Commercial Aircraft Aftermarket Parts Market Outlook:

Commercial Aircraft Aftermarket Parts Market size was valued at USD 30.1 billion in 2025 and is projected to reach USD 58.6 billion by the end of 2035, rising at a CAGR of 6.9% during the forecast period, i.e., 2026-2035. In 2026, the industry size of commercial aircraft aftermarket parts is estimated at USD 32.1 billion.

The global commercial aircraft aftermarket parts market is closely related to fleet size, utilization rates, and the regulatory maintenance requirements set by civil aviation authorities. According to the Indian Aerospace & Defense Bulletin September 2025 report, the global commercial aircraft fleet exceeded 28,000 aircraft in service with sustained utilization driven by the post pandemic traffic recovery and long-haul capacity restoration. Besides, the Airport Council International data in September 2023 indicates that the global scheduled passenger traffic reached 9.4 billion in 2024, directly increasing the demand for replacement parts, rotable components, and consumables required to meet mandatory airworthiness and continuing maintenance standards. Additionally, regulatory oversight from authorities such as the FAA and EASA mandates strict compliance with airworthiness directives and life-limited part replacement schedules, ensuring narrowbody and widebody fleets.

Further, the aging aircraft supports the demand for the market. As per the IATA December 2024 report, the global fleet average age has risen to a record 14.8 years, an increase from the 13.6 years average for 1990 to 2024. This indicates that the component replacement frequency rises materially due to fatigue limits and inspection findings. Moreover, the industry-wide maintenance, repair, and overhaul activity, of which parts procurement is the largest cost element, remains a priority for airlines and lessors. The IATA 2024 data estimates that the MRO expenditure is high, representing USD 104 billion in 2024, reflecting both high material prices and supply chain normalization efforts. Overall, the combination of MRO spending and the aging fleet is driving the sustained growth in the market.

Global MRO Spend vs Total Expenses and Revenues (2019-2024)

|

|

2019 |

2020 |

2021 |

2022 |

2023 |

2024 |

|

Global MRO Spend (USD Billion) |

82 |

50 |

62 |

79 |

94 |

104 |

|

% of Global Expenses |

10% |

10% |

11% |

11% |

11.1% |

11.5% |

|

% of Global Revenues |

10% |

13% |

12% |

11% |

10.3% |

10.8% |

Source: IATA 2024

Key Commercial Aircraft Aftermarket Parts Market Insights Summary:

Regional Highlights:

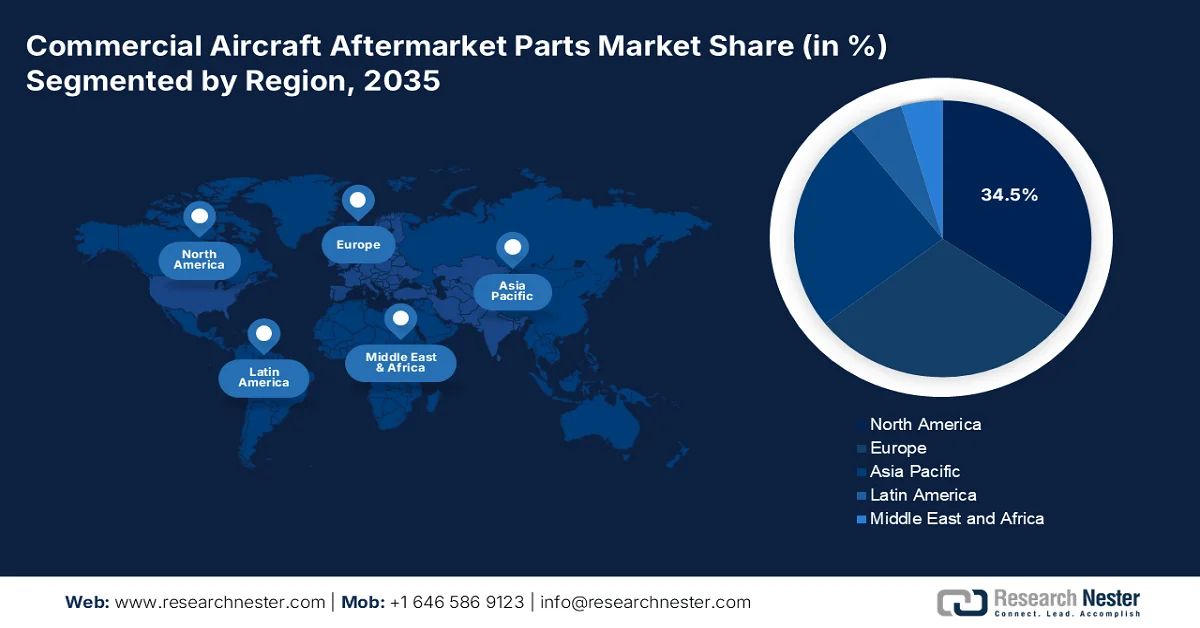

- North America is projected to command a 34.5% revenue share by 2035 in the commercial aircraft aftermarket parts market, supported by the world’s largest airline and MRO base, stringent FAA-driven replacement mandates, and extensive adoption of digitalized aftermarket supply chains.

- Asia Pacific is anticipated to expand at a CAGR of 6.5% during 2026–2035, underpinned by rapid fleet additions by low-cost carriers, government-backed aviation programs, and accelerated investments in regional MRO infrastructure.

Segment Insights:

- The commercial aviation sub-segment is expected to account for a dominant 75.6% share by 2035 in the commercial aircraft aftermarket parts market, strengthened by mandatory airworthiness compliance, rising aircraft utilization, and intensified heavy maintenance cycles.

- The MRO parts replacement sub-segment represents the largest product type share by 2035, reinforced by non-discretionary component replacement cycles, escalating regulatory directives, and increased overhaul frequency stemming from aging global aircraft fleets.

Key Growth Trends:

- Growth in active commercial aircraft fleet and utilization

- Aging fleet dynamics and expansion

Major Challenges:

- OEM dominance and design rights

- High capital intensity and inventory costs

Key Players: Boeing (U.S.), Airbus (Europe), GE Aerospace (U.S.), Raytheon Technologies (U.S.), Safran (France), Lufthansa Technik (Germany), AAR Corp. (U.S.), HEICO Corporation (U.S.), Honeywell Aerospace (U.S.), Rolls-Royce (UK), Satair (an Airbus Services company) (Denmark), Triumph Group (U.S.), MTU Aero Engines (Germany), Air France Industries KLM Engineering & Maintenance (France), AJW Group (UK), Mitsubishi Heavy Industries (Japan), Korean Air Aerospace Division (South Korea), Air Works (India), StandardAero (U.S.), Haeco (Hong Kong).

Global Commercial Aircraft Aftermarket Parts Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 30.1 billion

- 2026 Market Size: USD 32.1 billion

- Projected Market Size: USD 58.6 billion by 2035

- Growth Forecasts: 6.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (34.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, France

