Cyanate Ester Resins Market Outlook:

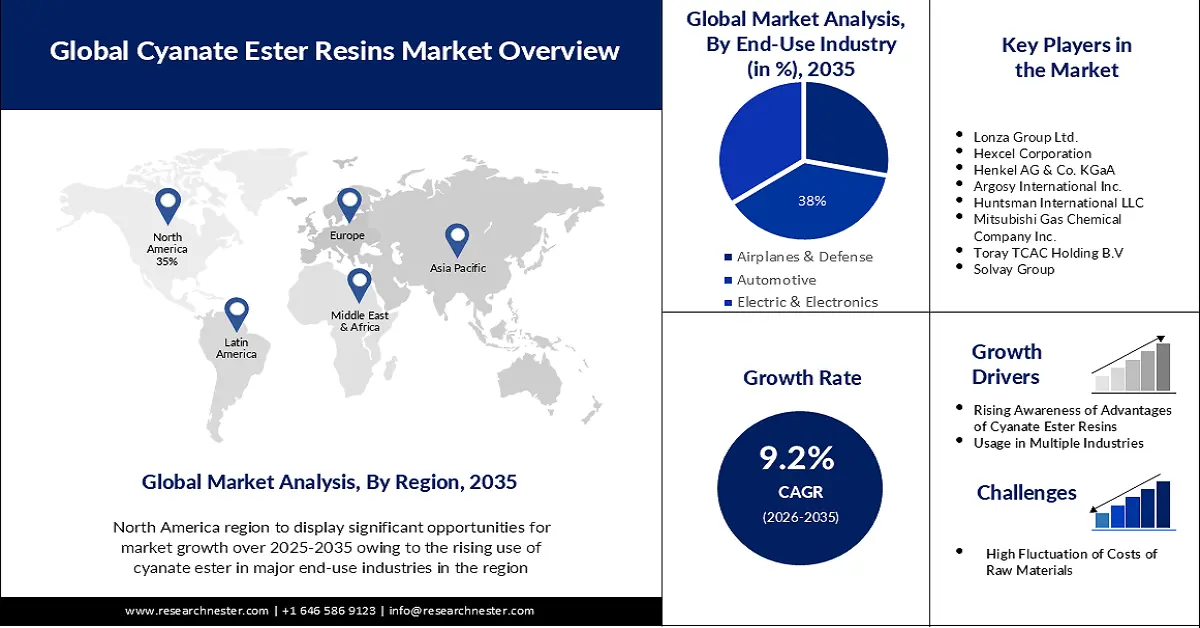

Cyanate Ester Resins Market size was over USD 375.76 Million in 2025 and is anticipated to cross USD 906.02 Million by 2035, witnessing more than 9.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of cyanate ester resins is assessed at USD 406.87 Million.

The rising utilization of cyanate ester resins and different types of polymers in several end-user industries owing to their excellent thermal resistance properties, dielectric properties, and good flame retardancy is the major factor in the robust growth of the market during the assessment period.

Properties of cyanate ester resins such as excellent strength, lower moisture absorption, and enhanced electrical properties as compared with other resins are the major factor for their high utilization rate in various end-use industries.

Furthermore, it has other advantages such as high resistance power against heat and harsh reactions along with flexibility and robustness which makes it a preferred option for electronics and automobiles that require strong materials for smooth and effective operation for years. All these properties & advantages are creating numerous expansion opportunities for the market.

