Cold Chain Logistics Market Outlook:

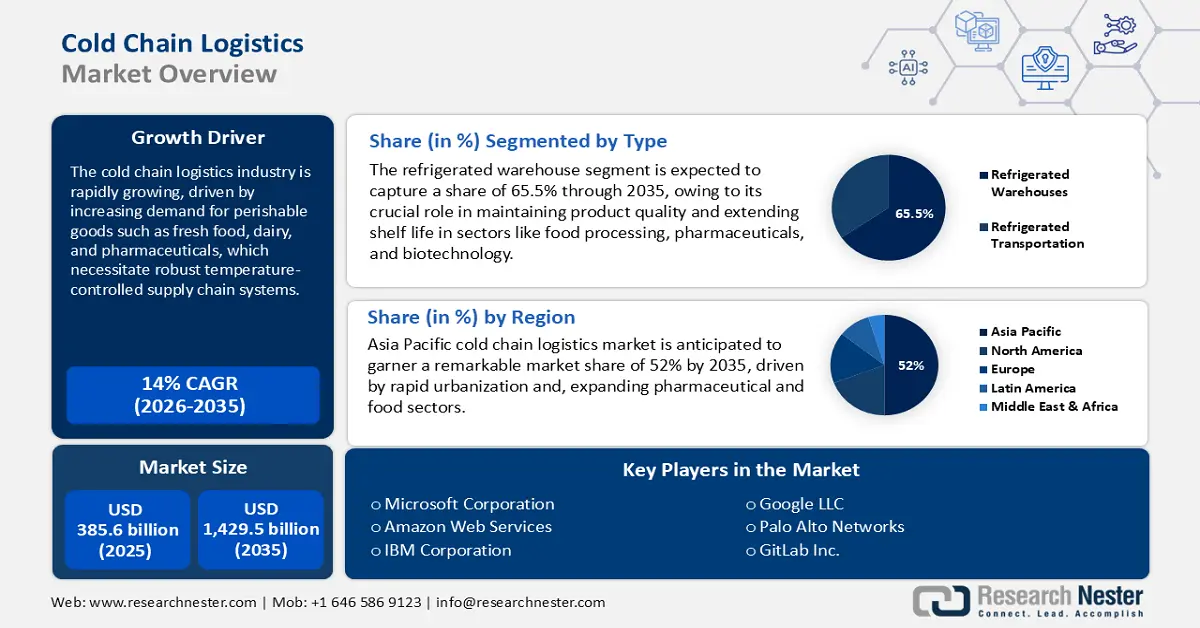

Cold Chain Logistics Market size was valued at USD 385.6 billion in 2025 and is projected to reach USD 1,429.5 billion by the end of 2035, rising at a CAGR of 14% during the forecast period, i.e., 2026-2035. In 2026, the industry size of cold chain logistics is assessed at USD 439.5 billion.

The cold chain logistics market is rapidly growing, driven by increasing global demand for temperature-sensitive goods, especially in the food and pharmaceutical industries. Underpinning this expansion are advancements in refrigeration technology, real-time tracking, and data analytics, which are reshaping the industry into a highly efficient and transparent system. In July 2025, Lineage Logistics grew its footprint in Canada through the acquisition and consolidation of three new cold storage facilities in Quebec, increasing its North America network for fruits, vegetables, and frozen products logistics. Growing consumer demand for fresh, high-quality items delivered on demand is also putting new strain on logistics providers to run their networks at maximum efficiency.

Government agencies across the globe are increasingly realizing the ultimate significance of an effective cold chain for economic stability, national security, and public health. It has precipitated a surge in new policies, investments, and regulatory frameworks to enhance cold chain infrastructure and facilitate the safe and reliable distribution of perishable products. In May 2024, the US White House published its National Cybersecurity Strategy Implementation Plan, which contains clear instructions for securing food and pharma cold chains by establishing resilience goals and cross-industry standards. These initiatives by the government are making the cold chain logistics sector more organized and secure, leading to innovation and stimulating investment in the private sector.

