Cognitive Computing Market Outlook:

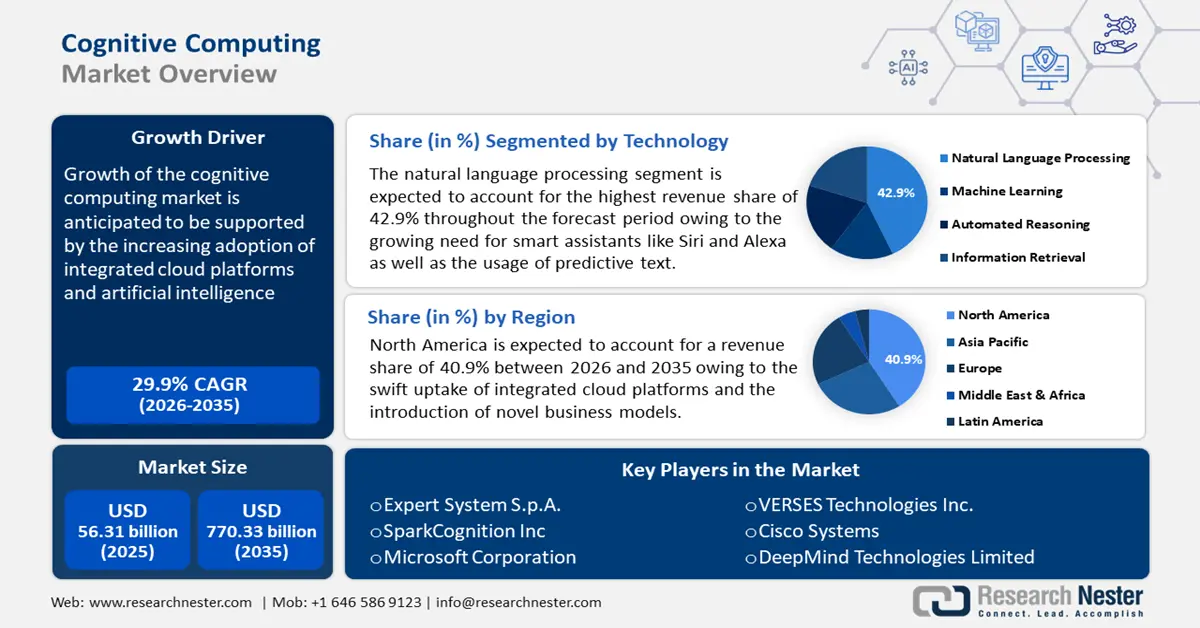

Cognitive Computing Market size was valued at USD 56.31 billion in 2025 and is expected to reach USD 770.33 billion by 2035, registering around 29.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of cognitive computing is evaluated at USD 71.46 billion.

The growth of the cognitive computing market is anticipated to be supported by the increasing adoption of integrated cloud platforms and artificial intelligence. By 2028, the cloud computing market will have grown to over USD 1 trillion globally. Robotic Process Automation (RPAs) is pertinent to public and private agencies interested in digitizing their records by the joint NARA Memorandum- M-19-21 and the Office of Management and Budget’s (OMB) transition to electronic records.

The memorandum has mandated agencies to electronically manage permanent and temporary records with the appropriate metadata. Governments are encouraging digitization as it requires organizations to move away from agency-operated records storage facilities and leverage RPAs. how cognitive technologies could automate Federal records management functions. The use of cloud-based cognitive technology by corporations is one of the new trends in the market. The potential of cognitive cloud computing to boost organizational effectiveness, save expenses, and raise income is advantageous to businesses. Businesses are also concentrating on deploying cognitive cloud computing solutions for supply chain optimization and product development.

