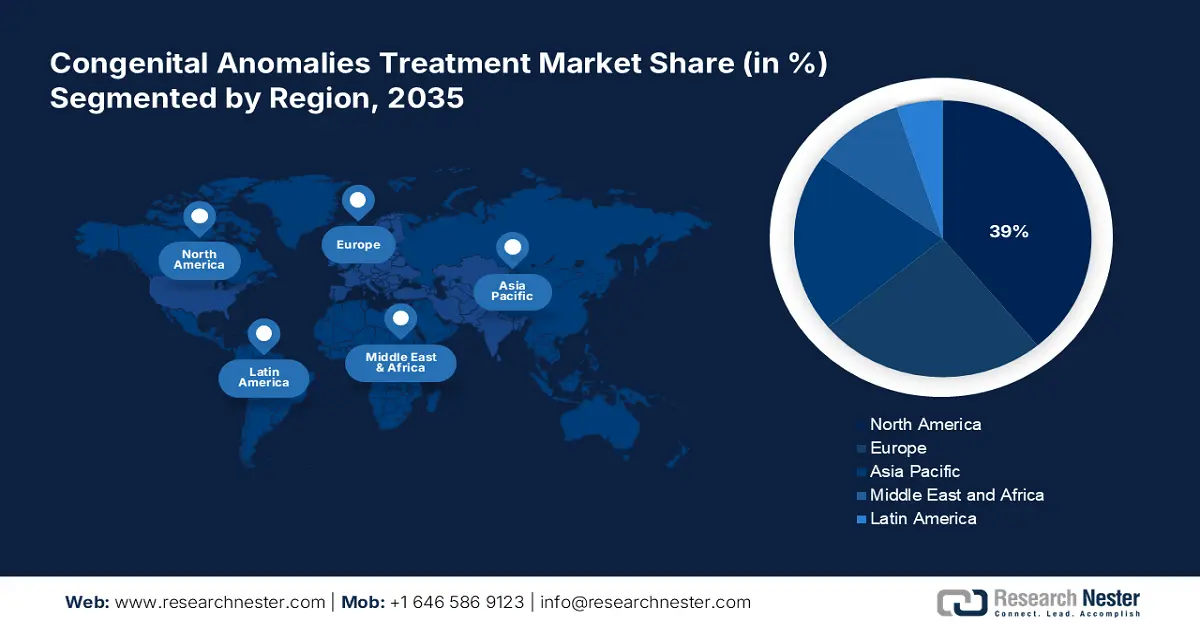

Congenital Anomalies Treatment Market - Regional Analysis

North America Market Insights

North America market is expected to hold the highest market share of 39% by the end of 2035, largely due to the U.S. and Canada’s flourishing provincial initiatives to bridge the gaps between supply and demand. According to a report by CMS in December 2024, U.S. health care spending grew by 7.5% in 2023, reaching USD 4.9 trillion or USD 14,570 per capita. Health care expenditures thus amounted to 17.6 percent of the gross national product. This increase has witnessed thousands of patients gaining medical accessibility every year. The presence of renowned pharmaceutical and biotech companies also accelerated the development of modern therapies and diagnostics for congenital disorders.

The congenital anomalies treatment market in the U.S. is growing due to increasing healthcare investments and expanding access to specialist medical services. As per a report by CMS in June 2025, prescription drug spending rose by 11.4% in 2023, thus reaching approximately USD 449.7 billion. This growth rate exceeds the 7.8% increase recorded in 2022 and is due to increased utilization of advanced therapies. This increased pharmaceutical expenditure is directly contributing to the marketplace for novel treatments aimed at congenital disorders. Further entry points in this regard are being provided by the government support programs for rare diseases and interventions into the earliest stages in creating a viable ecosystem for diagnosing and treating congenital anomalies.

The congenital anomalies treatment market in Canada is growing due to increased government financing for health infrastructures and initiatives for better maternal and child health outcomes. According to a report by the World Health Organization in 2025, life expectancy at birth in Canada has improved by 2.4 years, from 79.1 to 81.6, reflecting improvements in early diagnosis and effective treatment of various illnesses, including congenital anomalies. This improvement brings on positive changes with improved healthcare services and further supports the need for newer treatments targeting congenital anomalies. With increasing awareness among healthcare professionals and parents regarding early intervention options, there is consequently a large demand for such specialized treatment all over the country.