- Emerging Countries: India, Indonesia, Vietnam, Thailand, Malaysia

Last updated on : 6 February, 2026

Commercial Aircraft Aftermarket Parts Market - Growth Drivers and Challenges

Growth Drivers

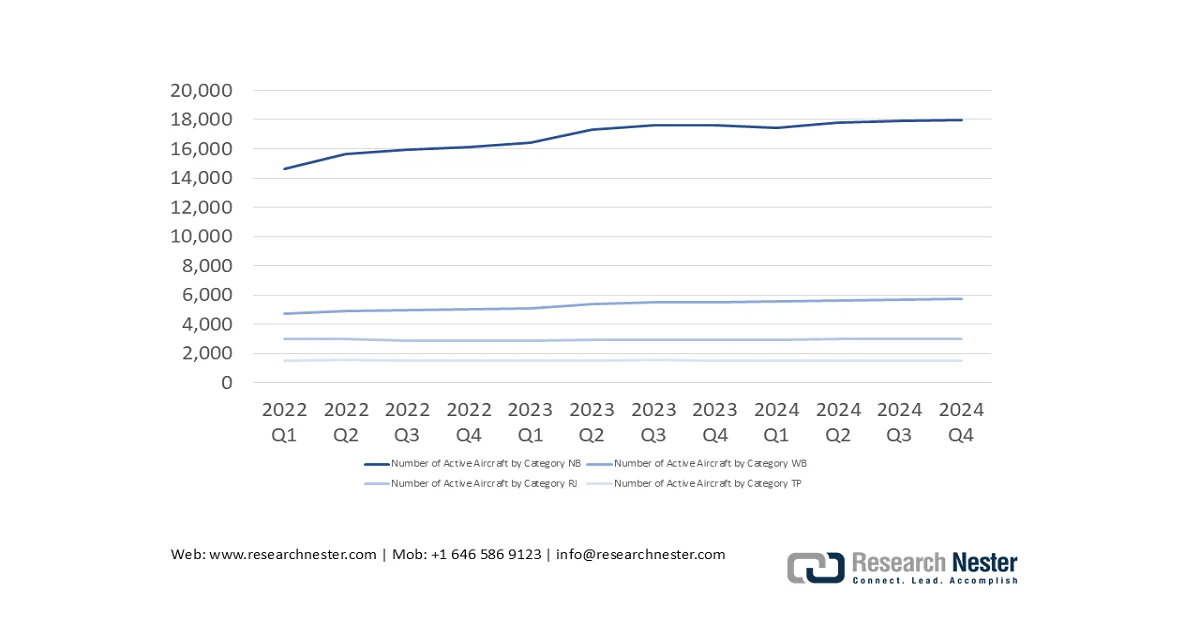

- Growth in active commercial aircraft fleet and utilization: The expansion and intensified use of the aircraft fleet are primary drivers for the commercial aircraft aftermarket parts market. According to the IATA 2024 data, the share of the global active aircraft remains steady at 85% in 2024, with the utilization rebounding strongly due to restored international routes and higher aircraft daily flight hours. Higher utilization directly stimulates the wear on engines, landing gear, avionics, and consumables, shortening the replacement cycles. Further, the report also indicates that the global revenue passenger kilometers is increasing by 8.0% annually, driving higher flight cycles per aircraft. For aftermarket suppliers, this translates into predictable demand growth tied to flight hour-based maintenance schedules rather than new aircraft deliveries.

Number of Active Aircraft by Category

Source: IATA 2024

- Aging fleet dynamics and expansion: The demand for the market is propelled by the growing installed base and increasing average age of aircraft. According to the IATA 2024 report, the global fleet in 2024 counted 33,271, which is set to increase by 1.9% every year, creating a large addressable market. besides a significant portion of the global fleet is aging, necessitating more intensive maintenance and heavier parts consumption for aging aircraft programs. This trend pushes the MRO providers and parts suppliers to stock legacy components while also integrating data analytics to predict the failure rates for older systems. Further, the surging need for structural repair and corrosion-related part replacements becomes a predictable demand stream for specific part categories.

- Growth in narrowbody fleets for short-haul and regional travel: The government reported traffic data shows a strong recovery in short-haul and domestic travel, driving the narrowbody aircraft utilization. Further, the ARSA 2022 to 2032 report depicts that the global commercial aircraft fleet is expected to be more than 28,000 aircraft, which is mainly driven by the narrowbody aircraft used on short and medium haul routes. Besides, the narrowbody aircraft have higher cycle counts, leading to faster replacement of brakes, wheels, avionics, and consumables. Additionally, the aviation authorities note that the higher takeoff and landing frequencies on short-haul routes stimulate fatigue wear, increasing the intervals and mandatory component replacement under the continuing airworthiness programs. Overall, the market demand is expected to grow faster for narrowbody platforms than for widebody aircraft over the medium term.

Narrowbody Fleet Summary

|

Region |

Fleet |

|

Africa |

430 |

|

Middle East |

505 |

|

APAC |

1,690 |

|

North America |

4,062 |

|

Europe |

3,931 |

Source: ARSA 2022 to 2032 report

Challenges

- OEM dominance and design rights: The original equipment manufacturers control the design data and intellectual property, often locking airlines into their parts ecosystems via restrictive contracts and power-by-the-hour agreements. This limits the addressable commercial aircraft aftermarket parts market for independents. A key battleground is the U.S. parts manufacturer approval process, which allows for alternative parts. Moreover, the active PMA demonstrates the ongoing efforts to boost competition. The modification and replacement parts association actively advocates for these rights, providing a collective voice for independent manufacturers against OEM dominance.

- High capital intensity and inventory costs: The parts market demands massive capital for inventory of slow moving high value parts to meet airline AOG service level agreements. This ties up finances and creates a significant risk. Top companies reduce this via advanced supply chain analytics and a vast global network, allowing them to optimize stock. Further, the top distributors hold inventory valued in the hundreds of millions of dollars, a barrier that prevents smaller players from competing on availability for a broad range of parts.

