Vinyl Ester Market Outlook:

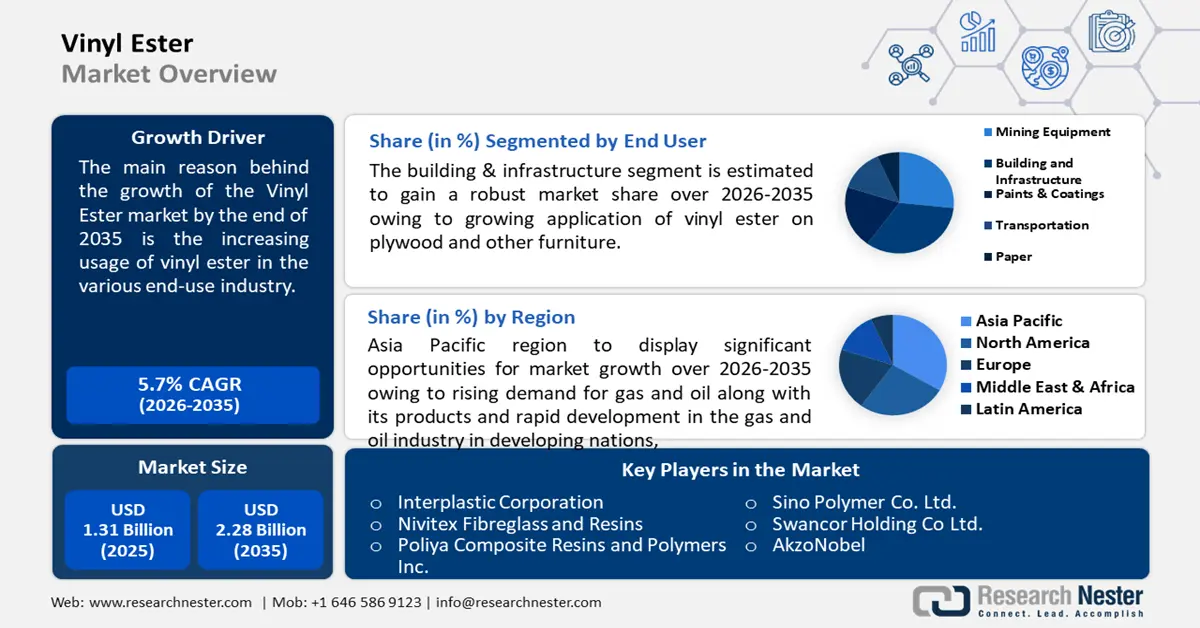

Vinyl Ester Market size was over USD 1.31 billion in 2025 and is poised to exceed USD 2.28 billion by 2035, growing at over 5.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of vinyl ester is estimated at USD 1.38 billion.

The growth of the market can be attributed to the increasing usage of vinyl ester in the various end-use industry, supported by the rising industrialization and increasing industrial production across the globe. It was observed that in the USA, in September 2022, industrial production rose by 0.4 percent, and in the third quarter, it rose by 2.9 percent annually. The mining index increased by 0.6 percent. Total industrial production in September increased by 5.3 percent from the same month last year, or 105.2% of its 2017 average.

A resin known as vinyl ester resin, or frequently just vinyl ester, is created when acrylic or methacrylic acids are added to an epoxy resin. The vinyl ester resins have higher strength and greater chemical resistance properties, and hence, are suitable for various applications. Given that they are waterproof and have superior mechanical qualities, vinyl ester resins are frequently used in laminating and repairing materials. Vinyl ester fiberglass-reinforced structures are widely used in the kit for aircraft. Moreover, rising investment in the aircraft and aviation industry is estimated to support market growth. For instance, among all industrial businesses, the United States aviation industry continues to create the maximum trade balance (USD 77.6 billion in 2019) and the second-highest quantity of exports (USD 148 billion), with aerospace exports expanding at a 5.31 percent average rate over the last decade. Further, the vinyl resin market is also anticipated to rise owing to increased use in flue-gas desulfurization installations, as well as high demand for corrosion-resistant materials for limestone slurry pipes and stack liners in the flue-gas desulfurization process.

