Defect Management Tools Market Outlook:

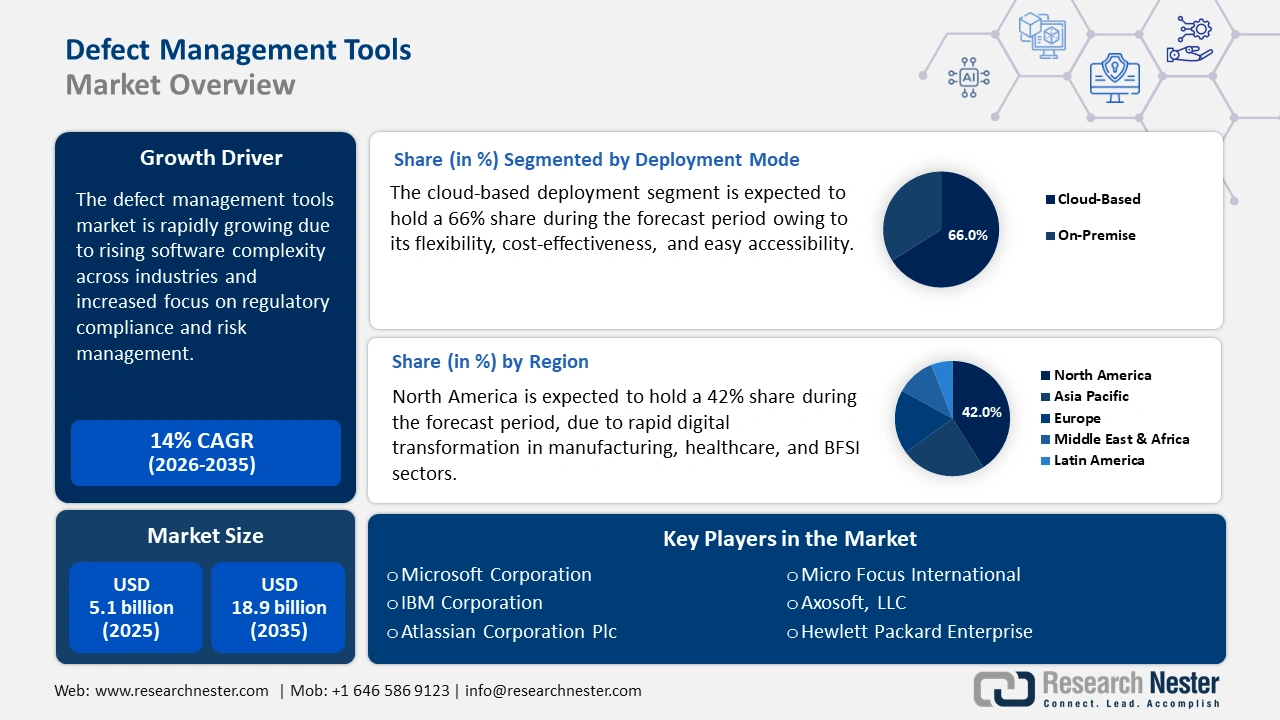

Defect Management Tools Market size is valued at USD 5.1 billion in 2025 and is projected to reach a valuation of USD 18.9 billion by the end of 2035, rising at a CAGR of 14% during the forecast period, i.e., 2026-2035. In 2026, the industry size of defect management tools is estimated at USD 5.8 billion.

The defect management tool market is strategically positioned for robust growth, which is primarily fueled by the growing adoption of DevOps practices and the need to maintain quality checks continuously in fast-release cycles. The key opportunity lies in leveraging cutting-edge technologies like Artificial Intelligence (AI) for automating defect triage, predicting failures, and making transparent cross-functional processes. In August 2025, the Press Information Bureau in India released a factsheet underscoring its commitment to secure, high-quality digital services. This factsheet details initiatives like the Digital Service Standard framework and the utilization of the National Cybercrime Reporting Portal, both aimed at empowering governance through digital infrastructure and combating fraudulent communications and cybercrime.

