In Vitro Diagnostics Market Outlook:

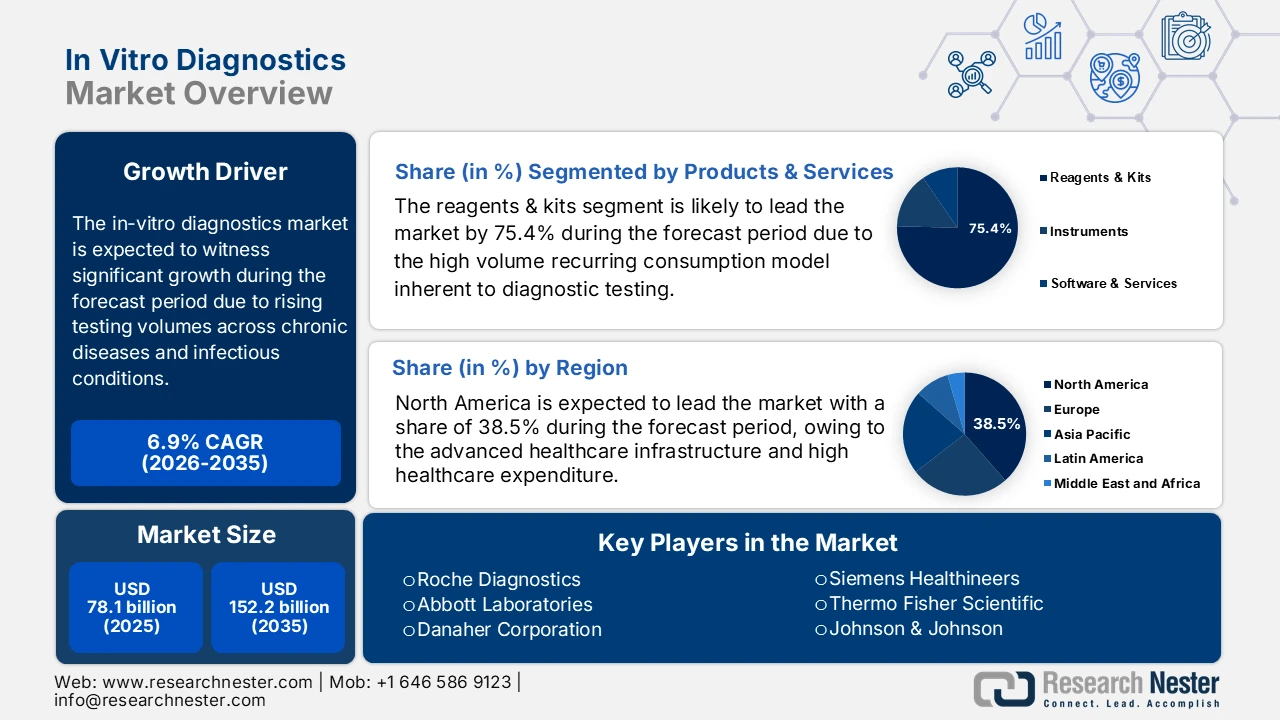

In Vitro Diagnostics Market size was valued at USD 78.1 billion in 2025 and is projected to reach USD 152.2 billion by the end of 2035, rising at a CAGR of 6.9% during the forecast period, i.e., 2026-2035. In 2026, the industry size of in vitro diagnostics is assessed at USD 83.4 billion.

The market growth trajectory is shaped by the rising testing volumes across chronic and infectious disease preventive screening programs, driven largely by demographic and public health pressures rather than discretionary demand. According to the NIH study in November 2023, 6 in 10 people in the U.S. live with at least one chronic disease, and 4 in 10 experience multiple chronic diseases, creating a demand for routine and longitudinal diagnostic testing across care settings. The American Diabetes Association report in November 2023 depicts that diabetes alone affects more than 38 million people in the U.S., reinforcing the high utilization of laboratory assays for monitoring and risk stratification. Infectious disease surveillance remains another structural demand driver. The World Health Organization report in November 2025 recorded over 10.7 million tuberculosis cases globally and continued monitoring needs for HIV, hepatitis B, and C, and emerging pathogens.

