Table of Contents

1. Research Methodology

2. Executive Summary

3. Strategic Recommendations

4. Global Cryptocurrency: Product Outlook

5. Global Cryptocurrency: Market Outlook

6. Global Cryptocurrency Market Dynamics

6.1 Global Cryptocurrency Market Drivers

6.1.1 Growing usage of Cryptocurrency in trading, remittance and payment

6.1.2 Fluctuations in Monetary Regulations

6.1.3 Rapidly growing technological innovations

6.1.4 Increasing number of online users across the globe

6.2 Global Market Restraints

6.2.1 Lack of awareness and technical understanding

6.2.2 Security threats with increasing cases of money laundering

6.3 Global Cryptocurrency Market Trends

6.3.1 Acceptance of cryptocurrencies across various industries

6.3.2 Growth in number of Ecommerce Companies Accepting Cryptocurrencies as Mode of Payment

6.3.3 Increasing tourism due to Idea of Traveling with One Global Currency

6.4 Global Cryptocurrency: Competitive Landscape

6.4.1 Global Cryptocurrency – By Market Share 2017

6.4.2 Global Cryptocurrency Market Share Overview 2017

6.4.3 Global Cryptocurrency – By Market Share 2018

6.4.4 Global Cryptocurrency Market Share Overview 2017

6.4.5 Porter’s Five Force Analysis

6.4.6 SWOT Analysis

7. Global Cryptocurrency Market: An Analysis

7.1 Global Cryptocurrency Market: By Value 2017-2024 (USD Billion)

8. Global Cryptocurrency Market – Segmental Analysis:

8.1 By Type (2018, 2024)

8.1.1 Global Cryptocurrency Market, By Bitcoin by Value: 2017-2024 (USD Billion)

8.1.2 Global Cryptocurrency Market, By Ethereum by Value: 2017-2024 (USD Billion)

8.1.3 Global Cryptocurrency Market, By Ripple by Value: 2017-2024 (USD Billion)

8.1.4 Global Cryptocurrency Market, By Litecoin by Value: 2017-2024 (USD Billion)

8.1.5 Global Cryptocurrency Market, By Others by Value: 2017-2024 (USD Billion)

8.1.6 Market Attractiveness Chart of Global Cryptocurrency Market – By Type

8.2 By Constituents (2018, 2024)

8.2.1 Global Cryptocurrency Market, By Exchange by Value: 2017-2024 (USD Billion)

8.2.3 Global Cryptocurrency Market, By Wallet by Value: 2017-2024 (USD Billion)

8.2.4 Global Cryptocurrency Market, By Payments by Value: 2017-2024 (USD Billion)

8.2.5 Global Cryptocurrency Market, By Mining by Value: 2017-2024 (USD Billion)

8.2.6 Market Attractiveness Chart of Global Cryptocurrency Market – By Constituents

9. Global Cryptocurrency Market: Regional Analysis