The market is shifting from simple bug tracking to full-fledged Defect Lifecycle Management (DLM) solutions that provide end-to-end auditability within the company. Increasing software sophistication, particularly in regulated industries like finance and healthcare, ensures continued demand for products that have strong audit trails and compliance automation features. Such increased scrutiny is also seen in public sector IT, where, in May 2025, the UK's new Software Vendor Code for government procurement requires the employment of secure, auditable defect management, accelerated patching, and public disclosure procedures for severe vulnerabilities and problems.

Key Defect Management Tools Market Insights Summary:

Regional Insights:

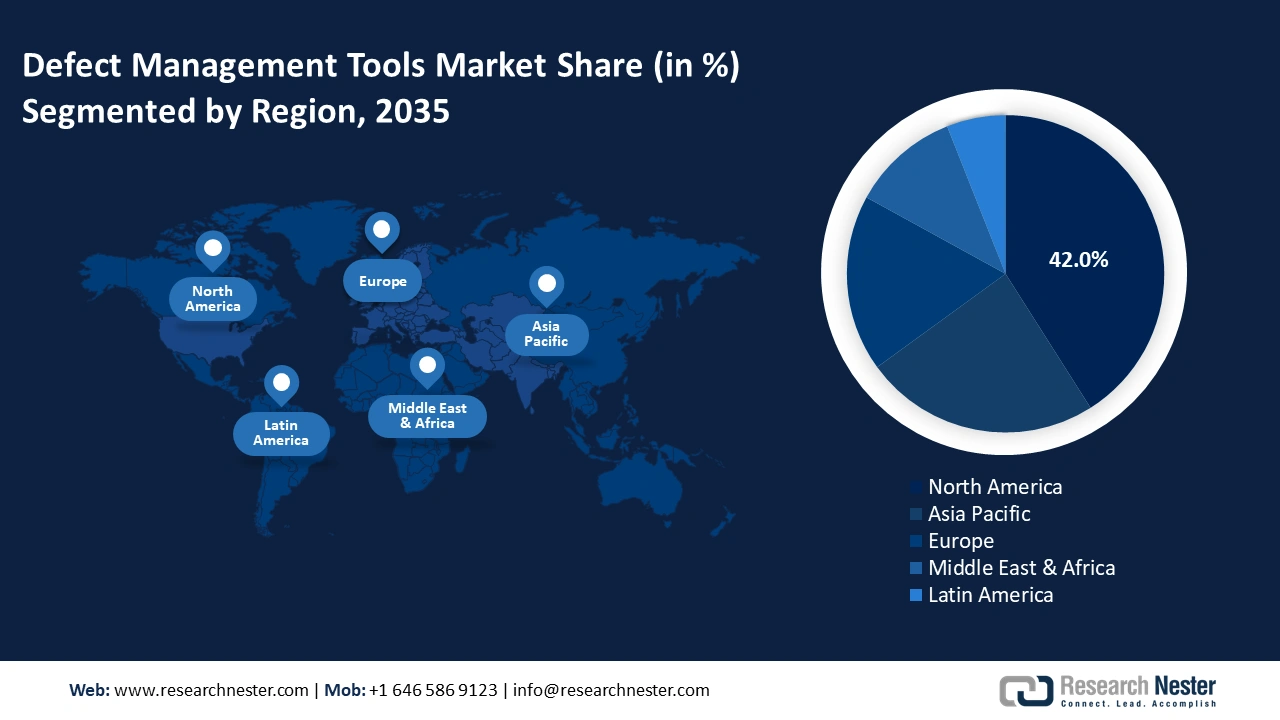

- North America defect management tools market is likely to maintain a 42% market share during the forecast period in the Defect Management Tools Market, impelled by the region’s concentration of key tech companies and extensive DevOps adoption.

- Asia Pacific market is expected to record a CAGR of 14.5% through the forecast period, fueled by broad-based industrial digitization and rising software integration complexity.

Segment Insights:

- The cloud-based deployment segment is projected to hold around 66% market share during the forecast period in the Defect Management Tools Market, owing to its advantages of collaboration, accessibility, and scalability.

- The information technology sector is expected to maintain a market share of 31.5% by 2035, supported by its continual demand for faster time-to-market and zero-defect releases.