Prevalence of Selected Congenital Anomalies (per 10,000 births) (2023)

|

Anomaly Type |

Rate (per 10,000) |

Trend |

|

Neural tube defects |

4.8 |

Stable |

|

Genital anomalies |

68.0 |

Stable |

|

Congenital heart defects |

20.8 |

Stable |

|

Limb deficiency defects |

4.0 |

Stable |

|

Oro-facial clefts |

15.8 |

Stable |

|

Diaphragmatic hernia |

3.1 |

Stable |

|

Abdominal wall defects |

5.8 |

Decreasing |

|

Gastrointestinal defects |

14.2 |

Stable |

|

Chromosomal defects |

18.0 |

Stable |

|

CNS defects |

5.3 |

Decreasing |

|

Urinary tract defects |

13.8 |

Increasing |

|

Sense organ defects |

4.9 |

Stable |

Source: Government of Canada

Asia Pacific Market Insights

The congenital anomalies treatment market in the Asia Pacific is anticipated to capture the fastest-growing market by the end of 2035 due to increasing healthcare and pharmaceutical investments, technological advancements, and rising disease occurrence. According to a report by OECD in November 2022, average neonatal mortality in the lower-middle and lower-income economy nations in the region still stands high at 15.8 deaths per 1,000 live births. These points point toward the beauty challenges that indicate the urgent need for basic and advanced healthcare treatments and infrastructure. With most countries creating and expanding prenatal screening programs, fair optimism exists regarding an upward growth trajectory of this market, which is further promoted through investments in modern medical equipment.

The congenital anomalies treatment market in India is projected to register the fastest growth rate during the forecast period. This is primarily driven by supportive government policies and initiatives. As per a report by Invest India in May 2025, the medical devices sector size in India is expected to be around USD 14 billion, and is expected to increase to USD 30 billion by 2030. India has the fourth-largest medical device market in Asia after Japan, China, and South Korea, and one of the world's top 20 medical device markets. After that, the expanding consciousness of congenital disorders and infrastructural growth for healthcare in urban and rural settings keep up the demand for modern treatment modalities throughout the country.

The congenital anomalies treatment market in China is increasing due to growing government support for healthcare innovation, rising birth defect awareness, and expanding access to specialized medical care. As per a report by NLM in April 2023, the Center for Drug Evaluation (CDE) published and disseminated over 100 consultation drafts for drug R&D guidelines in 2022, marking the ramp-up in China for fast-tracking development and approval of innovative therapies, some of which are for rare or congenital disorders. The wave of regulations, in addition to the great investments made into pediatric healthcare and prenatal diagnostics, is ushering in higher rates of early detection and treatment for congenital anomalies across the country.