9.1 Global Cryptocurrency Market, By Regional Share, By Value – (2018, 2024)

9.2 Market Attractiveness Chart of Global Cryptocurrency Market – By Region

10. North America Cryptocurrency Market: An Analysis

10.1 North America Cryptocurrency Market, By Value 2017-2024

10.2 North America Cryptocurrency Market: Segmental Analysis

10.2.1 North America Cryptocurrency Market, By Type, By Value 2017-2024 (USD Billion)

10.2.2 North America Cryptocurrency Market, By Constituents, By Value 2017-2024 (USD Billion)

11. North America Cryptocurrency Market – Country Analysis

11.1 United States Cryptocurrency Market

11.1.1 United States Cryptocurrency Market, By Value 2017-2024

11.1.2 United States Cryptocurrency Market, By Type 2017-2024

12. Europe Cryptocurrency Market: An Analysis

12.1 Europe Cryptocurrency Market, By Value 2017-2024

12.1.1 Europe Cryptocurrency Market, By Type, By Value 2017-2024 (USD Billion)

12.1.2 Europe Cryptocurrency Market, By Constituents, By Value 2017-2024 (USD Billion)

13. Europe Cryptocurrency Market: Country Analysis

13.1 Germany Cryptocurrency Market

13.1.1 Germany Cryptocurrency Market, By Value 2017-2024

13.1.2 Germany Cryptocurrency Market, By Type 2017-2024

14. Asia-Pacific Cryptocurrency Market: An Analysis

14.1 Asia-Pacific Cryptocurrency Market, By Value 2017-2024

14.1.1 Asia-Pacific Cryptocurrency Market, By Type, By Value 2017-2024 (USD Billion)

14.1.2 Asia-Pacific Cryptocurrency Market, By Constituents, By Value 2017-2024 (USD Billion)

15. Asia-Pacific Cryptocurrency Market: Country Analysis

15.1 Japan Cryptocurrency Market

15.1.1 Japan Cryptocurrency Market, By Value 2017-2024

15.1.2 Japan Cryptocurrency Market, By Type 2017-2024

16. Rest of the World Cryptocurrency Market: An Analysis

16.1 Rest of the World Cryptocurrency Market, By Value 2017-2024

16.1.1 Rest of the World Cryptocurrency Market, By Type, By Value 2017-2024 (USD Billion)

16.1.2 Rest of the World Cryptocurrency Market, By Constituents, By Value 2017-2024 (USD Billion)

17. Company Profiles

17.1 Bitmain Technologies

17.2 Ripple Networks

17.3 Coinbase

17.4 BitGo

17.5 NVIDIA Corporation

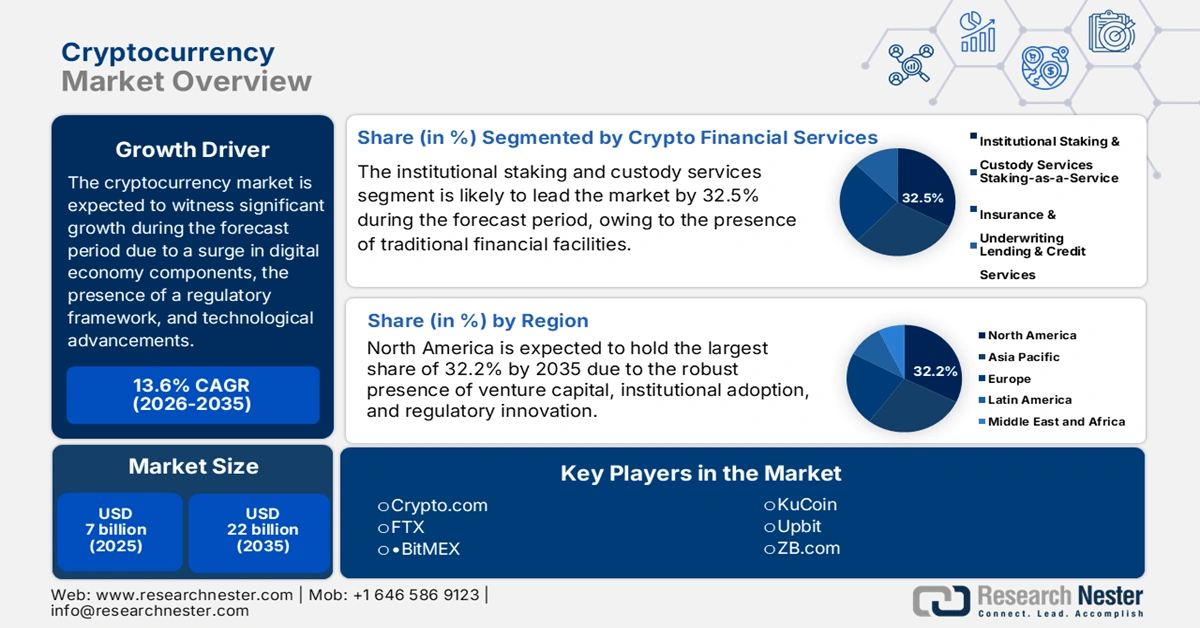

Cryptocurrency Market Outlook:

Cryptocurrency Market size was over USD 7 billion in 2025 and is estimated to reach USD 22 billion by the end of 2035, expanding at a CAGR of 13.6% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of cryptocurrency is evaluated at USD 7.9 billion.