Commercial Aircraft Aftermarket Parts Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.9% |

|

Base Year Market Size (2025) |

USD 30.1 billion |

|

Forecast Year Market Size (2035) |

USD 58.6 billion |

|

Regional Scope |

|

Commercial Aircraft Aftermarket Parts Market Segmentation:

End user Segment Analysis

The commercial aviation sub segment is leading the end user segment in the market and is poised to hold the share value 75.6% by 2035. The segment is driven by the need to comply with mandatory airworthiness directives and scheduled checks to ensure fleet safety and reliability. The scale of this demand is witnessed in the U.S. Bureau of Transportation Statistics report in March 2023, indicating that the U.S. airlines transported an estimated 853 million passengers, a significant recovery from previous years, directly correlating to increased aircraft utilization and subsequent parts consumption for maintenance. This operational rebound solidifies the airlines' positions as the primary source of aftermarket demand. Further, the rapid expansion of aircraft leasing and the return of stored aircraft into active service are intensifying heavy maintenance visits, accelerating demand for certified aftermarket components and consumables across the commercial aviation segment.

Product Type Segment Analysis

The MRO parts replacement sub-segment holds the largest product type share as it encompasses the essential non-discretionary replacement of components to meet the strict regulatory maintenance schedules. This demand is inelastic and cyclical, driven by the flight hours and cycles. The critical volume of this activity is underscored by the regulatory oversight. The Federal Aviation Administration has issued new airworthiness directives, a key indicator of mandated inspection and replacement actions that directly fuel the MRO parts market. This continuous regulatory-driven requirement ensures the segments' sustained revenue dominance. Further, the aging global aircraft fleet and extended service life strategies adopted by the airlines are increasing the frequency and scope of component overhauls, further reinforcing the steady high volume demand for MRO parts replacement.

Aircraft Type Segment Analysis

The narrow-body aircraft is the leading segment in the commercial aircraft aftermarket parts market. The direct result of their massive global fleet size and high utilization on dense short to medium haul routes accelerates the wear and maintenance intervals. The fleet’s growth relies on Boeing’s June 2023 commercial market report, stating that the single-aisle aircraft accounted for over 75% of the projected global demand for new airplanes over the next 20 years, ensuring their installed base and thus their aftermarket parts consumption will continue to expand. This ongoing fleet expansion indicates the narrow-body segment’s long-term leadership in aftermarket part volumes. Moreover, the dominance of the low-cost carriers operating the narrowbody fleets with high daily flight cycles boosts the maintenance frequency, further driving the repeat aftermarket parts demand.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Component |

|

|

Aircraft Type |

|

|

Product Type |

|

|

Distribution Channel |

|

|

End user |

|

|

Material |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Commercial Aircraft Aftermarket Parts Market - Regional Analysis

North America Market Insights

The North America is dominating and the largest market expected to hold the regional revenue share of 34.5% by 2035. This leadership is due to the world’s largest MRO and airline fleet base centered in the U.S. The key drivers include the high concentration of the aging narrow-body aircraft requiring sustained heavy maintenance, robust FAA regulatory mandates driving the mandatory part replacements, and the presence of major OEMs and distributors. Moreover, the primary trend is the surging digitalization of supply chains and parts tracking supported by the federal investments in the U.S. in aviation R&D and infrastructure that enhance the aftermarket efficiency and predictability. Further, the presence of vast aerospace companies boosts the region’s position as the dominant hub for aftermarket parts and services.

The U.S. commercial aircraft aftermarket parts market is reinforced by the high fleet utilization, regulatory-driven maintenance, and expanding domestic supply capabilities. According to the Boeing December 2024 report, there are nearly 7,900 active aircraft in 2024, with narrowbody aircraft dominating the domestic operations and driving the higher replacement rates for wheels, brakes, and avionics. Further, the passenger volumes are also rising, increasing the demand, increasing the flight cycles, and increasing the number of mandatory maintenance events. Supporting this demand, the industry investments are strengthening the capacity for the aftermarket. In November 2025, Avcon Industries’ 33,000 square foot parts fabrication facility in Kansas will enhance the in-house manufacturing for replacement and modification components. Additionally, in July 2023, Marubeni’s acquisition of a 50% stake in Diversified Aero Services expands the U.S. distribution of expendable and rotable parts, supporting the sustained aftermarket growth and supply resilience. Overall, the rising traffic, regulatory oversight, and high aircraft utilization continue to anchor stable aftermarket growth in the U.S.

