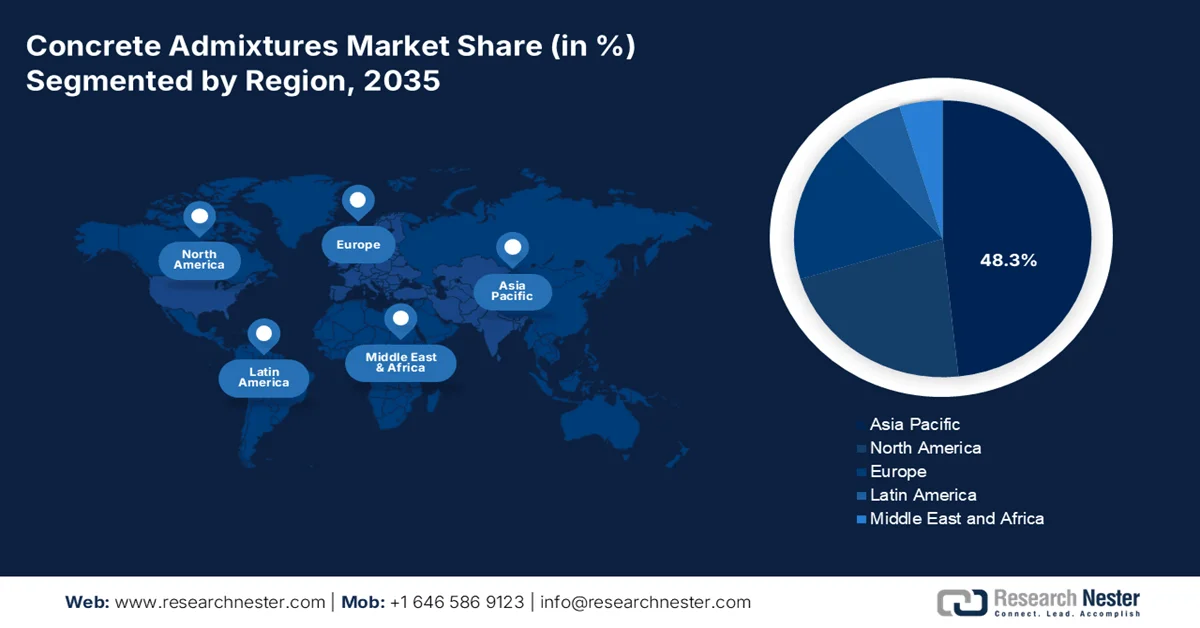

Concrete Admixtures Market - Regional Analysis

APAC Market Insights

The Asia Pacific concrete admixtures market is the largest and the dominating market, poised to hold the regional revenue share of 48.3% by 2035. The dominance is due to the rising urbanization, massive public infrastructure investment, and growing focus on construction quality and sustainability. The primary demand driver is the national initiatives' active expansion and rising investment in infrastructure modernization. These investments are a multi trillion dollar programs and mandate for high volume of concrete. A significant trend is the rapid shift from basic to high-performance polycarboxylate ether-based superplasticizer admixtures, enabling easier construction and quicker. Moreover, the governments implement the green building codes, which increase the demand for admixtures that minimize the consumption of cement and water.

Large scale public infrastructure investment and rapid urban development supported by the central government programs are driving the India market. According to the IBEF October 2025 data, the cement production in India in 2024 was around 426.29 million tonnes. Higher cement output indicates the increased volumes of ready-mix, precast, and on-site concrete, where admixtures are routinely used to control workability, setting time, durability, and performance. Besides, the PIB February 2024 report shows the construction sector is growing significantly by 10.7%, indicating a rising demand and usage of concrete admixtures. Moreover, the RBSA December 2023 report depicts that the central government has allocated over USD 81 million for road construction, relying on ready mix and precast concrete. These data create a high volume demand for the concrete admixtures in India.

The China market is fundamentally driven by the scale and continuity of government-led infrastructure and urban construction programs. According to the NLM July 2025 study, concrete manufacturing relies on 4 billion tons of cement, and China is the largest cement producer with 1.9 billion metric tons in 2024, accounting for half of the global output, underscoring the volume base that supports the consumption. Besides the public investment, the infrastructure modernization grew by a significant percentage with the sustained funding directed towards transport networks, municipal utilities, water management, and more. Additionally, the improved quality control and durability in concrete construction are reinforcing the systematic admixture usage in precast and ready mix applications. This boosts the adoption across various applications, such as public housing, transportation, and municipal infrastructure projects in China.