The worldwide cryptocurrency market is currently in a phase constituting escalated maturation, shifting from a speculative and niche asset category into a foundational modern digitalized economy component. This transition has been characterized by an increase in institutional participation, the rise of a wide-ranging regulatory framework, and effective technological innovations that have enhanced utility and scalability. According to the 2024 data report published by the UNCTAD Organization, there has been a surge in internet users from 1 billion in 2005 to 5.4 billion as of 2023. In addition, smartphone shipments have doubled between 2010 and 2023, increasing from 500 million to almost 1.2 billion. Therefore, this digital economy has created a huge growth opportunity for the overall market globally.

Furthermore, as per an article published by the CFR Organization in January 2024, since the bitcoin creation, cryptocurrencies have been continuously exploding in popularity, and are presently worth over USD 1 trillion. In addition, 130 nations, including the U.S., are considering unveiling their respective central bank digital currencies to significantly compete with the cryptocurrency boom. Approximately 17% of adults in the U.S. traded, utilized, and invested in cryptocurrency in mid-2023. Meanwhile, El Salvador achieved success by emerging as the first-ever nation to make bitcoin legal tender, despite less than 15% of the population utilizing it as of 2023. Furthermore, an evolution in centralized exchanges, blockchain and artificial intelligence (AI) convergence, a rise in decentralized physical infrastructure, increased focus on account abstraction and user experience, and non-fungible token maturation are also driving the market internationally.

Historical Increase in Cryptocurrencies Globally

|

Years |

Market Value |

|

2014 |

USD 5.5 billion |

|

2015 |

USD 7.2 billion |

|

2016 |

USD 15.9 billion |

|

2017 |

USD 333.8 billion |

|

2018 |

USD 109.9 billion |

|

2019 |

USD 189.1 billion |

|

2020 |

USD 591.6 billion |

|

2021 |

USD 2.5 trillion |

|

2022 |

USD 889.3 billion |

|

2023 |

USD 1.5 trillion |

|

2024 |

USD 1.8 trillion |

Source: CFR Organization

Key Cryptocurrency Market Insights Summary:

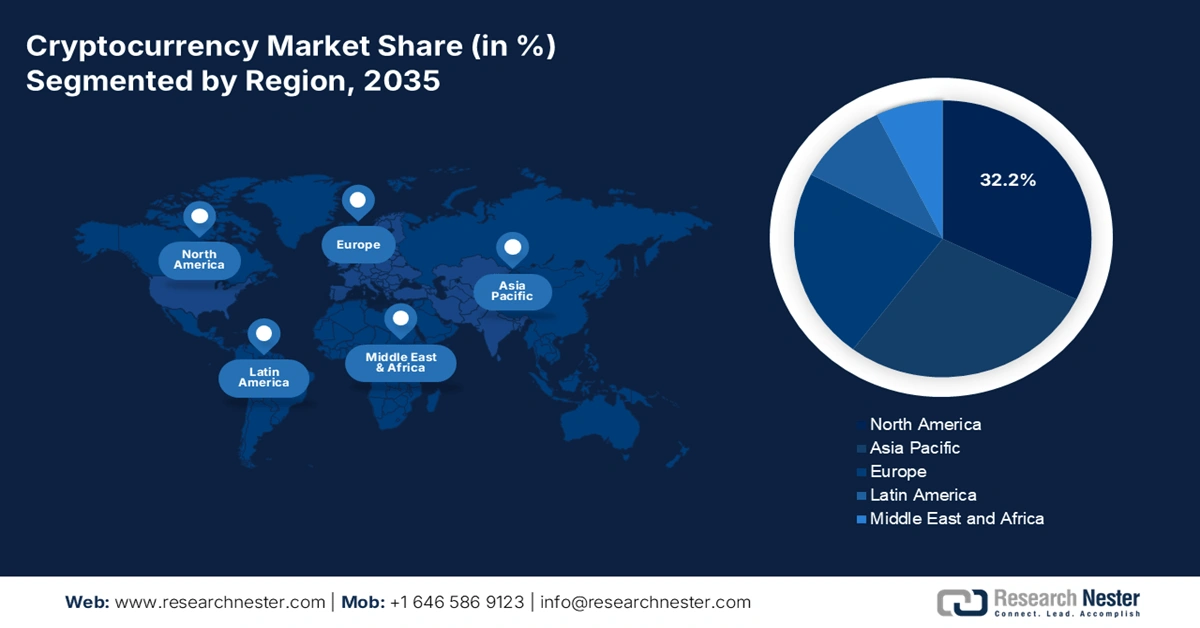

Regional Highlights:

- North America is anticipated to command a 32.2% share by 2035 in the cryptocurrency market, supported by sophisticated institutional adoption, expanding venture capital inflows, and progressive regulatory clarity.

- Europe is expected to emerge as the fastest-growing region by 2035, strengthened by its comprehensive crypto-assets regulatory framework that enhances legal certainty and attracts institutional capital.

Segment Insights:

- The institutional staking and custody services segment is projected to secure a 32.5% share by 2035 in the cryptocurrency market, bolstered by the growing allocation of capital from conventional finance entities seeking regulated, yield-generating, and secure digital-asset infrastructure.

- The layer-1 consensus and smart contract platforms segment is anticipated to hold the second-largest share by 2035, sustained by its essential role as the settlement layer for on-chain activity and the strengthening network effects that elevate developer participation and transaction volumes.

Key Growth Trends:

- Financialization and institutional adoption

- Interoperability and technological scalability

Major Challenges:

- Regulatory fragmentation and uncertainty

- Systematic risks and security vulnerabilities

Key Players: Coinbase (U.S.), Binance (Global / Seychelles), Kraken (U.S.), Bitfinex (Hong Kong), Coincheck (Japan), Korbit (South Korea), WazirX (India), Luno (U.K.), Bitstamp (Luxembourg), Gemini (U.S.), Crypto.com (Singapore), FTX (Bahamas), BitMEX (Seychelles), Bybit (British Virgin Islands), KuCoin (Seychelles), Upbit (South Korea), ZB.com (China), OKX (Seychelles), Huobi Global (Seychelles), eToro (Israel)

Global Cryptocurrency Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7 billion

- 2026 Market Size: USD 7.9 billion

- Projected Market Size: USD 22 billion by 2035

- Growth Forecasts: 13.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region:North America (32.2% share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, Germany, China, Japan, South Korea

- Emerging Countries: India, Singapore, Thailand, Australia, Mexico

Last updated on : 17 November, 2025

Cryptocurrency Market - Growth Drivers and Challenges

Growth Drivers

- Financialization and institutional adoption: The entry of large-scale corporations and banks, along with major asset managers, is effectively offering unprecedented liquidity and legitimacy, which is positively impacting the cryptocurrency market globally. According to an article published by the GFMA Organization in August 2025, distributed ledger technology possesses the ability to reshape fixed incomes through UBS’s CHF 375 million on the six digital exchange (SDX). Besides, the Asia-based Infrastructure Investment Bank’s (AIIB) USD 500 million digital bond is considered yet another milestone, which has been combined with DLT-specific settlement with conventional infrastructure integration. Meanwhile, fund management has also contributed to ensuring substantial progress through tokenization, which is also propelling the market’s growth.

- Interoperability and technological scalability: The presence of solutions, such as cutting-edge Layer 1 blockchains and Layer 2 rollups, is responsible for solving severe risks pertaining to low throughput and increased transaction fees. This has significantly enabled more user-friendly and complicated applications, particularly from decentralized finance to gaming, and operate efficiently, thereby enhancing the market internationally. As per an article published by Sustainable Futures in December 2024, the worldwide decentralized finance sector was valued at an estimated USD 22 billion as of 2022. This was predicted to increase to USD 23.9 billion as of 2023, with a further upsurge in the market size, amounting to USD 48 billion by the end of 2031, which can reflect a 9% growth rate within the duration, thus making it suitable for the market’s upliftment.

