Chemotherapy Chairs Market Outlook:

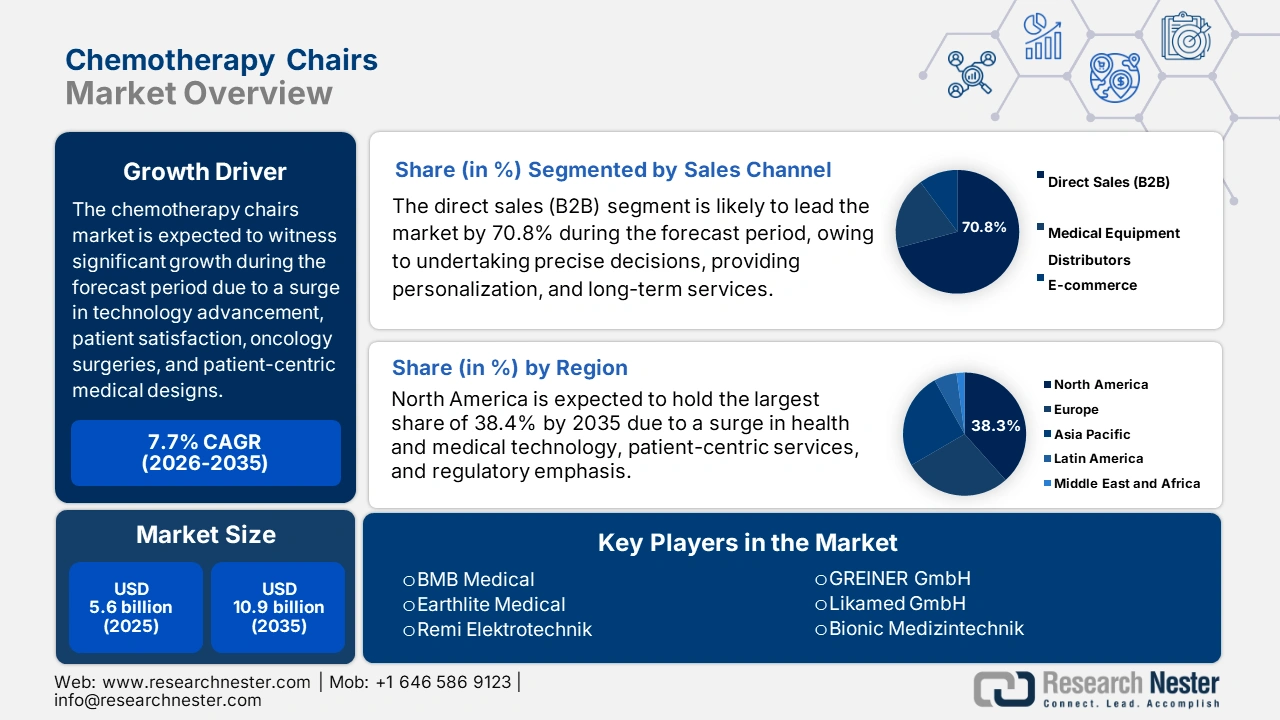

Chemotherapy Chairs Market size was USD 5.6 billion in 2025 and is anticipated to reach USD 10.9 billion by the end of 2035, increasing at a CAGR of 7.7% during the forecast period, i.e., 2026-2035. In 2026, the industry size of chemotherapy chair is estimated at USD 6 billion.

The market is witnessing extensive growth, which is highly driven by a robust convergence of clinical, technological, and demographic trends. These include a surge in international cancer cases, a sudden shift to outpatient care services, technological innovation, patient-centric design, and an increase in the aging population. According to an article published by the Public Health in Practice in December 2024, at present, healthcare systems across low-and middle-income nations frequently provide inadequate care services, leading to 60% of institutional deaths. This, in turn, is increasing the demand for outpatient services, due to which there is a huge growth opportunity for the market.

Moreover, as stated in the January 2025 MDPI article, patient-centric medical approaches resulted in a catalyzed increase in patient satisfaction from 0 to 2.4 million between 2022 and 2025, which is also fueling the overall market. Besides, the aspect of increased spending in healthcare expenditure is also positively impacting the market across different nations. In this regard, the June 2023 World Health Organization (WHO) article indicated that developing countries need to increase their respective health and medical spending to achieve health-based SDGs, along with an additional USD 371 billion yearly, which is deliberately required by the end of 2030.