The market in Canada is experiencing steady growth, which is supported by the rising air traffic, cargo expansion, and strengthened regulatory policies. According to the Government of Canada, July 2025 data, in 2024, Canada airports handled 1.60 tonnes of air cargo, which is a 5.2% rise driven by e-commerce growth and route expansion, which increased aircraft utilization and parts replacement frequency. The passenger traffic also rose by 4%, with 57 million passengers screened at the eight largest airports, exceeding the pre-pandemic levels and indicating sustained operational intensity at major hubs. Moreover, the management of airspace by NAV Canada across a network of 1,900 certified airports further reflects the high aircraft movement levels. Transport Canada’s safety, security, and sustainability initiatives reinforce the demand for the continuous growth in Canada’s market.

APAC Market Insights

The Asia Pacific commercial aircraft aftermarket parts market is the fastest growing and is poised to grow at a CAGR of 6.5% during the forecast period 2026 to 2035. The market is driven by explosive fleet expansion to meet the rising passenger demand. The growth of the market is primarily fueled by the rapid procurement of new-generation narrow-body aircraft by low-cost carriers in Southeast Asia and India, which will mature into a significant aftermarket demand. Moreover, the key drivers include supportive government aviation policies such as India’s UDAN scheme, major investments in MRO infrastructure, and the strategic need for regional supply chain resilience. As airlines broaden their operations in the region, the demand for aftermarket parts and services is likely to rise significantly.

The market in India is expanding rapidly and is supported by the strong traffic growth, fleet expansion, and the regulatory-driven maintenance requirements. According to the Digital Sansad March 2025, India handled over 376 million air passengers in 2023 to 2024, reflecting sustained growth in the domestic and international operations that increased aircraft utilization and maintenance cycles. Besides, the rise in the commercial aircraft fleet is dominating the narrowbody platforms operating the high-frequency short-haul routes, surging the replacement demand for consumables, retables, and life-limited components. Moreover, the strict DGCA airworthiness and safety compliance aligned with the ICAO standards are reinforcing the demand for the market.

The large-scale fleet utilization, strong traffic recovery, and stringent regulatory oversight are supporting the China commercial aircraft aftermarket parts market. According to the People’s Republic of China in December 2024 report, China Airlines carried over 700 million passengers in 2023, marking a full recovery of domestic travel and driving higher flight cycles across the narrowbody fleets. Further, the rising air cargo and mail volumes are reinforcing the demand for freighter-related structural and systems components. On the other hand, Boeing's August 2024 report indicates that the commercial aircraft fleet exceeded 4,345, dominating the high-frequency short and medium-haul operations that accelerate the replacement of consumables, retables, and life-limited parts. Moreover, the continued enforcement of CAAC airworthiness directives aligned with ICAO standards ensures recurring, compliance-driven aftermarket demand, supporting steady market growth.

Europe Market Insights

The Europe commercial aircraft aftermarket parts market is defined by a mature, high-value fleet dominated by major network carriers and a robust network of independent MRO providers. A key driver is the region’s high fleet age, mainly for workhorse narrow providers. Further, the regulatory agencies, such as the European Union Aviation Safety Agency, are vital in boosting the market via safety and environmental regulations. The leading countries include France UK, and Germany, are featuring the competitive landscape for the key players in the region. The growth is further defined by the strong growth in the region’s freighter conversion market, driven by e-commerce, which generates a specific demand for cargo system parts and heavy structural modifications. Moreover, the sustained intra-European short-haul traffic is accelerating the replacement cycles, thereby reinforcing recurring aftermarket demand across the region.

Germany market is supported by the high aircraft utilization, strong cargo activity, and a well-developed aviation ecosystem. According to the IATA February 2025 data, the aviation industry contributes USD 142.7 billion to GDP and supports 1.5 million jobs, underscoring the sustained operational intensity across support airlines and MRO providers. Moreover, in 2023, the airports in Germany handled 4.7 million tonnes of air cargo, ranking the third largest cargo market, which drives the demand for freighter conversions, structural components, and cargo system parts. Passenger traffic remains predominantly international with 71.1 million international departures, and Europe accounts for 78% of outbound flows, sustaining the high narrowbody use and frequent maintenance cycles. Overall, the country has a steady market growth.

The UK commercial aircraft aftermarket parts market is defined by high international connectivity, intensive fleet utilization, and stringent regulatory oversight. According to the Government of the UK, December 2024 data, the UK airports handled 240.9 million passengers in 2023, with international travel accounting for the majority of traffic, sustaining high narrowbody and widebody utilization. Further, Heathrow Airport data in March 2024 reported that it alone managed 79 million passengers in 2023, reinforcing frequent maintenance and component replacement cycles. Besides, continued compliance with UK CAA and EASA-aligned airworthiness requirements ensures recurring, non-discretionary demand for certified aftermarket components across airlines and independent MRO providers.

