Data Destruction Service Market Outlook:

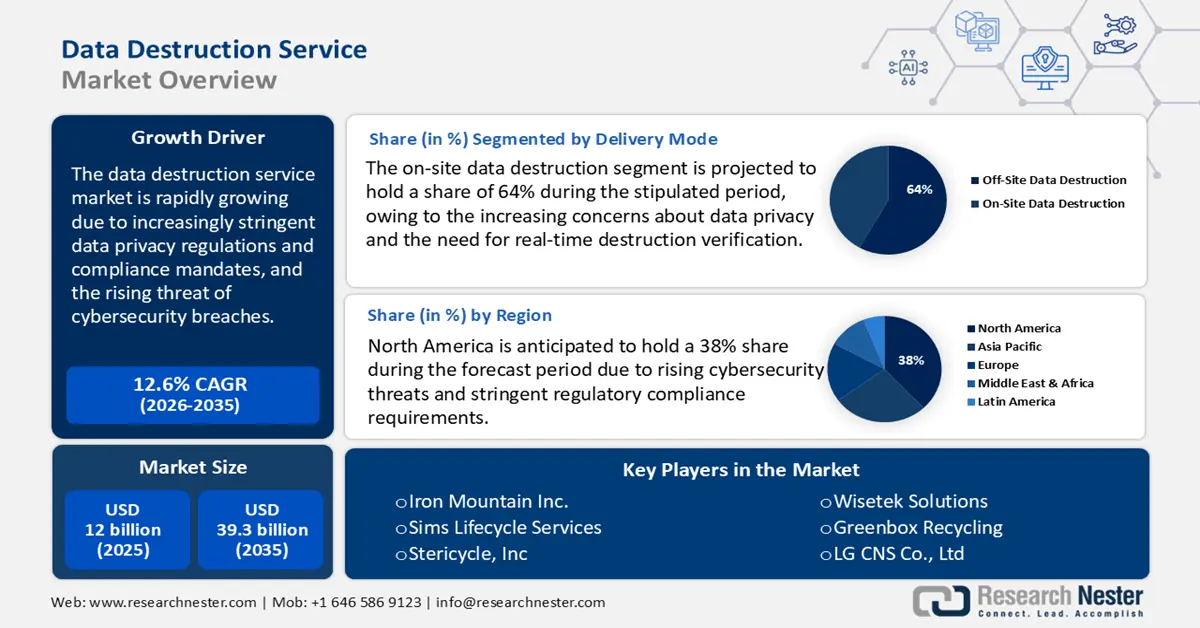

Data Destruction Service Market size was valued at USD 12 billion in 2025 and is projected to reach USD 39.3 billion by the end of 2035, rising at a CAGR of 12.6% during the forecast period, i.e., 2026-2035. In 2026, the industry size of data destruction service is assessed at USD 13.5 billion.

The global market is mainly driven by increasing stringent data privacy regulations and compliance mandates. The regulatory environment has grown significantly more complex and rigorous in recent years, particularly concerning the handling, retention, and destruction of sensitive data. Legislation such as the General Data Protection Regulation (GDPR) in the European Union, the California Consumer Privacy Act (CCPA) and Health Insurance Portability and Accountability Act (HIPAA) in the United States, and the Digital Personal Data Protection Act (DPDP Act) introduced in India in 2023, all place strict obligations on organizations regarding how data is stored, processed, and securely destroyed after its intended use.

|

GDPR Fines and Penalties |

|

|

Violation Category |

Fine Amount |

|

Less Severe Violations (Art. 83(4) GDPR) |

Up to €10 million or up to 2% of global annual turnover (whichever is higher) |

|

Severe Violations (Art. 83(5) GDPR) |

Up to €20 million or up to 4% of global annual turnover (whichever is higher) |

Source: GDPR

These regulatory frameworks have pushed organizations to execute secure data disposal methods to avoid legal penalties and reputational damage. These regulations often mandate that data must be irretrievably destroyed when it is no longer needed, creating the need for certified data destruction providers who can verify and audit destruction processes. A recent example of regulatory enforcement happened in May 2023, when Meta Platforms Inc. was fined USD 1.30 billion by the Irish Data Protection Commission (DPC) for breaching GDPR rules related to unlawful cross-border transfers of European user data to the U.S.