Key Growth Trends:

- Instructive integration with CI/CD pipelines and DevOps

- Adoption of AI for predictive defect triaging

Major Challenges:

- Integration complexity with legacy systems and tool chains

- Failure to have standardized public sector defect reporting

Key Players: Atlassian Corporation Plc, Microsoft Corporation, IBM Corporation, Hewlett Packard Enterprise (HPE), Zoho Corporation Pvt. Ltd., Micro Focus International, JetBrains s.r.o., Axosoft, LLC, Inflectra Corporation, Zuken Inc., and Yokogawa Electric Corporation.

Global Defect Management Tools Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.1 billion

- 2026 Market Size: USD 5.8 billion

- Projected Market Size: USD 18.9 billion by 2035

- Growth Forecasts: 14% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (42% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, India, United States, Germany, Japan

- Emerging Countries: Indonesia, Vietnam, Mexico, Brazil, South Korea

Last updated on : 6 October, 2025

Defect Management Tools Market - Growth Drivers and Challenges

Growth Drivers

- Instructive integration with CI/CD pipelines and DevOps: The global trend towards Agile development and DevOps requires that defect management be integrated continuously and automatically into the software delivery pipeline. This combined approach secures issues being caught and repaired in real time at the code commit point, reducing remediation costs significantly. This requirement has been well understood by vendors, as in September 2025, BrowserStack released version 13.4.0 of its BrowserStack Integration for Jira Cloud on the Atlassian Marketplace with minor improvements to the existing integration. The integration continues to provide two-way binding, allowing teams to easily access and keep track of their test runs and test cases on both platforms.

- Adoption of AI for predictive defect triaging: The addition of Artificial Intelligence (AI) and Machine Learning (ML) capabilities is transforming qualitatively the process of defect management into a predictive practice. AI is utilized to automate defect triage, suggest severity/priority tags, and carry out predictive root cause analysis, drastically reducing the Mean Time To Resolve (MTTR). This technology is crucial in staying ahead of the massive volume of data that newer QA teams and monitoring tools generate. In June 2025, ACCELQ released a significant new version of its AI-powered defect tracking software. This advancement introduced AI-driven defect triaging, suggested priority assignment, and predictive root cause analysis, demonstrating a strong push for intelligence by DevOps teams.

- Rising regulatory and audit compliance requirements: The increasing complexity of global regulations (e.g., financial and government) is demanding defect management solutions that provide end-to-end traceability and auditable, comprehensive audit trails. Organizations require auditable records of every phase of the defect life cycle, from finding and repair, to sign off, to facilitate regulatory compliance. Solutions must provide advanced multi-level issue escalation and root cause analysis for compliance-driven customers. The business strategy benefit of robust defect tracking is evident, as BMW Group in November 2023 made public data regarding its Smart Maintenance using an AI solution for car assembly, with the solution's analytics allegedly preventing over 500 minutes of car assembly downtime annually.

