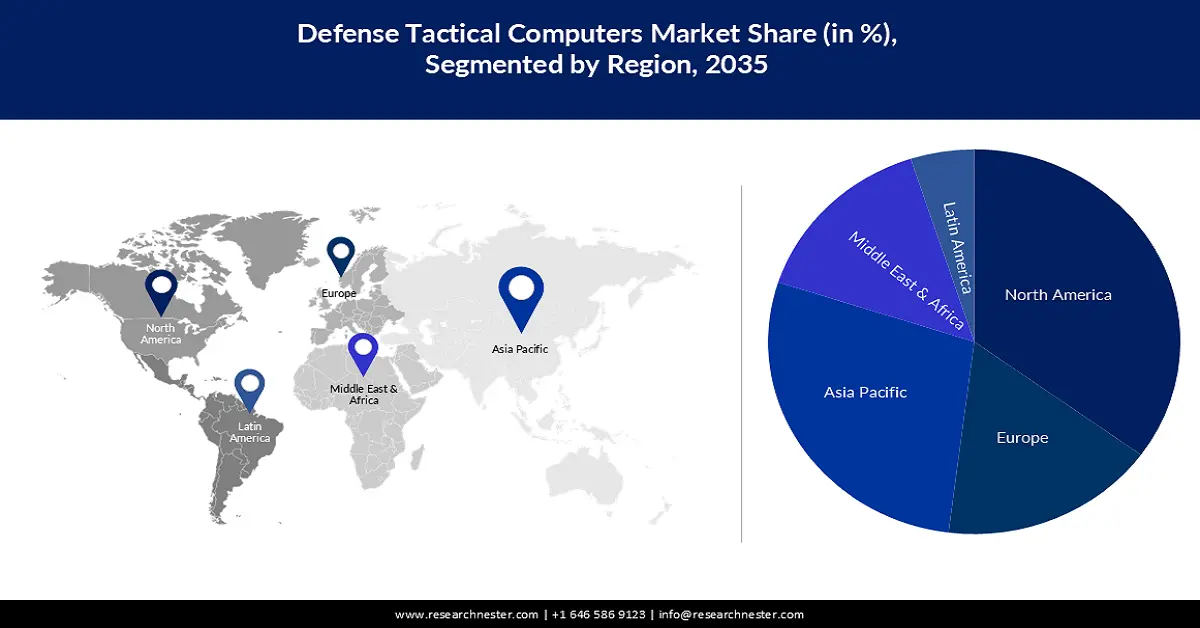

- North America is anticipated to command the majority revenue share in the defense tactical computers market by 2035, spurred by rising military spending.

- The Asia Pacific region is projected to hold the second-largest share by 2035, underpinned by growing government financing for modernizing defense information-sharing platforms.

Segment Insights:

- The vehicle-mounted segment is projected to secure a robust share by 2035 in the defense tactical computers market, propelled by the expanding operational advantages these systems provide.

- The land segment is expected to capture a notable share by 2035, fostered by increased deployment of defense tactical computers in hazardous land-force missions.

Key Growth Trends:

- Rising Demand for Tactical Communication Systems

- Increase in Demand for More Advanced Military Technology

Major Challenges:

- Lack of Awareness related to Defense Tactical Computers in Lower Economic Regions

- Vulnerability to Cyber Attack

Key Players: Saab AB, BAE Systems Plc, Bharat Heavy Electricals Ltd, Cornet Technology Inc., Curtiss-Wright Corp., Elbit Systems Ltd., General Dynamics Corp., Honeywell International Inc., Leonardo Spa, Mercury Systems Inc.

Global Defense Tactical Computers Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.14 billion

- 2026 Market Size: USD 6.47 billion

- Projected Market Size: USD 10.89 billion by 2035

- Growth Forecasts: 5.9%

Key Regional Dynamics:

- Largest Region: North America

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Russia, United Kingdom, France

- Emerging Countries: India, South Korea, Australia, Israel, United Arab Emirates

Last updated on : 20 November, 2025

Defense Tactical Computers Market - Growth Drivers and Challenges

Growth Drivers

- Rising Demand for Tactical Communication Systems – It is expected that rising investment in military communication gear and the growing need for encrypted communication is to drive market growth. Further, to meet the demand for tactical communication defense tactical computers are needed since they are smaller in size, and offer secure encryption protocols.

