Global Data Center Switch Market Size, Forecast and Trend Highlights Over 2025-2037

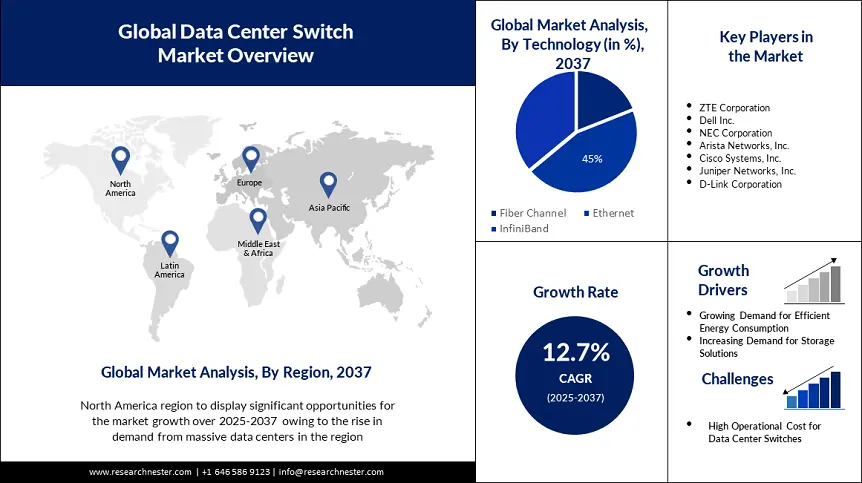

Data Center Switch Market size was valued at USD 8.4 billion in 2024 and is expected to secure a valuation of USD 40 billion in 2037, expanding at a CAGR of 12.7% during the forecast period, i.e. 2025-2037. In 2025, the industry size of data center switch is evaluated at USD 9.3 billion.

The rising need for cloud-based applications and services is fueling the growth of hyperscale data centers globally. The major cloud service providers, including AWS, Microsoft Azure, and Google Cloud, are expanding their infrastructure to manage massive workloads and high-speed data processing. In March 2024, AWS acquired a 960-megawatt hyperscale data center campus in Pennsylvania for USD 650 million, powered by carbon-free nuclear energy from the Susquehanna Nuclear Station, as it demonstrates the latest trends in modern data center management.

The demand for data center switches is rising as businesses require these advanced systems to deliver both minimal latency and high throughput performance. Hyperscale environments need intelligent switching solutions that support high-bandwidth architecture scalability, as these environments constantly evolve. Switch manufacturers are working on developing energy-efficient components, dense port arrays, and programmable programming tools that serve hyperscale implementation needs.

Data Center Switch Sector: Growth Drivers and Challenges

Growth Drivers

- Increasing integration of edge computing across several sectors: The edge computing adoption by industries, including autonomous vehicles, manufacturing, smart cities, and healthcare, requires high-density switches capable of power efficiency in demanding operating environments. Scenarios need flexible infrastructure systems that provide uninterrupted connectivity and reliability, as advanced edge-ready switching solutions are becoming essential for these applications. Major switch manufacturers enhance their product portfolios and include AI automation features for live traffic control and predictive system maintenance, which is boosting the data center switch market growth.

- Shift toward software-defined networking: The adoption of software-defined networking is accelerating the necessity for smart data center switches. Modern database operations require these switches since they provide advanced capabilities for programming, control, as well as automation, which enables dynamic data center management. For instance, in October 2023, Pica8, a leader in open networking solutions, partnered with FS to distribute its full product range, including PicOS, PicOS-V, and the AmpCon Network Controller. Such partnerships assist the development of open programmable networking systems, which focus on enterprise and cloud data center switch markets.

Challenges

- High capital and operational expenditures: SMEs experience difficulty implementing advanced data center switches due to their expensive initial costs and operational requirements. Modern switches include high initial expenses as they require special hardware components, software licensing, and infrastructure upgrades. Ongoing operational expenses of energy consumption, cooling systems, system maintenance demands, and technical support elevate the burden on operational budgets. For many companies, the return on investment may lack clear evidence, resulting in hesitation to upgrade legacy systems. The high implementation expenses of cloud computing reduce the adoption of these systems across developing economies and businesses seeking maximum cost efficiency.

