Ground Surveillance Radar (GSR) Systems Market Outlook:

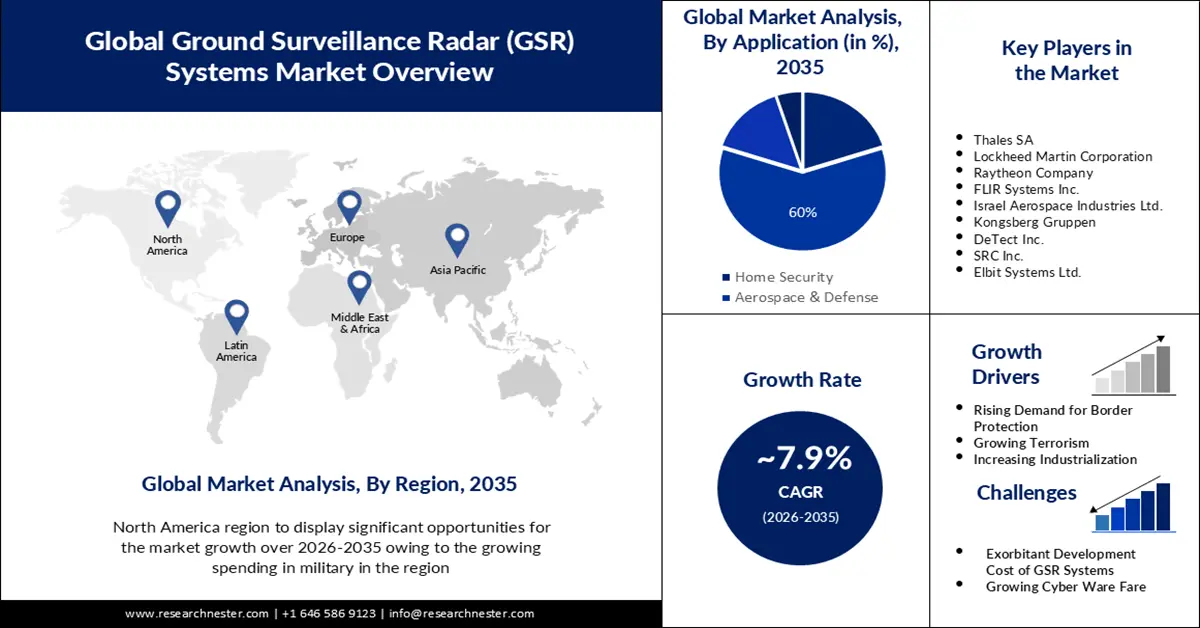

Ground Surveillance Radar (GSR) Systems Market size was valued at USD 43.43 billion in 2025 and is likely to cross USD 92.9 billion by 2035, registering more than 7.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of ground surveillance radar systems is estimated at USD 46.52 billion.

The growth of the market can be attributed to the increasing aerospace sector. For instance, radar technology developments are making it possible to create more sophisticated and advanced ground surveillance radar systems. These systems are more appealing to clients since they're able to offer more precision and improved target identification skills.

In addition to these, factors that are believed to fuel the market growth of ground surveillance radar (GSR) systems include the rise in technological advancements in the field of radar systems. For instance, radar technology developments are making it possible to create more sophisticated and advanced ground surveillance radar systems. These systems are more appealing to clients since they're able to offer more precision and improved target identification skills. Additionally, the growing demand for environmental monitoring is predicted to present the potential for market expansion over the projected period

Key Ground Surveillance Radar (GSR) Systems Market Insights Summary:

Regional Highlights:

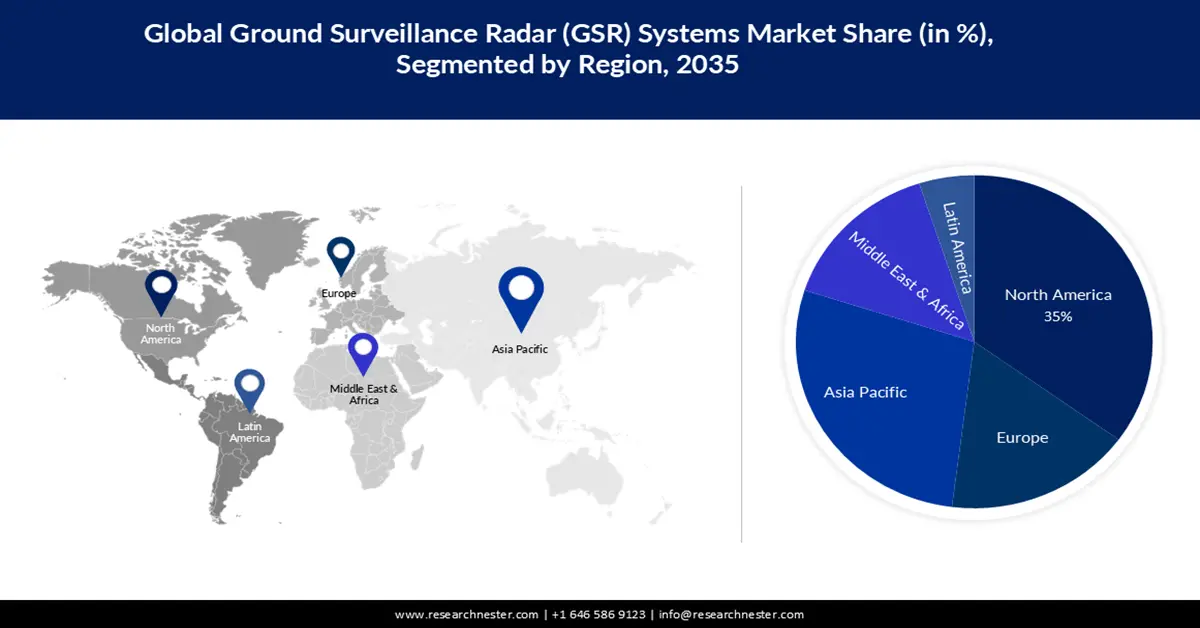

- North America is forecasted to capture a 35% share by 2035 in the ground surveillance radar (GSR) systems market, supported by escalating military spending in the region.

- The Asia Pacific region is projected to secure the second-largest share by 2035, reinforced by rising investments in air missile and ballistic missile systems.

Segment Insights:

- The aerospace & defense segment is projected to command the largest share by 2035 in the ground surveillance radar (GSR) systems market, propelled by increasing global aerospace and defense spending.

- The long-range segment is expected to attain a significant share by 2035, owing to the rising need for advanced long-range radar security systems

Key Growth Trends:

- Growing Terrorism

- Rising Demand for Border Protection

Major Challenges:

- Exorbitant Development Cost of Ground Surveillance Radar Systems

- Growing Cyber WareFare

Key Players: Saab AB, Company OverviewThales SA, Lockheed Martin Corporation, Raytheon Company, FLIR Systems Inc., Israel Aerospace Industries Ltd., Kongsberg Gruppen, DeTect Inc., SRC Inc., Elbit Systems Ltd.

Global Ground Surveillance Radar (GSR) Systems Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 43.43 billion

- 2026 Market Size: USD 46.52 billion

- Projected Market Size: USD 92.9 billion by 2035

- Growth Forecasts: 7.9%

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Australia, Mexico

Last updated on : 20 November, 2025

Ground Surveillance Radar (GSR) Systems Market - Growth Drivers and Challenges

Growth Drivers

-

Growing Terrorism– On account of the increasing threat of terrorism, governments and security agencies are looking to improve their surveillance and monitoring capabilities to prevent and mitigate potential security risks, which as a result is expected to expand the market more in the upcoming years. According to estimates, there were over 9,000 terrorist acts in 2020, and more than 25,000 terrorist-related deaths globally.

-

Rising Demand for Border Protection – The use of cutting-edge technologies, such as ground surveillance radar systems, to identify and track potential security threats is growing as nations are looking to improve border security, which in turn is estimated to drive market growth. In 2021, the U.S. Border Patrol reported more than 1 million interactions with migrants along the border with Mexico.

-

Increasing Industrialization – It is expected that surging industrial activities across the globe are predicted to increase the demand for ground surveillance radar systems as they are used to monitor infrastructure and industry, including pipeline leak detection, traffic flow, and building structural integrity. According to the most recent data, in India industry is the end-use sector that currently uses the most energy, and its share in total final consumption will rise over 35% by 2040

-

Surging Marine Sector – As the marine industry grows, there is likely to be an increase in shipping traffic, which is anticipated to drive the market growth. As of 2020, the export of marine products in India climbed over 1 MMT, exhibiting an annual growth rate of more than 6%

Challenges

-

Exorbitant Development Cost of Ground Surveillance Radar Systems- The high price of ground surveillance radar systems is one of the major factors predicted to slow down the market growth. For instance, the design, construction, and testing of ground surveillance radar systems necessitate intensive research and development activities. This can be a labor-intensive and costly operation that calls for specific knowledge, supplies, and tools.

