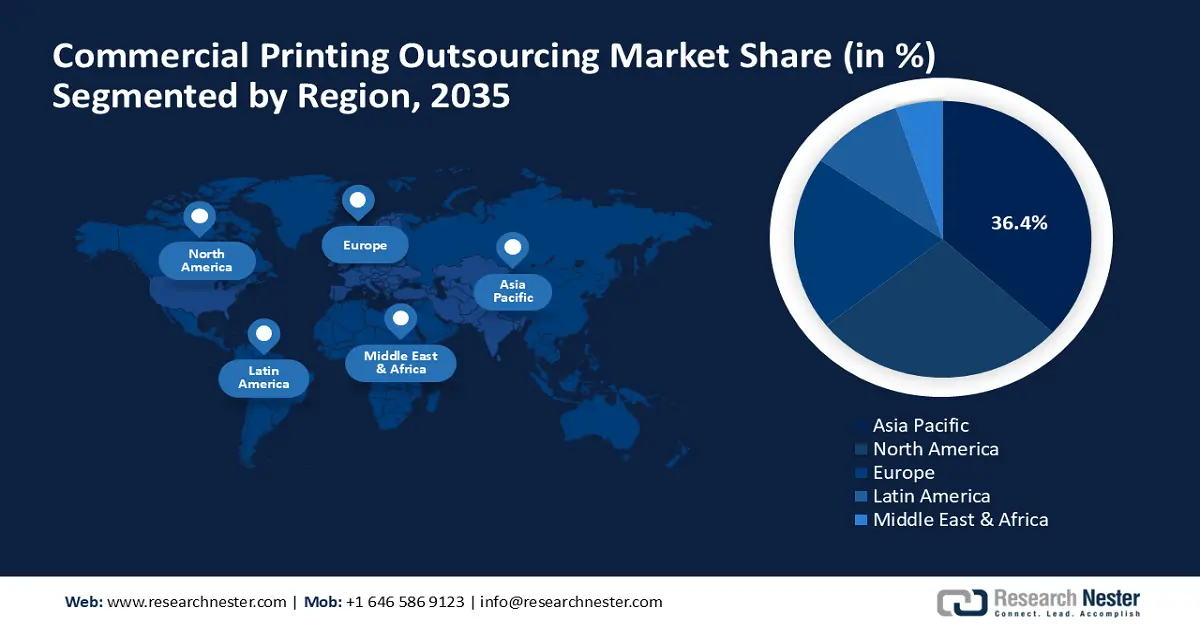

Commercial Printing Outsourcing Market - Regional Analysis

APAC Market Insights

Asia Pacific commercial print outsourcing market is predicted to hold a 36.4% market share throughout the forecast period on the back of e‑commerce scale, rapid product cycles, and regional fulfillment networks. Commercially, integrated stacks that reduce deployment overhead and accelerate localization are differentiating outcomes for learner teams. As a result, packaging, POS, and logistics providers are well‑placed to seize growth with quantifiable efficiency gains.

China is expected to capture a significant market share of APAC through localization, platform ecosystems, and managed access patterns for ruled manufacturing. From a policy lens, national strategies are tightening governance over AI use, data flows, and content provenance in commercial operations. In August 2025, China’s State Council advanced the “AI Plus” Action Plan to embed AI across manufacturing, media, and public services alongside strengthened guardrails for trustworthy AI deployment and data security coordination. Consequently, vendors that align print‑plus‑digital workflows with state‑backed transparency, filing, and provenance expectations are best positioned to scale under China’s evolving compliance regime.

India is anticipated to be a significant driver of APAC growth as businesses regulate data governance and digitize print buying for compliant reach. In practice, codified consent, erasure, and grievance processes are becoming baseline selection criteria in enterprise RFPs. In July 2025, India published Draft Digital Personal Data Protection Rules to roll out the DPDP Act, 2023, which sets the stage for defining consent, erasure, and Data Protection Board procedures impacting marketing communications, print mailers, and data enrichment. As a result, suppliers with proof of consent provenance and trackable data use will become more popular among Indian enterprises and public‑sector tenders.

North America Market Insights

North America is forecast to record a CAGR of 8% from 2026 to 2035, aided by scale providers, integrated tech stacks, and public‑sector frameworks that standardize secure print. Strategically, centralized print management influences device consolidation, bid structures, and sourcing standards for agencies and enterprises. In July 2025, the U.S. General Services Administration updated government IT and print management assets, consolidating policies that direct outsourced print, secure print, and device consolidation with references to acquisition support and modernization initiatives. Providers aligned to federal standards and sustainability defaults are therefore poised to maintain share in regulated verticals.

The U.S. is positioned to lead with policy definitions on print governance, privacy, and data transfer standards. In procurement, national specifications and privacy guidance calibrate requirements for secure, efficient fleets and compliant, multi‑channel campaigns. In May 2024, the U.S. State Department released its global digital policy strategy focusing on trusted data flows and platform responsibility, a standard frequently followed in business governance and cross‑border commerce. As a result, suppliers showing compliance with federal specs and privacy‑sensitive data flows will continue to be top picks for sophisticated, multi‑channel programs.

Canada industry is predicted to rise as privacy-protective data environments and cyber protection readiness guide enterprise print procurement. This growth is driven by the increasing demand for secure and compliant data handling. Practically, trusted data and platform accountability expectations shape vendor qualification and cross-border transfer architectures. Accordingly, compliant, consolidated platforms demonstrating cross-border protections should grow in Canadian retail, financial services, and public-sector accounts.

Europe Market Insights

Europe commercial printing outsourcing market is predicted to experience continued growth from 2026 to 2035, with characteristic robust consumer protection and advertising equity regimes. In practice, clearer subscription, disclosure, and packaging obligations are elevating documentation standards for print‑plus‑digital deliverables. In April 2025, consequential regulations to the Digital Markets, Competition and Consumers Act 2024 were passed in the UK, facilitating CMA enforcement on digital markets and consumer protection with effects on advertising transparency and unfairness. Thus, providers incorporating auditability and brand‑safety controls across print‑plus‑digital deliverables are expected to increase share in Europe.

Germany is likely to maintain a dominant position throughout Europe due to its industrial B2B base and high bar for reliability and auditability on enterprise procurements. From a policy standpoint, the federal push on digital infrastructure and sovereign cloud is setting modernization guardrails for enterprise selection. In 2025, Germany's formal guidance also emphasized the country’s drive for digitization and a sovereign administrative cloud with infrastructure acceleration, as tagged as first‑order public interest through to 2030, simplifying approvals and planning for national connectivity and secure services. As a result, suites with lifecycle assurance and context‑secure data access move more easily through German RFPs where governance is a stringent requirement.

The UK is forecasted to significantly contribute to Europe’s continued growth up to 2035 by merging innovation with more effective governance and identity verification across channels. In market terms, government‑led advertising and consumer‑protection initiatives are raising compliance bars for omnichannel promotions. In December 2024, the UK government’s Online Advertising Taskforce progress report reported a trial of Intermediary and Platform Principles to enhance ad compliance, such as removal of non‑compliant adverts and better age targeting, with future steps to integrate into ASA processes. As a result, suppliers that provide fast iteration with maintained auditability and brand protection will be poised to garner share in the UK.