Server Market Outlook:

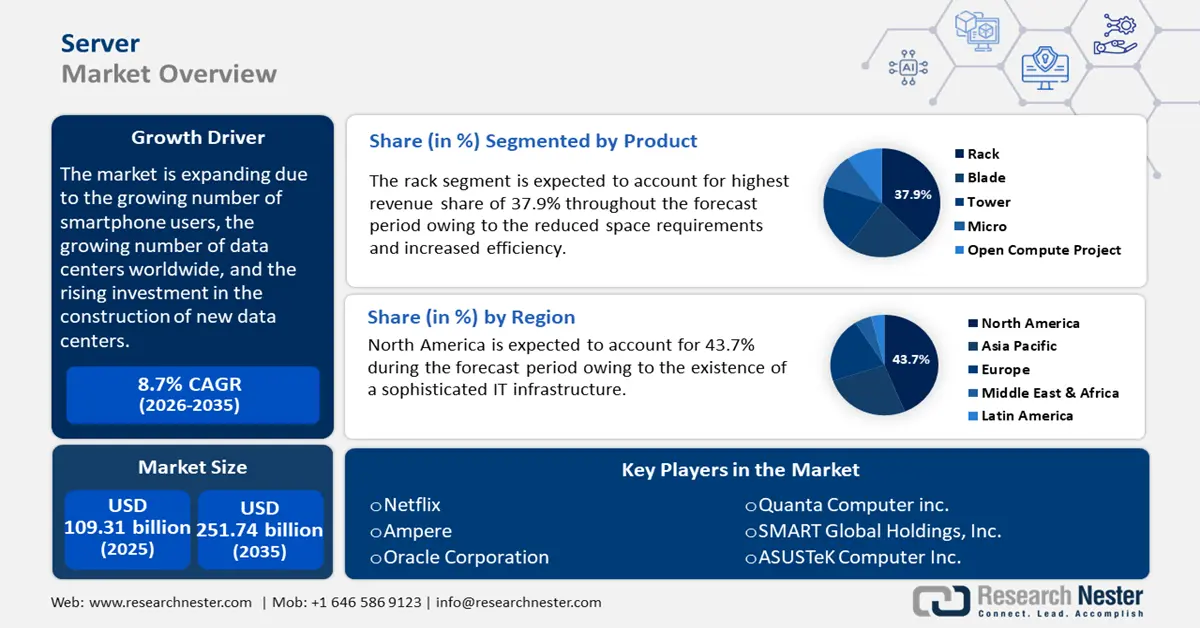

Server Market size was valued at USD 109.31 billion in 2025 and is likely to cross USD 251.74 billion by 2035, expanding at more than 8.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of server is assessed at USD 117.87 billion.

The server market is expanding due to the growing number of smartphone users, the growing number of data centers worldwide, and the rising investment in the construction of new data centers. For instance, spending on IT data centers is projected to reach USD 222 billion globally in 2023.

As companies digitize their operations, explore ways to maximize profits, and seek the longstanding resiliency of their business models, server infrastructure has reformed from cost to asset and generates tangible returns on its investments. With the depreciation of old servers and added cumulative maintenance costs, IT leaders have impelled procurement of public cloud alternatives. Historically, the exorbitant total cost of ownership (TCO) of on-premise servers has influenced IT decision-makers to decommission and rationalize server replacements. In 2023, direct digital transformation continued over 50% of overall ICT investments and this shift in the market dynamics is expected to proliferate the adoption of modern server infrastructure leading to revenue growth and operating profits for businesses, in turn, proliferation.

Key Server Market Insights Summary:

Regional Highlights:

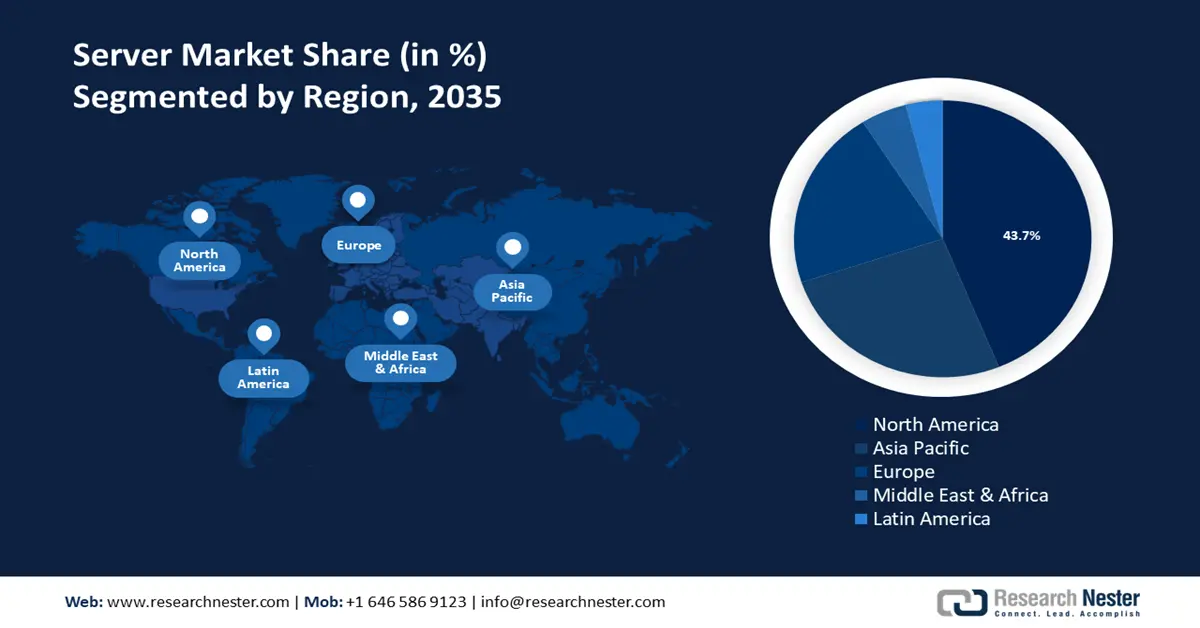

- North America’s 43.7% share in the server market dominates due to the existence of a sophisticated IT infrastructure, propelling demand through 2026–2035.

- The Asia Pacific server market is experiencing stable growth through 2035, driven by the increasing industrial infrastructure development and the rise of the start-up culture in the corporate sector.

Segment Insights:

- The IT & Telecom segment is projected to hold a 40.7% share of the Server Market by 2035, fueled by growing infrastructure development to meet rising data demands.

- The Rack Segment is expected to achieve a 37.9% share by 2035, propelled by reduced space requirements and increased efficiency.

Key Growth Trends:

- Prominent advancements in Rack PDU Power

- Shift away from cloud to on premise as a part of sustainability efforts

Major Challenges:

- Security concerns

- Lack of supply chain

- Key Players: Netflix, Ampere, Oracle Corporation, Quanta Computer inc., SMART Global Holdings, Inc., ASUSTeK Computer Inc., Cisco Systems, Inc., Huawei Technologies Co., Ltd., Intel Corporation.

Global Server Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 109.31 billion

- 2026 Market Size: USD 117.87 billion

- Projected Market Size: USD 251.74 billion by 2035

- Growth Forecasts: 8.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (43.7% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 14 August, 2025

Server Market Growth Drivers and Challenges:

Growth Drivers

- Prominent advancements in Rack PDU Power: Many data centers often have their bottom lines due to the lack of intelligent and cutting-edge rack power distribution unit (PDU)-based metering for addressing power quality issues. data centers typically face challenges in obtaining power-quality data at the rack level due to the lack of sufficient information from PDUs, inevitably leading to compromised performance and safety. This underscores the need for a robust solution that delivers comprehensive and precise power-quality data.

Usually, in most data centers the IT load uses 40% of the power load and uses several power chain designs to regulate power efficiency to reduce the risk of outages. The next-generation rack PDUs are being designed with advanced built-in power quality diagnostic tools to ensure the optimal fault tolerance level at both the inlet and outlets. With the development of these switch-mode data center power supplies, there have been regulations defined to standardize their operation and one such policy includes Curve by the Computer and Business Equipment Manufacturers Association (CBEMA) as a part of the Information Technology Industry Council (ITIC).