Key Data Destruction Service Market Insights Summary:

Regional Insights:

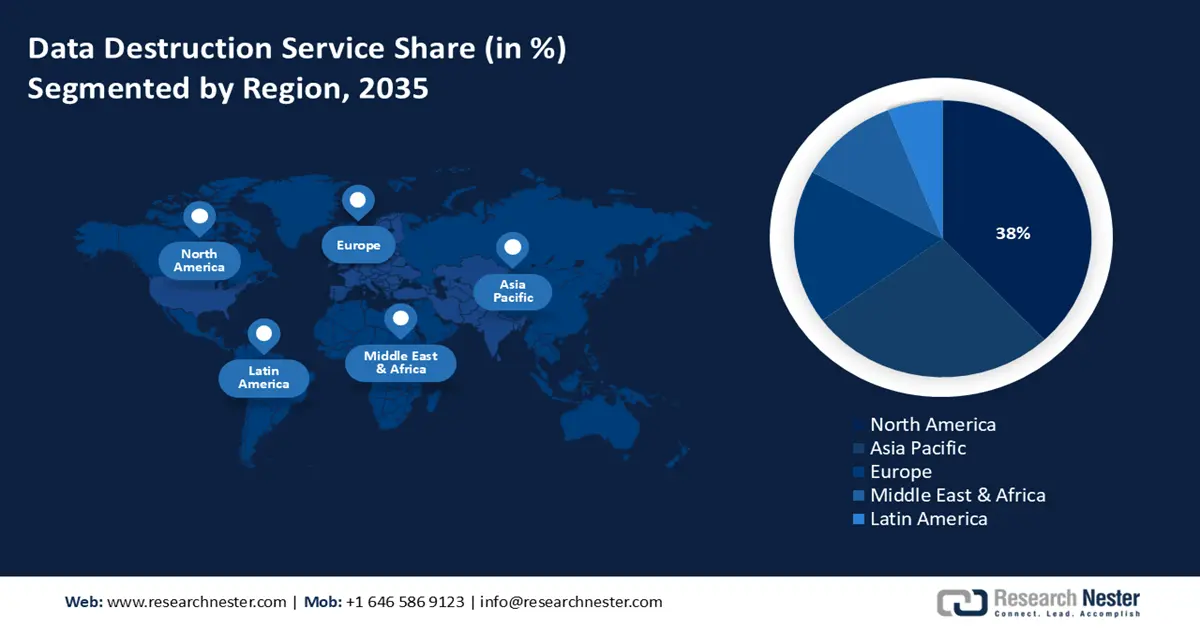

- The North America data destruction service market is anticipated to hold a 38% share by 2035, propelled by stringent data privacy regulations such as HIPAA and CCPA.

- The Asia Pacific market is projected to grow at a 9% CAGR between 2026 and 2035, due to increasing digitization, high IT hardware turnover, and stricter data privacy mandates.

Segment Insights:

- The digital (logical) destruction segment is projected to hold a 40% share by 2035, driven by its cost-effectiveness and sustainability advantages.

- The on-site data destruction segment is expected to capture a 64% share by 2035, owing to increasing concerns about data privacy and the need for real-time destruction verification.

Key Growth Trends:

- Rapid growth of ICT hardware and e-waste volume

- Government initiatives and public sector digital transformation

Major Challenges:

- Lack of standardized global compliance frameworks

- High service costs

Key Players: Iron Mountain Inc., Sims Lifecycle Services, Stericycle, Inc., Veolia Environment S.A., Stena Metall Group, Wisetek Solutions, Greenbox Recycling, TES-Amm (TES Sustainable Solutions), LG CNS Co., Ltd., Cerebra Integrated Technologies Ltd.

Global Data Destruction Service Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 12 billion

- 2026 Market Size: USD 13.5 billion

- Projected Market Size: USD 39.3 billion by 2035

- Growth Forecasts: 12.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, United Kingdom, Canada, France

- Emerging Countries: India, Australia, South Korea, Singapore, Japan

Last updated on : 30 September, 2025

Data Destruction Service Market - Growth Drivers and Challenges

Growth Drivers

- Rapid growth of ICT hardware and e-waste volume: The expansion of servers, storage units, and mobile devices has resulted in higher amounts of obsolete hardware that require environmentally responsible data destruction and recycling. The Global E-waste Monitor 2024 reported over 62 million metric tons of e-waste generated globally in 2023, with only 22.3% officially documented as properly recycled. This is driving demand for secure destruction solutions in the ICT sector.

- Government initiatives and public sector digital transformation: Governments across the world are investing in digital infrastructure, 5G networks, national broadband programs, and cloud transitions, especially in healthcare, defense, and public administration. This expansion of ICT systems results in huge data volumes and increased demand for secure equipment disposal processes during upgrades, encouraging the adoption of data destruction services. For instance, in 2023, the U.S. Federal Communications Commission (FCC) approved $42.45 billion for the Broadband Equity, Access, and Deployment Program funding infrastructure, which involves the secure handling and decommissioning of legacy systems.