U.S. Chronic Disease Prevalence and Impact

|

Statistic |

Value |

Details/Source Reference |

|

People with at least 1 major chronic disease |

129 million |

Includes heart disease, cancer, diabetes, obesity, hypertension; defined by HHS. |

|

Leading causes of death linked to chronic diseases |

5 of top 10 |

Preventable and treatable chronic diseases. |

|

Prevalence trend |

Steady increase |

Over past 2 decades; expected to continue. |

|

Multiple chronic conditions |

42% have 2+; 12% have 5+ |

Increasing proportion affected. |

|

Health care expenditure attribution |

90% of USD 4.1 trillion annually |

Managing/treating chronic diseases and mental health conditions |

Source: CDC February 2024

The government-backed screening initiatives, such as the population-level cancer screening programs in Europe and the U.S., further boost the baseline test volumes, while aging populations expand utilization intensity in hospital and reference laboratory networks. These factors collectively support a stable, high-throughput diagnostic testing environment with the predictable procurement cycles for reagents, instruments, and consumables. From a policy and funding perspective, public healthcare expenditure and regulatory oversight play a decisive role in shaping the market. The American Hospital Association report in December 2024 states that the national health expenditure reached USD 4.9 trillion in 2023, with laboratory services representing a consistent non-deferrable component of diagnostic care pathways. Reimbursement frameworks such as the Clinical Laboratory Fee Schedule directly influence the test mix and adoption rates, mainly for high-volume assays.

Key In-vitro Diagnostics Market Insights Summary:

Regional Highlights:

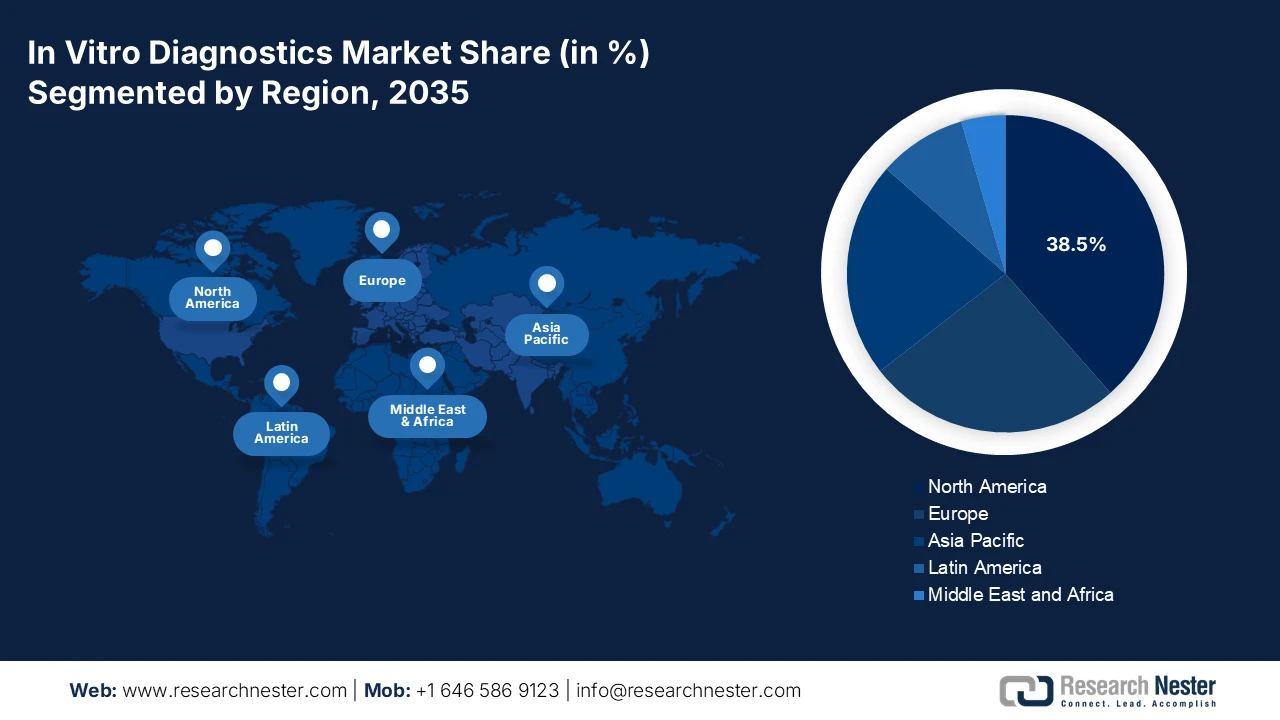

- North America in the in-vitro diagnostics market is anticipated to secure a 38.5% revenue share by 2035, underpinned by advanced healthcare infrastructure, strong precision medicine uptake, and AI-enabled diagnostic platforms supported through favorable FDA and CMS frameworks.

