Condom Market Outlook:

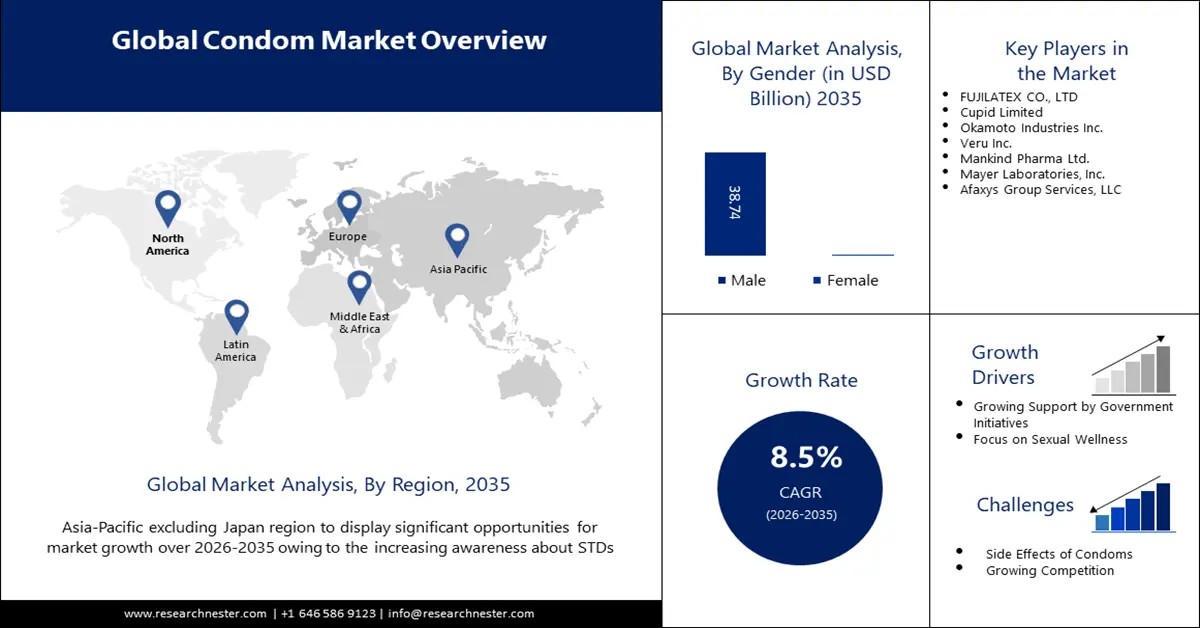

Condom Market size was valued at USD 11.75 billion in 2025 and is set to exceed USD 26.57 billion by 2035, expanding at over 8.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of condom is estimated at USD 12.65 billion.

The condom market is driven by the rising awareness about sexually transmitted diseases (STDs) such as HIV, syphilis, and chlamydia. According to the Joint United Nations Programme report on HIV/AIDS published in 2023, approximately 39 million people were living with HIV in 2022, across the globe. Furthermore, there has been a growing concern among women about the side effects of contraceptive pills. This has fostered the adoption of female condoms.

Key Condom Market Insights Summary:

Regional Highlights:

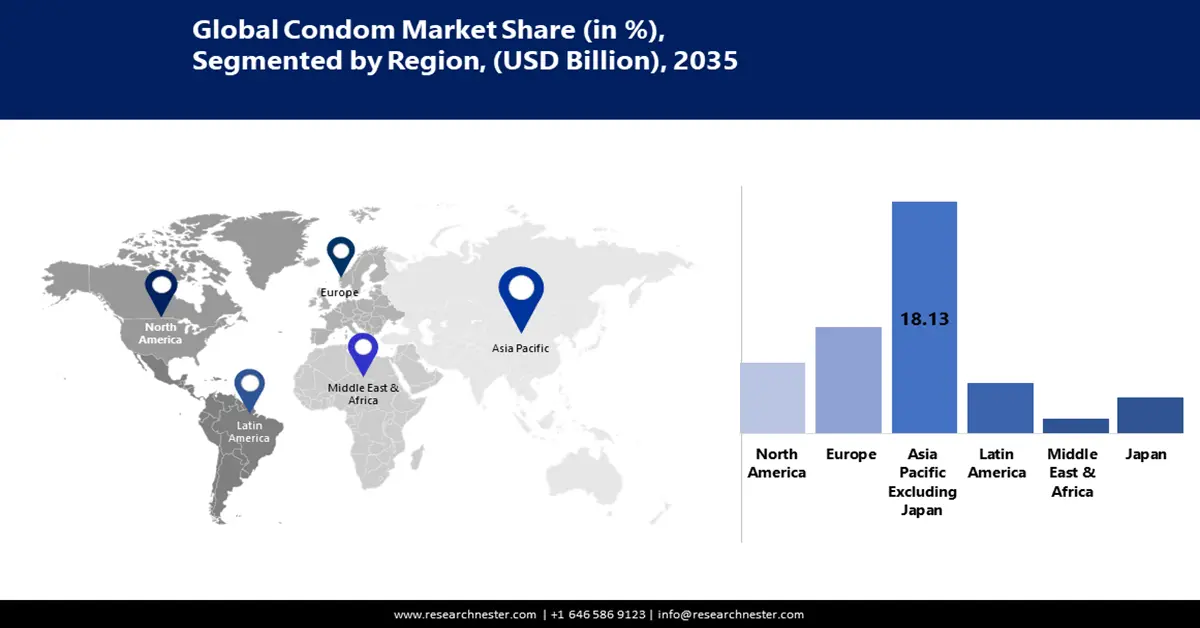

- The Asia Pacific condom market achieves a 48% share by 2035, driven by government initiatives promoting safe sexual practices and regulatory guidelines.

- The North America market will register massive growth during the forecast timeline, driven by government campaigns promoting safe sex and rising demand for diverse condom products.

Segment Insights:

- The male segment in the condom market is anticipated to maintain a dominant share by 2035, attributed to higher adoption and wider availability of male condoms.

- The latex segment in the condom market is expected to hold an 82% share by 2035, driven by latex's affordability, safety, and widespread use.

Key Growth Trends:

- Establishment of robust government regulations and initiatives

- Rising advertisement on digital media

Major Challenges:

- Side effects of condoms

- Growing competition

Key Players: FUJILATEX CO., LTD, Cupid Limited, Okamoto Industries Inc., Veru Inc., Mankind Pharma Ltd., Mayer Laboratories, Inc., Afaxys Group Services, LLC.

Global Condom Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 11.75 billion

- 2026 Market Size: USD 12.65 billion

- Projected Market Size: USD 26.57 billion by 2035

- Growth Forecasts: 8.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (48% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, India, Thailand, Indonesia, Brazil

Last updated on : 17 September, 2025

Condom Market Growth Drivers and Challenges:

Growth Drivers

-

Establishment of robust government regulations and initiatives- As part of the U.S. Agency for International Development (USAID) Global Health Supply Chain-Quality Assurance Program (GHSC-QA), Family Health International (FHI 360) performs risk-based quality assessment of manufacturers, suppliers, and products. It ensures compliance with the International Organization for Standardization (ISO) and provides recommendations for procurement. FHI 360 Procurement and Supply Management (PSM) maintains approved supplier, vendor, and product lists. The well-established international regulatory standards have streamlined the product supply chain.

The GHSC-PSM quantifies, forecasts condom market proliferation, and plans supply, procurement, and distribution of lubricants, condoms, and other HIV prevention products, particularly for the marginalized populations. Through diversification of the supplier pool, contract negotiations, and strategic sourcing, GHSC-PSM has made significant cost savings, while assuring the adequate supply of prevention and family planning/reproductive health (FP/RH) products to reach more people.

In 2023, the United Nations Fund for Population Activities (UNFPA) and UNAIDS collaboratively launched the Condom Needs Estimation Tool (CNET) to prevent HIV and other STIs as well as unintended pregnancies. The CNET facilitates strong government stewardship, domestic funding allocations, and a continuum of care services including HIV testing and counseling, voluntary medical male circumcision, antiretroviral therapy, and PrEP services. 4.2 million female condoms were procured in 2022 for 12 President’s Emergency Plan for AIDS Relief (PEPFAR)-supported countries in Africa. Such government regulations and initiatives are used to reinforce condom demand. - Rising advertisement on digital media - Businesses are increasingly using digital platforms to reach a larger audience for advertising and creating awareness about condoms. For instance, in November 2024, Skore Condoms announced a new digital campaign to condom market its product lineup. Furthermore, in September 2022 Population Services International (PSI) launched USAID-funded Viya for men. It is aimed at creating a digital, stigma-free ecosystem where individuals are guided throughout their reproductive health and wellness journey, providing access to quality products and content. The brand’s positioning has been designed to cater to multiple male archetypes via social media posts and chatbots.

Challenges

-

Side effects of condoms - The usage of condoms might result in health issues including allergic reactions, and skin infections, which is expected to restrict the industry's growth. For example, some people may experience allergic reactions to latex condoms, resulting in symptoms such as rash, hives, and a runny nose.