Key Cyanate Ester Resins Market Insights Summary:

Regional Highlights:

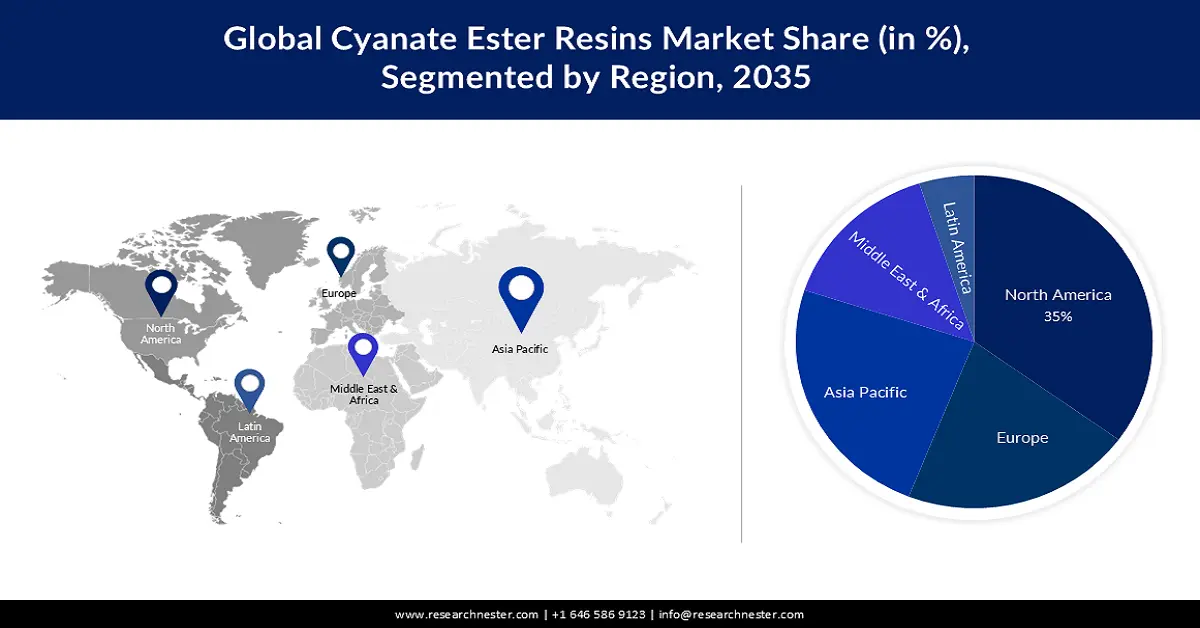

- The North America cyanate ester resins market is predicted to capture 35% share by 2035, fueled by growth in the chemical industry and applications in aerospace.

- The Asia Pacific market will secure 24% share by 2035, driven by increased R&D investment and favorable government initiatives.

Segment Insights:

- The adhesives segment in the cyanate ester resins market is projected to secure a 45% share by 2035, attributed to the versatility of ester resins in applications such as aircraft and electronics.

- The automotive segment in the cyanate ester resins market is projected to hold a 38% share by 2035, driven by rising use of cyanate ester resins for lightweight, durable vehicles.

Key Growth Trends:

- Increasing Demand and Production of Vehicles

- Growth in the Electronics Sector

Major Challenges:

- High Processing and Manufacturing Costs

- Fluctuation in Prices of Raw Materials

Key Players: Lonza Group Ltd., Hexcel Corporation, Henkel AG & Co. KGaA, Argosy International Inc., Huntsman International LLC, Mitsubishi Gas Chemical Company Inc., Toray TCAC Holding B.V, Solvay Group.

Global Cyanate Ester Resins Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 375.76 Million

- 2026 Market Size: USD 406.87 Million

- Projected Market Size: USD 906.02 Million by 2035

- Growth Forecasts: 9.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 9 September, 2025

Cyanate Ester Resins Market Growth Drivers and Challenges:

Growth Drivers

-

Increasing Demand and Production of Vehicles – As economies grow, so does the demand for lightweight, fuel-efficient vehicles. According to the International Organization of Motor Vehicle Manufacturers (OICA), global vehicle sales increased to 56 million in 2021 from 53 million in 2020. In contrast, global vehicle production reached 57 million in 2021. Cyanate ester resin, a versatile component with many added benefits such as high mechanical strength, increased durability, and resistance to harsh conditions, is used in many automotive components such as race car exhausts, brakes, and others. As a result, rising vehicle demand and production are expected to boost the utilization rate of cyanate ester resins in the automotive sector over the next few years.

