Lit Fiber Market Outlook:

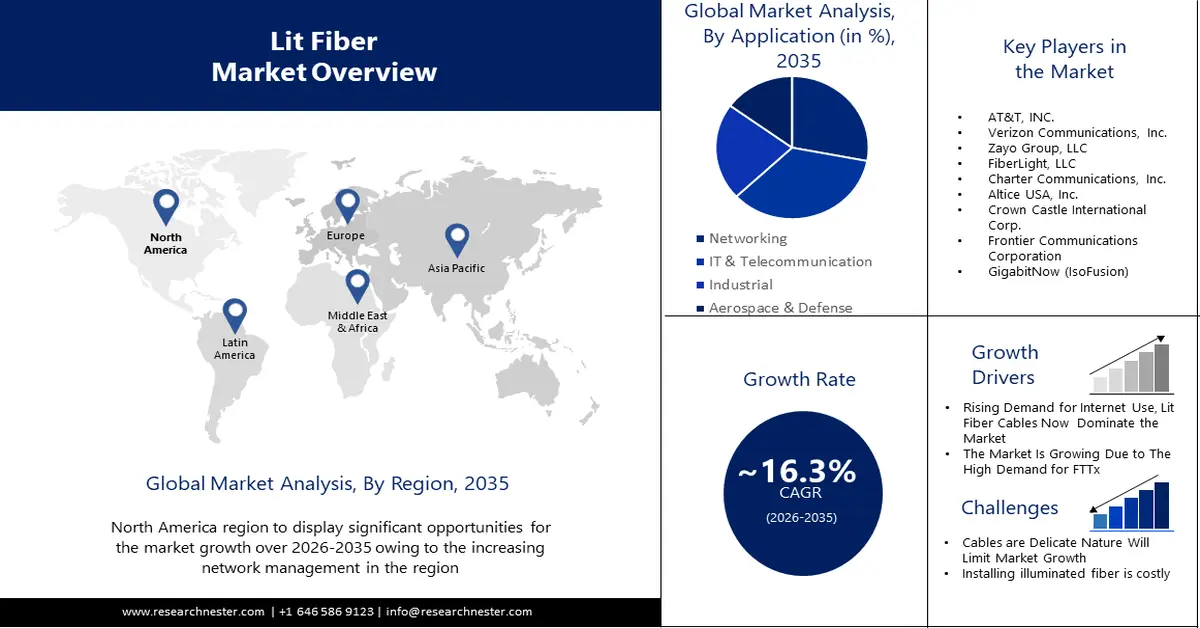

Lit Fiber Market size was over USD 6.22 billion in 2025 and is anticipated to cross USD 28.16 billion by 2035, witnessing more than 16.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of lit fiber is assessed at USD 7.13 billion.

In response to the growing need for mobile data and the arrival of 5G services, telecom service providers are actively acquiring existing fiber and investing in the development of new infrastructure. This is a reaction to the impending availability of 5G services.

More generally, the rollout of 5G is awaited to coincide with a rise in global data consumption. Estimates indicate that 2028 mobile data traffic will reach about 330 exabytes per month, more than tripling the amount used in 2022. By the end of 2023, 45% of the world's population is estimated to be covered by 5G and by 2029, that percentage is expected to rise to 85% or more.

In addition to these, two further factors that are said to fuel the growth of the dark fiber network industry over the anticipated period are the audience of users of portable devices' ever-increasing bandwidth requirements and cable providers' compulsory conversion to HD video quality.

Key Lit Fiber Market Insights Summary:

Regional Highlights:

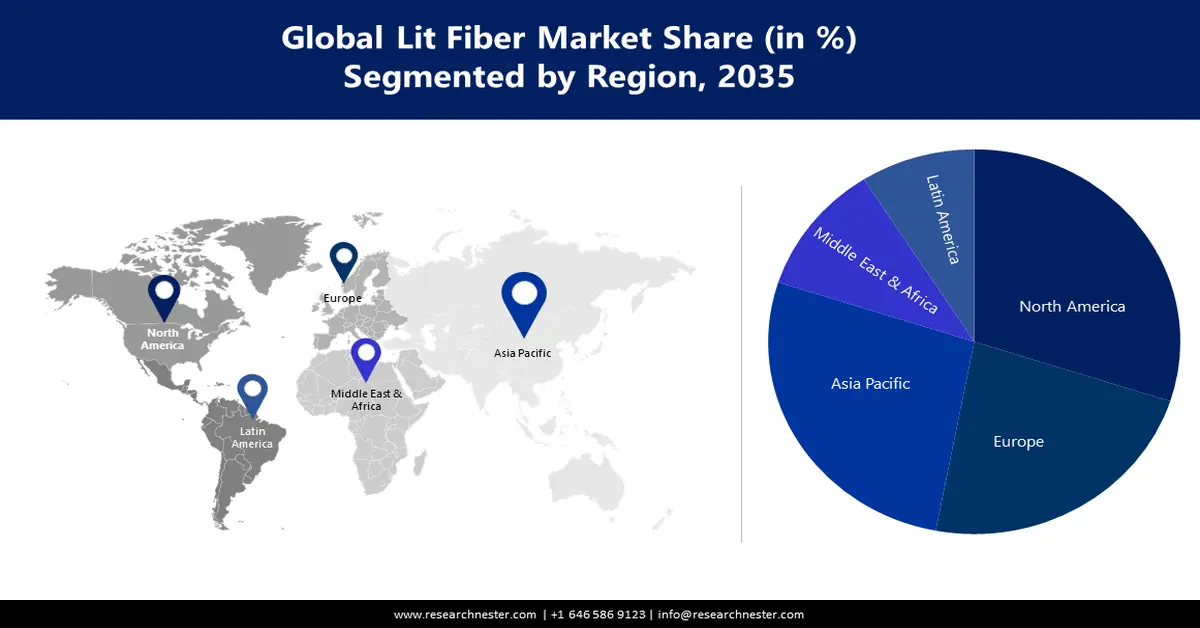

- North America lit fiber market is expected to capture 30% share by 2035, attributed to increased network management, mobile data, internet service penetration, and preference for 5G network services.

- Asia Pacific market will attain a 27% share by 2035, driven by rapid technological developments and widespread use of technology in various sectors.

Segment Insights:

- The multi-mode segment in the lit fiber market is expected to capture a 67% share by 2035, driven by increasing demand for short-distance data transmission and LAN/video surveillance.

- The it & telecommunication segment in the lit fiber market is projected to achieve a 35% share by 2035, attributed to rising data traffic and the need for high-bandwidth lit fiber infrastructure.

Key Growth Trends:

- High demand for FTTx

- Increasing usage of OTT platforms

Major Challenges:

- Cables' delicate structure will constrain market growth

Key Players: AT&T, INC., Verizon Communications, Inc., Zayo Group, LLC, FiberLight, LLC, Charter Communications, Inc., Altice USA, Inc., Crown Castle International Corp., Frontier Communications Corporation, GigabitNow (IsoFusion).

Global Lit Fiber Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.22 billion

- 2026 Market Size: USD 7.13 billion

- Projected Market Size: USD 28.16 billion by 2035

- Growth Forecasts: 16.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (30% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 16 September, 2025

Lit Fiber Market Growth Drivers and Challenges:

Growth Drivers

- Rising demand for internet use- The Internet is a global network of interconnected devices. Fibre optics is the backbone of the internet, data is sent from one source to another via lighted fibers. Currently, 5.03 billion people use the internet globally, making up 63.1 percent of the world's population. The population using the internet is also rapidly growing. Internet consumption is driven by the expanding significance of cloud computing, IoT, and data transit and storage. The number of internet users is predicted to increase quickly in the next years as more businesses and individuals resort to cloud computing for a variety of functions.

- High demand for FTTx- Any broadband service design known as FTTx uses lit fiber as the optical channel for last-mile telecommunications, allowing data to be transmitted in a local loop. FTTH, FTTB, FTTP, FTTN, and FTTC are all included in FTTx. Lit fiber's capacity to accommodate higher bandwidth at faster speeds has made it a crucial element for network evolution. Communication applications are continually growing, and some of these features require higher bandwidth and faster speeds. Advanced uses include IoT, OTT, and video technology. As the use of these applications grows, more network topologies like FTTH and FTTB are required. The most bandwidth-intensive technologies are those that use video.

- Increasing usage of OTT platforms- The term "over-the-top" (OTT) describes how media content is distributed online, including audio, video, and other formats. To access the material, users of over-the-top (OTT) services do not require a subscription to traditional cable or satellite pay-tv services. Similar growing trends are being seen in over-the-top (OTT) and video technologies. In the US, two of the most well-known over-the-top (OTT) entertainment providers are SlingTV and Hulu. According to estimates, the OTT video industry will have 3,508.0 million users by 2027. Consequently, lit fiber market demand will rise as the number of OTT users grows.

Challenges

- Cables' delicate structure will constrain market growth- Fiber is more prone to physical or mechanical damage than traditional metal wirings since it is thinner and lighter. During building renovations, lit fiber cables are easily destroyed or cut by accident. Even a single cut in the wire can cause significant difficulty. To prevent cable breakage, this must be inspected before deployment.