Federal Cybersecurity Grants Driving Defect Management Tools Market

|

Aspect |

Tribal Cybersecurity Grant Program (TCGP) |

State & Local Cybersecurity Grant Program (SLCGP) |

Combined Market Impact |

|

Funding Amount |

$18.2 million |

$279.9 million |

$298.1 million total addressable market |

|

Scope & Reach |

30+ tribal governments |

All state, local, and tribal governments nationwide |

Massive scale across entire public sector infrastructure |

|

Program Status |

Inaugural awards in 2024 |

Third year of funding in 2024 |

Establishes sustained, multi-year funding stream |

|

Tools Application |

Basic vulnerability management and security defect tracking |

Enterprise-grade defect management and vulnerability tracking platforms |

Creates demand across entire product spectrum from basic to advanced |

Source: CISA

Defect Management Tools Market Opportunity by Incident Root Cause

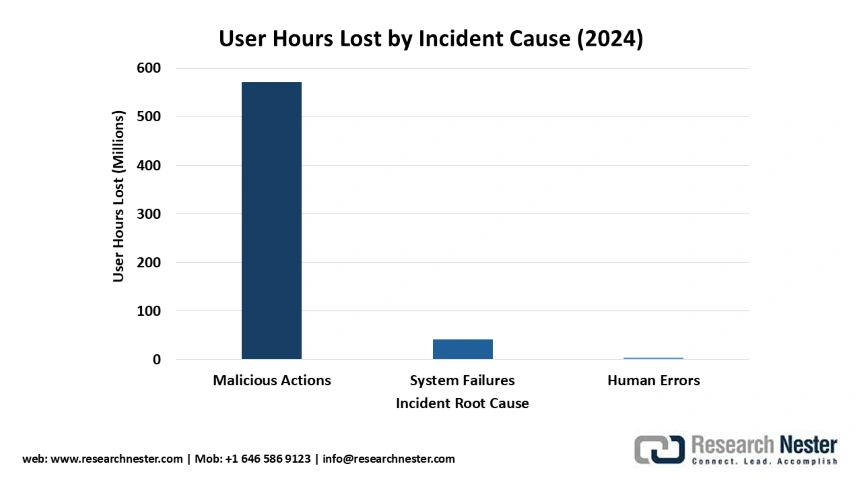

The cybersecurity incident data reveals substantial market opportunities for defect management tools, with malicious actions representing the highest-value segment despite fewer incidents due to their massive impact of 571 million user hours lost. System failures, while more frequent, drive demand for proactive defect detection and root cause analysis tools to prevent hardware and software malfunctions.

Source: ENISA

Challenges

- Integration complexity with legacy systems and tool chains: A significant issue is the inability to integrate new, cloud-native defect management software with the disparate collection of older, legacy Application Lifecycle Management (ALM) systems and on-premise, proprietary tools utilized by large organizations. This fragmentation creates data silos and prevents there from being a single, unified view of quality across the entire development and operations lifecycle. The expense and complexity of implementing two-way synchronization across dissimilar systems normally delay enterprise adoption and limit the value of continuous feedback loops.

- Failure to have standardized public sector defect reporting: Despite increased digital maturity of governments, one common challenge remains the lack of universally recognized, standardized defect and cyber incident reporting procedures across different public sector agencies. This deficit becomes more difficult for vendors to meet and keeps cross-agency coordination away from studying and avoiding the recurrence of errors. Even as nations individually advance, the lack of global or federal standardization slows down the development of high-quality, public-sector-utilized defect management solutions.

Defect Management Tools Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

14% |

|

Base Year Market Size (2025) |

USD 20.4 billion |

|

Forecast Year Market Size (2035) |

USD 18.9 billion |

|

Regional Scope |

|

Defect Management Tools Market Segmentation:

Deployment Mode Segment Analysis

The cloud-based deployment segment is projected to hold around 66% market share during the forecast period and emerge as the dominant model due to its inherent advantages of collaboration, accessibility, and scalability. Cloud solutions allow distributed development and QA teams to directly access a common repository of bugs in real-time, which is essential for DevOps-based projects. The model minimizes internal IT overhead and allows for rapid scaling of testing efforts up and down. In September 2025, BetterCloud was recognized as the SaaS Management Platform Leader in the Fall 2025 G2 Report for the third consecutive quarter. This reflects the growing enterprise demand for solutions to manage SaaS sprawl, costs, and security risks.

Industry Segment Analysis

The information technology sector is expected to maintain a market share of 31.5% by 2035, remaining the largest user of defect management tools due to its fundamental reliance on software products and continuous cycle of development. The industry is made up of software vendors, cloud vendors, and IT services companies that require high levels of quality control over their internal systems and customer outputs. The extreme need for faster time-to-market and zero-defect releases drives high adoption rates directly. This persistent need is met by constant platform upgrades. For instance, in July 2025, Zoho launched Zia LLM, significantly expanding its AI portfolio with prebuilt agents, a custom agent builder, and a marketplace. These new tools are designed to enhance various Zoho products, including AI-driven features for automation and improved workflows across the Zoho suite.

Functionality Segment Analysis

The defect tracking segment is expected to hold a 35% market share by 2035 and remain the largest functional segment since it is the focal, non-fungible requirement of any quality assurance initiative: tracking, classifying, and tracing an issue through its life cycle. Advanced testing and analytics are growing, but the core functionality of defect tracking is the back-end database for all other quality metrics and fix efforts. This underpinning demand is constantly bolstered by new tools that incorporate stronger evidence. In August 2025, BrowserStack introduced a new Testing Toolkit, a Chrome extension that integrates key manual testing tools and bug reporting into a single, unified interface. This launch showcases the advancement of their core capabilities.