- Increase in Demand for More Advanced Military Technology- The need for minimizing uncertainty, and boosting military capabilities and efficiency is expected to result in increased demand for more advanced military technologies including defense tactical computers.

- In addition, factors such as the rise in digitization of the battlefield and the rising need for wearable computers will all contribute to the market's expansion.

Challenges

- Lack of Awareness related to Defense Tactical Computers in Lower Economic Regions - The lack of awareness is one of the major factors predicted to slow down the market growth. For instance, a lack of awareness in lower economic regions a lack of awareness may result in insufficient information on the uses of defense tactical computers, limiting their adoption in these areas.

- Vulnerability to Cyber-Attack- For instance, defense computers are used for military operations which involve vast amounts of sensitive data which may attract cybercriminals from other nations.

Defense Tactical Computers Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.9% |

|

Base Year Market Size (2025) |

USD 6.14 billion |

|

Forecast Year Market Size (2035) |

USD 10.89 billion |

|

Regional Scope |

|

Defense Tactical Computers Market Segmentation:

Type Segment Analysis

The vehicle-mounted segment in the defense tactical computers market is estimated to gain a robust revenue share in the coming years. The segment growth can be attributed to the increasing benefits offered by this type. Vehicle-mounted tactical computers are gaining popularity in the defense sector across the globe owing to the numerous benefits offered by them which may lead to an increase in their demand in the near future. For instance, vehicle-mounted tactical computers provide real-time data, improve firing accuracy, and allow easy communication within the military network.

Platform Segment Analysis

The land segment is set to garner a notable share in the near future. The growth of the segment is driven by the growing usage of defense tactical computers. Land force missions frequently take place in critical and hazardous situations, necessitating the use of these computers to obtain real-time information about the situation and make informed judgments to prevent serious damage. Besides this, they also provide navigation tools to easily move across strange regions and find out the safest route.

Our in-depth analysis of the global market includes the following segments:

|

By Type |

|

|

By Platform |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Defense Tactical Computers Market - Regional Analysis

North America Market Insights

North America industry is anticipated to dominate majority revenue share by 2035. The market growth in the region is impelled by an increase in military spending. For instance, a high military budget can be utilized to modernize the armed forces and upgrade technologies to effectively support defense activities. This as a result is expected to rise the demand for defense tactical computers in the region. The United States leads the list of countries with the highest military spending in 2021, with over USD 745 billion predicted in 2023, rising to nearly USD 1 trillion by 2033.

APAC Market Insights

The Asia Pacific defense tactical computers market is estimated to be the second largest, during the forecast timeframe. The growth of the market can be led by the growing government financing for the modernization of existing defense information-sharing platform systems. This may result in growing demand for defense tactical computers in the region as they allow for easy communication and data sharing between defense networks and can be successfully integrated into the network.

Defense Tactical Computers Market Players:

- Saab AB

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- BAE Systems Plc

- Bharat Heavy Electricals Ltd

- Cornet Technology Inc.

- Curtiss-Wright Corp.

- Elbit Systems Ltd.

- General Dynamics Corp.

- Honeywell International Inc.

- Leonardo Spa

- Mercury Systems Inc.

Recent Developments

- Mercury Systems Inc. launched next-generation rugged edge servers with 4th generation Intel Xeon Scalable processors known as Sapphire Rapids for aerospace & defense missions to address the rigorous needs of mission-critical workloads.

- Curtiss-Wright Corp. introduced the mini modular mission computer Parvus DuraCOR 313 developed for best performance in the hardest military and aerospace situations in terms of size, weight, and power.

- Report ID: 3873

- Published Date: Nov 20, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Defense Tactical Computers Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.