Key Chemotherapy Chairs Market Insights Summary:

Regional Insights:

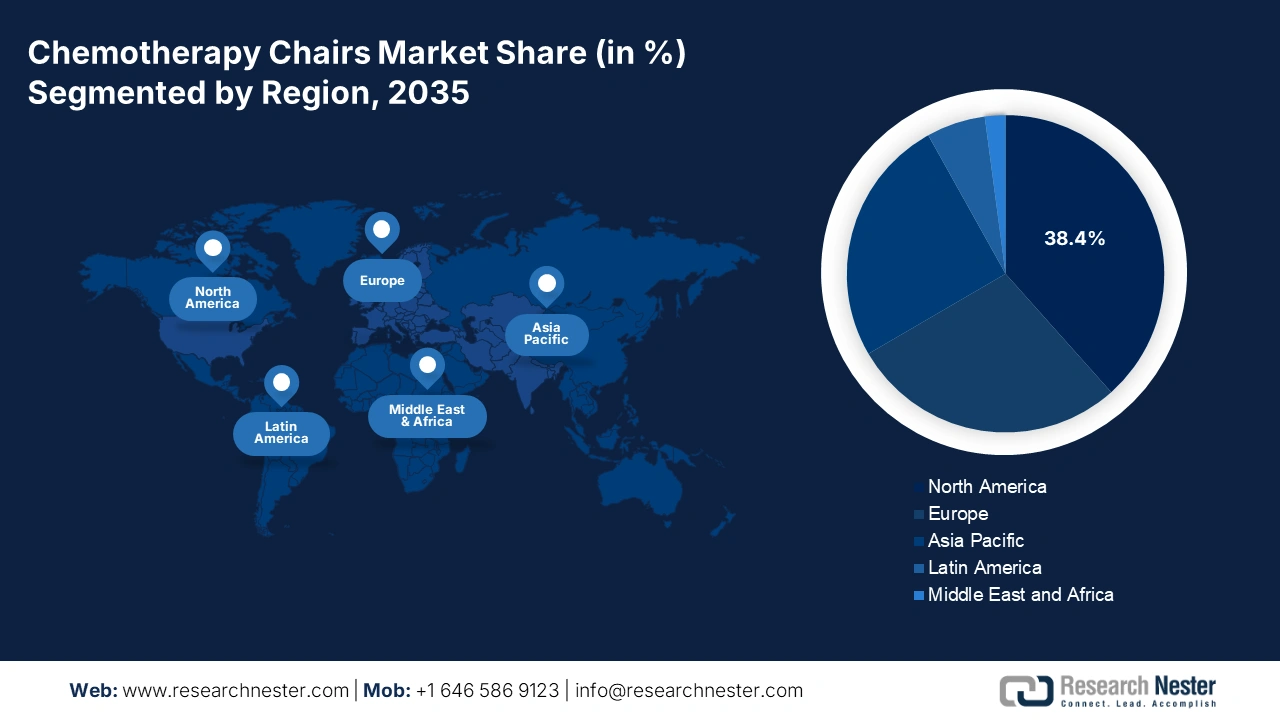

- North America in the Chemotherapy Chairs Market is projected to secure a 38.4% share by 2035, owing to robust healthcare infrastructure investments, regulatory emphasis on safety and quality, and the presence of leading medical manufacturers.

- Asia Pacific is anticipated to witness the fastest expansion during 2026–2035, spurred by growing oncology infrastructure demand, rising healthcare expenditure, and strong government policy reforms.

Segment Insights:

- The direct sales (B2B) segment in the Chemotherapy Chairs Market is forecasted to capture a dominant 70.8% share by 2035, propelled by high-value institutional procurement, personalized demonstrations, and volume-specific price negotiations.

- The vinyl/upholstery segment is predicted to experience significant growth through 2026–2035, driven by its durability, ease of maintenance, and antimicrobial and fluid-resistant characteristics crucial for infection control.

Key Growth Trends:

- Expansion in targeted and biologics therapies

- Boost in the medical tourism

Major Challenges:

- Fragmented and complicated supply chain logistics

- Rapid technological obsolescence and cycle upgradation

Key Players: BMB Medical, Earthlite Medical, Remi Elektrotechnik, GREINER GmbH, Likamed GmbH, Bionic Medizintechnik, Score BV, Nanning Passion, Health Tec Medical Ltd, IBIOM Instruments Ltd, Camelot Furniture Ltd, Praticima, MEDI SPEC, Fresenius Medical Care, Champion Manufacturing.