Key Cold Chain Logistics Market Insights Summary:

Regional Insights:

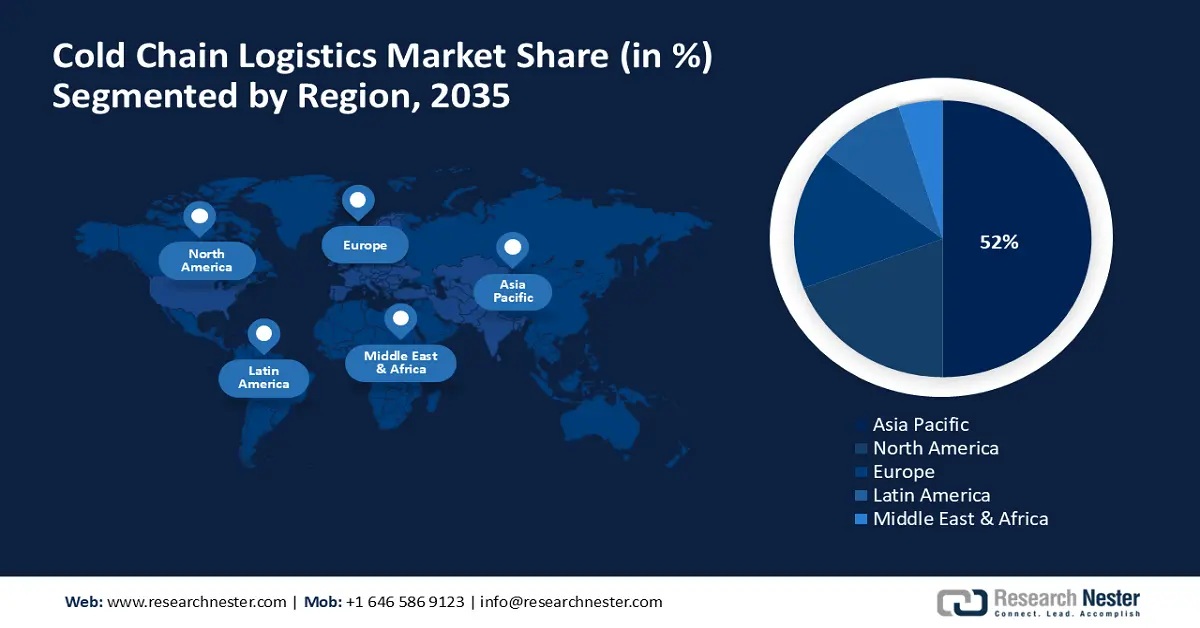

- Asia Pacific is projected to command 52% of the Cold Chain Logistics Market by 2035, supported by rapid economic expansion and rising middle-class demand for fresh and high-quality foodstuffs.

- North America is set to grow at a 14.8% CAGR during 2026–2035, underpinned by strong consumer preference for fresh and frozen goods and advancements in pharmaceutical cold chain systems.

Segment Insights:

- The refrigerated warehouse segment is expected to secure a 65.5% share through 2035 in the Cold Chain Logistics Market, propelled by extensive investments in expanded and upgraded temperature-controlled storage infrastructure.

- The dairy and frozen desserts segment is anticipated to hold a 38% share by 2035, bolstered by rising demand for premium and artisanal products.

Key Growth Trends:

- Increasing demand for perishable and temperature-sensitive products

- Technology upgrades in monitoring and automation

Major Challenges:

- Cybersecurity risks to digitalized supply chains

- Infrastructure and standardization gaps in emerging markets

Key Players: Americold Logistics, Lineage Logistics Holding LLC, DB Schenker, DHL Supply Chain, Nippon Express, Kuehne + Nagel International AG, Agility Logistics, CEVA Logistics, DSV A/S, NewCold Advanced Cold Logistics, Snowman Logistics, CJ Logistics, Linfox Logistics, Tiong Nam Logistics Holdings Bhd, VersaCold Logistics Services.