Data Center Switch Market: Key Insights

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2037 |

|

CAGR |

12.7% |

|

Base Year Market Size (2024) |

USD 8.4 billion |

|

Forecast Year Market Size (2037) |

USD 40 billion |

|

Regional Scope |

|

Data Center Switch Segmentation

End user (Government, IT & Telecom, Retail, BFSI, Enterprise)

The IT and telecom segment is expected to account for the largest revenue data center switch market share during the forecast period. The adoption of AI and ML technology in the IT and telecom industry is driving the need for powerful data center hardware infrastructure. The applications need quick data processing of enormous volume sizes that rely on networks that deliver low-delay and large-bandwidth connectivity.

The expansion of digital services, 5G networks, and cloud-based platforms, in addition to increasing adoption of video conferencing and consumer demand, requires scalable and resilient networking solutions. Growing bandwidth and connectivity needs are encouraging the IT and telecom companies to use modular and programmable data center switches as their primary choice. Network switches provide continuous scalability through modern infrastructure systems, which enhance operational efficiency and support electronic service delivery practices, thus playing a crucial role in the evolving digital sector.

Technology (Fiber Channel, Ethernet, InfiniBand)

The Ethernet segment is expected to register rapid growth during the forecast period as high-speed Ethernet technologies, including 400GbE and 800GbE, are gaining widespread momentum. These technologies are handling massive data volumes generated by advanced applications, including ML, AI, and big data analytics. Scalable data center environments heavily rely ona high-speed Ethernet switches for their ability to boost bandwidth while decreasing network challenges to enhance overall network operations. Data center operators are adopting advanced switching solutions as the growing volume of data is driving them to invest in these solutions to support seamless connectivity, all while future-proofing their infrastructure.

Our in-depth analysis of the global data center switch market includes the following segments:

|

End use |

|

|

Switch Type |

|

|

Technology |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Data Center Switch Industry - Regional Scope

North America Market

The North America data center switch market is expected to hold a share of 32% during the analysis period, due to the rapid digital transformation. Private companies and government agencies are making substantial investments to enhance their digital infrastructure, which supports cloud computing and IoT, and AI-based applications. The establishment of data centers in the U.S. and Canada by local and regional cloud service providers is fueling the construction of new data centers. These facilities demand low-latency networking hardware, which is driving companies to deploy advanced data center switches.

The data center switch market in the U.S. is projected to witness rapid growth during the assessment period. This growth is attributed to a rapid surge in data-intensive application requests, including generative AI, video streaming, and cloud-based enterprise solutions. The rising demand for hyperscale data centers requires high-throughput and low-latency switching solutions to ensure quick and dependable data communication through complicated networks.

Europe Market Analysis

The Europe data center switch market is expected to register a significant growth during the analysis period. The data protection laws, including the General Data Protection Regulation (GDPR), are driving organizations to handle personal data within particular jurisdiction boundaries. Significant cloud providers are making substantial investments to establish their data infrastructure as their customer base expands. The market is propelling due to the rising need to implement high-performance data center switches that handle bigger network traffic volumes for maintaining flawless connectivity.

The U.K. data center switch market is expected to grow at a steady pace, owing to the government's strategic initiatives related to AI and data economy development. The plans to establish AI growth zones and enhance public computing capability require state-of-the-art data centers, which need high-performance network switches for handling rising data processing requirements.

Companies Dominating the Data Center Switch Landscape

- Cisco Systems, Inc.

- Company Overview

- Business Strategy

- Key Technology Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Arista Networks, Inc.

- NEC Corporation

- Huawei Technologies Co., Ltd.

- Juniper Networks, Inc.

- Hewlett Packard Enterprise Development LP

- Dell Inc.

- Extreme Networks, Inc.

- D-Link Corporation

- ZTE Corporation

The data center switch market is highly competitive, with key players including Cisco Systems, Arista Networks, Juniper Networks, Huawei Technologies, and Hewlett-Packard Enterprise. These companies are continually innovating to offer high-speed, low-latency switching solutions that cater to cloud computing, AI, and edge computing demands. Strategic collaborations,a product launches, and technology upgrades are central to maintaining market leadership. Here are some key players operating in the global market:

Recent Developments

- In October 2024, Astera Labs launched the Scorpio Smart Fabric Switch portfolio, featuring the industry's first PCIe 6 switch. These switches are optimized for AI dataflows, offering high performance per watt, reliability, and ease of deployment at a reduced cost.

- In August 2024, the European Union Commission approved HPE's USD 14 billion acquisition of Juniper Networks. The merger is expected to enhance HPE's position in the data center switch market by integrating Juniper's networking solutions.

- Report ID: 4893

- Published Date: May 05, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Data Center Switch Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert