Dark Fiber Networks Market Outlook:

Dark Fiber Networks Market size was valued at USD 8.1 billion in 2025 and is projected to reach USD 28.7 billion by the end of 2035, rising at a CAGR of 15.1% during the forecast period, i.e., 2026-2035. In 2026, the industry size of dark fiber networks is estimated at USD 9.3 billion.

The dark fiber networks market is poised for extensive growth in the upcoming years, efficiently fueled by insatiable demand for high-bandwidth, low-latency, and secure connectivity. This growth is also underpinned by the densification of 5G and future 6G networks, which require extensive fiber for fronthaul and backhaul, along with the exponential data traffic generated by cloud computing, hyperscale data center interconnections. According to the article published by the Ministry of Communications in April 2025 revealed that C-DOT, in collaboration with Sterlite Technologies Limited, has demonstrated India’s first quantum key distribution transmission over a 4-core multi-core fibre, thereby enabling simultaneous quantum and high-capacity classical data transmission over a single dark fibre. It also mentioned that the stable QKD link, validated over 100 km, highlights the feasibility of integrating quantum-secured communication with next-generation optical networks, hence positively impacting market growth.

Furthermore, in June 2023, the Biden-Harris Administration announced a substantial USD 930 million investment through the NTIA to expand middle-mile high-speed Internet infrastructure across 35 states and Puerto Rico. It notes that this funding will support more than 12,000 miles of new fiber, improve network resiliency, and lower the cost of delivering high-speed Internet to underserved regions. In addition, all of these projects will use future-proof fiber technology and will pass near nearly 7,000 community anchor institutions. Awardees will also contribute USD 848 million in matching funds, bringing the total investment close to USD 1.8 billion. Hence, this large-scale fiber expansion increases demand for dark fiber assets and accelerates overall market growth.

Key Dark Fiber Networks Market Insights Summary:

Regional Highlights:

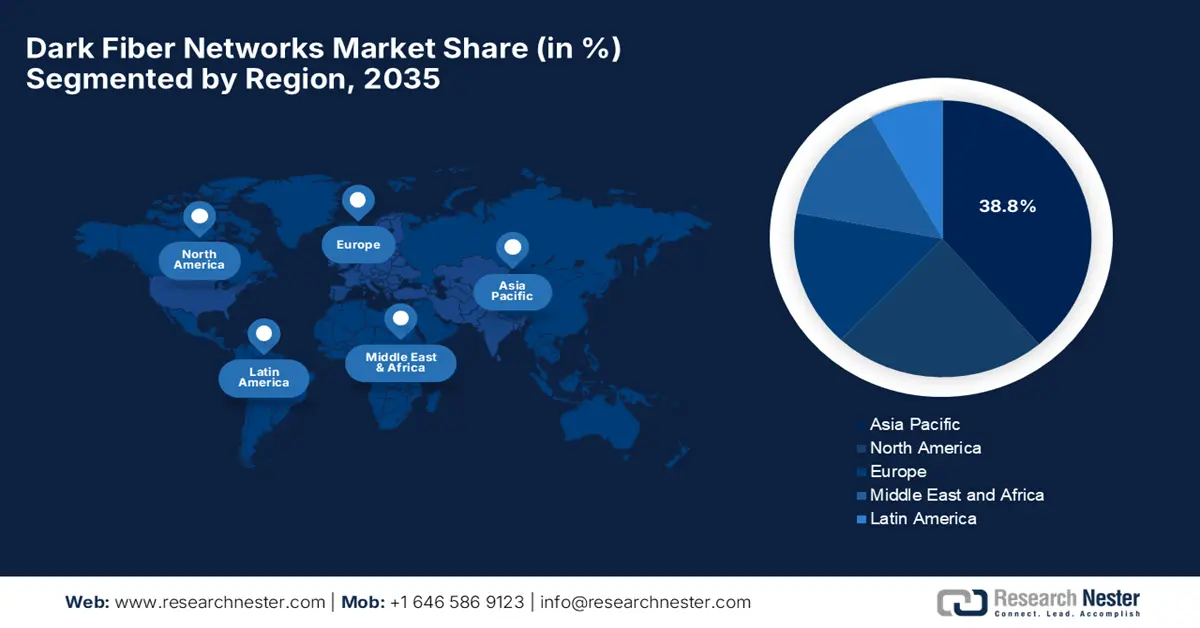

- Asia Pacific is projected to secure a 38.8% share in the dark fiber networks market by 2035, upheld by accelerating digitalization, a rising middle class, technological leadership, and substantial infrastructure investments.

- North America is expected to maintain consistent growth through 2035, bolstered by increasing adoption of edge computing and private enterprise networks.

Segment Insights:

- The metro or access dark fiber segment in the dark fiber networks market is forecast to hold a 58.5% share by 2035, reinforced by soaring demand in dense urban corridors and last-mile connectivity.

- The network expansion segment is set to advance significantly by 2035, underpinned by mounting traffic from cloud computing, video streaming, and IoT.

Key Growth Trends:

- Rising demand for high-bandwidth connectivity

- Expansion of 5G edge computing

Major Challenges:

- High capital expenditure

- Regulatory and permitting constraints

Key Players: AT&T (U.S.), CenturyLink (U.S.), Comcast Corporation (U.S.), Lumen Technologies (U.S.), Zayo Group (U.S.), Colt Technology Services Group Limited (U.K.), Cogent Communications (U.S.), EXA Infrastructure (U.K.), Windstream Communications (U.S.), Telstra Group (Australia), euNetworks (U.K.).

Global Dark Fiber Networks Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 8.1 billion

- 2026 Market Size: USD 9.3 billion

- Projected Market Size: USD 28.7 billion by 2035

- Growth Forecasts: 15.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (38.8% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: India, South Korea, Singapore, Brazil, Australia

Last updated on : 8 December, 2025

Dark Fiber Networks Market - Growth Drivers and Challenges

Growth Drivers

- Rising demand for high-bandwidth connectivity: This is the primary growth driver for the dark fiber networks market since the rise in cloud services, video streaming, IoT, and data-intensive applications is encouraging enterprises to adopt high-capacity dark fiber infrastructure. In this context, the Government of India in May 2025 reported that BharatNet, one of the world’s largest rural broadband projects, has connected 2,14,325 Gram Panchayats with 6.93 lakh km of optical fiber, enabling widespread digital access across India. It was implemented in phases through BBNL, and it supports multiple models, such as state-led, private-led, and CPSU-led-along with extensive last-mile solutions as Wi-Fi hotspots and FTTH. Also, the network is actively used through bandwidth and dark-fiber leasing, strengthening rural connectivity and advancing Digital India, hence denoting a positive market outlook.

- Expansion of 5G edge computing: This is necessitating dense, low-latency backhaul networks, which enhances the need for dark fiber to support small cells and edge data centers. For instance, in June 2023, Zayo announced that it had been awarded USD 92.9 million from the NTIA middle-mile grant program with a prime focus on expanding high-capacity fiber infrastructure across eight U.S. states, adding more than 2,100 route miles of new connectivity. It also stated that the three projects, which include Umatilla/Northern California to Reno, El Paso to Dallas, and Dallas to Atlanta, will bring scalable, reliable fiber backhaul to unserved and underserved communities. In addition, this federally backed expansion strengthens broadband access and enhances the national middle-mile fiber backbone, supporting future digital growth.