Global Cold Chain Logistics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 385.6 billion

- 2026 Market Size: USD 439.5 billion

- Projected Market Size: USD 1429.5 billion by 2035

- Growth Forecasts: 14% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (52% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Australia, Mexico

Last updated on : 26 September, 2025

Cold Chain Logistics Market - Growth Drivers and Challenges

Growth Drivers

- Increasing demand for perishable and temperature-sensitive products: Global demand for fresh produce, exotic fruits, and temperature-sensitive pharmaceuticals is the main growth driver for the cold chain logistics market. Increasing consumer demand for healthier and more varied diets is driving demand for trustworthy cold chain capabilities to carry perishable products over long distances. Increased emphasis in the pharmaceutical sector on biologics and vaccines that need to be controlled at strict temperatures is another key contributor. For instance, DHL, in July 2025, declared a strategic investment of EUR 2 billion to upgrade its life sciences and healthcare logistics services, such as the installation of fresh pharma cold storage facilities globally. This massive investment signifies the sector's reaction to increased demand for specialized cold chain solutions. This development is hence driving the logistics providers to increase their capacity and implement more advanced technologies.

- Technology upgrades in monitoring and automation: Technological innovations are transforming the cold chain logistics sector, making it more efficient, transparent, and reliable. The use of Internet of Things (IoT) sensors, artificial intelligence (AI), and blockchain technology is offering unparalleled visibility of the supply chain, where temperature monitoring and product tracking in real-time are possible. Automation in cold storage warehouses is also enhancing operational efficiency and minimizing the possibility of human error. In July 2025, CtrlChain and NewCold further strengthened their strategic alliance to introduce a digitally integrated solution encompassing cold warehousing, brokerage, and transport. The solution offers end-to-end orchestration of supply chains in Europe and North America, demonstrating the potential of technology in establishing a more integrated and efficient cold chain. Such integration is redefining the operational excellence benchmark in the sector.

- Strict regulatory standards and quality control: More stringent regulations controlling the storage and transportation of temperature-sensitive goods are a major force driving the cold chain logistics industry. The emphasis on traceability and quality control is also influencing the take-up of solutions that are capable of recording a full audit trail of a product's movement along the supply chain. In June 2025, new advice on safe cold storage, traceability, and compliance with legislation was published by the UK Department for Environment, Food & Rural Affairs, covering the poultry and processed-food industries. This advice mirrors the increasing importance placed on regulatory compliance as a fundamental element of cold chain management. Consequently, those companies that are able to prove a commitment to such high levels of standards are reaping the benefits of a competitive edge.

