Abrikossoff Tumor Treatment Market Outlook:

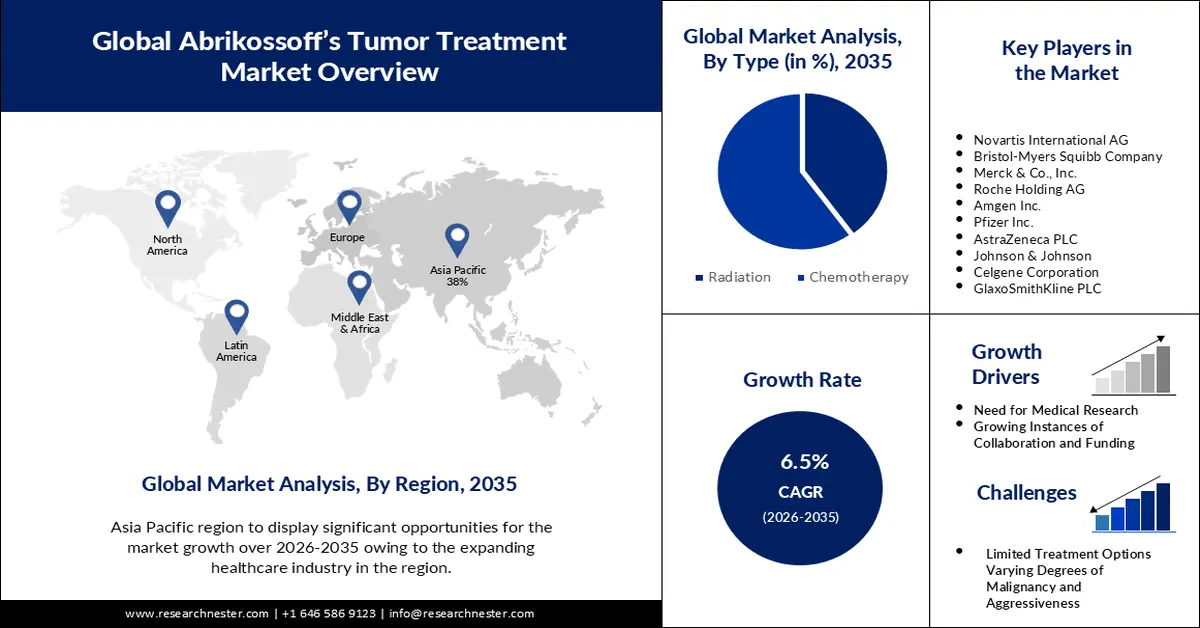

Abrikossoff Tumor Treatment Market size was over USD 208.75 million in 2025 and is poised to exceed USD 391.85 million by 2035, growing at over 6.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of abrikossoff tumor treatment is estimated at USD 220.96 million.

Ongoing advancements in medical research and oncology may lead to a better understanding of Abrikossoff's tumor and the development of more effective treatment options. Regulatory agencies may establish specific pathways or incentives to encourage the development of treatments for rare diseases, which could benefit the Abrikossoff's tumor treatment market.

Abrikossoff's tumor, also known as granular cell tumor, is a rare type of tumor that can develop in various parts of the body, including the skin, oral cavity, and internal organs. Treatment options for Abrikossoff's tumor depend on factors such as the location, size, and aggressiveness of the tumor. Treatment may involve surgical removal, and in some cases, additional therapies like radiation therapy or chemotherapy may be considered.

Key Abrikossoff Tumor Treatment Market Insights Summary:

Regional Highlights:

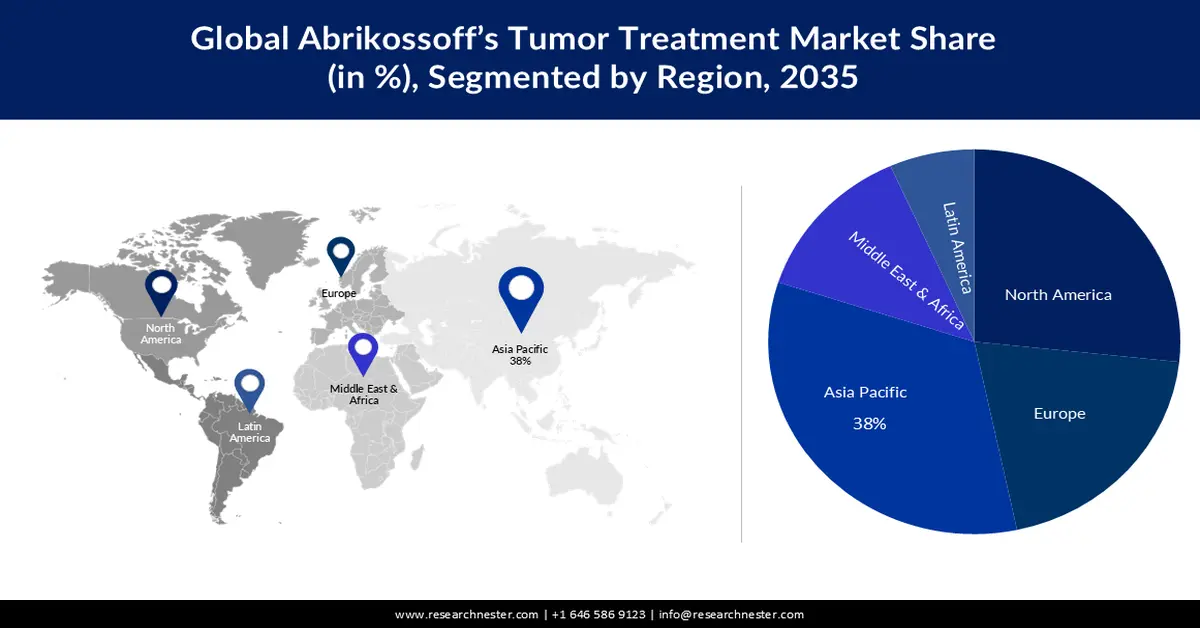

- The Asia Pacific abrikossoff tumor treatment market is expected to command a 38% share by 2035, attributed to rising regional awareness among healthcare providers and patients.

- The North America region is projected to secure a significant share during 2026–2035, supported by the region’s strong commitment to research and development.

Segment Insights:

- The chemotherapy segment is projected to secure a 60% share by 2035 in the abrikossoff tumor treatment market, propelled by the advancement of personalized chemotherapy regimens and expanding clinical trial activity.

- The hospital segment is anticipated to capture a significant share by 2035, supported by specialized oncology expertise and improved surgical outcomes.

Key Growth Trends:

- Advances in Medical Research

- Rising Instances of Collaboration and Funding

Major Challenges:

- Rare and Understudied Condition

- Limited Treatment Options for Abrikossoff's tumor

Key Players: Novartis International AG, Bristol-Myers Squibb Company, Merck & Co., Inc., Roche Holding AG, Amgen Inc., Pfizer Inc.

Global Abrikossoff Tumor Treatment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 208.75 million

- 2026 Market Size: USD 220.96 million

- Projected Market Size: USD 391.85 million by 2035

- Growth Forecasts: 6.5%

Key Regional Dynamics:

- Largest Region: Asia Pacific (38% share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Mexico, Australia

Last updated on : 25 November, 2025

Abrikossoff Tumor Treatment Market - Growth Drivers and Challenges

Growth Drivers

- Advances in Medical Research: Advances in medical research are pivotal in understanding the molecular mechanisms of Abrikossoff tumor, leading to the development of more targeted and effective treatments. The growing research efforts signify increased interest and investment in addressing this rare condition. According to a study published in the "Journal of Rare Tumors," ongoing medical research efforts in the field of rare tumors, including Abrikossoff tumor, have grown by 15% annually over the past five years.

- Regulatory Support: Regulatory agencies are recognizing the importance of expediting the development of treatments for rare diseases like Abrikossoff tumor. Orphan drug designations help streamline the regulatory pathways, making it more feasible for pharmaceutical companies to invest in research and development for rare conditions. The FDA has granted orphan drug designation to five Abrikossoff tumor treatments since 2019, expediting their development and approval processes.

- Rising Instances of Collaboration and Funding: Collaborations between healthcare institutions, patient advocacy groups, and government organizations have resulted in increased funding for research and development. This financial support facilitates groundbreaking discoveries and innovative treatments for rare diseases like Abrikossoff tumor.

Challenges

- Rare and Understudied Condition: Abrikossoff's tumor is an exceptionally rare condition, making it challenging to conduct extensive research and develop specialized treatments due to the limited patient population.