- Growth of data centers & colocation facilities: Hyperscale and regional data center expansions rely on dark fiber for high-speed, secure interconnection, prompting a highly profitable business environment for the market. In September 2025, Vantage Data Centers announced that it had secured a USD 1.6 billion investment from GIC and ADIA to accelerate the expansion of its Asia-Pacific platform, effectively driven by rising AI and cloud infrastructure demand. The company also underscored that it will use the funding to acquire Yondr’s 300MW+ Johor, Malaysia hyperscale campus, expanding Vantage’s APAC footprint to 1GW of planned and operational capacity. Furthermore, the Johor site, one of Southeast Asia’s largest and offering dark-fiber connectivity, strengthens the firm’s position as a market leader in this field.

Challenges

- High capital expenditure: This, coupled with infrastructure expenses, is considered to be a major drawback for the dark fiber networks market expansion. The costs for fiber-optic cable manufacturing, trenching, installation, and associated network infrastructure, such as conduit and equipment, can be a barrier for smaller telecom operators and emerging-market players. Even leasing existing fiber can involve costly agreements and long-term commitments, making it challenging for small-scale manufacturers. In addition, the urban areas represent additional expenses owing to the congested underground utilities and complex permitting processes. Therefore, this high initial expenditure can limit market entry, ultimately slowing down expansion, and affect ROI timelines, further compelling companies to carefully evaluate network deployment strategies.

- Regulatory and permitting constraints: The market faces major challenges associated with regulatory permissions since which can hinder network deployment. Installing fiber often requires multiple approvals from municipal, state, and federal authorities, which also includes permissions for trenching, road crossings, environmental compliance, and access to public or private land. Also, the regulatory processes are different across countries and regions, thereby creating complex compliance requirements for multinational operators. Therefore, any delays or restrictions in terms of these approvals increase project timelines and costs, negatively affecting service adoption. Moreover, the aspect of government policies on fiber sharing and infrastructure access can negatively impact profitability in this field.

Dark Fiber Networks Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

15.1% |

|

Base Year Market Size (2025) |

USD 8.1 billion |

|

Forecast Year Market Size (2035) |

USD 28.7 billion |

|

Regional Scope |

|

Dark Fiber Networks Market Segmentation:

Network Type Segment Analysis

Based on the network type, the metro or access dark fiber segment in the dark fiber networks market is expected to dominate with the largest share of 58.5%. This sub-segment is driven by explosive demand in dense urban corridors and for last-mile connectivity. The USD 42.45 billion BEAD Program, created under the IIJA, is a nationwide federal initiative to ensure every citizen has access to high-speed internet by funding state and territory partnerships for broadband expansion. It states that the funds can be used for planning, deploying, or upgrading infrastructure in unserved and underserved areas, supporting community anchor institutions, installing service in multi-unit buildings, and enabling digital adoption and workforce readiness. In addition, NTIA has begun approving state final proposals, thereby advancing large-scale last-mile broadband deployment across the country, which mandates prioritizing future-proof fiber networks, directly fueling metro and access dark fiber deployment for network backhaul.

Application Segment Analysis

The network expansion segment is anticipated to grow in the market by the end of 2035, attributable to the relentless traffic growth from cloud computing, video streaming, and IoT. In this regard Ministry of Economy & Industry reported that global connectivity is accelerating as 5G and fiber broadband drive ultra-fast networks, wherein 5G alone represents about one-tenth of worldwide connections in 2022 and is projected to reach 50% by the end of 2030. It also stated that digital transformation spending is expected to surge to USD 3.9 trillion by 2027, which reflects the rapid adoption of technologies such as generative AI, cloud computing, IoT, cybersecurity, edge computing, and big data. Furthermore, enterprises are integrating these advanced tools to enhance efficiency and productivity, whereas the demand for reliable, high-performance digital infrastructure continues to rise.