Opportunities Driving Cold Chain Logistics Market Growth

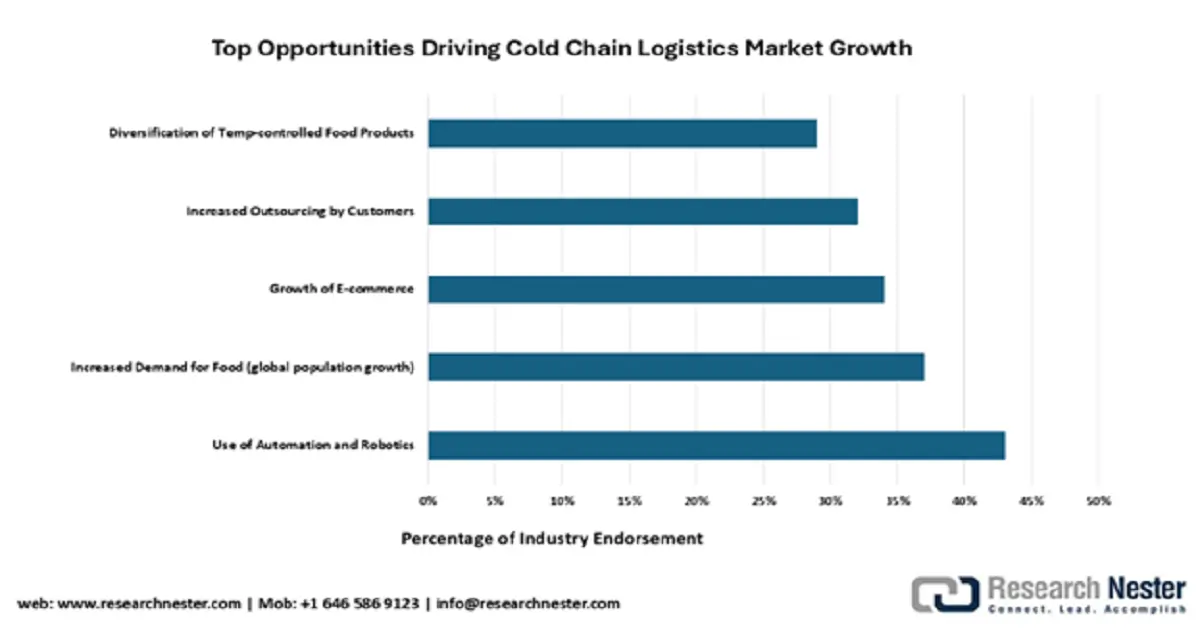

The cold chain logistics market is poised for significant transformation, led by automation and robotics which 43% of industry experts identify as the top opportunity to enhance efficiency and reduce spoilage. Growing global population demand and e-commerce expansion further drive need for scalable, temperature-controlled logistics solutions. These trends highlight a critical shift toward technology-driven, outsourced cold chain services to meet evolving consumer and regulatory demands for perishable goods integrity.

Source: GCCA

Challenges

- Cybersecurity risks to digitalized supply chains: As the cold chain logistics market continues to become digitalized, it thereby becomes exposed to cybersecurity risks. The dependence on interconnected systems to monitor and control the supply chain introduces novel points of entry for malicious individuals. A successful cyber attack would disrupt business, expose sensitive information, and even cause spoilage of temperature-controlled products, resulting in financial losses of considerable magnitude. The industry's complicated network of partners and suppliers adds to the dangers as well. In October 2024, the Canadian Centre for Cyber Security published its National Cyber Threat Assessment 2025–2026, which emphasized the necessity for new digital controls and traceability in temperature-sensitive supply chains. This assessment reinforces the increasing importance of cybersecurity as a key issue for the cold chain industry.

- Infrastructure and standardization gaps in emerging markets: As demand for cold chain logistics increases worldwide, however, most emerging markets lack the infrastructure and standardized procedures to accommodate a contemporary cold chain. Poor road systems, unstable power grids, and too few refrigerated storage facilities can pose major logistical challenges. Unclear standardized regulations and best practices among regions can also complicate cross-border trade and pose compliance issues. These infrastructure shortcomings could result in increased operational costs as well as more product wastage. In May 2025, the Ministry of Food Processing Industries of India published new national guidelines for Integrated Cold Chain and Value Addition Infrastructure. This move to encourage public-private investment in cold chains in refrigerated transport and storage recognizes the current infrastructure gaps and the imperative to come together to create a stronger cold chain ecosystem in the country.

Cold Chain Logistics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

14% |

|

Base Year Market Size (2025) |

USD 385.6 billion |

|

Forecast Year Market Size (2035) |

USD 1,429.5 billion |

|

Regional Scope |

|

Cold Chain Logistics Market Segmentation:

Type Segment Analysis

The refrigerated warehouse segment is expected to capture a share of 65.5% through 2035, forming the core of the cold chain logistics sector. These warehouses are necessary for the secure storage of a vast array of temperature-sensitive products, ranging from fresh fruits to pharmaceuticals. Increased demand for chilled and frozen foods, along with the complexities of modern global supply chains, are fueling major investments in the expansion and upgrade of refrigerated storage facilities. Sophisticated automation and energy-saving designs are emerging as major differentiators within this space. In March 2025, Lineage Logistics finalized the takeover of Bellingham Cold Storage in Washington State, acquiring three new facilities and expanding its seafood, meat, and processed food storage capacity. This deal is a part of the general trend of consolidation and capacity-building in the cold storage warehousing industry.

