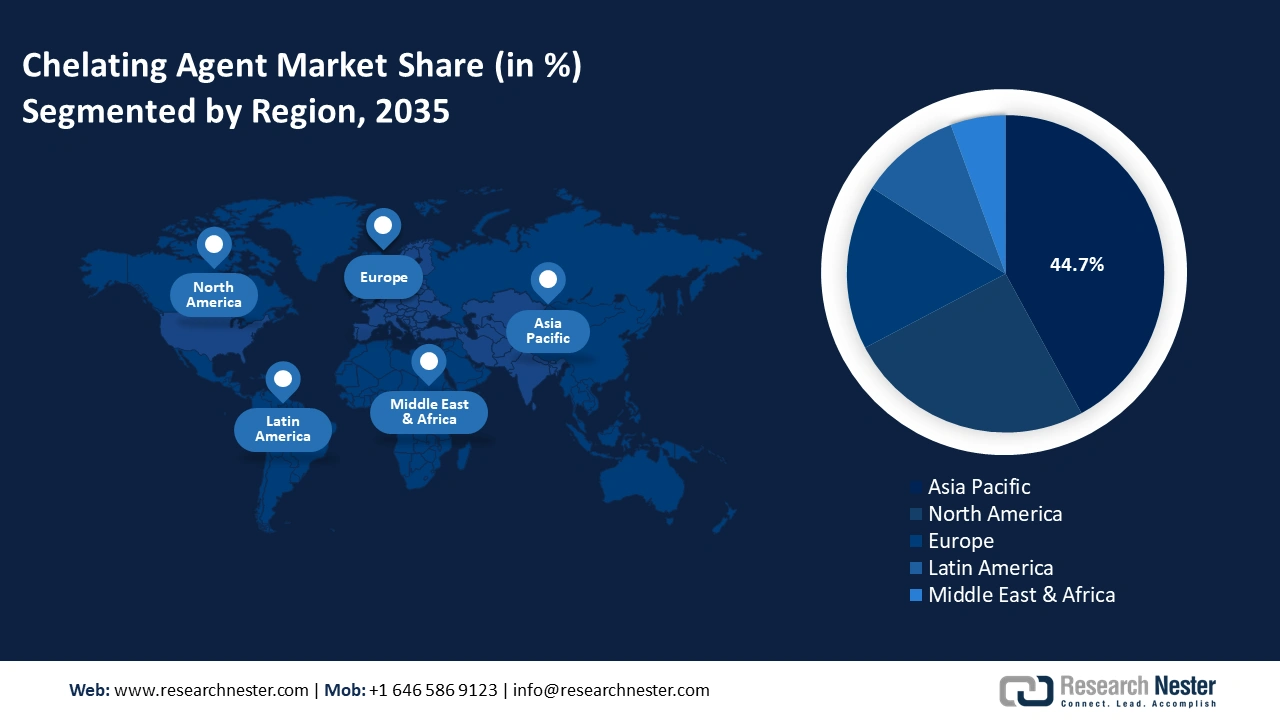

Chelating Agents Market Regional Analysis:

Asia Pacific Market Insights

The Asia Pacific region represented the most significant portion of the global chelating agents market, comprising roughly 47.8%, with China and India identified as major contributors. This dominance is attributed to rapid industrialization, urbanization, and the significant expansion of end-use industries such as pulp & paper, textiles, water treatment, and agrochemicals. India is witnessing growing demand for chelating agents driven by robust agricultural activity, a flourishing paper and packaging sector, and rising investments in water infrastructure. The country’s expanding textile industry further contributes to this trend, requiring efficient chelating solutions for dyeing and finishing processes.

In China, the rise in manufacturing coupled with stricter environmental regulations designed to mitigate water pollution has led to an increased demand for both conventional chelating agents like EDTA and eco-friendly alternatives such as GLDA and MGDA. The government’s emphasis on eco-friendly production practices has also incentivized industries to adopt biodegradable formulations. Shandong IRO Chelating Chemicals manufactures a broad portfolio of chelating agents, including EDTA and biodegradable variants. The company serves diverse industries across Asia, aligning its offerings with evolving regulatory standards and sustainability goals.

North America Market Insights

The chelating agents market in North America, especially in the U.S. and Canada, occupies a substantial portion, propelled by a strong industrial framework and stringent environmental regulations. Agencies such as the U.S. Environmental Protection Agency (EPA) and Canada’s Environment and Climate Change department have implemented policies that encourage the use of environmentally friendly and biodegradable chelating agents to mitigate ecological impact. This regulatory environment, combined with a strong presence of industries such as pharmaceuticals, pulp & paper, and household & industrial cleaning, has fueled consistent demand for agents like EDTA, DTPA, and biodegradable alternatives.

The region also demonstrates high consumer preference for premium and sustainable cleaning formulations, which further supports the adoption of advanced chelating technologies. Moreover, the growing pharmaceutical and personal care sectors, along with increased investment in water treatment infrastructure, are expected to sustain North America’s market leadership. Dow Chemical Company provides a variety of chelating agents, which include environmentally friendly alternatives. Dow’s focus on innovation, regulatory compliance, and sustainable solutions positions it as a key player in addressing the evolving needs of the North America market.