- Asia Pacific is projected to emerge as the fastest-growing region with a CAGR of 6.8% during 2026–2035, stimulated by large-scale public healthcare investments, rising chronic disease prevalence, and rapid adoption of point-of-care and molecular diagnostics.

Segment Insights:

- The reagents & kits sub-segment in the in-vitro diagnostics market is expected to capture a 75.4% share by 2035, sustained by its recurring consumption model, expanding biomarker-based test menus, and large-scale public health surveillance procurement.

- Hospitals & Clinics are forecast to account for the largest end-user share by 2035, reinforced by their concentration of complex diagnostic workloads and accelerated deployment of automated, high-throughput laboratory systems.

Key Growth Trends:

- Rising burden of chronic diseases driving longitudinal testing

- Diagnostics as a pillar of universal health coverage

Major Challenges:

- Reimbursement complexity and pricing pressure

- Rapid technological obsolescence

Key Players:Roche Diagnostics, Abbott Laboratories, Danaher Corporation, Siemens Healthineers, Thermo Fisher Scientific, Johnson & Johnson, Sysmex Corporation, Becton, Dickinson and Company, bioMérieux, Quest Diagnostics, Grifols, Bio-Rad Laboratories, Qiagen, Mindray, Hologic, Diasorin, Shenzhen Mindray Bio-Medical Electronics, Sekisui Medical, Ortho Clinical Diagnostics, Werfen.

Global In-vitro Diagnostics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 78.1 billion

- 2026 Market Size: USD 83.4 billion

- Projected Market Size: USD 152.2 billion by 2035

- Growth Forecasts: 6.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: India, South Korea, Singapore, Brazil, Australia

Last updated on : 30 January, 2026

In Vitro Diagnostics Market - Growth Drivers and Challenges

Growth Drivers

- Rising burden of chronic diseases driving longitudinal testing: Chronic disease prevalence continues to expand the baseline demand for routine and repeat diagnostic testing, propelling the in vitro diagnostics market. The U.S. CDC report states that many people in the U.S. live with chronic conditions necessitating continuous laboratory monitoring. Furthermore, diabetes is also the condition generating a sustained demand for biochemical and immunoassay-based testing. Similar trends are seen worldwide, with the World Health Organization's (WHO) September 2025 report pointing out that non-communicable diseases account for 74% of global deaths. The high volume of disease cases is driving increased demand for testing and favoring scalable reagent supply models along with long-term service agreements with centralized laboratories.

- Diagnostics as a pillar of universal health coverage: Diagnostics are the key driver directly influencing the market access quality and the effect of care delivery. The WHO report in March 2025 estimates that nearly 70% of the clinical decisions depend on the diagnostic test results, underscoring the central role of laboratory services in effective treatment pathways. However, the governments and multilateral agencies are expanding the national Essential Diagnostics Lists and allocating public funding toward laboratory capacity building, workforce training, and supply chain strengthening. These policy-driven investments are embedding diagnostics into publicly funded primary and secondary care systems. From a market perspective, this shift supports sustained volume-led demand growth in emerging economies, mainly in government procurement and donor-backed health programs rather than discretionary private spending.

- Government funding for precision medicine initiatives: National investments in precision or personalized medicine are catalyzing demand for companion diagnostics and advanced genomic tests. These initiatives fund the research, development, and integration of tests that guide targeted therapies. The U.S. All of Us Research Program, funded by the NIH, aims to collect genetic and health data from a million people, inherently promoting the use of genomic sequencing and related diagnostics. Similarly, Genomics England and national genomic medicine initiatives in countries such as Australia mandate the use of specific NGS-based diagnostics, creating guaranteed markets for approved assays linked to funded treatment pathways.

Challenges

- Reimbursement complexity and pricing pressure: Securing favorable reimbursement codes and payment rates from the insurers is critical in the market. The governments actively constrain pricing to manage healthcare budgets. The detection kits that are launched by the top players face a multi-year reimbursement challenge with Medicare impacting commercial adoption despite breakthrough status. Though there is a growth in the market, the government pricing constraints in major markets such as Japan and the EU compress the manufacturers' margins.