Global Chemotherapy Chairs Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.6 billion

- 2026 Market Size: USD 6 billion

- Projected Market Size: USD 10.9 billion by 2035

- Growth Forecasts: 7.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: India, South Korea, Australia, Brazil, Mexico

Last updated on : 1 October, 2025

Chemotherapy Chairs Market - Growth Drivers and Challenges

Growth Drivers

- Expansion in targeted and biologics therapies: These therapies are essential for the chemotherapy chairs market since they provide precision and personalization in complicated conditions, such as autoimmune and cancer diseases. This is possible by focusing on particular pathways or molecules, which result in optimized effectiveness and lower side effects in comparison to traditional therapy options. According to an article published by NLM in August 2024, a clinical study was conducted on 427 potential patients, of which 70.0% to 72.0% were catered to different therapy lines, along with numerous biologics, thus suitable for the overall market’s growth.

- Boost in the medical tourism: This driver optimizes international healthcare by offering patients with specialized, timely, and cost-effective treatments, which are readily unavailable in their respective regional countries. According to the June 2024 NLM article, the international medical tourism revenue has effectively surged from USD 24,175.9 million to USD 27,931.5 million in 2022, which further represents a 4.1% growth rate. Therefore, this rise caters to the demand for medical treatments regardless of associated complications, which is driving the market globally.

- Presence of a strict administrative framework: This is extremely crucial for the chemotherapy chairs market to provide efficiency, administer resources, effectively maintain quality care services, comply with regulations, and successfully guarantee patient safety. As per the April 2025 NLM article, almost 263 to 446 million people readily suffer from rare diseases, due to which there is a huge requirement for a standard and suitable healthcare payer environment across every nation. In addition, there is a huge demand for drug development for which regulatory policies are essential, and in turn, boosting the market’s exposure.

Different Cancer Incidence Driving the Market (2022)

|

Cancer Type |

Cases |

Incidence Percentage |

Death Rate |

|

Lung Cancer |

2.5 million |

2.4% |

1.8 million |

|

Female Breast Cancer |

2.3 million |

11.6% |

670,000 |

|

Colorectal Cancer |

1.9 million |

9.6% |

900,000 |

|

Prostate Cancer |

1.5 million |

7.3% |

760,000 |

|

Stomach Cancer |

970,000 |

4.9% |

660,000 |

Source: WHO, February 2024

Rapidly Ageing Population Uplifting the Chemotherapy Chairs Market (Historical and Projected Data)

|

Years |

Average Ratio |

Minimum Ratio |

Maximum Ratio |

|

1950 |

13.6 |

6.1 |

20.9 |

|

1975 |

18.9 |

7.7 |

27.4 |

|

2000 |

21.9 |

8.7 |

29.5 |

|

2025 |

33.6 |

15.4 |

56.3 |

|

2050 |

52.5 |

30.5 |

80.1 |

|

2075 |

63.3 |

36.7 |

111.5 |

|

2100 |

69.5 |

50.1 |

103.7 |

Source: OECD

Challenges

- Fragmented and complicated supply chain logistics: Chemotherapy chairs are usually heavy and bulky, and require careful handling, which makes the international logistics expensive and complicated, thus negatively impacting the chemotherapy chairs market. Manufacturers are advised to effectively manage the distributor network, deliberately navigate export and import regulations, customs clearance, tariffs, and successfully maintain localized inventory for timely installation and delivery. Besides, the current international supply chain crisis has exacerbated these risks, causing delays in severe components and increasing shipping expenses.

- Rapid technological obsolescence and cycle upgradation: There has been a rapid pace in medtech advancement, which has readily shortened product lifecycles, thereby causing a hindrance in the chemotherapy chairs market growth. A chair, which has been launched recently, might appear to be obsolete years back, owing to innovation in sensor implementation, new comfort materials, and IoT connectivity. This has caused pressure on manufacturers to engage in an expensive and continuous R&D cycle to remain competitive. Besides, it has developed a major incorporation gap for consumers, while hospitals are reluctant to invest suitable capital in equipment, which might soon be outdated.