Key Cognitive Computing Market Insights Summary:

Regional Highlights:

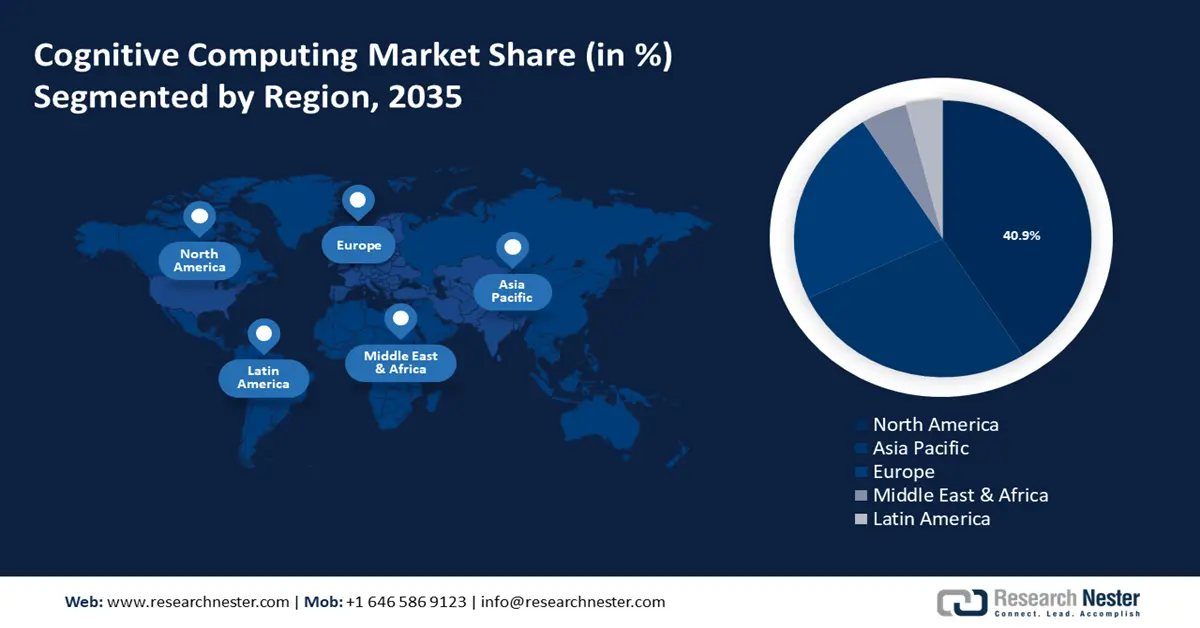

- North America cognitive computing market will account for 40.90% share by 2035, driven by swift uptake of integrated cloud platforms, novel business models, and strong government regulations on data security.

- Asia Pacific market will register stable CAGR during 2026-2035, driven by increasing internet usage, growth of startups, and technological advances like IoT and 5G adoption.

Segment Insights:

- The natural language processing segment in the cognitive computing market is projected to hold a 42.90% share by 2035, driven by the growing need for smart assistants and ability to analyze unstructured data.

- The cloud segment in the cognitive computing market is anticipated to experience lucrative growth till 2035, attributed to the emergence of integrated cloud storage and customized cloud solutions.

Key Growth Trends:

- Key enablers including IP upgrades and drop in sensor prices

- Emergence of neuromorphic edge computing

Major Challenges:

- Risks to data security

- High initial costs turned out to be an inhibiting factor

Key Players: Expert System S.p.A., SparkCognition Inc, Microsoft Corporation, VERSES Technologies Inc., International Business Machines Corporation, Cisco Systems, DeepMind Technologies Limited, SVT RoboticsTM.

Global Cognitive Computing Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 56.31 billion

- 2026 Market Size: USD 71.46 billion

- Projected Market Size: USD 770.33 billion by 2035

- Growth Forecasts: 29.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.9% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: China, India, Japan, Singapore, South Korea

Last updated on : 18 September, 2025

Cognitive Computing Market Growth Drivers and Challenges:

Growth Drivers

-

Key enablers including IP upgrades and drop in sensor prices: NARA experts estimate that there will be 75.44 billion devices by 2025 connected to the internet worldwide and over 30% of all data replicated or captured will be created in real-time. Firstly, the revolutionization of Internet protocol (IP) has resulted in forward-thinking perspectives on the integration of cognitive computing across industries. Typically, IP addresses use a 32-bit protocol but the abovementioned estimates have showcased total number of devices eventually would outstrip the protocol’s capacity of providing unique 4.3 billion addresses. The ratification of Internet version protocol 6 (IPv6) is anticipated to suffice the exponential growth of IoT devices.