- Rapid technological obsolescence: The fast pace of innovation risks rendering new products obsolete quickly. Companies must continuously invest in next-gen platforms. For example, companies focusing solely on the traditional PCR system face displacement by firms with their droplet digital PCR technology, which offers superior precision for niche applications such as liquid biopsy, as detailed in their annual R&D investment reports.

In Vitro Diagnostics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.9% |

|

Base Year Market Size (2025) |

USD 78.1 billion |

|

Forecast Year Market Size (2035) |

USD 152.2 billion |

|

Regional Scope |

|

In Vitro Diagnostics Market Segmentation:

Product & Service Segment Analysis

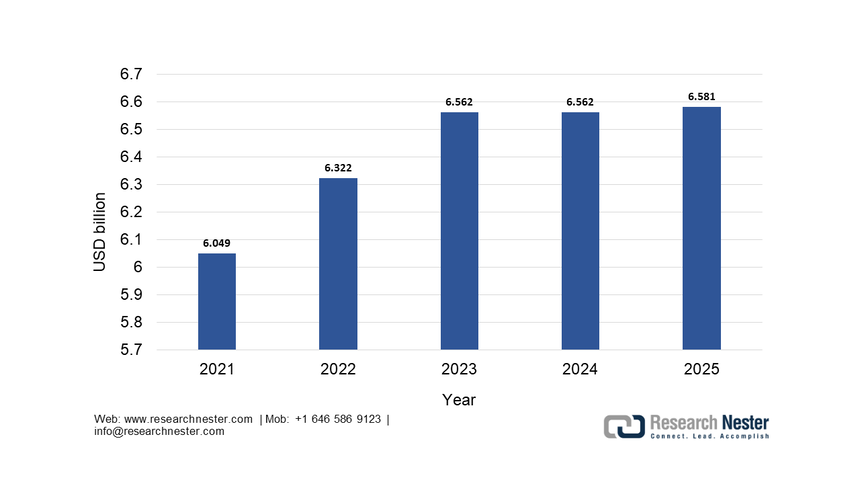

The reagents & kits sub-segment dominates and is expected to hold the share value of 75.4% by the end of 2035. This dominance is due to the high-volume recurring consumption model inherent to diagnostic testing, where instruments are often placed with long-term service contracts to guarantee reagent purchases. The continuous expansion of test menus is driven by the new biomarkers for oncology, neurology, and infectious diseases, which directly fuel the reagent sales. A key statistical driver is the public health investment in infectious disease monitoring. According to the National Institute of Allergy and Infectious Disease 2025 data, the funding for allergy and infectious disease research reached USD 6.581 billion in 2025, primarily allocated for test kits and reagents to sustain the national surveillance and response capabilities. This model of bulk reagents is to sustain national surveillance and response capabilities. This model of bulk procurement for public health underscores the segment’s stability and growth, which is further stimulated by the automation of high-throughput laboratory platforms.

NIAID Research Funding History, through 2025

Source: NIAID 2025

End user Segment Analysis

Hospitals & Clinics remain as the leading end user projected to hold the largest share value in the in vitro diagnostics market. This centrality is due to their role as the primary hubs for acute emergency and high complexity testing that cannot be decentralized. This segment’s growth is powered by the adoption of integrated automated laboratory systems designed to handle vast test volumes efficiently alongside the expansion of specialized testing within hospital-based oncology and cardiology centers. A critical statistical reinforcement comes from U.S. government healthcare expenditure data. According to the Centers for Medicare & Medicaid Services, national healthcare spending in hospital care services grew to USD 4.5 trillion in 2022 and is projected to continue its upward trend. This massive financial flow into hospitals directly supports infrastructure investments in advanced diagnostic equipment and the consumables required for patient care, cementing this segment’s market leadership.