End user Segment Analysis

By the end of the discussed timeframe, the telecommunication service providers segment is expected to attain a lucrative share in the market. The demand is highly propelled by the global transition to 5G standalone networks, wherein the architecture necessitates dense, high-capacity, low-latency fronthaul and backhaul, which dark fiber uniquely provides. In addition, the surge in cloud computing, video streaming, and IoT applications is driving unprecedented bandwidth requirements that only scalable dark fiber networks can meet. Both government and private players are making heavy investments in middle-mile and last-mile fiber infrastructure, which is creating new leasing and deployment opportunities for telecom providers. Furthermore, with ongoing digital transformation initiatives, telecom operators are positioned to leverage dark fiber for offering premium services.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Network Type |

|

|

Application |

|

|

End user |

|

|

Fiber Type |

|

|

Installation |

|

|

Material |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Dark Fiber Networks Market - Regional Analysis

APAC Market Insights

Asia Pacific is expected to hold a commanding share of 38.8% in the dark fiber networks market over the forecasted years. The region’s upliftment in this field is effectively attributable to digitalization, the rising middle class, technological leadership, and massive infrastructure investments. In December 2022, BB Backbone and JR WEST Optical Network announced that they had launched the Osaka NANIWA ring, which is a redundant fiber-optic ring connecting major data centers in Osaka City, including Osaka Business Park, Dojima, and Sonezaki. It also stated that by utilizing JRWON’s railroad fiber routes and BB Backbone’s expertise, the ring supports 100GBASE-LR4 standard connections, enabling stable, fault-tolerant, and cost-efficient data center connectivity. Furthermore, the network can also link to existing fiber infrastructures across Osaka, Kansai, Chugoku, and Kyushu regions, reducing reliance on relay stations, hence enhancing the market by expanding high-capacity, redundant fiber infrastructure for data centers.

China is growing exponentially in the regional market with the presence of government-supported national backbone networks and cross-provincial initiatives to strengthen intercity connectivity. The country’s growth in this field is also driven by large cloud service operators who are deploying private fiber for AI research clusters and industrial IoT applications. In July 2024, ZTE announced that, in collaboration with China Telecom and YOFC, it had launched the world’s first-ever live hollow-core fiber transmission system, achieving a single-wavelength speed of 1.2 Tbit/s and unidirectional capacity exceeding 100 Tbit/s over 20 km. Besides, the deployment between China Telecom’s Hangzhou Intelligent Computing Center and Yiqiao IDC supports high bandwidth for distributed computing and intelligent computing scenarios. Hence, this deployment strengthens the market by increasing demand for high-capacity, low-latency fiber infrastructure.

India is extensively growing in the regional dark fiber networks market on account of the national broadband programs and digital infrastructure projects, which are connecting rural and urban centers. Simultaneously, the service providers and large enterprises in the country are opting for dark fiber to ensure high-capacity links for fintech, e-commerce, and cloud computing applications. In February 2025, the Delhi Metro Rail Corporation announced that it had partnered with Beckhaul Digital to deploy a 700 km high-speed optical fiber network across all metro corridors, which is starting with the Pink and Magenta Lines. It also highlighted that the network will serve as a backbone for ISPs, telecom providers, data centers, and smart city initiatives, thereby supporting the growth of 5G services in Delhi-NCR. Furthermore, this project enhances digital connectivity, optimizes existing metro infrastructure in the country.

North America Market Insights

North America is continuously growing in the dark fiber networks market, efficiently propelled by the growing adoption of edge computing and private enterprise networks. Large-scale fiber expansions in urban and suburban areas of this region are being fueled by partnerships between carriers, data center operators, and municipal governments to enhance network resiliency. In June 2025, Lumen Technologies announced that it is deploying its dark fiber network to provide terrestrial backhaul for the JUNO Trans-Pacific Cable by connecting its U.S. landing in Grover Beach to PoPs in San Jose and Los Angeles. It also stated that this infrastructure ensures high-capacity and low-latency data transport between Asia and the U.S. Furthermore, by linking into cloud hubs, edge computing sites, and data centers, this supports AI applications and enterprise operations, hence making it suitable for the overall market growth.