Furthermore, the U.S. Energy Star program has outlined detailed specifications for data center equipment. However, while Energy Star applies to the latest power supply requirements, the older devices are transitioning to ensure compliance to avoid lower power factors and total harmonic distortion. This is particularly true for non-major server vendors and older servers. The server market is marked by numerous investments and development of modern servers. Legrand’s Raritan and Server Technology product portfolio has a range of intelligent rack PDU models that comprise the Server Technology PRO4X and the Raritan PX4 with built-in advanced power rack quality metrics. In February 2024, Exagate launched its 2nd Generation Intelligent PDU featuring an IPS LCD for improved lifespan and state-of-the-art features to cater to evolving needs of modern IT infrastructure. - Shift away from cloud to on premise as a part of sustainability efforts: A highlight from the Earth March 2024 report says that only 22.3% of the overall e-waste generated in 2022 was formally documented and recycled in an environmentally sound manner. The year’s e-waste mass left U.S. USD 62 billion worth of unaccounted recoverable natural resources. The global annual e-waste generation is swelling at 2.6 million tonnes and is on track to surpass 82 million tonnes by 2030, states UNITAR. It further discusses an anticipated drop in the recycling rate from 22.3% in 2022 to 33% by the end of 2030. Unrecycled e-waste potentially mercury contamination and associated health risks.

More end use industries including healthcare, communications, IT, and automotive have identified environmental compromises and challenges associated with on-premise servers and are adopting cloud-based. Cloud computing offers several offers software as a service, software storage, software backup, and cloud hosting solutions. Cloud servers enable greater scalability, unrestricted access to processing power, and ease of memory and space upgrades to accommodate increased user counts. These features make cloud servers perfect for expanding enterprises. - Proliferation of 5G technologies: The adoption of 5G technology is expected to result in a notable rise in server demand. Higher bandwidth, reduced latency, and quicker data transfer rates are offered by 5G networks, which will increase data traffic volumes and open the door to new services and applications including improved IoT solutions, augmented reality (AR), and virtual reality (VR). Servers need to be able to handle the increased data load and have the computing power to enable these improvements. The increasing requirement for dependable and robust servers is necessary to manage increased network capacities and guarantee the smooth delivery of state-of-the-art services and applications.

Challenges

- Security concerns: Cybercriminals are increasingly using security lapses and cyberattacks as means of stealing or interfering with online business operations, misusing consumer data, or intercepting online transactions. Deploying strong counterattack software is crucial for organizations to mitigate the risk of future security vulnerabilities. As a result, the server market's growth is being restrained by the growing number of cyberattacks and security vulnerabilities.

- Lack of supply chain: Production and shipment timelines for servers have been significantly hampered by supply chain interruptions and shortages of components. Critical server components are less readily available due to delays and higher costs brought on by shortages of semiconductors and logistical issues. While producers have progressively increased their production capacity and adjusted to these supply-side challenges, the continuous requirement for prompt and effective component sourcing affects production schedules and worldwide server shipment dynamics, impeding server market expansion.

Server Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.7% |

|

Base Year Market Size (2025) |

USD 109.31 billion |

|

Forecast Year Market Size (2035) |

USD 251.74 billion |

|

Regional Scope |

|

Server Market Segmentation:

Product (Rack, Blade, Tower, Micro, Open Compute Project)

The rack segment in the server market is projected to gain about 37.9% share through 2035. Benefits from the rack server, like reduced space requirements and increased efficiency, are driving the segment's rise in a number of different industries. Rack servers are distinguished by their design, which calls for mounting in a rigid rack. Utilizing data from the organization's data center and computing environment at the organizational level, a rack server operates. This kind of server is incredibly dependable, scalable, and efficient. These servers make data center space more effectively utilized. Rack servers are similar to PCs, however they are wider in shape. They can be mounted using rails or screws.

Since it requires the least amount of money to install, it is regarded as the most cost-effective and efficient choice for this kind of server. Because of their design, rack servers are incredibly powerful, easy to install and maintain, and take up very little space. It is the perfect type for the demand of fewer servers because of its higher cooling capacity. For instance, in August 2023, with the AMD EPYC 4th Gen processor, HP unveiled the HPE ProLiant DL360 Gen11 server, designed to handle applications that require a high level of core density and performance. This server can support up to 96 cores per server.

End user (IT & Telecom, BFSI, Government & Defense, Healthcare, Energy, Others)

Based on the end user, the IT & telecom segment is likely to hold a 40.7% share of the global server market during the forecast period. The segment's growth is being accelerated by the IT and telecom industries' growing infrastructure development, which is a result of the world's population growing. In recent times, there has been a change in the IT and telecom sectors. Large databases created by the use of fixed-to-mobile broadband services and cloud-based services fuel the need for effective servers to maintain data.

