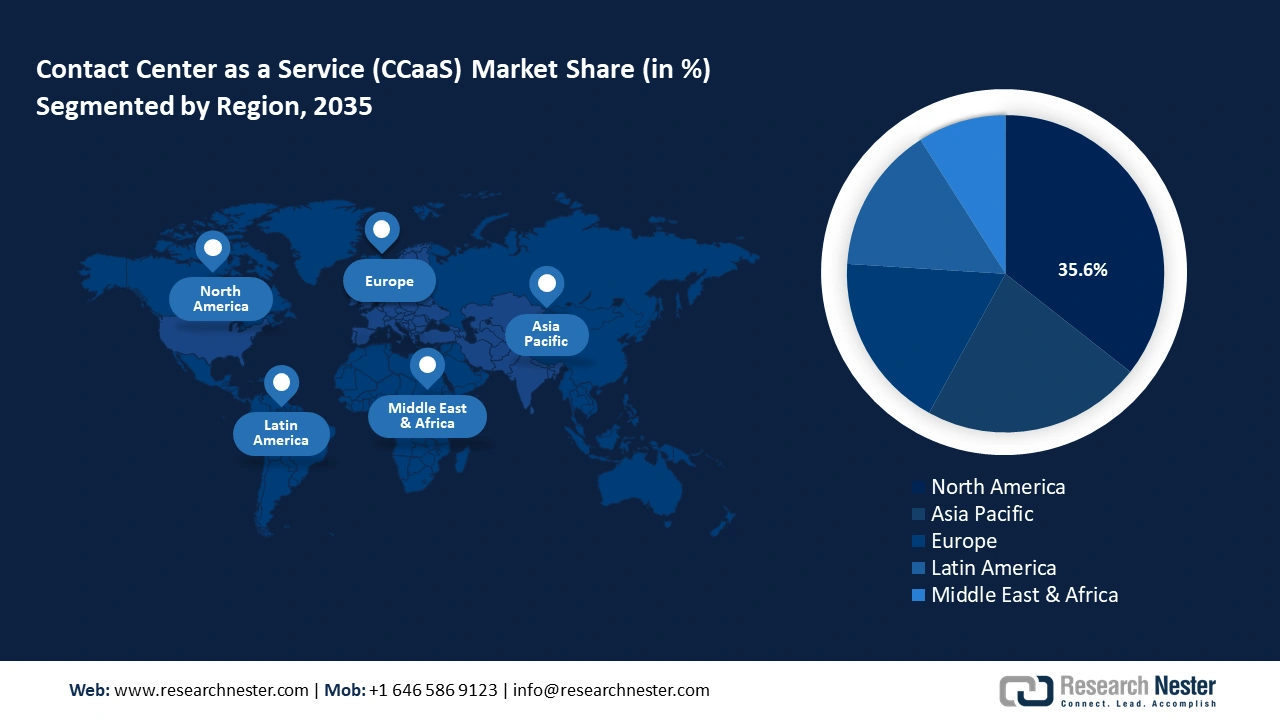

Contact Center as a Service Market - Regional Analysis

North America Market Insights

The North America contact center as a service market is estimated to hold a dominant revenue share of 35.6% during the forecast period. The regional market’s growth is supported by the rising adoption of AI-based customer-facing solutions across various industries. Additionally, trends in North America highlight a heightened rate of cloud migration, which paves the continued adoption of CCaaS. With consumer trends shifting, the opportunities in the North America CCaaS market are rising for the deployment of advanced AI-based solutions.

The market in the U.S. is expanding rapidly, driven by strong adoption of AI-driven customer engagement, cloud migration, and the need for omnichannel experiences. U.S. enterprises are emphasizing enhancing customer satisfaction while lowering operational costs, making cloud-based contact centers a strategic choice. Industries such as retail, healthcare, and BFSI are top adopters, combining CCaaS platforms to optimize customer journeys and achieve real-time insights. The rise of remote and hybrid work culture further promotes demand for scalable and secure CCaaS solutions. For instance, in March 2025, Zoom Video Communications revealed the expansion of its Zoom Contact Center with AI Companion features, helping U.S. businesses to offer smarter, personalized, and efficient customer support. Additionally, the U.S. market has been at the forefront of embracing cloud-based solutions, which have assisted enterprises in leveraging cost-effective solutions to streamline workflows.