Test Location Segment Analysis

The point of care testing sub-segment is dominating the location segment in the in vitro diagnostics market. Its expansion is driven by the powerful trends of healthcare decentralization, patient self-management, and the demand for immediate clinical decisions. Leading drivers include the integration of continuous glucose monitoring for diabetes management into standard care pathways and the commercialization of advanced CLIA-waived molecular devices for rapid infectious disease diagnostics in clinics. A definitive statistical indicator of this growth is documented in U.S. public health reporting. This trajectory is fundamentally reshaping the diagnostic landscape, moving critical testing from the core lab directly to the patient’s side. As technology advances, PoC testing is becoming more accurate, affordable, and accessible, ensuring its role as the cornerstone of modern responsive healthcare delivery.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Product & Service |

|

|

Technology |

|

|

Application |

|

|

Test Location |

|

|

End user |

|

|

Specimen |

|

|

Usability |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

In Vitro Diagnostics Market - Regional Analysis

North America Market Insights

The North America in vitro diagnostics market is dominating and is expected to hold the revenue share of 38.5% during the assessment timeline. The market is driven by the advanced healthcare infrastructure and high healthcare expenditure. The key drivers include the strong adoption of precision medicine, escalating demand for point-of-care and home-based testing, and a robust pipeline of oncology and genomic tests. Regulatory frameworks from the FDA and CMS reimbursement policies shape the landscape, promoting innovation while managing costs. A dominant trend is the integration of AI and big data analytics into diagnostic platforms to enhance accuracy and workflow efficiency. The market also faces consolidation with major players acquiring innovative standardizing care and expanding diagnostic capacity, mainly in response to surgical backlogs highlighted by the pandemic, fostering demand for high-efficiency laboratory automation.

The U.S. in vitro diagnostics market is characterized by high innovation and stringent value demonstration driven by the world’s largest healthcare budget. A primary trend is the shift toward decentralized testing, fueled by the CMS reimbursement for home-use devices such as continuous glucose monitors, aiming to reduce hospitalization in chronic disease management. The Centers for Disease Control and Prevention emphasizes the role of rapid molecular diagnostics and genomic sequencing in public health surveillance for antimicrobial resistance and outbreak response, directing federal procurement. The U.S. FDA has approved several in-vitro diagnostic devices, such as the AAV5 DetectCDx by ARUP Laboratories, underscoring a regulatory pathway that prioritizes the novel biomarkers for targeted therapies.

FDA Approved Companion Diagnostic Devices (In-vitro and Imaging Tools)

|

Diagnostic Name |

Indication - Sample Type |

Drug Trade Name |

Biomarker |

Biomarker (Details) |

Approval Date |

|

AAV5 DetectCDx (ARUP Laboratories) |

Hemophilia A Patients - Plasma |

ROCTAVIAN |

Anti-AAV5 Antibodies |

Antibodies to the adeno-associated virus serotype 5 (AAV5) viral vector |

06/29/2023 |

|

Abbott RealTime IDH1 (Abbott Molecular, Inc.) |

Myelodysplastic Syndromes (MDS) - Peripheral Blood or Bone Marrow |

Tibsovo |

IDH1 |

R132 mutations (R132C, R132H, R132G, R132S, and R132L) |

10/24/2023 |

|

Abbott RealTime IDH1 (Abbott Molecular, Inc.) |

Acute Myeloid Leukemia - Peripheral Blood or Bone Marrow |

Rezlidhia |

IDH1 |

R132 mutations (R132C, R132H, R132G, R132S, and R132L) |

12/01/2022 |

|

Agilent Resolution ctDx FIRST assay (Resolution Bioscience, Inc.) |

Non-Small Cell Lung Cancer (NSCLC) - Plasma |

Krazati |

KRAS |

KRAS G12C |

12/12/2022 |

Source: FDA December 2025

The in-vitro diagnostic market in Canada is shaped by its single-payer, provincially administered healthcare system, prioritizing cost control and equitable access. A major trend is federal and provincial investment to address diagnostic backlogs exacerbated by the pandemic, with initiatives such as Ontario’s USD 324 million investment to expand the MRI and CT scanning capacity, which includes supporting laboratory infrastructure, based on the Government of Ontario’s March 2022 report. Procurement is heavily influenced by the health technology assessments conducted by the CADTH, which evaluates clinical and cost effectiveness before provincial adoption. The public health agency of Canada focuses on strengthening the national surveillance for infectious diseases and antimicrobial resistance, creating a demand for standardized high-throughput laboratory platforms.