Chemotherapy Chairs Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.7% |

|

Base Year Market Size (2025) |

USD 5.6 billion |

|

Forecast Year Market Size (2035) |

USD 10.9 billion |

|

Regional Scope |

|

Chemotherapy Chairs Market Segmentation:

Sales Channel Segment Analysis

Based on the sales channel, the direct sales (B2B) segment in the chemotherapy chairs market is projected to garner the largest share of 70.8% by the end of 2035. The segment’s exposure is highly attributed to the high-value and specialized nature of chemotherapy chairs. Besides, precise decisions are undertaken at the institution-based level by clinic administrators and hospital procurement committees, prioritizing personalized product demonstrators, long-lasting service contracts, strict regulatory compliance, and volume-specific price negotiations. Meanwhile, this direct manufacturer-to-end-user deal has ensured the effortless implementation of complicated equipment into clinical workflows, making it suitable for the segment’s development.

Material Segment Analysis

Product Type Segment Analysis

Our in-depth analysis of the chemotherapy chairs market includes the following segments:

|

Segment |

Subsegments |

|

Sales Channel |

|

|

Material |

|

|

Product Type |

|

|

End user |

|

|

Technology |

|

|

Chair Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Chemotherapy Chair Market - Regional Analysis

North America Market Insights

North America in the chemotherapy chairs market is anticipated to garner the highest share of 38.4% by the end of 2035. The market’s exposure in the region is subject to the robust investment in healthcare technology infrastructure and medical research, increased focus on patient-centered care services, regulatory emphasis on safety and quality, and the presence of notable multi-national healthcare systems and manufacturers. According to the 2025 AHA report, hospitals in the region employed over 6 million people for full and part-time employment, purchased more than USD 1 trillion in medical goods and services, and backed nearly 18 million job opportunities.

The chemotherapy chairs market in the U.S. is growing significantly, owing to a surge in oncology incidences, suitable government funding, federal strategies to extend cancer care accessibility, innovative outpatient therapy infrastructure, rapid technology incorporation, and focus on operational efficiency, along with patient comfort. As per the May 2024 NLM article, 43% of home healthcare agencies in the country utilized EHR, followed by 29% that utilized electronic PoC documentation, and 21% incorporated telemedicine technology. Therefore, this denotes a huge growth opportunity for the overall market to gain increased exposure in the country.

The chemotherapy chairs market in Canada is also growing due to the presence of a universal healthcare system, wide-ranging provincial reimbursement frameworks, an increase in federal and provincial healthcare allocation for cancer care services, emphasis on equitable accessibility, particularly in rural and remote locations, along with public investment for ergonomic enhancements, accessibility, and infection prevention. According to the 2025 Cancer Research Society article, the organization has readily invested over USD 423 million for more than 80 years in research giants and fellowships, displaying a pivotal role in advancing cancer research across the country, thus suitable for bolstering the market’s development.

Cancer Treatment Expenses in North America (2020-2030)

|

U.S. |

Canada |

||

|

Components |

Incidence/Amount |

Components |

Incidence/Amount |

|

Cancer cases |

1.7 million |

Cancer survival rate |

3.0% |

|

Out-of-pocket cancer treatment |

USD 5.6 billion to USD 183 billion |

Cancer patient cost |

CAD 1,600 |

|

Increase in cost by 2030 |

USD 246 billion (34%) |

Yearly cost |

CAD 1,511 |

|

Breast cancer |

USD 7.5 billion |

Annual out-of-pocket expenses in household with cancer (patients/survivor) |

CAD 10,112 |

|

Colorectal cancer |

USD 2.8 billion |

Rural location cost |

CAD 1,556 |

|

Blood cancer |

USD 1.8 billion |

Population center 1,000,000 or over |

CAD 1,840 |

Sources: AAM 2025; NLM, June 2022

APAC Market Insights

Asia Pacific in the chemotherapy chairs market is projected to emerge as the fastest-growing region during the forecast period. The market’s development in the region is highly fueled by an increased demand for oncology infrastructure, a surge in healthcare expenditure, as well as public investments, technological innovation and advancement adoption, home healthcare and outpatient models, and policy reforms, along with regulatory optimization. As per the March 2025 NLM article, high-income nations in the region comprise healthcare expenditure per capita, which ranges from USD 2,189 to USD 4,880. Besides, Australia, South Korea, and Japan provide compulsory national health insurance schemes that are financed primarily by taxes, thus suitable for the overall market.

The chemotherapy chairs market in China is gaining increasing traction, owing to the existence of infrastructure development campaigns, government-based focus on local manufacturing, import substitution under the Made in China 2025 initiatives, growth in the middle class, urbanization, and an expansion of home healthcare services. As stated in the August 2024 Frontiers Organization report, the number of people over 60 years old will reach 1 in 6 by the end of 2030. Additionally, it has been reported that 18.7% of the population in the country is more than 60 years old, thereby effectively increasing the need for remote health and medical services.