Manufacturers are retrofitting devices with smart IoT sensors for collecting comprehensive data in real time to further pass it to developing ERP solutions. As more manufacturers strive to make their legacy systems more intelligent, the sensors and controllers market size has grown substantially and reached USD 6.1 billion in 2020, as per a Microsoft study. A 200% drop in sensor price from 2004, with USD 0.44 per sensor was recorded in 2018. Decreasing costs, coupled with ease of deployment have bolstered Wi-Fi connectivity since 2019. Furthermore, the AWS IoT pricing of MQTT and HTTP messaging is approximately USD 0.7 per million messages. - Emergence of neuromorphic edge computing: Two primary classes of cognitive computing systems are anticipated to emerge during the forecast timeline. The first can perform tasks without human intervention, including autonomous vehicles and drones. The second enables physicians to diagnose disease and perform surgery. Both classes of evolutionary AI hinge majorly on neuromorphic computing. It maps human functional capabilities using artificial neurons that map characteristics of the human brain.

Current tech leaders are best positioned to benefit from the emergence of neuromorphic computing, given the large capital appetite required to build and maintain complex models. The EU Human Brain Project supported the development of BrainScaleS and SpiNNaker to facilitate neuroscience simulations at scale. The EU-sponsored initiative proposed an online-learning digital spiking neuromorphic (ODIN), an optimized digital neuromorphic processor called has also been proposed for processing complex neuron models. Intel’s Loihi and IBM’s TrueNorth are examples of private advancements in the field, while academic efforts include DYNAPs, IFAT, Neurogrid, and BrainScales-2.

Conventional large-scale neuromorphic computers and chips are silicon-based and developed with metal oxide semiconductor technology. Despite this, there is significant R&D in using new materials such as ferroelectric, phase-change, non-filamentary, topological insulators, and channel-doped biomembranes neuromorphic implementations. Furthermore, rising number of connected devices powered by 5G and IoT has fostered investments in this area. In March 2024, Innatera secured an investment of USD 21.0 million to accelerate its progress on cognitive computing solutions, address the increasing need for sustainable computing solutions, and fuel innovation in the field of AI semiconductors. - Cognitive computing is becoming more and more necessary for predictive analytics to save operational expenses: The field of cognitive computing has experienced rapid growth due to advancements in artificial intelligence and computer science, and it is expected to continue expanding during the projected time. The primary goal of cognitive computing is to assist organizations in making decisions. Utilizing ML technologies such as predictive analytics, is the ideal approach to executing seamless corporate processes.

Many business users are using these powerful predictive analytics tools to perform routine business activities since they are effective tools for producing exact outcomes. It is projected that 30% of business procedures will be automated by the start of 2030. Predictive analytics solutions also boost revenue by recommending products and services to certain customers based on past data. These strategies are paying off by cutting the administrative expenses of the corporation.

Challenges

-

Risks to data security: Concerns about data security remain a major barrier to the cognitive computing market. Providers of cognitive computing solutions are primarily in charge of database administration and supervision. Databases hold financial data such as addresses, picture IDs, debit or credit card information, and a range of sensitive user data. Cybercriminals employ various tactics such as malware, Distributed Denial-of-Service (DDoS), phishing, and SQL injection assaults in an attempt to breach networks and obtain authentic user credentials.

- High initial costs turned out to be an inhibiting factor: The development of cognitive solutions necessitates a substantial initial investment to establish maintenance architecture and infrastructure, resulting in elevated operating expenses. The setup and operation process is far more involved and demands a lot of resources. A significant quantity of electricity, network components, data centers, and other resources are used in this process. Furthermore, it is anticipated that concerns about governmental regulations and ambiguous compliance would restrict the growth of the cognitive computing business. Due to SMEs' lack of understanding, the market is expected to face several difficulties.

Cognitive Computing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

29.9% |

|

Base Year Market Size (2025) |

USD 56.31 billion |

|

Forecast Year Market Size (2035) |

USD 770.33 billion |

|

Regional Scope |

|

Cognitive Computing Market Segmentation:

Technology Segment Analysis

The natural language processing segment in the cognitive computing market is projected to gain about 42.9% share through 2035. NLP's development has contributed to the global advancement of cognitive technology in IT infrastructure, in keeping with current trends. Furthermore, cognitive computing solutions are becoming more widely available due to the growing need for smart assistants like Siri and Alexa as well as the usage of predictive text.