- Technological innovations: The global market for data destruction services is expected to grow due to ongoing technological advancements. The integration of blockchain, artificial intelligence (AI), and machine learning (ML) is set to make these services more advanced. In August 2025, CrowdStrike introduced two new expert-led services in its AI Security Services lineup, namely AI Systems Security Assessment and AI for SecOps Readiness. These offerings help companies protect their AI systems and safely use AI in their security operations. This indicates that key players are focused on the production of advanced data destruction solutions.

Challenges

- Lack of standardized global compliance frameworks: One of the most important challenges in the market is the absence of globally standardized compliance regulations. While many regions enforce strict data privacy laws, such as the GDPR in Europe, HIPAA in the U.S., and the Digital Personal Data Protection Act in India, there is no unified global framework. This creates dispersed regulations, which complicates operations for top MNCs. This absence of harmonization increases legal risks, compliance costs, and operational inefficiencies, especially for service providers managing cross-border data.

- High service costs: High costs are one of the key restraints in the data destruction service industry. This is a major challenge faced by the small and mid-sized enterprises (SMEs). Certified data destruction requires advanced technologies and trained personnel, which adds to the costs. Thus, this factor majorly limits the sales of data destruction services in the price-sensitive markets.

Data Destruction Service Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

12.6% |

|

Base Year Market Size (2025) |

USD 12 billion |

|

Forecast Year Market Size (2035) |

USD 39.3 billion |

|

Regional Scope |

|

Data Destruction Service Market Segmentation:

Type Segment Analysis

The digital (logical) destruction segment is projected to hold a share of 40% during the stipulated period owing to its cost-effectiveness and sustainability advantages, as it allows the reuse of hardware and reduces e-waste. The data wiping/erasure technology helps software to permanently delete data from storage devices without physically destroying the hardware. The increasing adoption of cloud computing and virtualization globally fuels demand for safe, remote data erasure solutions. The strict data privacy regulations need verified, irreversible deletion, boosting the use of certified wiping software. Organizations value data wiping for its speed and ability to securely erase data on multiple devices simultaneously.

Delivery Mode Segment Analysis

The on-site data destruction segment is expected to capture a 64% share by 2035, owing to increasing concerns about data privacy and the need for real-time destruction verification. This consists of securely destroying data at the client’s location by using mobile shredders, degaussers, or other technologies. Many organizations opt for on-site services to reduce risks related to data transport and ensure compliance with strict mandatory rules. The rising cybersecurity threats and rigid data protection laws are encouraging demand for immediate, transparent destruction processes. Additionally, industries such as healthcare and finance favor on-site solutions to safeguard critical information during hardware decommissioning.

Industry Vertical Segment Analysis

The BFSI segment is projected to capture the largest market share throughout the study period, owing to the sensitivity and volume of data it handles. These institutions produce vast amounts of information, both personal and transactional, daily, which is vital to keep safe. The strict data protection regulations and the increasing cyber threats are prime factors boosting the demand for data destruction services. The report by IBM disclosed that the average cost of a data breach worldwide has risen to USD 4.88 million, up from USD 4.45 million last year, marking the largest increase since the pandemic. For financial companies, the cost is even higher, averaging USD 6.08 million, which is 22% more than the global average. This indicates that the data breach concerns are influencing the demand for data destruction services.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Media Type |

|

|

Industry Vertical |

|

|

Deployment Mode |

|

|

Delivery Mode |

|

|

Organization Size |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Data Destruction Service Market - Regional Analysis

North America Market Insights

The data destruction service market in North America is anticipated to hold a 38% share during the forecast period due to stringent data privacy regulations such as HIPAA and CCPA. Increasing corporate data generation and frequent cyberattacks are driving businesses to adopt secure end-of-life data disposal methods. The region’s well-established IT infrastructure and rapid digital transformation further fuel demand for these services due to cybersecurity concerns about corporate espionage and identity theft. Additionally, massive volumes of old, outdated electronics are pushing the demand for new, sustainable data destruction methods.

The U.S. market is rapidly expanding, owing to the changing regulatory frameworks, and federal programs such as the FCC’s broadband expansion and digital equity initiatives are accelerating data infrastructure growth, leading to higher demand for secure data disposal. To make the internet safer and stronger, the 2025 Budget offered around USD 13 billion for cybersecurity to various government departments and agencies. These initiatives are directly driving the adoption of data destruction systems. Enterprises in the finance, healthcare, and defense sectors are increasing investments in certified destruction methods to adhere to federal norms such as NIST 800-88. The increase in remote work and technology renewal has also increased the need for on-site and off-site data destruction. Moreover, growing awareness of reputational risks tied to data leaks is pushing companies toward professional services. Sustainability goals are encouraging the adoption of eco-friendly data wiping and recycling solutions.