The chemotherapy chairs market in India is also developing due to a rise in the population burden of heart disease, cancer, and diabetes, the presence of public health programs targeting rural locations, an expansion in clinic and hospital infrastructure, cell therapy products sourcing, and the incorporation of affordable treatment solutions. According to the February 2025 MOHFW data report, nearly 100 out of every 1 lakh (100,000) people are readily diagnosed with cancer in the country. Based on this, the MOHFW allocated Rs. 99,858.5 crore (USD 11.9 billion), along with Rs. 95,957.8 crore (USD 11.4 billion) designated for the Department of Health and Family Welfare as well as Rs. 3,900.6 crore (USD 467.1 million) for the Department of Health Research.

Cell Therapy Products 2023 Export and Import in Asia

|

Countries |

Export |

Import |

|

Turkey |

USD 39,400 |

- |

|

Singapore |

USD 3,730 |

- |

|

Japan |

- |

USD 20,000 |

|

India |

- |

USD 6,470 |

|

South Korea |

- |

USD 3,430 |

|

Thailand |

USD 17,000 |

- |

Source: OEC, June 2025

Europe Market Insights

Europe in the chemotherapy chairs market is projected to account for steady growth by the end of the forecast period. The market’s exposure in the region is highly driven by the presence of universal healthcare systems, along with technological advancement, regulatory compliance in medical devices, the increased preference for outpatient-based chemotherapy treatments, and region-wide research funding, along with health policy support. According to an article published by EORTC in June 2025, the overall income of the organization is EUR 496 million, of which 11.6% caters to grants for regulatory trials, 4.7% for subsidies, 8.1% for restricted and unrestricted grants, and 3.2% for other financials, thus uplifting the market growth.

The chemotherapy chairs market in Germany is gaining increased exposure, owing to a surge in per capita healthcare and medical spending, the presence of strong healthcare facilities, the robust existence of regional manufacturing processes, high administrative standards, government strategies under the German Cancer Plan, and an upsurge in the aging population. As per a data report published by OECD in 2023, the healthcare expenditure in the country amounts to EUR 5,159 per capita, along with a public funding share of 85.5%, which is usually higher than the overall region. Therefore, with the generous provision of funding, there is a huge growth opportunity for the market in the overall country.

The chemotherapy chairs market in France is growing due to the allocation of strategic healthcare budget with a focus on oncology care services, the presence of national cancer control programs, innovative and friendly regulatory policies, emphasis on quality of life and patient control, collaboration between administrative bodies, and an upsurge in outpatient chemotherapy volumes. Besides, cancer management programs in the country constitute the intention to optimize the cancer care pathway by including trained health and medical professionals to cater to patient preferences and needs.

Key Chemotherapy Chairs Market Players:

- BMB Medical

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Earthlite Medical

- Remi Elektrotechnik

- GREINER GmbH

- Likamed GmbH

- Bionic Medizintechnik

- Score BV

- Nanning Passion

- Health Tec Medical Ltd

- IBIOM Instruments Ltd

- Camelot Furniture Ltd

- Praticima

- MEDI SPEC

- Fresenius Medical Care

- Champion Manufacturing

The global chemotherapy chairs market is extremely concentrated, with the presence of notable international players from Europe, the U.S., China, and South Korea, effectively leading in market penetration and innovation, while firms in Japan are readily excelling in selective and domestic international markets. Besides, global organizations are deliberately integrating product innovation and R&D investments by focusing on ergonomic design, patient comfort, and smart medical technologies adoptions. Meanwhile, geographic expansions, acquisitions, and mergers are readily prevalent across emerging nations to achieve rising demand, particularly in Latin America and the Asia Pacific, thus suitable for the chemotherapy chairs market’s upliftment.

Here is a list of key players operating in the global market:

Recent Developments

- In June 2024, AstraZeneca’s Imfinzi, along with paclitaxel and carboplatin, followed by Imfinzi monotherapy has been effectively cleared in the U.S. for the suitable treatment of adult patients with recurrent endometrial cancer.

- In October 2023, Merck declared that the U.S. FDA has successfully approved KEYTRUDA, which is an anti-PD-1 therapy, for aiding patients with resectable non-small cell lung cancer (NSCLC) in combination with platinum-containing chemotherapy as neoadjuvant treatment.

- Report ID: 8146

- Published Date: Oct 01, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Chemotherapy Chairs Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.