Application Segment Analysis

The dairy and frozen desserts segment is anticipated to hold a revenue share of 38% by 2035, based on robust consumer demand and the highly perishable nature of the product. The requirement for uniform temperature along the supply chain is paramount in maintaining dairy and frozen dessert product quality and safety. The segment's growth also finds support with rising demand for premium and artisanal products, which tend to require stricter temperature control. The intricacy of the segment calls for high-tech logistics and relentless quality control. For example, Americold Logistics acquired Safeway Freezers in Vineland, NJ, for $24 million in March 2025. It augmented its dairy, frozen dessert, bakery, and pharmaceutical storage capacity on the US East Coast, reflecting continued investment in infrastructure to serve this important application segment.

Process Segment Analysis

The pre-cooling facilities segment is estimated to hold a 36% market share through 2035, serving a vital function of increasing the shelf life of perishables. Pre-cooling refers to the quick elimination of heat from recently harvested crops prior to storage or transportation. It is a necessary process to reduce the respiration rate and enzymatic breakdown of fruits and vegetables, hence maintaining their quality and freshness. The increasing need for fresh, high-quality produce and the expansion of international trade are creating demand for sophisticated pre-cooling technologies. Johnson Controls, a global leader in building technologies, presented its latest pre-cooling innovations at ACREX 2025, featuring AI-driven smart controls tailored for agricultural cold storage. This development highlights the critical role of AI and smart controls in enhancing energy efficiency and product quality in pre-cooling operations, making it a key growth enabler for the segment.

Our in-depth analysis of the cold chain logistics market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Temperature Type |

|

|

Technology |

|

|

Process |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cold Chain Logistics Market - Regional Analysis

Asia Pacific Market Insights

Asia Pacific cold chain logistics market is expected to capture an impressive market share of 52% by 2035, and thus be the world's largest and fastest-growing region. This is fueled by the rapid economic growth in the region, increasing disposable incomes, and a large, expanding middle class with a huge demand for fresh and high-quality foodstuffs. The absence of proper cold chain facilities throughout much of the region is both an opportunity and a challenge for development. The enormity of the market opportunity is drawing massive international investment.

China is a leading market, with its significant population and booming economy. The government has prioritized building a new cold chain logistics network as a national goal. China's State Council included cold chain logistics as a priority in January 2025's "14th Five-Year" Modern Logistics Plan in an effort to promote the growth of refrigerated rail, multi-modal corridors, and temperature-control networks in the last-mile segment. This top-down process is speeding up the creation of a world-class cold chain infrastructure.

India is a lucrative market in APAC with a vast agricultural economy and a burgeoning need for processed foods and pharmaceuticals. India's government is actively encouraging the growth of the country's cold chain infrastructure to minimize food waste and enhance the supply of safe and high-quality products. The market is dominated by a fragmented nature, with a combination of big players and small, regional operators. In July 2025, Snowman Logistics Limited commenced operations at a new warehousing facility in Kundli, Delhi NCR. This new facility, secured on a long-term lease, increases the company's capacity by 3,576 pallet positions, bringing its total to 154,330 pallets across 44 warehouses in 21 cities. Complementing its extensive warehousing network, Snowman also manages a fleet of 296 owned and over 325 leased refrigerated vehicles, providing comprehensive cold chain connectivity throughout the country.

North America Market Insights

North America cold chain logistics market is expanding at a strong CAGR of 14.8% between 2026 and 2035, led by high demand from consumers for fresh and frozen produce and a large and advanced pharmaceutical sector. The region hosts one of the largest cold chain logistics companies worldwide and is a center of innovation in cold chain technology. The growing use of e-commerce and grocery delivery online is also driving the demand for last-mile cold chain solutions. The dynamic nature of the market continues to evolve in response to the shifting demands of consumers and businesses.

The U.S is a prominent market in North America, boasting a highly advanced cold chain infrastructure coupled with a robust regulatory landscape. The government also plays an active role in aiding the industry with grants and research funding. In July 2025, the US Department of Agriculture released its most recent Food Supply Chain Infrastructure Spending report, which outlined grants to increase cold chain capacity for meat, dairy, and produce. This illustrates a willingness to fortify the country's food supply chain.

