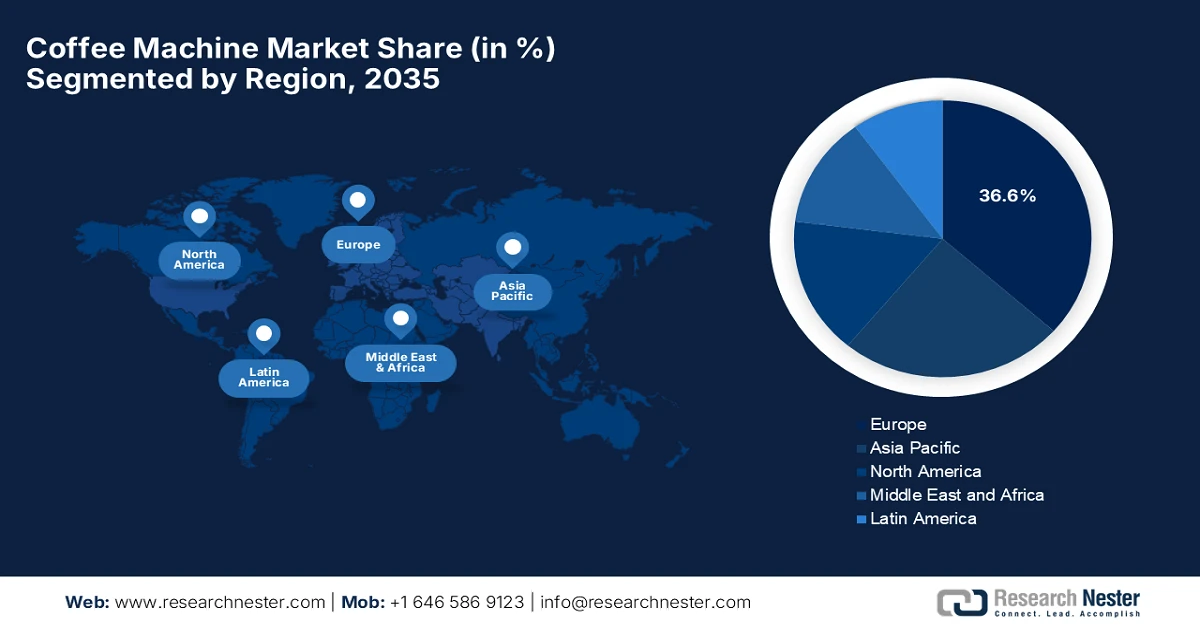

Coffee Machine Market - Regional Analysis

Europe Market Insights

Europe coffee machine market is anticipated to command the largest revenue stake of 36.6% by the end of 2035. The region’s prominence in this field is effectively propelled by the per capita coffee consumption and the heightened demand for specialty coffee. The presence of key coffee machine market players and their strategic activities is also propelling continued growth in the region’s market. In April 2025, Evoca announced that its Wittenborg W100 coffee machine won the prestigious red dot design award in the product category, which marks the company’s third consecutive design recognition. The company also stated that this award follows previous honors from the European Product Design Award and the iF Design Award, thereby emphasizing Evoca’s focus on innovation and excellence in product design. Furthermore, the W100 consists of a contemporary aesthetic with sleek, modular lines and soft corners, combining modern style with functional usability, hence creating coffee machines that are both visually attractive and technologically advanced.

Germany coffee machine market is growing on account of high consumer preference for fully automatic and capsule machines. The country’s market also benefits from a strong culture of specialty coffee consumption, technological innovation, and environmentally conscious purchasing decisions. In this context, in June 2025, Mahlkönig, which is a part of the Hemro Group, announced that it had acquired the Germany-based espresso machine startup Zenia, strengthening its presence in the high-end coffee machine segment. The acquisition allows Mahlkönig to expand its product portfolio with Zenia’s innovative espresso technology and design by targeting specialty coffee enthusiasts and premium home brewing sectors. In addition, this move also highlights the trend of established coffee equipment manufacturers investing in startups to drive innovation and capture growing demand for automated and specialty brewing solutions in this region.

The UK coffee machine market is witnessing interest in terms of convenience and specialty coffee at home, driving the adoption of these machines. Besides the trends such as smart home integration, energy efficiency, and customizable brewing profiles, influence consumer choices, fostering increased uptake. In this context, Majestic Coffee Ltd in January 2026 became a corporate partner of the UK Golf Federation, with a prime focus on enhancing hospitality experiences at golf clubs across the country. Also, the partnership leverages Majestic Coffee’s range of espresso machines, which includes fresh-milk bean-to-cup models, to improve beverage quality, member satisfaction, and profitability. In addition, by integrating high-quality coffee solutions into more than 1,500 venues, the collaboration supports golf clubs in boosting revenue, footfall, and overall visitor experience. Therefore, such initiatives will boost the country’s market by increasing demand for premium and specialty machines across commercial and leisure venues, expanding overall sales and consumer exposure.