APAC Market Insights

The Asia Pacific in-vitro diagnostic market is the fastest growing and is expected to grow at a CAGR of 6.8% during the forecast period 2026 to 2035. The market is driven by the confluence of expansive healthcare investment, rising disease burden, and technological adoption. The primary catalysts include massive government-led healthcare infrastructure expansion, such as China’s Healthy China 2030 initiative and universal health coverage drivers in India and Thailand, which are significantly increasing diagnostic accessibility. A rising middle class, an aging demographic facing a high prevalence of diabetes and cancer, and increasing health awareness are fueling private sector demand. The trend is decisively toward local manufacturing to reduce the import dependency, rapid uptake of point-of-care and molecular diagnostics for infectious disease management, and digital health integration.

China market expansion is centrally planned and executed via the Healthy China 2023 strategy, which prioritizes early screening and preventive care, driving massive procurement for public health programs. Government mandates for local innovation and Made in China self-reliance have surged the dominance of the domestic players, such as Mindray, in core laboratory segments. The National Medical Products Administration has streamlined approvals for critical tests, including high-throughput platforms for oncology and infectious diseases. A key statistical driver is the scale of public investment. According to the NLM study in September 2024, the total health expenditure in the nation reached 8,532.749 billion yuan and has maintained a high baseline, directly funding the deployment of the diagnostics across counties and community health centers.

The India in vitro diagnostics market is positioned for sustained long term growth supported by demographic, economic, and policy-driven factors. An aging population, rising disposable incomes, and increasing prevalence of lifestyle-related diseases are expanding the demand for routine and preventive diagnostic testing. Shifting patient attitudes toward early detection, wider insurance coverage, and growing adoption of point-of-care diagnostics are further increasing the test volumes across the urban and semi-urban settings. On the supply side, the report from Invest India in June 2021 states that the government of India’s production-linked incentive scheme 2.0 is a structural catalyst aimed at strengthening domestic in-vitro manufacturing and reducing import dependence. By targeting companies with the local manufacturing revenues of 5,000 crore or more, the scheme seeks to create globally competitive Indian manufacturers capable of integrating into international value chains and scaling advanced diagnostic technologies.

Europe Market Insights

The Europe market is a mature, evolving and is defined by the robust regulation cost containement pressures and a strong push toward integrated healthcare. The implementation of the in-vitro diagnostic regulation is the dominant force raising compliance barriers that favor large established players with robust quality systems while potentially slowing the innovation from smaller entrants. The key drivers include the region’s aging population, increasing the prevalence of chronic diseases requiring monitoring, and a strategic focus on personalized medicine and early diagnosis to improve outcomes and reduce the long term costs. The European Commission’s EU4Health programme represents a significant demand catalyst funding initaitive to strengthen the health systems including a cross border health threats.

The Germany in-vitro diagnostic market is led by its extensive statutory health insurance system and dense network of hospitals and independent laboratories. The growth is structurally driven by the aging demographic and strong emphasis on early diagnosis and outpatient care, increasing the test volumes. The implementation of the Digital Healthcare Act and Hospital Future Act is a critical catalyst providing billions in funding for digital infrastructure that mandates the integration of diagnostic data into electronic patient records, fueling the demand for connected devices. The report from the Federal Statistical Office in April 2023 states that the healthcare expenditure in Germany reached 474.1 billion euros in 2021, representing a continued growth, providing a substantial and expanding financial base for diagnostic services and procurement.

The UK in vitro diagnostics market operates under a distinct regulatory framework post Brexit, governed by the UK Medicines and Healthcare products Regulatory Agency. A primary growth driver is the NHS Long Term Plan, which prioritizes early cancer diagnosis and community-based care, directing the demand toward rapid diagnostic centers and point-of-care tests. The UK’s world-leading Genomics Medicine Service creates a high-value niche for advanced molecular diagnostics and companion diagnostics. A key statistical indicator of the NHS diagnostic activity is the backlog for elective care. The report from the NHS England in February 2024 indicates that the number of patients waiting over 6 weeks for a key diagnostic test stood at 334,900, highlighting the sustained high demand and system pressure, which drives the ongoing investment and procurement in diagnostic capacity to reduce the wait times.

Key In Vitro Diagnostics Market Players:

- Roche Diagnostics (Switzerland)

- Abbott Laboratories (U.S.)

- Danaher Corporation (Beckman Coulter, etc.) (U.S.)

- Siemens Healthineers (Germany)

- Thermo Fisher Scientific (U.S.)