Canada cold chain logistics industry is also expanding steadily, underpinned by its large agricultural and food processing industries. Its government is funding the development of the cold chain infrastructure of the country in order to supply food and to drive the expansion of its overseas markets. Its enormous geography offers special logistical challenges and opportunities. In March 2025, the Canada government reiterated its commitment to strategic investments in national cold storage facilities for health and emergency response. This includes grants for vaccine distribution facilities that meet public health standards.

Europe Market Insights

The cold chain logistics market in Europe is expected to experience sustained growth through 2035, underpinned by a high emphasis on food safety, sustainability, and technology. The region boasts an advanced cold chain infrastructure and a strict regulatory environment that guarantees the quality and integrity of temperature-sensitive products. The growth in demand for organic and locally produced food is also fueling the need for more effective and clearer cold chain solutions. European consumers are some of the most demanding on the globe, propelling industry towards unprecedented levels of quality and service.

Germany is a dominant market in Europe, boasting a strong economy and a highly efficient logistics industry. The government of Germany is encouraging the use of sustainable and energy-efficient technology in the cold chain sector. In September 2024, Germany's Federal Ministry of Digital and Transport initiated grants for energy-efficient modernizations of refrigerated warehouses as well as green rail logistics in the agri-food supply chain. This is evidence of both economic efficiency and environmental stewardship.

The UK is another substantial market, with a well-developed and large food and pharma industry. The UK government is interested in improving the nation's food security and making its supply chains resilient. In June 2025, the UK National Cyber Security Centre unveiled a sectoral assurance program aimed at enhancing the resilience of food and pharma cold chains, such as collaborations for traceability, safety, and warehouse automation. This action is intended to create a stronger and more secure cold chain industry in the post-Brexit period.

Key Cold Chain Logistics Market Players:

- Americold Logistics

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Lineage Logistics Holding LLC

- DB Schenker

- DHL Supply Chain

- Nippon Express

- Kuehne + Nagel International AG

- Agility Logistics

- CEVA Logistics

- DSV A/S

- NewCold Advanced Cold Logistics

- Snowman Logistics

- CJ Logistics

- Linfox Logistics

- Tiong Nam Logistics Holdings Bhd

- VersaCold Logistics Services

The cold chain logistics industry is a competitive and dynamic sector, characterized by the presence of large multinational operators and specialist smaller providers. Major players like Americold Logistics, Lineage Logistics, and DHL Supply Chain have a dominating presence in the market, using their strong worldwide networks and wide-ranging service packages. Companies are investing significantly in infrastructure and technology to remain competitive and to address changing customer needs. There is also a lot of merger and acquisition activity in the market as firms try to gain additional geographic reach and additional capabilities.

Several companies are investing in new technologies, including automation, IoT, and AI, to get more efficient, gain better visibility, and lower their environmental footprint. The need for green logistics is also increasing, including energy-efficient refrigeration, alternative fuels, and eco-friendly packaging. The move toward sustainability is not only a question of corporate social responsibility but also a major competitive edge. For instance, DSV A/S finalized its €14.3 billion purchase of DB Schenker in April 2025, bringing on board one of the globe's largest cold chain logistics platforms and broadening its multimodal advanced temperature-controlled solutions. The acquisition shows the trend in the industry toward consolidation and forming more holistic and integrated service offerings.

Recent Developments

- In May 2025, DHL Supply Chain opened its fourth cold-storage warehouse at its Florstadt, Germany health logistics campus as part of a $2.2 billion investment in medical and pharmaceutical logistics through 2030. The facility features multiple temperature zones, deep-freeze rooms, and supports cell/gene therapy supply chains.

- In April 2025, Lineage Logistics announced the $247 million acquisition of four Tyson Foods cold storage warehouses (in Pennsylvania, Kansas, Illinois, Arizona) and entered multi-year agreements to develop two automated cold warehouses. This expands Lineage’s US cold chain capacity and enhances automation and technology use.

- In March 2025, Americold Logistics announced the acquisition of a state-of-the-art cold storage facility in Houston, Texas for $127 million, including planned expansions. The deal adds 35,700 pallet positions to Americold’s warehouse portfolio and supports a new grocery retailer contract.

- Report ID: 4557

- Published Date: Sep 26, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Cold Chain Logistics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.