- Tokenization of real-world assets: There has been a continuous growth in the movement to display conventional financial assets, such as commodities, real estate, and treasury bonds, as standard tokens on a blockchain. This successfully unlocks the newest levels of operational efficiency, fractional ownership, and liquidity for previously inaccessible assets and previously illiquid assets, uplifting the cryptocurrency market. As stated in the February 2025 IFSCA Government report, automated processes and smart contracts in various areas can readily propel approximated yearly international infrastructure operational expenses savings, ranging between USD 15 billion and USD 20 billion. In addition, by utilizing distributed ledger technology, particularly for collateral management, financial institutions can free up suitable capital, which is estimated at over USD 100 billion every year, thereby boosting the market’s exposure.

Challenges

- Regulatory fragmentation and uncertainty: The most formidable challenge in the cryptocurrency market is the absence of a global and consistent regulatory framework. Jurisdictions are integrating massively different strategies, from the wide-ranging and proactive MiCA administration, particularly in Europe, to the stringent enforcement-based stance of the U.S. SEC, as well as the outright ban in China. This fragmentation has created a complicated and expensive compliance landscape for global organizations, developing regulatory arbitrage and stifling advancement. For instance, the continuous debate in the U.S. regarding whether a digital asset is a commodity or a security creates effectively legalized risk for exchanges and projects, resulting in business uncertainty.

- Systematic risks and security vulnerabilities: Despite technological innovation, the market continues to remain a prime target for sophisticated cyberattacks, leading in huge losses per year. These vulnerabilities are considered multifaceted, which comprises vulnerabilities in cross-chain bridges, exchange hacks, and smart contract exploits. Besides, the persistent hot wallet in comparison to the cold storage dilemma has created intense tension between asset safety and user convenience. Moreover, the interconnected nature of the cryptocurrency market means that the exploitation or failure of a major protocol, exchange, or lending platform can lead to a cascading contagion effect, thus causing a hindrance in the market’s expansion.

Cryptocurrency Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

13.6% |

|

Base Year Market Size (2025) |

USD 7 billion |

|

Forecast Year Market Size (2035) |

USD 22 billion |

|

Regional Scope |

|

Cryptocurrency Market Segmentation:

Crypto Financial Services Segment Analysis

Based on crypto financial services, the institutional staking and custody services segment in the cryptocurrency market is anticipated to garner the largest share of 32.5% by the end of 2035. The segment’s upliftment is highly attributed to the aspect of conventional finance entities, which include corporations, asset managers, and hedge funds, successfully allocating capital to cryptocurrencies. In addition, their primary demand is yield-generating, regulated, and secured infrastructure, which significantly uplifts the overall segment in the market. Besides, institutional-grade custody services offer the foundational trust layer, providing cold-storage and insured solutions for large-scale portfolios that are readily compliant with evolutionary administrative standards from bodies, such as the SEC, which has successfully emphasized strict asset safeguarding.

Blockchain Infrastructure Segment Analysis

Based on the blockchain infrastructure, the layer-1 consensus and smart contract platforms segment in the market is expected to account for the second-largest share during the predicted period. The segment’s upliftment is highly driven by its crucial function and role as the ultimate settlement layer for the overall on-chain activity. Layer-1 platforms, such as Avalanche, Solana, and Ethereum, readily generate revenues usually through transaction fees and at times through native tokens monetization. Meanwhile, the segment’s value is directly correlated with network effects, which caters to the component of more developers building decentralized applications for NFTs, DeFi, and gaming on a platform. As a result, there will be an increase in users, thereby developing a virtuous cycle that significantly enhances fee revenue and transaction volume.