-

Growing competition - The condom market is highly competitive with the presence of numerous established players including Tojan and Durex. The competitive landscape is dynamic, with global and local companies striving to strengthen the geographical footprint. The key players account for the majority of revenue share, thereby hindering the entrance of new players.

Condom Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.5% |

|

Base Year Market Size (2025) |

USD 11.75 billion |

|

Forecast Year Market Size (2035) |

USD 26.57 billion |

|

Regional Scope |

|

Condom Market Segmentation:

Gender Segment Analysis

In condom market, male segment share is anticipated to exceed 96% by 2035. Diverse portfolios, high adoption of male condoms in comparison to female condoms, and manufacturers' emphasis on producing male condoms are some of the factors contributing to the increase in the growth of the segment. Male condom use is encouraged by the wide range of alternatives available to them in terms of materials, thickness, and patterns. Unlike female condoms, male condoms have a higher success rate in preventing unplanned pregnancy. As per the data published by the World Health Organization (WHO), in February 2024, 98% of women whose male partners use male condoms avert unplanned pregnancy. On the other hand, 95% of women who use female condoms prevent accidental pregnancy.

Material Segment Analysis

By the end of 2035, latex segment share in the condom market is estimated to exceed 82%. The latex condom offers a convenient, user-controlled, safe, and reasonably priced method of birth control. Therefore, approximately 80% of the male condoms available in the U.S. are made of raw rubber latex. It is well-documented that latex condoms provide a second layer of protection against numerous STDs and unintended pregnancies. In addition, manufacturers are concentrating on studying and creating new items to serve the expanding condom market for premium latex condoms. Thus, the launch of new products is anticipated to fuel the growth of latex condoms in the market.

Our in-depth analysis of the global market includes the following segments:

|

Material |

|

|

Gender |

|

|

Income Group |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Condom Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is predicted to account for largest revenue share of 48% by 2035. Condom sales have increased in the region as a result of initiatives taken by the government to encourage safe sexual practices. Moreover, the Asia Pacific region has several regulatory guidelines for condoms to ensure their effectiveness, and safety. For instance, China, and India have their guidelines for condom distribution t0 prevent sexually transmitted diseases, and promote safe sex practices.

The national government of India has regulations about the production and distribution of condoms to encourage responsible sexual behavior and prevent STDs. In addition, there is a notable increase in the frequency of STIs, unsafe abortions, unintended pregnancies, HIV infection, and other STDs.

One of the biggest condom markets in the world is China. Availability of subsidized products and the growth of the middle class in recent years has made it easier for people to buy premium condoms from retail establishments. Popular condom brands like Okamoto, which has gained recognition among consumers in the medium- and high-price range, have benefited from the above-mentioned factors.

North America Market Insights

North America condom market is poised to register massive growth during the forecast period. The government's campaigns to promote safe sex practices and sexual health are boosting the demand for condoms. For example, the White House revised the HIV National Strategic Plan to eliminate HIV in the U.S. by raising public awareness and expanding access to HIV prevention services by 2030.

The growing demand for condoms among women, and the availability of flavored condoms are driving significant growth in the U.S. condom market. Moreover, both male and female condoms are available in the country, and they are made from various materials, with latex and non-latex being the most common types.

The demand for contraceptives has increased in Canada as a result of the relaxation of COVID-19 restrictions. This demand is also associated with a rise in social interaction and vaccination campaigns. The country’s high rate of unwanted pregnancies and rising STD prevalence present growth prospects for the condom industry.

Condom Market Players:

- Reckitt Benckiser Group PLC

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- HUMANWELL GROUP

- Church & Dwight Co., Inc.

- Karex Berhad

- FUJILATEX CO., LTD

- Cupid Limited

- Okamoto Industries Inc.

- Veru Inc.

- Mankind Pharma Ltd.

- Mayer Laboratories, Inc.

- Afaxys Group Services, LLC

Recent Developments

- In May 2024, Manforce launched a digital ad named #CondomNahiManforceBolo. By promoting the usage of "Manforce" instead of "condom," this campaign seeks to dominate the online searches linked to condoms. The campaign, which is slated to run for a year, aims to make Manforce Condoms the best option for customers.

- In April 2023, Afaxys Group Services, LLC, a mission-driven healthcare organization, and Veru Inc. inked a purchasing agreement that places an emphasis on the needs of safety-net and public health providers. By this partnership, up to 31 million people who depend on community and public facilities for basic healthcare would be able to get Veru's FC2 Female Condom through the AGS Group.

- Report ID: 6276

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Condom Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.