Defect Management Tools Market - Growth Drivers and Challenges

Growth Drivers

- Instructive integration with CI/CD pipelines and DevOps: The global trend towards Agile development and DevOps requires that defect management be integrated continuously and automatically into the software delivery pipeline. This combined approach secures issues being caught and repaired in real time at the code commit point, reducing remediation costs significantly. This requirement has been well understood by vendors, as in September 2025, BrowserStack released version 13.4.0 of its BrowserStack Integration for Jira Cloud on the Atlassian Marketplace with minor improvements to the existing integration. The integration continues to provide two-way binding, allowing teams to easily access and keep track of their test runs and test cases on both platforms.

- Adoption of AI for predictive defect triaging: The addition of Artificial Intelligence (AI) and Machine Learning (ML) capabilities is transforming qualitatively the process of defect management into a predictive practice. AI is utilized to automate defect triage, suggest severity/priority tags, and carry out predictive root cause analysis, drastically reducing the Mean Time To Resolve (MTTR). This technology is crucial in staying ahead of the massive volume of data that newer QA teams and monitoring tools generate. In June 2025, ACCELQ released a significant new version of its AI-powered defect tracking software. This advancement introduced AI-driven defect triaging, suggested priority assignment, and predictive root cause analysis, demonstrating a strong push for intelligence by DevOps teams.

- Rising regulatory and audit compliance requirements: The increasing complexity of global regulations (e.g., financial and government) is demanding defect management solutions that provide end-to-end traceability and auditable, comprehensive audit trails. Organizations require auditable records of every phase of the defect life cycle, from finding and repair, to sign off, to facilitate regulatory compliance. Solutions must provide advanced multi-level issue escalation and root cause analysis for compliance-driven customers. The business strategy benefit of robust defect tracking is evident, as BMW Group in November 2023 made public data regarding its Smart Maintenance using an AI solution for car assembly, with the solution's analytics allegedly preventing over 500 minutes of car assembly downtime annually.

Federal Cybersecurity Grants Driving Defect Management Tools Market

|

Aspect |

Tribal Cybersecurity Grant Program (TCGP) |

State & Local Cybersecurity Grant Program (SLCGP) |

Combined Market Impact |

|

Funding Amount |

$18.2 million |

$279.9 million |

$298.1 million total addressable market |

|

Scope & Reach |

30+ tribal governments |

All state, local, and tribal governments nationwide |

Massive scale across entire public sector infrastructure |

|

Program Status |

Inaugural awards in 2024 |

Third year of funding in 2024 |

Establishes sustained, multi-year funding stream |

|

Tools Application |

Basic vulnerability management and security defect tracking |

Enterprise-grade defect management and vulnerability tracking platforms |

Creates demand across entire product spectrum from basic to advanced |

Source: CISA

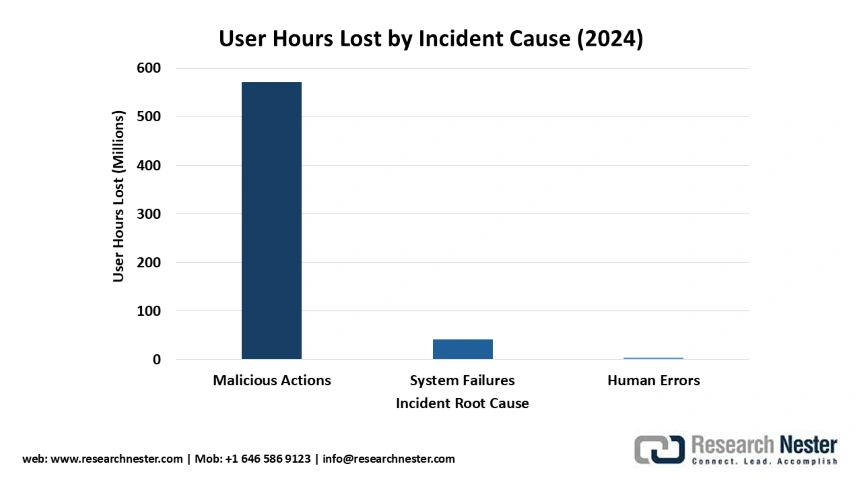

Defect Management Tools Market Opportunity by Incident Root Cause

The cybersecurity incident data reveals substantial market opportunities for defect management tools, with malicious actions representing the highest-value segment despite fewer incidents due to their massive impact of 571 million user hours lost. System failures, while more frequent, drive demand for proactive defect detection and root cause analysis tools to prevent hardware and software malfunctions.

Source: ENISA

Challenges

- Integration complexity with legacy systems and tool chains: A significant issue is the inability to integrate new, cloud-native defect management software with the disparate collection of older, legacy Application Lifecycle Management (ALM) systems and on-premise, proprietary tools utilized by large organizations. This fragmentation creates data silos and prevents there from being a single, unified view of quality across the entire development and operations lifecycle. The expense and complexity of implementing two-way synchronization across dissimilar systems normally delay enterprise adoption and limit the value of continuous feedback loops.

- Failure to have standardized public sector defect reporting: Despite increased digital maturity of governments, one common challenge remains the lack of universally recognized, standardized defect and cyber incident reporting procedures across different public sector agencies. This deficit becomes more difficult for vendors to meet and keeps cross-agency coordination away from studying and avoiding the recurrence of errors. Even as nations individually advance, the lack of global or federal standardization slows down the development of high-quality, public-sector-utilized defect management solutions.

Defect Management Tools Market Size and Forecast:

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

14% |

|

Base Year Market Size (2025) |

USD 20.4 billion |

|

Forecast Year Market Size (2035) |

USD 18.9 billion |

|

Regional Scope |

|