Decentralized Applications Segment Analysis

Based on decentralized applications, the decentralized finance (DeFi) protocols segment in the market is projected to cater to the third-largest share by the end of the forecast duration. The segment’s development is highly fueled by its creation of a transparent, accessible, and open financial system by overcoming intermediaries, such as speeding up transactions, reducing expenses, and banks. According to an article published by NLM in August 2022, there has been an increase in DeFi users from 3,000 to more than 210,000. This readily denotes a 6,900% surge in the overall users of these protocols, which creates an optimistic outlook for the overall segment in the market. In addition, the total DeFi valuation also rose from USD 119 million to over USD 83 billion, displaying more than 60,000%, thus deliberately uplifting the segment internationally.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Crypto Financial Services |

|

|

Blockchain Infrastructure |

|

|

Decentralized Applications |

|

|

Digital Assets |

|

|

Trading & Exchange Platforms |

|

|

Mining & Validation |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cryptocurrency Market - Regional Analysis

North America Market Insights

North America in the cryptocurrency market is anticipated to garner the highest share of 32.2% by the end of 2035. The market’s upliftment in the region is highly attributed to an increase in sophisticated institutional adoption, strong venture capital investment, and clear regulatory advancements. According to an article published by the FDIC Government in February 2024, there has been an increase in retail crypto wealth for regional households, with an estimated increase of USD 30 billion in consumption. In addition, the overall U.S. effect readily peaked at between USD 70 to and USD 100 billion, which is creating an optimistic outlook for the market in the overall region. Besides, the rapid growth in Bitcoin, significant investment in blockchain infrastructure by large-scale technological firms, and the institutional tokenization of real-world assets (RWAs) are also fueling the market’s growth in the region.

The cryptocurrency market in the U.S. is growing significantly, owing to the existence of the IRS and the Treasury Department proactively refining tax guidance for digitalized assets, which has emphasized compliance and reporting. In addition, the Financial Innovation and Technology for the 21st Century Act has successfully aimed to establish standard jurisdictional lines between the SEC and CFTC, which is pushing for clear legislative frameworks. As per a data report published by the White House Government in 2025, the approval rate among investors is 72% for cryptocurrencies, and 1 in 5 people, which is more than 68 million people, own cryptocurrencies. Besides, during the first quarter of 2025, venture capitalists deployed USD 4.8 billion into blockchain and crypto-based startups, which readily supported industrial forecasts of a 70% year-over-year (YoY) boost in overall venture dollars investment. Meanwhile, an increase in digital assets is also shaping the overall market in the country.

Digital Assets Size in Relation to Other Asset Categories in the U.S.

|

Asset Type |

2015 (USD) |

2019 (USD) |

2024 (USD) |

|

Overall Crypto Market Cap |

7.0 |

197.0 |

2,385.0 |

|

Bitcoin Market Cap |

6.4 |

134.0 |

1,364.0 |

|

Other Coin Market Cap |

0.6 |

57.0 |

855.0 |

|

Stablecoins Market Cap |

0.0 |

5.0 |

166.0 |

|

Overall U.S. Equity Market Cap |

23,364.0 |

33,935.0 |

59,787.0 |

|

Overall Marketable Tsy Debt |

13,207.0 |

16,682.0 |

27,728.0 |

|

Treasury Bills |

1,514.0 |

2,417.0 |

6,005.0 |

|

Overall Real Estate Market Cap |

25,990.0 |

33,479.0 |

52,319.0 |

|

Money Market Funds AUM |

2,759.0 |

3,604.0 |

6,468.0 |

|

Commercial Bank Deposits |

10,991.0 |

13,291.0 |

17,732.0 |

|

Currency in Circulation |

1,426.0 |

1,802.0 |

2,359.0 |

Source: U.S. Department of the Treasury

The cryptocurrency market in Canada is also growing due to the presence of its collaborative and proactive approach, the establishment of an early precedent for regulated crypto investment vehicles, as well as the aspect of wholesale Central Bank Digital Currency (CBDC) research. Besides, as stated in the July 2025 IVEY article, the country’s digitalized asset economy is predicted to reach USD 913 million by the end of 2025. This is further expected to boost the market’s adoption across different industries, such as logistics, energy, and finance, in the nation. Meanwhile, as per an article published by the Bank of Canada in July 2023, 24% of the population in the country owned bitcoin, which eventually decreased to 19% as of 2022. Simultaneously, the population percentage pertaining to not owning bitcoin remained stable at 4%. Based on this, 61% constitute low crypto literacy, and only 6% are a part of the high-literacy crypto category, which denotes a growth opportunity for the market.