Our in-depth analysis of the defect management tools market includes the following segments:

|

Segment |

Subsegments |

|

Deployment Mode |

|

|

Industry |

|

|

Functionality |

|

|

Pricing Model |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Defect Management Tools Market - Regional Analysis

North America Market Insights

North America defect management tools market is likely to maintain a 42% market share during the forecast period based on the region's concentration of key software and tech companies and extensive use of DevOps practices. The market is supported by heavy private sector investment in AI-based QA automation and cloud-native solutions, allowing for swift defect resolution in the finance and technology industries. The stringent security and privacy regulations (e.g., those of the OPC in Canada) create ongoing demand for equipment with robust audit and traceability features. This regional precedence is also supported by a rapid technology adoption pace.

The U.S. market is driven by its rapid adoption of real-time monitoring as well as deep analysis to reduce software flaws and justify in-house development processes across federal governments and big businesses. Rapid software deployment necessitates the adoption of integrated tools for continuous improvement. Companies cherish solutions that offer end-to-end visibility across the code-to-production pipeline. The commitment to continuous improvement is demonstrated by the practice, as in March 2024, of US federal websites, such as GOV.UK, publishing transparency reports detailing its initiatives to mitigate software defects. These reports highlight the utilization of tools like Sentry and other real-time defect monitoring systems for the identification and resolution of anomalies.

Canada market is highly sensitive to government mandates regarding digital service provision, data breach management, and privacy compliance for federal agencies. There is emphasis on platforms that provide careful tracking of security defects and auditability of privacy events. The regulatory environment sparks sustained procurement for sophisticated defect management solutions. In August 2025, Canada's Office of the Privacy Commissioner made public data on huge defects, data breaches, and cyber incident tracking in the Canada Revenue Agency (CRA) and Employment and Social Development Canada (ESDC). A government-mandated system now tracks, audits, and reports all computerized faults and breaches, with effective remedies imposed.

APAC Market Insights

Asia Pacific market for defect management software is expected to record a CAGR of 14.5% through the forecast period, led by broad-based industrial digitization and rising software integration complexity in emerging markets. A rapid process of urbanization and expansion of intelligent manufacturing initiatives in nations like India and China is fueling the uptake of advanced quality control solutions at a more accelerated pace. The market presents a significant opportunity for vendors of cloud-scalable tools serving big, multi-national QA teams and local-language environments. This growth is a reflection of the region investing more in advanced quality assurance tools.

China market is characterized by massive, state-driven digital transformation, with defect management demand driven by the need for quality assurance on high-stakes e-government and security-sensitive trade platforms. The government maintains a robust software defect tracking regime in national security compliance for sensitive platforms. It is a focus area on active case management and rapid defect fixing across citizen-facing services. In March 2025, China's State Council released its annual report on government work. This report highlighted substantial investments in several key areas: digital error tracking, rapid defect repair, and inter-agency governance programs for e-government portals that serve citizens.

India market is expanding, fueled by the sheer size of its e-governance programs and the underlying Digital India initiatives, which necessitate robust quality assurance for citizen-facing services. Growth is primarily driven by government directives for real-time digital grievance redressal and performance management throughout all states and union territories. The increased sophistication of federal digital services requires integrated defect and incident management. In July 2025, India legally mandated defect/incident tracking as a core module for Pragati VC 2.0. This national platform is designed for real-time digital redressal of grievances and e-government scheme performance management at both union territory and state levels.

Europe Market Insights

Europe defect management tools market is poised to see steady growth from 2026 to 2035, led by high national quality standards (such as Germany's DIN SPEC) and the imperative of mastering complex cross-border digital services. Government demand for secure software supply chains and rigorous regulatory compliance demands (such as GDPR) power the market. The region’s focus is on sellers of audit-compliant, secure, SaaS-based solutions to both government and enterprise procurement. Formal defect lifecycle management is highly conducive to this setting.