APAC Market Insights

The Asia Pacific coffee machine market is expected to represent the fastest growth from 2026 to 2035. The region’s growth in this field is effectively propelled by urbanization, rising disposable incomes, and specialty coffee culture that is driving adoption. The aspect of international coffee trends, coupled with continued investments in modern brewing methods and fully automatic machines, is also positively influencing market expansion. In September 2025, Nescafé Dolce Gusto announced that it had launched its next-generation NEO coffee system in Japan and Korea, that is featuring SmartBrew technology, home-compostable pods, and smartphone connectivity for personalized brewing. This expansion targets the growing at-home café trend, offering seven coffee styles in one machine and introducing environmentally friendly pods to these industries, making it suitable for overall coffee machine market growth.

China coffee machine market is efficiently growing owing to the rising middle-class incomes and increasing exposure to Western coffee culture. Coffee chains and specialty cafés in the country are also promoting consumption, consistently stimulating household adoption. In this regard, Jetinno in October 2025 announced that it had inaugurated its new intelligent R&D and manufacturing base in Guangzhou, China, investing USD 40 million in a 68,000-square-meter facility. The plant features automated production lines, AI-based inspection systems, and in-house brewing and grinding component manufacturing, boosting capacity by more than 200% and ensuring high-quality output. Furthermore, it is equipped with a smart warehouse and advanced logistics; the facility supports worldwide delivery to more than 90 countries, reinforcing Jetinno’s position as a leader in innovative coffee equipment for both commercial as well as home use.

India coffee machine market is growing exponentially, facilitated by the growing trend of home brewing and the rising popularity of specialty coffee. Consumers in the country are shifting from traditional filter coffee makers to modern drip and automatic machines, attracting more investments from pioneers. The country’s market also benefits from work-from-home trends, smart home tech adoption, and exposure to global coffee culture, fueling demand for both basic drip machines and high-end automatic espresso makers. In February 2025, Kaapi Machines announced that it had launched the WMF Espresso NEXT, which is designed to deliver barista-quality espresso and a variety of specialty coffee beverages with precision and consistency. Furthermore, the launch showcases the company’s focus on enhancing the coffee experience and supporting the country’s growing café culture by bringing world-class equipment to the domestic businesses and homes.

North America Market Insights

The North America coffee machine market is mainly driven by strong consumer demand for convenience, premium home brewing experiences, and the growing café culture. Innovation in terms of smart and IoT-enabled coffee machines, along with rising interest in specialty coffee, encourages both residential and commercial adoption. In this regard, Keurig Dr Pepper, in March 2024, unveiled its next-generation Keurig coffee system, introducing K-Rounds plastic- and aluminum-free pods and the new Keurig Alta brewer to redefine home coffee brewing. Besides, the innovation enables consumers to prepare espresso, hot, and cold coffee using a single machine while eliminating traditional pod waste through plant-based, compostable materials. In addition, this multi-year initiative underscores the company’s focus on sustainability, convenience, and barista-style quality, shaping the future of single-serve coffee in North America.

The U.S. coffee machine market is mainly propelled by busy lifestyles and a growing preference for at-home café-quality coffee. The country’s market also benefits from the proliferation of specialty coffee culture and subscription services for beans and pods, which efficiently boost the demand for premium machines. In June 2024, Olympia Express partnered with Siemens Digital Industries Software to modernize the design and production of its handcrafted espresso machines, utilizing the Siemens Xcelerator portfolio. The company also stated that by adopting Solid Edge, Teamcenter, and NX CAM, the company reduced prototyping efforts by around 50% and increased productivity by up to 30%, thereby freeing resources for innovation. Hence, this digital transformation supports both the development of new products, such as the Mina portable espresso machine, and the servicing of legacy machines, solidifying the company’s blend of Swiss precision, sustainability, and long-term product durability.

Canada coffee machine market is also growing continuously, facilitated by the trend of work-from-home setups and the adoption of smart kitchen appliances, which is accelerating the uptake of high-end coffee machines. Local retailers and manufacturers in the country are focused mainly on machines that combine automation with sustainable features. This shift is also supported by the rising preference for in-home café experiences, as consumers are opting for professional-grade brewing without visiting cafés. Manufacturers are integrating connected features, programmable settings, and energy-efficient designs with a prime focus on aligning with smart home ecosystems. In addition, sustainability initiatives, such as recyclable brewing formats, are also gaining prominence in product offerings. Therefore, the presence of all of these factors is reinforcing long-term demand for premium and technologically advanced coffee machines across households in Canada.