Europe Market Insights

Europe in the market is projected to emerge as the fastest-growing region during the predicted period. The market’s development in the region is highly fueled by the increased presence of the pioneering fields in crypto-assets regulation. This is considered a wide-ranging administrative framework, which has been significantly established by the Europe Securities and Markets Authority (ESMA). This offers the aspect of legalized certainty required for fostering advancement while ensuring customer protection, thereby making the region an increasingly attractive economy for institutional investment. According to an article published by the International Monetary Fund in July 2024, the overall region’s venture capital investments usually account for 0.4% of the gross domestic product (GDP) within three years. Besides, as per the October 2022 NLM article, the region comprised 92 unicorns, with a €253.3 billion valuation. In addition, government-owned venture capital initiatives accounted for 12.5% of the regional deals, while government-sponsored funds cater to an additional 29.7%.

The cryptocurrency market in the UK is gaining increased traction, owing to its status as the ultimate international fintech center, and the generous support received from the country’s government for the digital asset sector, which also comprises fund allocation from His Majesty's Treasury for resources to significantly establish a wide-ranging regulatory regime for crypto assets. According to a data report published by the FCA Organization in November 2024, 12% of adults in the country own crypto, which denotes a 10% increase from previous years. In addition, there has been a rise in crypto awareness from 91% to 93%, with the average valuation upheld by the population increased from £1,595 to £1,842. Based on this, it has been identified that friends and family in the country are the most common source of information for those never purchased crypto. Besides, almost 1 in 10 people in the country did not conduct any research before purchasing crypto, which denotes a huge growth opportunity for the market.

The cryptocurrency market in Germany is also growing due to the existence of strict regulatory compliance and an increase in institutional integration, comprehensive implementation of the Crypto Asset Tax Clarification Act for providing suitable guidelines for taxing digitalized assets that offer confidence to both corporations and investors. According to the November 2025 GTAI data report, the digital assets valuation in the country amounts to EUR 1.7 billion as of 2025, along with EUR 327 million for venture funding as of 2023. In addition, 4% of the venture capital funding and 5.5% of deals in the country go to blockchain startups as of 2023. Further, a 3% increase in funding in the same year demonstrated resilience during the international decline in investment. Meanwhile, 27% of domestic organizations are utilizing blockchain technology as of 2024, which constitutes a 6% surge since 2023.

APAC Market Insights

Asia Pacific in the market is projected to grow steadily by the end of the forecast duration. The market’s growth in the region is highly fueled by the presence of tech-savvy and massive youth population, an increase in mobile penetration, and a surge in the digitalized payment integration. As per an article published by the EIRA Organization in January 2025, there has been a significant growth in digital payments, readily accounting for more than 50% of transactions, and it is further projected to reach USD 416.6 billion by the end of 2028. This upsurge effectively supports financial inclusion, boosts small and medium-sized and micro enterprises, and enhances e-commerce. Besides, as stated in the June 2022 World Bank Organization article, 89% of adults in China have a financial account, and 82% utilize it to initiate digital merchant payments, which positively impacts the overall market in the region.

The cryptocurrency market in India is gaining increased exposure, owing to the government’s engagement with the intensified digital asset ecosystem, along with the Ministry of Finance clarifying tax policies for virtual digital assets. According to a data report published by Invest India in April 2024, the country incurred a substantial expense of ₹4,984 crore between April 2021 and March 2022, particularly for currency printing, which can be diminished by incorporating digital currency. Besides, the fintech industry in the country is expected to reach USD 6.2 trillion by the end of 2025. This growth comprises areas, including digitalized payments, peer-to-peer lending, blockchain technology, big data, ledger technology distribution, crowdfunding, and digital lending. In this regard, the October 2025 PIB Government article stated that the National Blockchain Framework was introduced in September 2024, accounting for a ₹64.7 crore budget.

