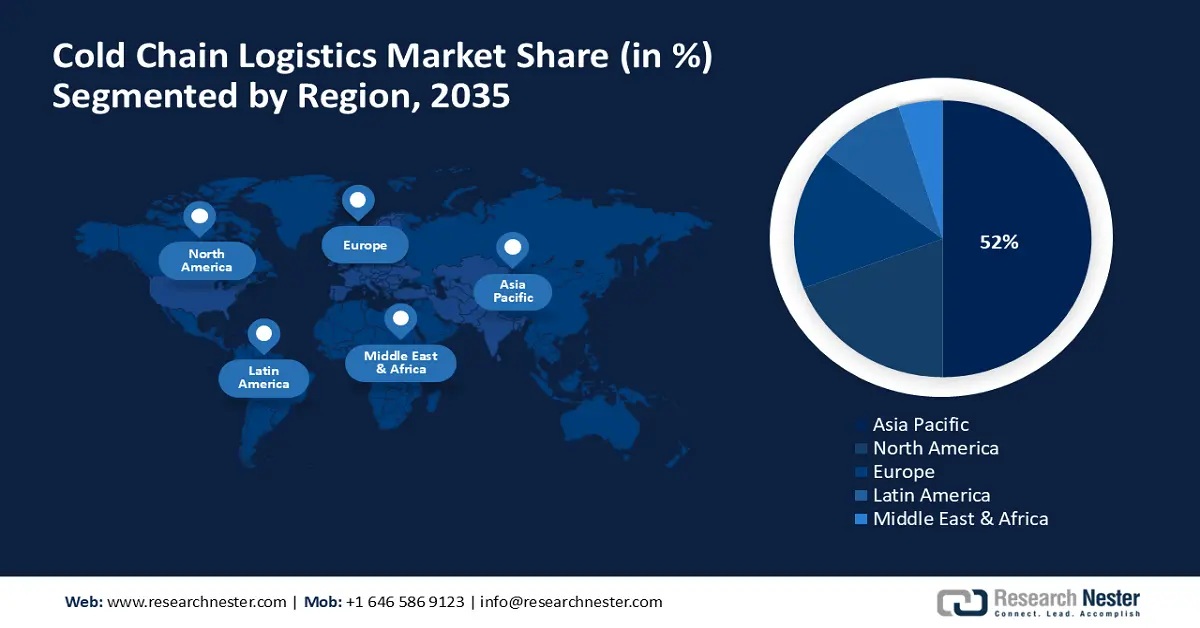

Cold Chain Logistics Market - Regional Analysis

Asia Pacific Market Insights

Asia Pacific cold chain logistics market is expected to capture an impressive market share of 52% by 2035, and thus be the world's largest and fastest-growing region. This is fueled by the rapid economic growth in the region, increasing disposable incomes, and a large, expanding middle class with a huge demand for fresh and high-quality foodstuffs. The absence of proper cold chain facilities throughout much of the region is both an opportunity and a challenge for development. The enormity of the market opportunity is drawing massive international investment.

China is a leading market, with its significant population and booming economy. The government has prioritized building a new cold chain logistics network as a national goal. China's State Council included cold chain logistics as a priority in January 2025's "14th Five-Year" Modern Logistics Plan in an effort to promote the growth of refrigerated rail, multi-modal corridors, and temperature-control networks in the last-mile segment. This top-down process is speeding up the creation of a world-class cold chain infrastructure.

India is a lucrative market in APAC with a vast agricultural economy and a burgeoning need for processed foods and pharmaceuticals. India's government is actively encouraging the growth of the country's cold chain infrastructure to minimize food waste and enhance the supply of safe and high-quality products. The market is dominated by a fragmented nature, with a combination of big players and small, regional operators. In July 2025, Snowman Logistics Limited commenced operations at a new warehousing facility in Kundli, Delhi NCR. This new facility, secured on a long-term lease, increases the company's capacity by 3,576 pallet positions, bringing its total to 154,330 pallets across 44 warehouses in 21 cities. Complementing its extensive warehousing network, Snowman also manages a fleet of 296 owned and over 325 leased refrigerated vehicles, providing comprehensive cold chain connectivity throughout the country.

North America Market Insights

North America cold chain logistics market is expanding at a strong CAGR of 14.8% between 2026 and 2035, led by high demand from consumers for fresh and frozen produce and a large and advanced pharmaceutical sector. The region hosts one of the largest cold chain logistics companies worldwide and is a center of innovation in cold chain technology. The growing use of e-commerce and grocery delivery online is also driving the demand for last-mile cold chain solutions. The dynamic nature of the market continues to evolve in response to the shifting demands of consumers and businesses.

The U.S is a prominent market in North America, boasting a highly advanced cold chain infrastructure coupled with a robust regulatory landscape. The government also plays an active role in aiding the industry with grants and research funding. In July 2025, the US Department of Agriculture released its most recent Food Supply Chain Infrastructure Spending report, which outlined grants to increase cold chain capacity for meat, dairy, and produce. This illustrates a willingness to fortify the country's food supply chain.

Canada cold chain logistics industry is also expanding steadily, underpinned by its large agricultural and food processing industries. Its government is funding the development of the cold chain infrastructure of the country in order to supply food and to drive the expansion of its overseas markets. Its enormous geography offers special logistical challenges and opportunities. In March 2025, the Canada government reiterated its commitment to strategic investments in national cold storage facilities for health and emergency response. This includes grants for vaccine distribution facilities that meet public health standards.

Europe Market Insights

The cold chain logistics market in Europe is expected to experience sustained growth through 2035, underpinned by a high emphasis on food safety, sustainability, and technology. The region boasts an advanced cold chain infrastructure and a strict regulatory environment that guarantees the quality and integrity of temperature-sensitive products. The growth in demand for organic and locally produced food is also fueling the need for more effective and clearer cold chain solutions. European consumers are some of the most demanding on the globe, propelling industry towards unprecedented levels of quality and service.

Germany is a dominant market in Europe, boasting a strong economy and a highly efficient logistics industry. The government of Germany is encouraging the use of sustainable and energy-efficient technology in the cold chain sector. In September 2024, Germany's Federal Ministry of Digital and Transport initiated grants for energy-efficient modernizations of refrigerated warehouses as well as green rail logistics in the agri-food supply chain. This is evidence of both economic efficiency and environmental stewardship.

The UK is another substantial market, with a well-developed and large food and pharma industry. The UK government is interested in improving the nation's food security and making its supply chains resilient. In June 2025, the UK National Cyber Security Centre unveiled a sectoral assurance program aimed at enhancing the resilience of food and pharma cold chains, such as collaborations for traceability, safety, and warehouse automation. This action is intended to create a stronger and more secure cold chain industry in the post-Brexit period.