In Canada, the contact center as a service market is poised to grow due to the country's increasing digital transformation initiatives, customer experience, and rapid cloud adoption in enterprises. Organizations in Canada are looking for scalable solutions that can integrate multiple communication channels and support remote agents efficiently. The market is also fueled by the rising presence of fintechs and e-commerce players, which depend heavily on agile customer support platforms. Additionally, compliance with Canadian data privacy regulations is forcing CCaaS providers to offer secure, locally compliant services. A notable example came in March 2024, when TELUS International improved its CCaaS offerings in Canada by integrating generative AI capabilities, helping Canadian businesses improve efficiency and deliver faster, personalized customer interactions.

APAC Market Insights

The APAC contact center as a service market is rising at the fastest CAGR during the forecast period from 2026 to 2035. The lucrative growth is associated with the rising investments to hasten the digital transformation initiatives across multiple economies in the region. Additionally, APAC has large-scale consumer-centric economies such as India, where customer support outsourcing trends are rife, creating opportunities for the deployment of CCaaS services. As the disposable income in multiple APAC economies increases, the focus on creating improved customer service solutions has heightened, ensuring a steady demand for CCaaS within the regional sector.

The India contact center as a service market is predicted to expand at a rapid CAGR during the forecast period, driven by digitalization, e-commerce expansion, and demand for 24/7 support. This digitalization can be understood as top key players are expanding CCaaS solutions to remain competitive market. In June 2025, Zoom developed its AI-first, video-optimized Contact Center in India, alongside expanding Zoom Phone services to top regions including Mumbai, Bengaluru, Hyderabad, Andhra Pradesh, and Delhi-NCR. Rising hybrid work adoption, supportive government cloud policies, and a rising tech-savvy workforce further strengthen the country’s market presence.

In China, the contact center as a service market is increasing as enterprises largely adopt AI-driven conversational tools, cloud-native platforms, and omnichannel engagement models to fulfill rising consumer expectations. The country’s expanding e-commerce and fintech ecosystems necessitate highly flexible and efficient customer service infrastructures, which CCaaS platforms provide. Government support for cloud adoption and digital transformation initiatives is also supporting the trend. Companies in China are also focusing on local compliance and security, making domestic CCaaS providers very competitive. For instance, in July 2024, Alibaba Cloud upgraded its Intelligent Contact Center with next-generation AI and real-time analytics features, helping Chinese businesses to manage peak shopping season demands while granting personalized customer interactions.

Europe Market Insights

The market in Europe is predicted to hold a notable share during the forecast period as enterprises across sectors embrace AI-driven automation, omnichannel engagement, and cloud-first strategies to enhance customer experience. Regulatory requirements like GDPR are also pushing companies toward secure and compliant CCaaS platforms. The growing e-commerce industry, together with demand for multilingual and personalized services, is further driving adoption. European businesses are increasingly investing in AI chatbots and agent-assist tools to reduce operational costs while improving customer satisfaction.

In the UK, the contact center as a service market is growing due to rising demand for scalable cloud-based contact centers that can support hybrid work models and cost-efficient operations. The retail, BFSI, and healthcare sectors are primary adopters, looking to offer seamless digital-first customer journeys. With well-defined digital transformation initiatives, businesses are merging AI-powered analytics and conversational tools to improve agent productivity and personalization. The UK’s fintech and e-commerce platforms are also pushing CCaaS adoption to fulfill rising customer engagement expectations. For instance, in August 2025, 8x8 expanded its UK CCaaS solutions with AI and automation potential, enabling businesses to optimize workflows and offer quicker, more efficient support.

The CCaaS market in Germany is expanding fast, owing to the rising trend of data security and AI-enabled consumer engagement. Businesses are adopting CCaaS to manage a huge number of digital interactions while adhering to strict data protection and compliance standards. The country’s manufacturing and automotive industries are also deploying CCaaS solutions to control customer support, dealer communication, and after-sales services. The increase in remote and hybrid work further indicates the demand for scalable and reliable platforms.