Key Vinyl Ester Market Insights Summary:

Regional Highlights:

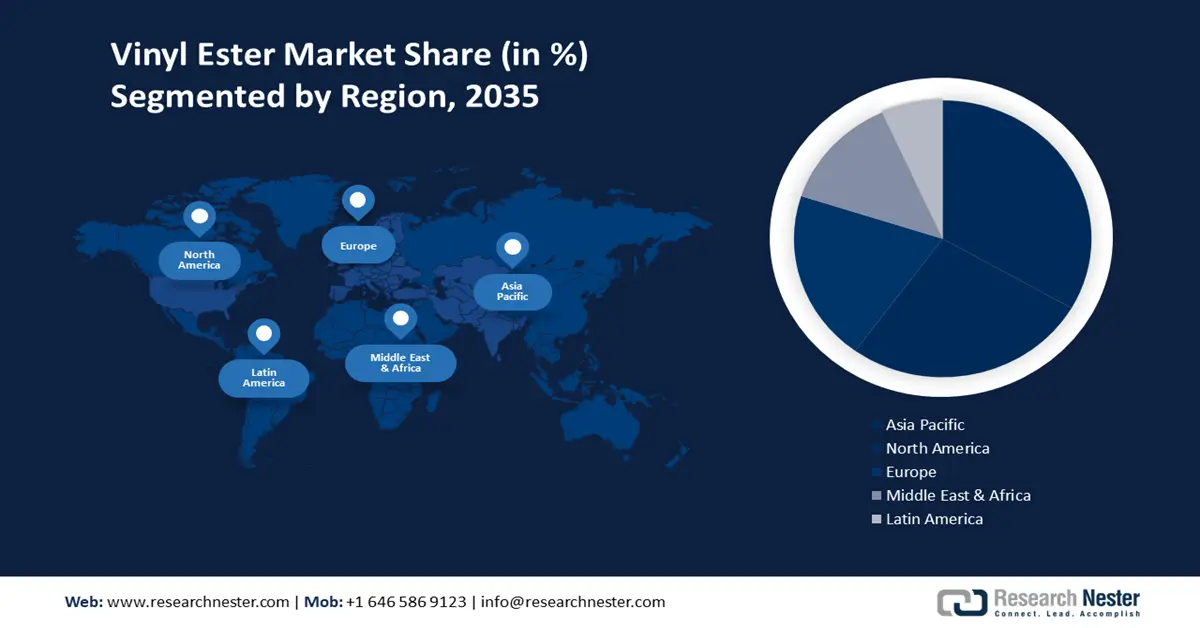

- Asia Pacific vinyl ester market achieves the largest share by 2035, driven by rising oil & gas demand and supporting infrastructure.

Segment Insights:

- The building & infrastructure segment in the vinyl ester market is projected to achieve the highest market share by 2035, attributed to increasing housing demand and refurbishment activities globally.

- The storage tank segment in the vinyl ester market is expected to hold the highest market share by 2035, driven by increased use of vinyl ester in chemical storage and environmental regulation compliance.

Key Growth Trends:

- Rising Marine Industry

- Growing Paint and Coating Consumption

Major Challenges:

- High Cost of Vinyl Ester

- Easy Availability of Substitutes

Key Players: INEOS Limited, Interplastic Corporation, Nivitex Fibreglass and Resins, Poliya Composite Resins and Polymers Inc., Polynt S.p.A., Scott Bader Company Limited, Showa Denko K. K., Sino Polymer Co. Ltd., Swancor Holding Co Ltd., AkzoNobel.

Global Vinyl Ester Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.31 billion

- 2026 Market Size: USD 1.38 billion

- Projected Market Size: USD 2.28 billion by 2035

- Growth Forecasts: 5.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: China, India, South Korea, Thailand, Brazil

Last updated on : 10 September, 2025

Vinyl Ester Market Growth Drivers and Challenges:

Growth Drivers

-

Rising Marine Industry – Approximately 80% of all products traded internationally are transported by sea, and this proportion is significantly larger for the majority of developing nations. Owing to the exceptional properties of vinyl ester including great adhesion, high chemical resistance, and superior anti-corrosion properties makes it the perfect choice for manufacturing marine equipment. Moreover, the rapid expansion of the marine industry across the globe is anticipated to boost market growth.

-

Growing Paint and Coating Consumption – Vinyl ester provides a chemical coating and solvent resistance. Thus, they are ideal for corrosion control containment application which is necessary for paints and coatings. Therefore, as a result of the high consumption of paint and coating, the utilization rate of the vinyl ester is also estimated to increase in the assessment period. It was found that nearly 860 million gallons of paint were consumed in the United States in total in 2020 and more than 350 million gallons of architectural paint were consumed in the United States by the DIY ('do it yourself') segment.

-

Increasing Paper Usage – Currently, Americans use more than 31 million tons of writing and printing paper annually, or nearly 661 pounds per person.

-

High Demand for Mining Equipment – In 2019, India imported mining equipment worth USD 189 million.

-

Growing Import-Export of Chemicals – It was noted that exports of chemicals from the EU outpaced imports by a sizeable margin from USD 242.03 billion in 2010 to USD 411.05 billion in 2020 and over this time, exports grew by 5% a year on average.