The telecom operators and cloud service providers are leveraging dark fiber to interconnect hyperscale data centers, driving strong business in the U.S. dark fiber networks market. In addition, the municipal broadband projects and fiber consortia are expanding middle-mile infrastructure to bridge gaps in underserved urban and rural areas, providing encouraging opportunities for long-term leases. In January 2023, Summit Infrastructure Group announced that it had launched a new, purpose-built underground dark fiber network in Greater Columbus, Ohio, which is aimed at supporting the region’s growing data center and hyperscale cloud sectors. Besides, the initial buildout will cover over 200 miles, offering unique and diverse routes distinct from existing legacy networks. Furthermore, Columbus’s role as a data center hub, driven by land availability, power supply, and state incentives, makes this expansion highly critical for high-performance connectivity.

Canada has gained momentum in the regional dark fiber networks market, effectively fueled by the need to connect resource-heavy industries such as oil, mining, and financial services across the country’s vast geographic areas. Fiber providers in the country are focused on building redundant ring networks in metropolitan hubs and linking them to remote industrial zones by ensuring high-capacity private networks for mission-critical operations. In addition, the adoption is also accelerated by the expansion of hyperscale cloud data centers and edge computing facilities, which demand ultra-low latency and scalable bandwidth. Telecom operators and enterprise providers in Canada are making investments in purpose-built underground fiber routes to enhance network resilience and service reliability. Furthermore, government initiatives to improve digital infrastructure in remote and rural regions are creating new opportunities for dark fiber deployment across the country.

Europe Market Insights

Europe is expected to acquire a significant stake in the global market owing to the regulatory support for open-access networks, which is accelerating adoption, particularly for metropolitan campuses. The region also benefits from the presence of operators who are focusing on deploying flexible, multi-terabit networks to accommodate increasing demand for cloud services. In April 2023 announced that it acquired a Belgian utility company’s dark fiber business, thereby adding 1,660 km of duct-based fiber across Brussels and long-haul routes in Belgium. This integration enhances network reach, unique routing, and connectivity to hyperscale data centers, thereby supporting high-bandwidth demands in Europe. Furthermore, this expansion strengthens euNetworks’ presence in Europe and provides customers with end-to-end fiber solutions.

Germany is maintaining its dominance in the regional market owing to industrial digitization and the need for high-capacity private networks in manufacturing hubs. Simultaneously, the domestic fiber consortia and telecom providers are expanding metro and regional networks to facilitate Industry 4.0 applications and secure data exchanges. In September 2024, the European Investment Bank reported that it provided a €350 million (≈ USD 384 million) InvestEU-backed loan to Deutsche Glasfaser to expand high-speed fiber broadband to 460,000 rural households in the country. Besides, the bank also noted that this project aims to bridge the digital divide by delivering gigabit-capable connections, which support cloud services, IoT, and emerging technologies. Hence, this initiative efficiently strengthens Germany’s digital infrastructure, prompting economic growth and future-proofing rural regions for high-capacity network demands over the forecasted years.

In the U.K. dark fiber networks market is highly influenced by the advent of full-fiber broadband initiatives and enterprise-grade interconnections. Providers in the country are focused on redundant metro and regional rings, thereby linking business parks, universities, and financial districts to enhance connectivity. NTT DATA and NTT Corporation in April 2024, have reported that they showcased their ultra-low-latency connections between data centers in the U.K., which efficiently achieved round-trip delays of just 0.9 milliseconds and jitter lower than 0.1 microseconds. The report also highlighted that this APN deployment enables geographically distributed data centers in the country to operate as one facility, which also supports real-time AI, financial services. Hence, it demonstrates how dark fiber can be used for scalable, mission-critical network applications without the need for new fiber installation.

Key Dark Fiber Networks Market Players:

- AT&T (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- CenturyLink (U.S.)

- Comcast Corporation (U.S.)

- Lumen Technologies (U.S.)

- Zayo Group (U.S.)

- Colt Technology Services Group Limited (U.K.)