The inherent ability to comprehend natural language exchanges is a major factor driving this market's expansion. A fundamental component of cognitive computing systems, natural language processing (NLP) technology aids in the analysis of unstructured data to meet the needs and expectations of customers. Therefore, NLP helps businesses gain better insights to optimize consumer perception, business processes, and operational costs, all of which drive the segment's growth. To enhance the consumer experience, major businesses are concentrating on implementing diverse marketing techniques, such as the introduction of new products.

Deployment Segment Analysis

Based on the deployment, the cloud segment in the cognitive computing market is likely to grow at lucrative CAGR during the forecast period. The emergence of novel data storage facilities, like integrated cloud storage facilities, and the development of customized cloud solutions, like private and public clouds, have supported market expansion. Additionally, owing to the exponential growth in data, organizations and corporations are turning to cloud services. The use of cloud solutions may present several opportunities for stakeholders to reduce the cost of cognitive computing. For instance, 90% of major businesses have implemented a multi-cloud infrastructure. Businesses utilize 2.6 public and 2.7 private clouds on average.

Our in-depth analysis of the cognitive computing market includes the following segments:

|

Technology |

|

|

Application |

|

|

Deployment |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cognitive Computing Market Regional Analysis:

North America Market Insights

North America industry is expected to hold largest revenue share of 40.9% by 2035. The swift uptake of integrated cloud platforms and the introduction of novel business models are credited with this expansion. Strong government regulations in the U.S. and Canada will probably encourage the importance of data security and hasten the regional rollout of these systems. For instance, in June 2023, Adobe Experience Cloud, underwent fresh advancements, according to Adobe, Inc. The new solutions maximized operational performance while enabling businesses to offer highly tailored experiences at every point of contact.

The U.S’ high growth rate can be ascribed to rising internet usage and the adoption of cognitive computing technologies by startups. Businesses, particularly in the US, have begun utilizing cognitive computing technologies to analyze massive amounts of data and produce better results. Latest technological breakthroughs, such as 5G and IoT have also aided in the boost of cognitive solutions in this region.

Asia Pacific Market Insights

Asia Pacific cognitive computing market is expected to experience a stable CAGR during the forecast period due to a few encouraging signs for the region's future including the rapidly increasing internet usage and the growing number of startups in China, Japan, Australia, India, and China. In 2022, the Asia-Pacific region's internet user base skyrocketed to over 2.6 billion.

In China, leading companies are using the potential of cognitive computing solutions, mostly due to the regional trend toward IoT and 5G as well as other technological improvements. Machine learning has significantly boosted regional growth by serving as a precursor to complementing cognitive solutions. Investments are anticipated to be encouraged by the rapid usage of machine learning in both developed and emerging economies.

The Japan cognitive computing market is expected to increase during the projected period due to the need to automate repetitive procedures in several industries, including healthcare, finance, and manufacturing, as well as the growing emphasis on tailored user experiences.

Cognitive Computing Market Players:

- IBM

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Expert System S.p.A.

- SparkCognition Inc

- Microsoft Corporation

- VERSES Technologies Inc.

- International Business Machines Corporation

- Cisco Systems

- DeepMind Technologies Limited

- SVT RoboticsTM

- Innatera

The leading companies in the industry are improving their services and platforms for cognitive computing. To enhance machine learning, automated reasoning, and natural language processing (NLP), they make significant investments in R&D. They are also customizing their products to fit the particular requirements of industries like healthcare, banking, retail, and more.

Additionally, they are working with industry professionals to provide customized solutions that let clients get the most out of their cognitive systems. In addition, the major firms are pushing cloud-based cognitive services to increase their scalability and accessibility. With the help of their global cloud infrastructure expansion, companies of all kinds may take advantage of cognitive computing without having to make large hardware investments.

Here are some leading players in the cognitive computing market:

Recent Developments

- In February 2023, SVT RoboticsTM partnered with VERSES Technologies Inc., to develop Robots with AI capabilities and deploy them in warehouses and distribution centers more quickly as a result of SVT's integration with VERSES' KOSMTM network operating system.

- In November 2021, IBM revealed more planned improvements to its Watson Discovery natural language processing (NLP) system. By revealing patterns and combining data from intricate papers, these planned upgrades aim to assist business users in sectors like finance, insurance, and law in improving customer service and expediting company procedures.

- Report ID: 6466

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Cognitive Computing Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.