The market in China is also growing due to its government's focus on spending on the underlying blockchain technology, which has readily focused on state-based projects. In addition, the rollout and development of the Digital Currency Electronic Payment (DCEP) system is equally responsible for fueling the market in the overall country. As per an article published by the ORF Organization in July 2025, the People’s Bank of China’s Digital Currency Research Institute reported that an estimated 180 million individual digital renminbi (RMB) have been activated, which amounts to almost 1 in every 8 citizens in the country. Moreover, cumulative transactions effectively reached RMB 7 trillion (USD 988 billion). Therefore, these not only boost liquidity but also risk entrenching its status in international reserves, potentially reducing continuous diversification efforts.

Key Cryptocurrency Market Players:

- Coinbase (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Binance (Global / Seychelles)

- Kraken (U.S.)

- Bitfinex (Hong Kong)

- Coincheck (Japan)

- Korbit (South Korea)

- WazirX (India)

- Luno (U.K.)

- Bitstamp (Luxembourg)

- Gemini (U.S.)

- Crypto.com (Singapore)

- FTX (Bahamas)

- BitMEX (Seychelles)

- Bybit (British Virgin Islands)

- KuCoin (Seychelles)

- Upbit (South Korea)

- ZB.com (China)

- OKX (Seychelles)

- Huobi Global (Seychelles)

- eToro (Israel)

- Coinbase has been successfully instrumental in ensuring legitimacy and institutional capital to the market through its stringent compliance-based approach, along with its role as a custody for different spot Bitcoin ETFs. The company’s user-friendly platform serves as an essential gateway for retail investors in the U.S. to effectively enter the digitalized asset space securely. Besides, as per its 2024 annual report, the company generated USD 7.4 billion in total net revenue, catering to the organization’s development.

- Binance has dramatically extended the international accessibility to cryptocurrency trading by providing an immense section of digital assets and pioneering low-fee and high-volume spot, along with derivatives trading. However, its effective contribution to the market liquidity as well as retail integration has been tempered by continuous regulatory risks across different jurisdictions.

- Kraken has successfully established itself as the ultimate cornerstone of the U.S.-based crypto ecosystem, well-known for its strong security track record as well as commitment to ensuring regulatory transparency. This exchange has deliberately contributed to market sophistication by providing innovative trading features. Meanwhile, as per its 2024 annual report, the company’s revenue amounted to USD 1.5 billion, with USD 424 million as adjusted EBITDA, USD 42.8 billion as assets on the platform, and USD 2.5 million as funded accounts.

- Bitfinex has historically catered to high-frequency and professional traders, readily contributing to the overall market’s depth by offering progressive order types, along with liquidity for large-scale trades. Besides, the firm is also suitable for in-depth involvement with Tether, which is considered the stablecoin that has emerged as the fundamental source of trading and liquidity pairs across the entire international crypto market.

- Coincheck significantly played a crucial role in popularizing cryptocurrency trading in Japan, thereby emerging as one of the nation’s highest exchanges by focusing on a simple user interface and a comprehensive altcoins array. Despite a major hack, the company’s subsequent acquisition and recovery by Monex Group has displayed resilience and contributed to the country’s maturation.

Here is a list of key players operating in the global market:

The international cryptocurrency market is intensely fragmented and competitive, and readily characterized by a tactical battle for regulatory and institutional legitimacy. Notable players, such as Kraken and Coinbase, are strongly pursuing compliance-based strategies, gaining licenses and introducing regulated products, such as Bitcoin ETFs, to attract institutional capital. Besides, offshore giants, including Binance, are focusing on a vast array of altcoins and high-volume retail trading, despite increasingly pivoting towards compliance to achieve market accessibility. Meanwhile, in December 2024, Fireblocks expanded its DeFi suite as he ultimate institutional adoption for digitalized assets. This has readily uplifted transactions in the same year, amounting to USD 60 billion, which has created a positive impact on the market globally.

Corporate Landscape of the Cryptocurrency Market:

Recent Developments

- In January 2025, Core Scientific, Inc., which is a leader in the digital facility for high-performance computing as well as bitcoin mining, introduced unaudited operations and production.

- In December 2024, Tether has effectively invested in StablR, which is a Europe-based stablecoin provider, to ensure acceleration in the regional adoption. The company’s generous investment provided suitable support for completely integrating and leading stablecoins.

- Report ID: 2011

- Published Date: Nov 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Cryptocurrency Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.