Challenges

-

High Cost of Vinyl Ester – Although vinyl ester has a wide range of applications in numerous industries, the high cost of the vinyl ester is anticipated to lower the adoption rate in the next years.

-

Easy Availability of Substitutes – With the recent developments, various alternative substitutes are now available in the market. Polyurethane composites are one such effective replacement for vinyl ester. Advantages such as superior tensile strength, greater impact resistance, and enhanced abrasion resistance as compared with vinyl ester. This trend is estimated to pose a challenge to market growth.

- Higher Toxicity Level

Vinyl Ester Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.7% |

|

Base Year Market Size (2025) |

USD 1.31 billion |

|

Forecast Year Market Size (2035) |

USD 2.28 billion |

|

Regional Scope |

|

Vinyl Ester Market Segmentation:

End-user Segment Analysis

The global vinyl ester market is segmented and analyzed for demand and supply by end-user into mining equipment, building & infrastructure, paints & coatings, transportation, and paper. Out of these, the building & infrastructure segment is expected to hold the highest market share by the end of 2035. The growth of the segment can be attributed to the growing application of vinyl ester on plywood and other furniture, supported by the increase in housing units and the refurbishment of old houses across the globe. For instance, in the USA, a projected 15.5% more housing units, or 1,595,101, were started in 2021 than in 2020 (1,379,601). Several beneficial properties of a vinyl ester such as anti-corrosive coating, high curing speed, and good mechanical strength make vinyl ester an ideal component used for the construction processes of buildings and infrastructures. Furthermore, the high flexibility of vinyl ester is being used for constructing strong parts which need to withstand impact with repeated flexing and without cracking or breaking. Thus, the demand for houses, buildings, commercial spaces, and other infrastructure by the burgeoning population is anticipated to fuel the revenue generation of the segment.

Application (Wind Power, Marine, Storage Tank, Chimney Liners, Oil & Gas, Scrubbers);

The global vinyl ester market is also segmented and analyzed for demand and supply by application into wind power, marine, storage tank, chimney liners, oil & gas, and scrubbers. Out of these, the strong tank segment is attributed to garnering the highest market share during the forecast period. As vinyl ester is being used in high-temperature formulations, it is very useful in chemical storage vessels and chemical reactors. Furthermore, it is being used in electro-refining tanks and as topcoats for metal containers. Vinyl ester is also being used in improving the strength of pipes and tanks with chemical resistance making them safe for use. In addition, massive investments made in developing strong esters, and rising government support in the research and development sector are also anticipated to fuel segment growth. Rising environmental awareness and stringent government rules are also projected to increase the usage of vinyl ester in the construction of storage tanks thus expanding the segment size during the analysis period.

Our in-depth analysis of the global market includes the following segments:

|

By Type |

|

|

By Application |

|

|

By End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Vinyl Ester Market Regional Analysis:

APAC Market Insights

The Asia Pacific vinyl ester market, amongst the market in all the other regions, is projected to hold the largest market share by the end of 2035. The growth can be ascribed to the rising demand for gas and oil along with its products and rapid development in the gas and oil industry in developing nations, mainly India, China, Japan, and Brazil. As various kinds of storage tanks and pipes are used in the oil and gas industry use signifies the high utilization rate of vinyl ester in the region. China's apparent gas consumption in 2022 was estimated to be between 375 and 380 billion cubic meters, up 1% to 3% annually. The demand for vinyl esters is also estimated to rise from numerous end-use industries present in the region including water and wastewater treatment, chemical, pharmaceutical, food processing, and transportation. In addition, the focus of the government to develop advanced materials for construction processes and other manufacturing activities is projected to create a positive outlook for market expansion in the region. Rising economies as well as gross domestic product (GDP) figures and awareness about the advantages offered by vinyl ester are anticipated to bolster the market for a significant revenue generation.

Vinyl Ester Market Players:

- INEOS Limited

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Interplastic Corporation

- Nivitex Fibreglass and Resins

- Poliya Composite Resins and Polymers Inc.

- Polynt S.p.A.

- Scott Bader Company Limited

- Showa Denko K. K.

- Sino Polymer Co. Ltd.

- Swancor Holding Co Ltd.

- AkzoNobel

Recent Developments

-

Polynt S.p.A. announced that to serve better in the North American coatings market, it planned to increase its coating resin production capacity. This growth would satisfy the expanding demand for the paint and coatings sector. The increase in production is expected to be completely operational by 2023.

-

Interplastic Corporation announced that it has selected Univar Solutions as a new distribution partner for its unsaturated polyester and vinyl ester resins, gel coats, colorants, and bonding compounds in Eastern Canada.

- Report ID: 4596

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Vinyl Ester Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.