Key Commercial Aircraft Aftermarket Parts Market Players:

- Boeing (U.S.)

- Airbus (Europe)

- GE Aerospace (U.S.)

- Raytheon Technologies (U.S.)

- Safran (France)

- Lufthansa Technik (Germany)

- AAR Corp. (U.S.)

- HEICO Corporation (U.S.)

- Honeywell Aerospace (U.S.)

- Rolls-Royce (UK)

- Satair (an Airbus Services company) (Denmark)

- Triumph Group (U.S.)

- MTU Aero Engines (Germany)

- Air France Industries KLM Engineering & Maintenance (France)

- AJW Group (UK)

- Mitsubishi Heavy Industries (Japan)

- Korean Air Aerospace Division (South Korea)

- Air Works (India)

- StandardAero (U.S.)

- Haeco (Hong Kong)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Boeing uses its OEM position to offer a comprehensive digital ecosystem via its Boeing Global Services Division. Its strategy centers on converting the part sales into long-term data-driven service agreements using data analytics from its vast fleet to predict part failures and optimize inventory, ensuring high fleet availability for its customers. According to the 2025 annual report, the company has made a revenue of USD 89,463 million.

- Airbus competes aggressively in the commercial aircraft aftermarket parts market via its services in the Airbus portfolio, aiming to expand its revenue share. A key initiative is the Skywise data platform, which analyzes in-flight data to enable predictive maintenance, allowing airlines to order parts actively and Airbus to streamline its aftermarket supply chain and logistics. In 2024, the company had a revenue of 69,230 million euros.

- GE Aerospace is also a top player in the market and is linked to its engine fleet. Its TrueChoice services indicate a strategic shift from selling individual parts to offering power by the hour contracts. By utilizing the advanced sensor data from its engines, GE predicts the parts' life and dispatches the replacements preemptively, maximizing engine uptime and creating a recurring service revenue model.

- Raytheon Technologies, via its Collins Aerospace and Pratt & Whitney units, is a dominant player in the commercial aircraft aftermarket parts market for avionics and engines. Its strategy involves vertical integration and digital tools such as Collins aerospace connecter services, which use operational data to monitor and ensure just-in-time part delivery, reducing the cost for operators.

- Safran is a key player in the market for landing systems, nacelles, and cabin interiors. Its strategic focus on expanding its services footprint mainly via Safran customer care programs. These offerings use data analytics for part condition monitoring and emphasize sustainable circular economy practices such as recycling and remanufacturing components to extend their lifecycle.

Here is a list of key players operating in the global market:

The commercial aircraft aftermarket parts market is defined by intense competition and consolidation, with the key players striving to enhance their market share via strategic acquisitions, long-term service agreements, and digital supply chain solutions. Established OEMs use their proprietary part certifications, while the large independent distributors compete via vast global networks and MRO partnerships. For example, in October 2024, VSE Corporation announced it had signed a definitive agreement to acquire Kellstrom Aerospace Group, Inc. Strategic initiatives are increasingly focused on sustainability, including parts recycling and remanufacturing programs, and investing in advanced inventory and data analytics to improve the availability and reduce the aircraft on ground times for airlines.

Corporate Landscape of the Commercial Aircraft Aftermarket Parts Market:

Recent Developments

- In January 2026, Adani Defence & Aerospace signed a Memorandum of Understanding (MoU) to develop an integrated regional transport aircraft ecosystem in India. The companies aim to collaborate on opportunities in aircraft manufacturing, supply chain, aftermarket services, and pilot training.

- In January 2026, Jet Parts Engineering announced that it had been acquired by TransDigm Group (NYSE: TDG), a leading global designer, producer, and supplier of highly engineered aircraft components.

- In June 2025, Toray Advanced Composites, Daher, and TARMAC Aerosave has announced the launch of a joint End-of-Life Aerospace Recycling Program for commercial aircraft production. Working with Airbus, this collaborative initiative will focus on advancing recycling technology practices in aerospace manufacturing by recovering and reusing end-of-life secondary structural components made from continuous fiber-reinforced thermoplastic composites.

- Report ID: 2239

- Published Date: Feb 06, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Commercial Aircraft Aftermarket Parts Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.