Germany is marked by a strong national focus on the formalization of software quality and traceability standards for public administration services. Significant interest has emerged in solutions that integrate defect correction into performance contracts and enable peer-reviewed service quality audits. This emphasis on verifiable requirements arises from the publication of DIN SPEC 66336, Quality requirements for online services and portals of public administration, by the German Federal DigitalService and Ministry of Digital Transformation in March 2025. This new standard lays down requirements that are verifiable in terms of analysis, implementation, operation, defect reporting, and evolution of government online services.

The UK market is expanding due to strong government initiatives for the security of its digital public sector and the imposition of formalities on standards for defect management by software vendors. The market is influenced by new procurement codes requiring suppliers to demonstrate secure defect correction and rapid patching processes. The demand is centered on cloud-based solutions with the capability to merge defect information with NCSC guidance and public reporting. In January 2025, a significant market event occurred when the UK Find a Tender service posted a notice of requirements for new defect management software. The software contract was subsequently awarded on local quotes, as outlined in Section 87 (2) of the Procurement Act. This acquisition procedure is seen as a key force behind market forces.

Key Defect Management Tools Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

The defect management tool market is highly competitive, with dominance by established Application Lifecycle Management (ALM) suite providers and disruption by specialized SaaS providers utilizing AI. Large market players like Atlassian Corporation Plc (Jira), Microsoft Corporation, and Zoho Corporation Pvt. Ltd., engage in advanced cross-platform integrations and automated triaging abilities on a regular basis. Competition is around offering homogenized, collaborative platforms to handle the entire defect life cycle, and not just first-time bug logging. The high demand for secure, cloud-based tools is causing investment and M&A activity.

Strategic investment and M&A are driving the unification of specialized defect management skill sets into larger, integrated platforms for regulated industries. This strategy expands the vendor's ability to deliver niche features like comprehensive audit trails and advanced automation. This is demonstrated in April 2024 when Surge Ventures closed the acquisition of Kovair, which focuses on application lifecycle and defect management software. This deal enables Kovair to expand its cloud-based defect management to more highly regulated users in financial industries, further broadening its integration and automation platform.

Here are some leading companies in the defect management tools market:

|

Company Name |

Country |

Market Share (%) |

|

Atlassian Corporation Plc |

Australia |

19.0 |

|

Microsoft Corporation |

U.S. |

17.0 |

|

IBM Corporation |

U.S. |

15.0 |

|

Hewlett Packard Enterprise (HPE) |

U.S. |

10.0 |

|

Zoho Corporation Pvt. Ltd. |

India |

7.0 |

|

Micro Focus International |

UK |

xx |

|

JetBrains s.r.o. |

Czech Republic |

xx |

|

Axosoft, LLC |

U.S. |

xx |

|

Inflectra Corporation |

U.S. |

xx |

|

Backlog (Nulab, Inc.) |

Japan |

xx |

|

Raygun Limited |

New Zealand |

xx |

|

Sentry (Functional Software, Inc.) |

U.S. |

xx |

|

Lasertec Corporation |

Japan |

xx |

|

Zuken Inc. |

Japan |

xx |

|

Yokogawa Electric Corporation |

Japan |

xx |

Below are the areas covered for each company in the defect management tools market:

Recent Developments

- In August 2025, Marker.io expanded its webhook notification system, adding new event triggers for issues and comments. The enhancement was part of broader updates focused on boosting workflow automation, especially for unsupported integrations. This was done to provide more detailed, real-time updates for external services like Zapier and n8n.

- In June 2025, Kualitee announced the expansion of its AI-powered capabilities with the AI assistant Hootie, which now features fully automated test execution. This allows for faster cycles, consistent results, and fewer missed issues. This release outlines Kualitee's AI roadmap for test and defect management.

- In February 2025, Yokogawa Electric Corporation announced the official release of OpreX Quality Management System for the pharma and manufacturing sector. Providing comprehensive defect and document management, the solution leverages automated defect identification, role-based workflow automation, and AI-driven root cause analysis, specifically tailored for compliance-driven industries.

- Report ID: 3585

- Published Date: Oct 06, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Defect Management Tools Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.