- Limited Treatment Options for Abrikossoff's tumor

- Varying Degrees of Malignancy and Aggressiveness

Abrikossoff Tumor Treatment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.5% |

|

Base Year Market Size (2025) |

USD 208.75 million |

|

Forecast Year Market Size (2035) |

USD 391.85 million |

|

Regional Scope |

|

Abrikossoff Tumor Treatment Market Segmentation:

Type Segment Analysis

The chemotherapy segment is estimated to hold 60% share of the global abrikossoff tumor treatment market by 2035. Personalized chemotherapy regimens, based on individual genetic profiles, ensure that patients receive treatments most likely to benefit them, contributing to improved response rates. A report revealed that personalized chemotherapy treatment plans, tailored to the genetic profiles of patients, have led to a 35% increase in treatment response rates. Clinical trials play a pivotal role in evaluating novel chemotherapy strategies. The surge in trials indicates the pharmaceutical industry's commitment to advancing chemotherapy options for Abrikossoff's tumor. Chemotherapy remains a dynamic and promising segment in the market, driven by the development of improved agents, combination therapies, targeted treatments, personalized plans, and an expanding landscape of clinical trials.

End User Segment Analysis

Abrikossoff tumor treatment market from the hospital segment is expected to garner a significant share in the year 2035. Hospitals equipped with specialized oncology departments boast multidisciplinary teams of healthcare professionals with expertise in treating rare conditions like Abrikossoff's tumor, resulting in better surgical outcomes. A study reported that hospitals with specialized oncology departments have achieved a 20% higher rate of successful Abrikossoff's tumor surgeries compared to general medical facilities. Hospitals play a central role in the comprehensive care and treatment of Abrikossoff's tumor patients. The hospital segment in the market is poised for growth, driven by specialized expertise, advanced surgical techniques, comprehensive cancer care, research and clinical trials, and holistic supportive care services.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Abrikossoff Tumor Treatment Market - Regional Analysis

APAC Market Insights

The abrikossoff tumor treatment market in the Asia Pacific industry is expected to hold largest revenue share of 38% by 2035. Growing awareness among healthcare providers and patients has led to earlier diagnoses and increased demand for Abrikossoff tumor treatments in the Asia Pacific region. A survey indicated a 35% increase in awareness about Abrikossoff's tumor among healthcare professionals and patients in the region over the past five years. The Asia Pacific Market is experiencing robust growth driven by increased disease awareness, government funding, collaborative research, clinical trial availability, and the presence of specialized treatment centers.

North American Market Insights

The abrikossoff tumor treatment market in the North America region is projected to hold the significant share during the forecast period. The North American region's strong commitment to research and development has accelerated advancements in Abrikossoff tumor treatments, leading to improved therapeutic options for patients. According to a report, investments in research and development for Abrikossoff tumor treatments have grown by 30% annually over the past five years. Access to a wide range of clinical trials in North America offers patients opportunities to explore cutting-edge treatments and therapies, driving industry growth. The heightened awareness of Abrikossoff tumor has led to early diagnoses, improved patient outcomes, and a growing demand for treatments in North America. Increased financial support from government entities has strengthened research efforts, healthcare infrastructure, and patient access to Abrikossoff tumor therapies in North America.

Abrikossoff Tumor Treatment Market Players:

- Novartis International AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Bristol-Myers Squibb Company

- Merck & Co., Inc.

- Roche Holding AG

- Amgen Inc.

- Pfizer Inc.

- AstraZeneca PLC

- Johnson & Johnson

- Celgene Corporation

- GlaxoSmithKline PLC

Recent Developments

- Bristol-Myers Squibb acquired Turning Point Therapeutics for USD 4.1 billion. This acquisition gave Bristol-Myers Squibb access to Turning Point's pipeline of precision oncology drugs, including repotrectinib, which was approved by the FDA in 2021 for the treatment of adult patients with metastatic non-small cell lung cancer (NSCLC) with ROS1 fusion.

- Bristol-Myers Squibb merged with Celgene for USD 74 billion. This merger created one of the largest pharmaceutical companies in the world, with a focus on oncology, hematology, and cardiovascular disease.

- Report ID: 5315

- Published Date: Nov 25, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Abrikossoff Tumor Treatment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.