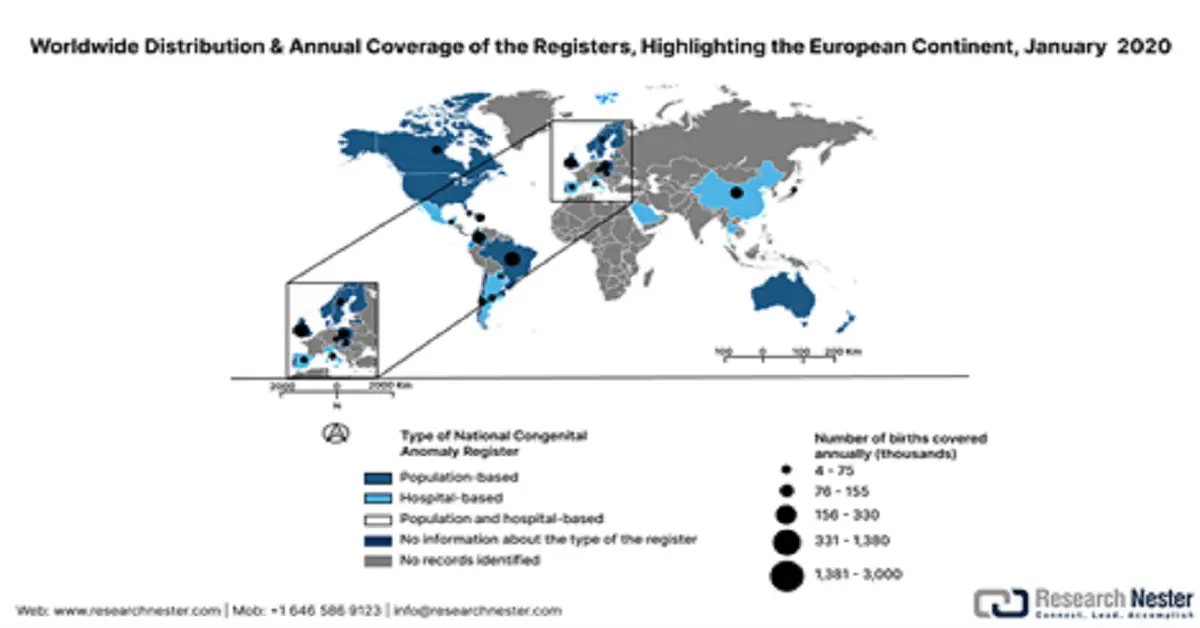

Europe Market Insights

The market in Europe is experiencing steady growth, advanced healthcare, and regulatory systems, in addition to higher investments in medical technologies. However, as per a report by OECD in December 2022, screening rates for breast cancer and cervical cancer dropped by 6%, on average, across the countries, signifying gaps in preventive care services. Besides, the document below summarizes the characteristics of the overall region's 14 congenital anomaly registers, along with national coverage that has been extracted from the National Congenital Anomaly Registers dataset. It includes coding systems, surveillance practices, pregnancy outcomes, and registry details, which are aligned with EUROCAT and ICBDSR standards.