-

Growth in the Electronics Sector – Since cyanate ester resins are good electrical conductors and increase the durability of the products, they are frequently used in the production of electrical goods and electronics. As a result, the rapid growth of the electronics industry and the high demand for electronic goods among the world's population are anticipated to have a positive impact on the expansion of the global market.

Challenges

-

High Processing and Manufacturing Costs – Cyanate ester resins are unique and distinct from other types of resins available in the market. As a result, the cyanate ester resin manufacturing process necessitates significant investment, raising manufacturing costs. The finished product's price rises, making it less affordable to industries with limited financial resources. Over the forecast period, these factors are expected to stifle market growth.

-

Fluctuation in Prices of Raw Materials

-

Issues Related to Reusability and Recyclability

Cyanate Ester Resins Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.2% |

|

Base Year Market Size (2025) |

USD 375.76 Million |

|

Forecast Year Market Size (2035) |

USD 906.02 Million |

|

Regional Scope |

|

Cyanate Ester Resins Market Segmentation:

End-Use Industry Segment Analysis

The automotive segment is poised to hold 38% share of the cyanate ester resins market by the year 2035. The prospering automotive industry along with the rising preference for connected vehicles and autonomous cars and the rising demand for cyanate ester resins for efficient vehicles is predicted to bolster the segment value. It was estimated by 2025, there will be almost 470 million connected cars on the roads of the world.

As the usage of cyanate ester resins helps in reducing the overall weight of the vehicle and increasing the durability as compared with steel, the recent high demand for automobiles is anticipated to increase the demand for cyanate ester resins to provide extra protective layers to new vehicles.

Application Segment Analysis

The adhesives segment in the cyanate ester resins market is set to generate the largest revenue share of 45% in the year 2035. The primary reason for segment growth is the high versatility of ester resins in adhesives applications. It is used for a variety of applications including space crafts, aircraft, missiles, antennae, radomes, microelectronics, and microwave products.

Moreover, adhesives have been highly used in electronic products owing to their advantages which are considered to be another growth factor for segment expansion during the projected years.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

Application |

|

|

End Use Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cyanate Ester Resins Market Regional Analysis:

North American Market Insights

North America industry is estimated to account for largest revenue share of 35% by 2035 as a result of the growth of the chemical industry in countries such as the United States, which is a positive indicator of the increased production rate of cyanate ester resins in the upcoming years with their growing applications in spacecraft, aircraft, and missiles. According to recent reports, the chemical industry generated nearly USD 550 billion in revenue in the United States in 2019.

APAC Market Insights

The Asia Pacific cyanate ester resins market is estimated to be the second largest, registering a share of about 24% by the end of 2035, owing to the increased investment in research and development activities to introduce high-quality cyanate ester resins in emerging nations such as China. Also, the rising favorable government initiatives encouraging major key players in the region to produce advanced materials such as ester resins with its rapidly augmenting demand in the various end-use industries in the region including chemical, and automotive, is anticipated to bring lucrative growth opportunities for the market shortly.

Cyanate Ester Resins Market Players:

- Lonza Group Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Hexcel Corporation

- Henkel AG & Co. KGaA

- Argosy International Inc.

- Huntsman International LLC

- Mitsubishi Gas Chemical Company Inc.

- Toray TCAC Holding B.V

- Solvay Group

Recent Developments

- Hexcel Corporation along with Spirit AeroSystems Europe has entered into a collaboration at its Aerospace Innovation Centre (AIC) to enhance aircraft manufacturing technologies for future aircraft production.

- Lonza Group Ltd. has joined hands with Adva Biotechnology Ltd. which will enable the expansion of automated bioreactors globally.

- Report ID: 4407

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Cyanate Ester Resins Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.