- Installing illuminated fiber is costly- Additionally, the user would need qualified personnel to install the lit fiber equipment and specialized equipment to guarantee the connection is stable. The user may incur significant costs at the end of the lit fiber installation process.

- Globally, the COVID-19 pandemic has had a substantial negative impact on the economy in several ways, indicating an unprecedented disruption in trade by forcing numerous suppliers to scale back on the construction and manufacturing of lit fiber network equipment.

Lit Fiber Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

16.3% |

|

Base Year Market Size (2025) |

USD 6.22 billion |

|

Forecast Year Market Size (2035) |

USD 28.16 billion |

|

Regional Scope |

|

Lit Fiber Market Segmentation:

Type Segment Analysis

The multi-mode segment in the lit fiber market is slated to gain a share of about 67% during the forecast timeframe. The growth of the market is because this transmission mechanism is most appropriate for short distances; this portion grows quickly. It is mostly utilized in LAN networks and video surveillance. Many light beams with greater attenuation and less brightness may be transferred across numerous light modes with ease using multi-mode wires.

The market for multi-mode fiber cable will expand due to consumers' growing need for higher bandwidth and faster connection times. Businesses and consumers are demanding more bandwidth due to the rise in internet usage for social networking, gaming, video chats, and online shopping.

Application Segment Analysis

The IT & Telecommunication segment in the lit fiber market is attributed to a revenue share of about 35% during the coming years. The proliferation of data coming from various sources, such as computer networks, e-commerce, the internet, and multimedia (voice, data, and video), has made the creation of a transmission medium that can handle such massive volumes of data necessary. Lit fiber connections have an infinite bandwidth, making them the ideal solution.

Moreover, lit fiber is an essential part of the infrastructure for telecommunications. For the past ten years, lit fiber has dominated the transmission landscape, meeting the growing demands for bandwidth, especially from telecommunications companies. To backhaul massive amounts of data at high speeds while improving dependability and reducing latency, faster fiber installation is essential. The telecom providers in the area are adding more spectrums to their offerings.

Our in-depth analysis of the market includes the following segments:

|

Type |

|

|

Application |

|

|

Connectivity |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Lit Fiber Market Regional Analysis:

North American Market Insights

North America industry is estimated to dominate majority revenue share of 30% by 2035, due to rising network management and customer preference for 5G network services in the region. . The growth is being driven by increased network management, mobile data, internet service penetration, customer preference for 5G network services, and the need for improved communication. The region's excellent infrastructure makes it easier to build lit fiber cables across North America. The Fiber Broadband Association (FBA) has released a new study indicating that more than 60 million US homes are already supplied by fiber as of 2022, up 12% from about 54 million in 2020. Therefore, the market for lit fiber will develop in the area in the upcoming years due to the increasing use of broadband.

APAC Market Insights

Lit fiber market in the Asia Pacific region is intended to attain a share of about 27% during the projected period. This region's growth is fueled by rapid technological developments and widespread use of technology in the administrative, telecommunications, and information technology sectors. Lit fiber cables are being used more often in India to transfer signals with less loss.

Additionally, the government is investing more money in the advancement of telecommunications services. In the Union Budget 2021-22, the Indian government allotted USD 1.9 Billion for telecom infrastructure. This includes building a fiber cable-based network for defense services, improving mobile services in the Northeast, and installing broadband in 2.2 lakh village counsils.

Lit Fiber Market Players:

- Comcast Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- AT&T, INC.

- Verizon Communications, Inc.

- Zayo Group, LLCFiberLight, LLC

- Charter Communications, Inc.

- Altice USA, Inc.

- Crown Castle International Corp.

- Frontier Communications Corporation

- GigabitNow (IsoFusion)

Recent Developments

- FiberLight, LLC- A new agreement has been established between FiberLight, LLC, a fiber infrastructure provider with over 20 years of experience in developing and managing high-bandwidth, mission-critical networks, and Atlanta-based Coloblox Data Centers. Having been among the first co-location companies in Atlanta, Coloblox now has over 250 clients spread over its 32,000 square feet of data center space.

- Frontier Communications Group- Frontier Communications declared that a 2-gig package will now be available over its whole fiber footprint. During its August 2021 Investor Day, Frontier first revealed its plan to roll out multi-Gig speeds over the entire network. Starting at USD 150 a month, the new Frontier FiberOptic service offers symmetrical download and upload speeds of up to 2 gigabits per second. With the most recent, lightning-fast Wi-Fi 6e technology, Frontier's 2 Gig routers unleashes reduced latency to provide a better user experience. All 2 Gig internet subscriptions come with the device and Wi-Fi extender for no additional cost.

- Report ID: 5621

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Lit Fiber Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.