- Johnson & Johnson (Ortho Clinical Diagnostics) (U.S.)

- Sysmex Corporation (Japan)

- Becton, Dickinson and Company (BD) (U.S.)

- bioMérieux (France)

- Quest Diagnostics (U.S.)

- Grifols (Spain)

- Bio-Rad Laboratories (U.S.)

- Qiagen (Germany)

- Mindray (China)

- Hologic (U.S.)

- Diasorin (Italy)

- Shenzhen Mindray Bio-Medical Electronics (China)

- Sekisui Medical (Japan)

- Ortho Clinical Diagnostics (U.S.)

- Werfen (Spain)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Roche Diagnostics dominates the global in vitro diagnostics market via its integrated diagnostics to therapy strategy. The company heavily invests in high-throughput laboratory automation and data management software to streamline clinical workflows. A key initiative is the fusion of IVD with digital health platforms using AI to interpret complex data from its oncology, cardiology, and infectious disease portfolios to support personalized healthcare decisions. In 2024, the company has made a rise of 4% in total diagnostic sales.

- Abbott Laboratories is a powerhouse in the decentralized in vitro diagnostics market, excelling in rapid point-of-care and portable testing. Its strategic focus is on democratizing diagnostics via platforms such as the handheld i-STAT and the scalable Alinity series. Abott aggressively pursues market penetration with high volume tests, ensuring clinical-grade results in minutes outside traditional labs from doctors’ offices to community settings. In 2024, the company made a total sale of USD 42 billion.

- Danaher Corporation leverages its vertical integration within the in vitro diagnostics market under operating companies such as Beckman Coulter, Leica Biosystems, and Cepheid. Its Danaher Business System drives continuous innovation and operational excellence. Strategically, it focuses on creating end-to-end solutions from specimen preparation and histopathology to molecular diagnostics, notably expanding rapid molecular testing for hospital-acquired infectious and respiratory diseases via its Cepheid GeneXpert systems.

- Siemens Healthineers shapes the in vitro diagnostics market with a strong emphasis on laboratory efficiency, connectivity, and sustainability. Its Atellica Solution automates and consolidates high-volume immunoassay and clinical chemistry testing. A core strategic initiative is the creation of a digitally connected diagnostic ecosystem linking IVD data with imaging and therapy insights under its syngo virtual cockpit to support holistic patient management and operational intelligence for health systems.

- Thermo Fisher Scientific strengthens its cornerstone position in the in vitro diagnostics market by providing the essential instruments, reagents, and consumables that underpin global testing. Its strategy revolves around being an indispensable partner for clinical labs and IVD manufacturers via its vast portfolio. It focuses on supporting the entire development cycle from research and clinical trial assays to high-volume commercialized testing, particularly in immunodiagnostics and molecular diagnostics.

Here is a list of key players operating in the global market:

The global in vitro diagnostics market is highly consolidated and is dominated by multinational corporations from the U.S., Europe, and Japan. These leaders compete via extensive R&D investments and strategic acquisitions to broaden test portfolios and expand into high-growth emerging markets, particularly in Asia. A key trend is the integration of AI and data analytics into diagnostic platforms to enable precision medicine. Meanwhile, companies are focusing on point of care and rapid diagnostics stimulated by the pandemic. To maintain dominance, players are forming partnerships with tech firms and healthcare providers to create integrated diagnostic solutions while also navigating increasing regulatory scrutiny across regions. For example, in April 2025, Sysmex Group’s new manufacturing base in India begins full-scale operations and launches the Make in India products.

Corporate Landscape of the In Vitro Diagnostics Market:

Recent Developments

- In June 2025, Fujirebio announced that it acquired Plasma Services Group and strengthened its position as a provider of critical and high-quality biological raw materials to the IVD and life science industries.

- In February 2025, Aiforia Technologies Plc announced that it had successfully obtained the In-vitro Diagnostic Regulation (IVDR) certification. At the same time, the company launches three new CE-IVD-marked AI models for breast and prostate cancer diagnostics.

- In January 2024, ELITechGroup announced the launch of the CE-IVDR certified GI Bacterial PLUS ELITe MGB Kit and expands in-vitro diagnostic portfolio. The company has planned to launch three additional kits covering the full range of gastrointestinal infections within the next quarter.

- Report ID: 1354

- Published Date: Jan 30, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

In-vitro Diagnostics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.