The server market is also growing as a result of the deliberate development in the telecommunications sector and the growing numbers of mobile phone users. The market is expanding due to the top telecom providers' increasing development of mobile applications and multimedia capabilities, which increase demand for high-quality service.

Our in-depth analysis of the server market includes the following segments:

|

Product |

|

|

Enterprise Size |

|

|

Channel |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Server Market Regional Analysis:

North America Market Analysis

North America industry is likely to account for largest revenue share of 43.7% by 2035. The industry is expanding due to the existence of a sophisticated IT infrastructure, which is propelling the demand for servers. The market's demand is being driven by the increased presence of the major players in technology. The rising demand from regional countries' data centers for servers is driving the market growth. For instance, North America is in the lead with 62% of all data center investments made in 2023 and 69% of all data center investments made through April 2024.

As far as economies go, the U.S. leads the world. According to the United Nations Conference on Trade and Development's Digital Economy Report 2021, the nation is also home to 50% of the world's hyper-scale data centers. The Bureau of Economic Analysis also projects that in 2022, the actual value added to the digital economy will increase by 6.3%. This is anticipated to fuel the expansion of the U.S. server market during the forecast period, together with the existence of significant businesses like Microsoft, Hewlett Packard Enterprise Size Development LP, Dell Inc., and Amazon Web Services, Inc.

The integration of artificial intelligence, the Internet of Things (IoT), and sensors, together with Canada's growing inclination of big corporations towards cloud-based services rather than on-premise services, are propelling the server market's expansion throughout the country.

Asia Pacific Market Analysis

Asia Pacific server market is expected to experience a stable CAGR during the forecast period. Due to the increasing industrial infrastructure development and the rise of the start-up culture in the corporate sector, which is propelling the growth of the server market, the region is anticipated to see the fastest growth in the demand for servers. The expansion of the market in the area is being driven by the escalating rivalry between the producers and retailers of servers and related technologies.

Japan is one of the top nations in the world for technical advancement and uptake, which has greatly aided in the expansion of the national market during the projection period. Among the significant projects is the collaboration between NVIDIA and Mitsui & Co., Ltd. to allow pharmaceutical businesses in Japan to utilize the Tokyo-1 NVIDIA DGX supercomputer.

The India server market has grown as a result of various factors, including increased digitalization, the development of the digital economy, and government initiatives to encourage the use of cloud computing. To drive the nation's digital future, for example, the Data Security Council of India and Google unveiled a new program in November 2022 called Secure with Cloud, which aims to empower the government and public sector to adopt and transform the cloud.

Key Server Market Players:

- Dell Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Netflix

- Ampere

- Oracle Corporation

- Quanta Computer inc.

- SMART Global Holdings, Inc.

- ASUSTeK Computer Inc.

- Cisco Systems, Inc.

- Huawei Technologies Co., Ltd.

- Intel Corporation

Prominent industry companies are investing heavily in R&D to broaden their product offerings, which will support the further expansion of the server market. In addition, industry participants are taking a variety of strategic measures to expand their global reach. Notable changes in the market include new product launches, agreements, mergers and acquisitions, higher investment levels, and collaboration with other businesses. In order to thrive in a highly competitive and ever-changing market, the server business needs to offer products at fair prices.

Here are some leading players in the server market:

Recent Developments

- In May 2024, Ampere and Qualcomm collaborated to launch an arm-based AI server that powers data centers. Qualcomm's Cloud AI 100 Ultra AI inferencing processors and Ampere's CPUs for executing the models are the two firms' jointly announced AI-focused server launch collaboration.

- In May 2024, Netflix revealed its plans to advertise technology platforms. This puts it up against other major players in the market that have ad servers, such as Google, Amazon, and Comcast. The announcement constitutes a substantial shift in the streaming behemoth's advertising strategy. To develop its ad technology, the firm first collaborated with Microsoft. This allowed Netflix to enter the ad market swiftly and overtake competitors like Hulu, which has had its own ad server for more than ten years.

- In January 2023, NVIDIA introduced new AI-enabled server technologies in called the A100 Tensor Core GPUs, which offer improved performance for workloads related to AI and machine learning. The business is still at the forefront of data center AI hardware development.

- Report ID: 6510

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Server Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.