The Canada data destruction service market is expected to increase at a healthy pace, owing to the Personal Information Protection and Electronic Documents Act (PIPEDA). The new provincial-level data privacy frameworks are also increasing the adoption of advanced data destruction services. With the growing importance of safeguarding customers' data, organizations are investing heavily in certified and auditable destruction services. The environmental regulations and the country’s commitment to reducing e-waste are further set to reshape the market growth.

Asia Pacific Market Insights

The Asia Pacific market is anticipated to exhibit the fastest growth of 9% between 2026 and 2035, due to increasing digitization, high IT hardware turnover, and stricter data privacy mandates across the region. Countries such as India, Australia, and South Korea are ramping up regulatory frameworks that mandate the secure disposal of obsolete digital assets. The surge in e-waste and a growing focus on environmental sustainability initiatives are encouraging businesses to choose certified destruction services. Government-backed digital economy programs are also increasing market demand. Additionally, increased cloud adoption is generating more end-of-life data that requires secure erasure.

The market in China is expected to register rapid growth during the forecast period due to government investments in data security and the modernization of digital infrastructure. The majority of businesses have employed data removal solutions due to rising cybersecurity norms and the rapid expansion of digital business. Moreover, the National Medical Products Administration’s focus on the safe disposal of medical data in China is continuously fueling demand. Investing in China is projected to offer high returns by the end of the study period.

The India market is estimated to be driven by the government’s strong push for digital transformation and stricter IT compliance rules. The sustainability trend and the surge in e-waste generation are also contributing to the market growth. The expanding telecommunication and data center sectors are also opening lucrative doors for data destruction service providers. Considering the growth of these sectors, the number of both domestic and international service providers is increasing at a swift pace. Attero India is one of the leading market players operating in the country.

Europe Market Insights

The Europe data destruction service market is estimated to be driven by the strict data privacy regulations, including the General Data Protection Regulation (GDPR). The robust shift towards digitalization and increased cloud migration is further increasing the demand for data destruction services. Physical shredding, degaussing, and certified data wiping are widely adopted by the BFSI and government sectors in the region. The sustainability trend is further set to increase the popularity of e-waste solutions.

Germany leads the sales of data destruction services, owing to the country’s strict data protection laws under the Bundesdatenschutzgesetz (BDSG) and GDPR enforcement. The presence of a strong industrial base and a large number of multinational corporations in automotive, finance, and manufacturing is also bolstering the demand for data destruction services. The Federal Statistical Office (Destatis) reported that, after adjusting for prices, seasons, and holidays, industrial production in July 2025 increased by 1.3% compared to the previous month. Further, the e-waste trend is set to accelerate the adoption of data destruction services.

The U.K. data destruction service market is anticipated to be driven by the convergence of GDPR and the UK Data Protection Act 2018. The strict regulations on data handling are projected to propel the sales of data destruction services. The expanding data center and BFSI sectors, coupled with robust digitalization, are poised to double the revenues of key market players in the years ahead. The strategic public-private partnerships are also expected to drive the overall market growth.

Key Data Destruction Service Market Players:

- Iron Mountain Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Sims Lifecycle Services

- Stericycle, Inc.

- Veolia Environment S.A.

- Stena Metall Group

- Wisetek Solutions

- Greenbox Recycling

- TES-Amm (TES Sustainable Solutions)

- LG CNS Co., Ltd.

- Cerebra Integrated Technologies Ltd

- InfoFort (Aramex)

- SNS Network (M) Sdn Bhd

- Fujitsu Limited

- Hitachi Systems, Ltd.

- NEC Corporation

The global data destruction service market is characterized by the strong presence of industry giants and the increasing emergence of new companies. Leading companies are employing various organic and inorganic marketing strategies, including technological innovations, mergers & acquisitions, partnerships & collaborations, and digitalization. They are also expanding their operations across emerging markets to earn lucrative gains from untapped opportunities. The organic sales are poised to double the revenues of key players in the years ahead. Given below is a table of the top players in the market with their respective shares.

Recent Developments

- In August 2025, Infoshred, a member of i-SIGMA, acquired Secure Eco Shred, a company in Brookfield, Connecticut, that shreds documents and destroys hard drives. This purchase is set to help Infoshred expand its services in Connecticut and New York.

- In February 2024, IBM revealed the launch of its Infrastructure Data Erasure service. This service safely and securely erases data from old devices in a client’s data center in an environmentally friendly way.

- Report ID: 3237

- Published Date: Sep 30, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Data Destruction Service Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.