European Congenital Anomalies Registers with National Coverage, January 10, 2020

|

Country |

Registry Name |

Year Created |

Type |

Network |

Births (thousands, % coverage) |

Compulsory |

Time Limit |

Anomaly Type |

Coding |

Pregnancy Outcomes |

Surveillance |

|

Czech Republic |

National Registry of Congenital Anomalies (NRCA) |

1964 |

Population |

ICBDSR, EUROCAT |

110 (100%) |

Yes |

15 years |

– |

ICD |

Live birth, Stillborn, TOPFA |

Yes |

|

Denmark |

Danish Medical Birth Registry |

1973 |

Population |

– |

– |

– |

1 year |

– |

ICD |

Live birth, Stillborn, TOPFA |

– |

|

England |

NCARDRS |

2015 |

Population |

BINOCAR, ICBDSR |

610 (100%) |

No |

– |

Major, minor |

ICD |

Live birth, Stillborn, TOPFA |

– |

|

Finland |

Register of Congenital Malformations |

1963 |

Population |

ICBDSR, EUROCAT |

60 (100%) |

Yes |

1 year |

Major |

ICD |

Live birth, Stillborn, TOPFA |

Yes |

|

Hungary |

Hungarian Congenital Abnormality Registry (HCAR) |

1962 |

Population |

ICBDSR, EUROCAT |

100 (100%) |

Yes |

1 year |

Major, minor |

ICD (modified) |

Live birth, Stillborn, TOPFA |

– |

|

Latvia |

Register of Patients Suffering from Certain Diseases |

1987 |

Population |

EUROCAT |

19.2 (100%) |

Yes |

18 years |

– |

– |

Live birth, Stillborn, TOPFA |

– |

|

Malta |

Malta Congenital Anomalies Register (MCAR) |

1985 |

Population |

ICBDSR, EUROCAT |

4 (100%) |

No |

1 year |

Major, minor |

ICD |

Live birth, Stillborn |

– |

|

Norway |

Medical Birth Registry of Norway (MBRN) |

1967 |

Population |

ICBDSR, EUROCAT |

60 (100%) |

Yes |

1 year |

– |

ICD-BPA |

Live birth, Stillborn, TOPFA |

Yes |

|

Poland |

Polish Registry of Congenital Malformations (PRCM) |

1997 |

Population |

EUROCAT |

300 (85%) |

Yes |

2 years |

Major, minor |

ICD |

Live birth, Stillborn, TOPFA |

Yes |

|

Portugal |

Portuguese National Registry of Congenital Anomalies (RENAC) |

1995 |

Population |

EUROCAT |

– |

No |

Neonatal period |

Major |

ICD |

Live birth, Stillborn, TOPFA |

Yes |

|

Scotland |

Scottish Linked Routine Data Congenital Anomaly Register |

2018 |

Population |

EUROCAT |

50-55 (100%) |

Hybrid |

1 year |

Major |

ICD |

Live birth, Stillborn, TOPFA |

– |

|

Slovakia |

Teratologic Information Centre, Slovak Medical University |

1964 |

Population |

ICBDSR |

55 (100%) |

Yes |

Hospital-based |

– |

– |

Live birth, Stillborn, TOPFA |

– |

|

Sweden |

Swedish Medical Birth Registry (MBR) |

1964 |

Population |

ICBDSR, EUROCAT |

100-120 (100%) |

Yes |

1 year |

– |

ICD |

Live birth, Stillborn, TOPFA |

Yes |

|

Wales |

Congenital Anomaly Register & Information Service for Wales (CARIS) |

1998 |

Population |

BINOCAR, ICBDSR, EUROCAT |

35 (100%) |

No |

1 year |

Major, minor |

ICD |

Live birth, Stillborn, TOPFA |

– |

Source: Scielosp, January 2020

The congenital anomalies treatment market in the UK is expected to grow due to the advancements in early diagnostics, pediatric care, and surgical innovations. According to a report by ONS in May 2024, in 2023, the entire healthcare expenditure grew by 5.6% in nominal terms, showing that economic pressures impacted the spending from a real-term perspective. The UK continues to direct investment towards critical health services, including terms such as maternal and neonatal health. Increasing weightage on genetic screening programs and NHS initiatives for early detection, intervention, and treatment of congenital disorders will contribute toward maintaining the demand for advanced treatment solutions in the coming years.

The market in Germany is expected to grow due to strong government initiatives to improve maternal and child health, along with ongoing R&D investments. As per a report by the World Health Organization in 2024, in 2022, Germany spent about 12.7% of its GDP on health. The government promotes early diagnosis through prenatal screening programs carried out nationwide, and there are regulations to support access to specialized pediatric care. In addition, the strong R&D landscape provides ample opportunities for public and private companies to innovate gene therapy, regenerative medicine, and advanced surgical techniques, thereby carving out enhanced treatment modalities for congenital anomalies.

Target Diseases of Neonatal Screening in Germany, Their Prevalence, and Their Year of Inclusion in The National Screening Program (2022)

|

Disease |

Classification |

Prevalence |

|

Very-long-chain-acyl-CoA-dehydrogenase deficiency (VLCAD) |

Fatty acid oxidation disorder, a metabolic disease |

1:75 562 |

|

Medium-chain acyl-CoA-dehydrogenase deficiency (MCAD) |

Fatty acid oxidation disorder, a metabolic disease |

1:10 086 |

|

Long-chain-3-OH-acyl-CoA-dehydrogenase deficiency (LCHAD) |

Fatty acid oxidation disorder, a metabolic disease |

1:141 824 |

|

Carnitine palmitoyl transferase 1 deficiency (CPT-1) |

Carnitine cycle defect, metabolic disease |

1:576 159 |

|

Carnitine palmitoyl transferase 2 deficiency (CPT-2) |

Carnitine cycle defect, metabolic disease |

|

|

Carnitine acylcarnitine translocase ‧deficiency (CACT) |

Carnitine cycle defect, metabolic disease |

|

|

Phenylketonuria (PKU) and hyperphenylalaninemia (HPA) |

Amino acid metabolism disorder, metabolic disease |

1:5 262 |

|

Maple syrup urine disease (MSUD) |

Amino acid metabolism disorder, metabolic disease |

1:170 714 |

|

Tyrosinemia type 1 |

Amino acid metabolism disorder, metabolic disease |

1:135 000*2 |

|

Glutaraciduria type 1 (GA1) |

Metabolic disease, organoacidopathy |

1:139 675 |

|

Isovaleric acidemia (IVA) |

Metabolic disease, organoacidopathy |

1:89 500 |

|

Biotinidase deficiency |

Metabolic disease |

1:28 365 |

|

Galactosemia |

Carbohydrate metabolism disorder, metabolic disease |

1:76 821 |

|

Primary hypothyroidism |

Endocrinopathy |

1:3 338 |

|

Adrenogenital syndrome (AGS) |

Endocrinopathy |

1:14 917 |

|

Cystic fibrosis (CF) |

Lung disease |

1:5 400*1 |

|

Severe combined immunodeficiency (SCID) |

Immune disease |

1:32 500*2 |

|

5q-associated spinal muscular atrophy (SMA) |

Muscular disease |

|

|

Sickle cell disease (SCD) |

Hematological disease |

|

|

Total |

1:1 333 |

Source: NIH