- Cogent Communications (U.S.)

- EXA Infrastructure (U.K.)

- Windstream Communications (U.S.)

- Telstra Group (Australia)

- euNetworks (U.K.)

- AT&T is one of the leading telecommunications providers in the U.S., which is offering extensive dark fiber solutions along with its broadband, wireless, and enterprise networking services. The company is focused on delivering high-capacity, low-latency fiber connectivity to enterprises, data centers, and service providers. Furthermore, strategic initiatives opted by the firm include expanding its fiber footprint, investing in metro and long-haul networks, and integrating advanced technologies to support 5G backhaul and cloud services.

- CenturyLink is now operating as Lumen Technologies, which provides enterprise-focused dark fiber solutions across major metropolitan and long-haul routes in the U.S. Simultaneously, the firm’s dark fiber offerings are targeting data centers, cloud service providers, and large enterprises requiring secure, scalable connectivity. In addition, CenturyLink emphasizes network expansion, acquisition of fiber assets, and innovative service packages that enhance bandwidth flexibility, thereby driving competitiveness in this field.

- Comcast Corporation is recognized as a prominent telecommunications and media company which is offering enterprise and wholesale dark fiber services in addition to its broadband and cable networks. The firm’s dark fiber strategy relies on expanding metro fiber networks, connecting enterprise campuses, and supporting next-generation applications such as IoT and 5G backhaul. Comcast is deeply leveraging its existing infrastructure and strategic partnerships to strengthen its footprint in both emerging and established markets.

- Zayo Group is considered to be a leading provider of dark fiber, metro, and long-haul optical networks across North America and Europe. The company serves data centers, enterprises, and telecom carriers, which are emphasizing scalable, secure, and customizable fiber solutions. Zayo’s prime focus includes fiber network expansion, acquisitions of regional fiber assets, and development of high-capacity metro routes with a collective goal of strengthening connectivity offerings in the dark fiber market.

- Colt Technology Services is based in Europe and is a leading provider of network, cloud, and voice services, with a strong focus on high-capacity dark fiber solutions across major metro areas. The company also operates an extensive fiber network that connects data centers, enterprises, and financial institutions, thereby delivering low-latency, high-performance connectivity. Furthermore, Colt leverages its regional network to provide scalable, secure, and flexible connectivity solutions for enterprise as well as wholesale customers.

Below is the list of some prominent players operating in the global market:

The international dark fiber networks market is extremely competitive, wherein the key players such as AT&T, CenturyLink, Comcast Corporation, and Lumen Technologies. The competition among these pioneers is readily emerging owing to the growing demand for high-capacity, low-latency connectivity from data centers, cloud providers, and enterprises. In August 2023, Dark Fiber and Infrastructure announced that it had strengthened its partnership with DataBridge Sites by connecting its Maryland facility to DF&I’s Express Connect network, providing the fastest, lowest-latency route between Maryland and Ashburn, Virginia. It also stated that the proprietary under-river crossing and on-net connectivity offer DataBridge’s customers direct fiber access to key data centers, carriers, and cloud services, enhancing performance and reliability. Furthermore, since its implementation, the network has become a preferred backbone route for carriers, delivering high-capacity, secure connectivity across Northern Virginia and Maryland.

Corporate Landscape of the Dark Fiber Networks Market:

Recent Developments

- In October 2025, SoftBank Corp. announced that, in collaboration with Cisco, it had begun deploying an all-optical network in Japan’s metro networks, starting with Osaka, to build high-capacity, scalable infrastructure for the Beyond 5G/6G era. This network eliminates optical-electrical conversion, reducing energy consumption by around 90%.

- In May 2024, BIG Fiber announced that it had partnered with Flexential to deliver high-capacity dark fiber connectivity to Flexential’s Atlanta Douglasville data center campus, supporting rapid data center growth in the region.

- Report ID: 8278

- Published Date: Dec 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Dark Fiber Networks Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.