North America Market Insights

The North America concrete admixtures market is the fastest growing and is expected to grow at a CAGR of 7.1% during the forecast period 2026 to 2035. The growth is driven by infrastructure renewal, stringent sustainability mandates, and advanced construction practices. The key drivers are the implementation of IIJA, which allocates a significant amount for infrastructure modernization, directly demanding for high performance concrete. Further, in Canada, the Invest in Canada plan supports the public infrastructure and low-carbon construction. A primary demand is the shift towards admixtures that facilitate low-carbon concrete mixes to meet ambitious embodied carbon targets such as the Buy Clean Initiative in the U.S. and Canada. The focus on repairing aging infrastructure over new builds also increases the demand for specialized repair and shotcrete admixtures.

The market in U.S. is strongly driven by the public sector procurement frameworks and the state-level infrastructure execution. The Illinois Department of Transportation Bureau of Materials report in January 2026 indicates the approved concrete admixtures list governs materials used in highway and bridge construction, reinforcing the role of the admixtures as the mandatory inputs rather than optional enhancements in federally and state-funded projects. This aligns with broader national spending trends. According to the U.S. Census Bureau report in January 2026, the public construction spending reached USD 524.0 billion, indicating a sustained concrete output. Further, the regulatory approvals and funding mechanisms create a predictable specification-driven demand for concrete admixtures across transportation, water, and civil infrastructure projects in the U.S.

IDOT Approved Concrete Admixtures

|

Company Name |

Brand Name |

Specification |

Material Code |

|

Chryso Inc |

Darex II AEA |

AIR ENTRAINING ADMIXTURES |

42138 |

|

DarCole Products, Inc. |

DNL 485 |

TYPE A, WATER REDUCING ADMIXTURES |

43958 |

|

Euclid Chemical Company |

Eucon Stasis |

TYPE B, RETARDING ADMIXTURES |

43949 |

|

Mapei |

Mapefast Super Set (Polychem Super Set) |

TYPE C, ACCELERATING ADMIXTURES |

43773 |

Source: Illinois Department of Transportation Bureau of Materials report January 2026

The Canada concrete admixtures market is closely related to the federally and provincially funded infrastructure and sustainability-focused construction programs. According to the Government of Canada's January 2026 report, the total investment in building construction reached USD 24.5 billion in November 2025, with public infrastructure accounting for a significant share of non-residential activity, supporting a steady demand for concrete and related admixtures. Moveover, the Housing Infrastructure and Communities of Canada report in September 2025 indicates that the nation continues to deploy funding under the Investing in Canada Plan, a long-term program of more than USD 180 billion supporting transportation, water, community infrastructure, and wastewater projects that rely on the performance specified concrete. These public investments are creating a stable and policy-driven demand for concrete admixture across Canada.

Europe Market Insights

The concrete admixture market in Europe is growing significantly and is driven by the stringent environmental regulations and major transnational infrastructure funding, balanced against a mature construction sector. The primary driver is the European Green Deal and its construction-specific directives, such as the Energy Performance of Buildings Directive recast and the proposed Construction Products Regulation, which mandate reductions in embodied carbon. This pushes the widespread adoption of admixtures that enable low clinker high performance concrete. On the other hand, the cohesion funds allocate significant billions for renovation and sustainable infrastructure, creating a direct demand. The key trend is the digitalization of construction, with admixture suppliers providing smart dosing systems and data services to optimize mix designs and ensure compliance.

The market in Germany is driven by the sustained public investment in transport and municipal infrastructure alongside strict regulatory standards governing construction quality and durability. According to the BAI August 2025 report, the highway railways, and energy infrastructure investment reached USD 400 billion, a significant portion of which is directed towards the maintenance and upgrading of existing assets, where the high-performance concrete and admixtures are specified. Besides, the Deutschland report in July 2025 indicates that in 2023 in 2023, nearly 300,000 houses and flats were built, and nearly 263,000 of these are new buildings, highlighting the rising consumption of the concrete admixtures and reflecting a strong demand in both the public and private sectors. These data reinforce consistent, specification-led demand for concrete admixtures across applications in the nation.

The UK concrete admixtures market is underpinned by the sustained public infrastructure investment and increasingly stringent performance and sustainability requirements in construction. As per the data from the Office of National Statistics in November 2025, the total construction new orders are expected to grow by 9.8%, nearly £1,078 million during Q3 2025, with the infrastructure accounting for a significant share of growth, mainly in transport utilities and public works. Besides, the Government of the UK report in February 2024 highlights that the National Infrastructure and Construction Pipeline outlines more than 660 projects with investments ranging from £700 to £775 billion over the next 10 years. These projects rely on durable high-performance concrete where admixtures are routinely specified. Further, these factors create a stable policy-driven demand environment for concrete admixtures in urban and commercial development projects in the UK.