-

Growing Cyber WareFare

-

Rising Electromagnetic Jamming Interference

Ground Surveillance Radar (GSR) Systems Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.9% |

|

Base Year Market Size (2025) |

USD 43.43 billion |

|

Forecast Year Market Size (2035) |

USD 92.9 billion |

|

Regional Scope |

|

Ground Surveillance Radar (GSR) Systems Market Segmentation:

Application Segment Analysis

The global ground surveillance radar (GSR) systems market is segmented and analyzed for demand and supply by application into home security, aerospace & defense, critical infrastructure, and others. Out of the four applications of ground surveillance radar (GSR) systems, the aerospace & defense segment is estimated to gain the largest market share in the year 2035. The growth of the segment can be attributed to the increased spending in the aerospace and defense sector across the globe. Demand for ground surveillance radar systems is probably going to rise along with spending in the aerospace and defense industries. For instance, to improve their surveillance and intelligence capabilities and respond to new security threats, aerospace and defense firms may choose to invest in the development of advanced ground surveillance radar systems. Further, ground surveillance radar systems are crucial for aerospace and defense operations as they are utilized for several tasks, including seeing and following enemy movements, and giving military troops situational awareness. In 2021, the total global military spending increased by over 0.5%. The top five spenders in 2021 were the US, China, India, the UK, and Russia, who together accounted for more than 60% of expenditure.

Product Segment Analysis

The global ground surveillance radar (GSR) systems market is also segmented and analyzed for demand and supply by product type into short-range, medium-range, and long-range. Amongst these three segments, the long-range segment is expected to garner a significant share in the year 2035. The growth can be attributed to the growing need for long-range radar security systems for air surveillance systems, air mapping systems, and weapon control systems. The demand for long-range radar systems, particularly those that offer advanced features such as high resolution, high accuracy, and reliable performance, is anticipated to increase in response to the increasing need for long-range radar security systems for air surveillance, air mapping, and weapon control systems. This, as a result, is anticipated to create numerous opportunities for the growth of the segment in the coming years.

Our in-depth analysis of the global market includes the following segments:

|

By Product Type |

|

|

By Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Ground Surveillance Radar (GSR) Systems Market - Regional Analysis

North American Market Insights

North America industry is expected to dominate majority revenue share of 35% by 2035. The growth of the market can be attributed majorly to the growing spending in the military. As military organizations try to improve their surveillance and intelligence capabilities to confront changing threats and challenges, the demand for ground surveillance radar systems is projected to increase with rising military spending in the region. Moreover, military organizations in the area are likely to invest in upgrading their existing systems or purchasing new ones to keep up with possible enemies. For instance, the United States, which accounted for around 40% of global military spending in 2020, is by far the largest military spender in the world. China is still far behind with over USD 250 billion. Further, the increasing concerns regarding safety in the region, along with the availability of major market players, are also anticipated to contribute to the market growth in the region. In addition, the region's increasing research and development spending to produce new, highly dependable military machinery and equipment is also anticipated to boost the market growth during the forecast period. With over 800 billion dollars allocated to the military in 2021, the United States was the nation with the largest military budget.

APAC Market Insights

The Asian Pacific ground surveillance radar (GSR) systems market is estimated to hold the second-largest, share by the end of 2035. The growth of the market can be attributed majorly to the increasing investments in air missile systems and ballistic missiles. The demand for ground surveillance radar systems is probably going to increase in the region as a result of growing investment in air missile systems and ballistic missiles. For instance, the need for these systems is anticipated to increase as nations in the area looking to improve their missile defense capabilities and respond to new security threats. Further, the growing instability in global politics between economies in the region is also anticipated to contribute to the market growth in the region. In addition, the growing technological advancements in the region have resulted in the creation of increasingly advanced and effective ground surveillance radar systems, which are also anticipated to boost market growth during the forecast period.

Europe Market Insights

Further, the market in Europe, amongst the market in all the other regions, is projected to hold a majority of the share by the end of 2035. The growth of the market can be attributed majorly to the increasing spending on defense. For instance, European countries are increasing their defense spending to improve their military preparedness and capability in response to the growing concerns about regional security threats. The need for ground observation radar systems, essential to military radar and information gathering, is anticipated to be driven by this increase in spending. Further, the growing technological advancements in the region, along with the surging automotive sector, are also anticipated to contribute to the market growth in the region. In addition, the region's increasing need for radar systems in the military and defense industry is also anticipated to boost market growth during the forecast period.

Ground Surveillance Radar (GSR) Systems Market Players:

- Saab AB

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Thales SA

- Lockheed Martin Corporation

- Raytheon Company

- FLIR Systems Inc.

- Israel Aerospace Industries Ltd.

- Kongsberg Gruppen

- DeTect Inc.

- SRC Inc.

- Elbit Systems Ltd.

Recent Developments

- Thales SA announced to provide Ukraine with GM200 radar and air defense systems, containing a variety of tools and sensor systems, which will help Ukrainian soldiers defend themselves against Russian forces. Further, target designators, radio communications, and C2 centers will all be a part of the air defense system.

- Israel Aerospace Industries Ltd. teamed up with ESG and decided to produce and provide 69 tactical mobile radar systems to the German Ground Army. Further, to successfully share best practices, the organization supplied training programs, resources, and initial spare parts.

- Report ID: 4004

- Published Date: Nov 20, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Ground Surveillance Radar (GSR) Systems Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.