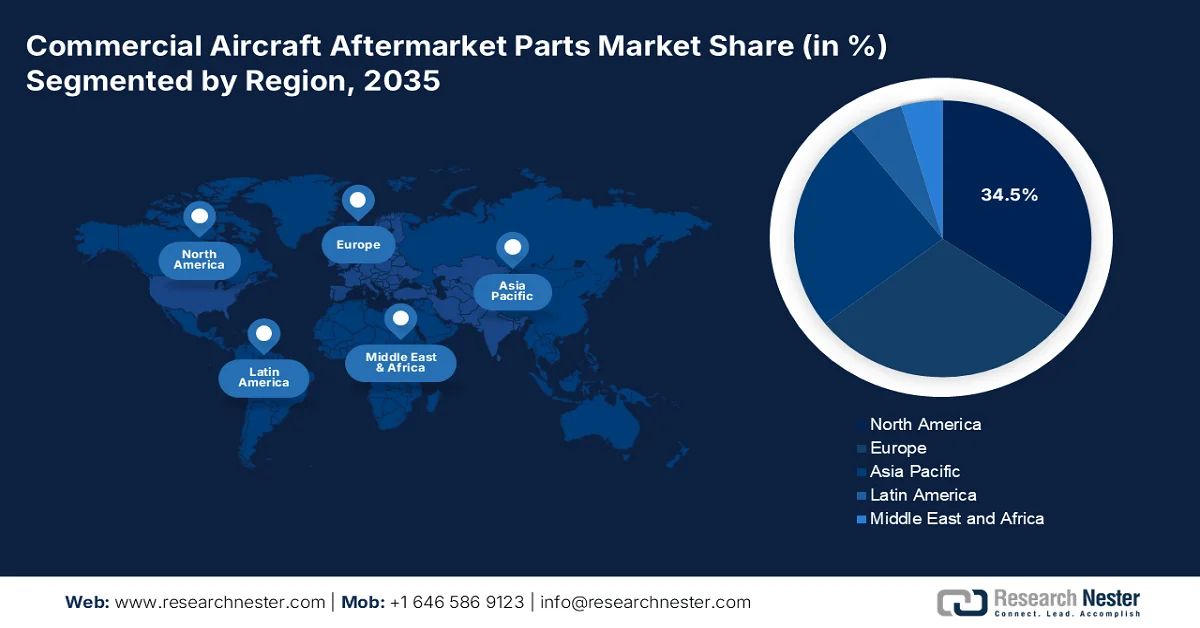

Commercial Aircraft Aftermarket Parts Market - Regional Analysis

North America Market Insights

The North America is dominating and the largest market expected to hold the regional revenue share of 34.5% by 2035. This leadership is due to the world’s largest MRO and airline fleet base centered in the U.S. The key drivers include the high concentration of the aging narrow-body aircraft requiring sustained heavy maintenance, robust FAA regulatory mandates driving the mandatory part replacements, and the presence of major OEMs and distributors. Moreover, the primary trend is the surging digitalization of supply chains and parts tracking supported by the federal investments in the U.S. in aviation R&D and infrastructure that enhance the aftermarket efficiency and predictability. Further, the presence of vast aerospace companies boosts the region’s position as the dominant hub for aftermarket parts and services.

The U.S. commercial aircraft aftermarket parts market is reinforced by the high fleet utilization, regulatory-driven maintenance, and expanding domestic supply capabilities. According to the Boeing December 2024 report, there are nearly 7,900 active aircraft in 2024, with narrowbody aircraft dominating the domestic operations and driving the higher replacement rates for wheels, brakes, and avionics. Further, the passenger volumes are also rising, increasing the demand, increasing the flight cycles, and increasing the number of mandatory maintenance events. Supporting this demand, the industry investments are strengthening the capacity for the aftermarket. In November 2025, Avcon Industries’ 33,000 square foot parts fabrication facility in Kansas will enhance the in-house manufacturing for replacement and modification components. Additionally, in July 2023, Marubeni’s acquisition of a 50% stake in Diversified Aero Services expands the U.S. distribution of expendable and rotable parts, supporting the sustained aftermarket growth and supply resilience. Overall, the rising traffic, regulatory oversight, and high aircraft utilization continue to anchor stable aftermarket growth in the U.S.

The market in Canada is experiencing steady growth, which is supported by the rising air traffic, cargo expansion, and strengthened regulatory policies. According to the Government of Canada, July 2025 data, in 2024, Canada airports handled 1.60 tonnes of air cargo, which is a 5.2% rise driven by e-commerce growth and route expansion, which increased aircraft utilization and parts replacement frequency. The passenger traffic also rose by 4%, with 57 million passengers screened at the eight largest airports, exceeding the pre-pandemic levels and indicating sustained operational intensity at major hubs. Moreover, the management of airspace by NAV Canada across a network of 1,900 certified airports further reflects the high aircraft movement levels. Transport Canada’s safety, security, and sustainability initiatives reinforce the demand for the continuous growth in Canada’s market.

APAC Market Insights

The Asia Pacific commercial aircraft aftermarket parts market is the fastest growing and is poised to grow at a CAGR of 6.5% during the forecast period 2026 to 2035. The market is driven by explosive fleet expansion to meet the rising passenger demand. The growth of the market is primarily fueled by the rapid procurement of new-generation narrow-body aircraft by low-cost carriers in Southeast Asia and India, which will mature into a significant aftermarket demand. Moreover, the key drivers include supportive government aviation policies such as India’s UDAN scheme, major investments in MRO infrastructure, and the strategic need for regional supply chain resilience. As airlines broaden their operations in the region, the demand for aftermarket parts and services is likely to rise significantly.

The market in India is expanding rapidly and is supported by the strong traffic growth, fleet expansion, and the regulatory-driven maintenance requirements. According to the Digital Sansad March 2025, India handled over 376 million air passengers in 2023 to 2024, reflecting sustained growth in the domestic and international operations that increased aircraft utilization and maintenance cycles. Besides, the rise in the commercial aircraft fleet is dominating the narrowbody platforms operating the high-frequency short-haul routes, surging the replacement demand for consumables, retables, and life-limited components. Moreover, the strict DGCA airworthiness and safety compliance aligned with the ICAO standards are reinforcing the demand for the market.

The large-scale fleet utilization, strong traffic recovery, and stringent regulatory oversight are supporting the China commercial aircraft aftermarket parts market. According to the People’s Republic of China in December 2024 report, China Airlines carried over 700 million passengers in 2023, marking a full recovery of domestic travel and driving higher flight cycles across the narrowbody fleets. Further, the rising air cargo and mail volumes are reinforcing the demand for freighter-related structural and systems components. On the other hand, Boeing's August 2024 report indicates that the commercial aircraft fleet exceeded 4,345, dominating the high-frequency short and medium-haul operations that accelerate the replacement of consumables, retables, and life-limited parts. Moreover, the continued enforcement of CAAC airworthiness directives aligned with ICAO standards ensures recurring, compliance-driven aftermarket demand, supporting steady market growth.

Europe Market Insights

The Europe commercial aircraft aftermarket parts market is defined by a mature, high-value fleet dominated by major network carriers and a robust network of independent MRO providers. A key driver is the region’s high fleet age, mainly for workhorse narrow providers. Further, the regulatory agencies, such as the European Union Aviation Safety Agency, are vital in boosting the market via safety and environmental regulations. The leading countries include France UK, and Germany, are featuring the competitive landscape for the key players in the region. The growth is further defined by the strong growth in the region’s freighter conversion market, driven by e-commerce, which generates a specific demand for cargo system parts and heavy structural modifications. Moreover, the sustained intra-European short-haul traffic is accelerating the replacement cycles, thereby reinforcing recurring aftermarket demand across the region.

Germany market is supported by the high aircraft utilization, strong cargo activity, and a well-developed aviation ecosystem. According to the IATA February 2025 data, the aviation industry contributes USD 142.7 billion to GDP and supports 1.5 million jobs, underscoring the sustained operational intensity across support airlines and MRO providers. Moreover, in 2023, the airports in Germany handled 4.7 million tonnes of air cargo, ranking the third largest cargo market, which drives the demand for freighter conversions, structural components, and cargo system parts. Passenger traffic remains predominantly international with 71.1 million international departures, and Europe accounts for 78% of outbound flows, sustaining the high narrowbody use and frequent maintenance cycles. Overall, the country has a steady market growth.

The UK commercial aircraft aftermarket parts market is defined by high international connectivity, intensive fleet utilization, and stringent regulatory oversight. According to the Government of the UK, December 2024 data, the UK airports handled 240.9 million passengers in 2023, with international travel accounting for the majority of traffic, sustaining high narrowbody and widebody utilization. Further, Heathrow Airport data in March 2024 reported that it alone managed 79 million passengers in 2023, reinforcing frequent maintenance and component replacement cycles. Besides, continued compliance with UK CAA and EASA-aligned airworthiness requirements ensures recurring, non-discretionary demand for certified aftermarket components across airlines and independent MRO providers.