Chelating Agents Market Outlook:

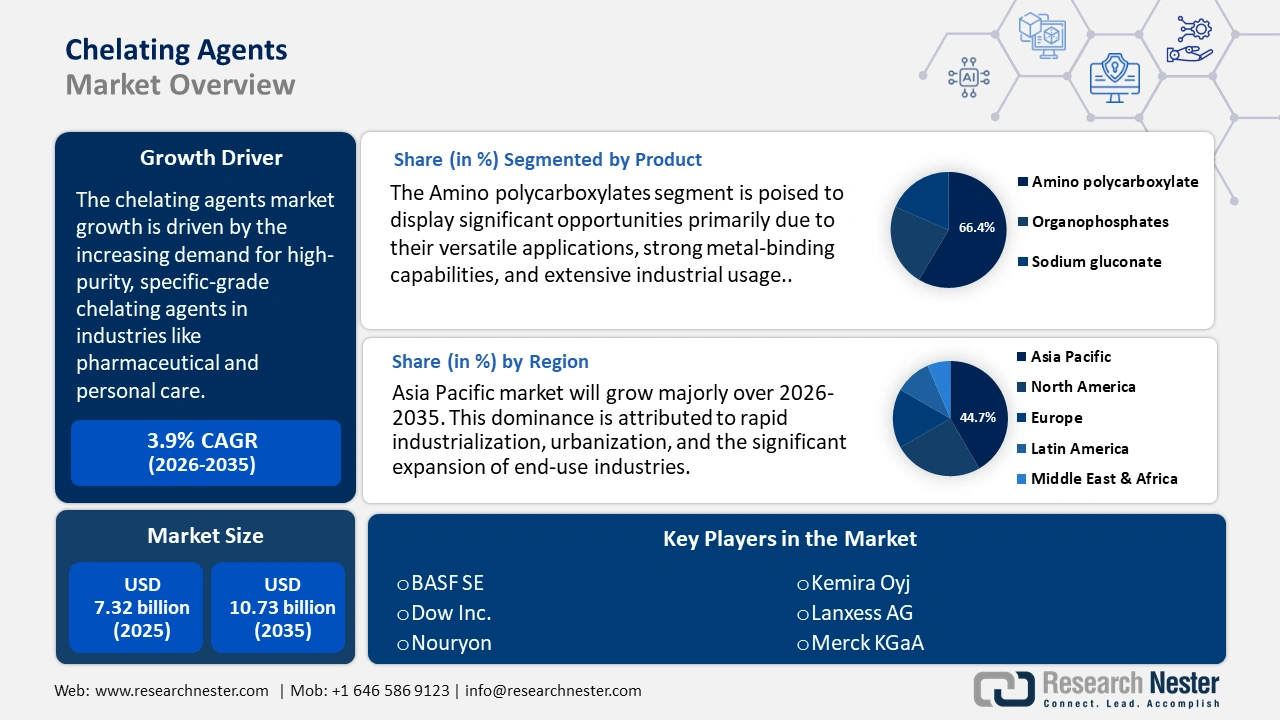

Chelating Agents Market size was valued at USD 7.32 billion in 2025 and is expected to reach USD 10.73 billion by 2035, registering around 3.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of chelating agents is evaluated at USD 7.58 billion.

The rising demand for chelating agents is driven by multiple issues, including water hardness, metal ion interference, and formulation instability in various products. Industries face challenges such as degradation of active ingredients, discoloration, and reduced shelf life due to metal contamination. Additionally, growing environmental regulations and consumer demand for eco-friendly, biodegradable solutions are pushing manufacturers to adopt advanced chelating agents in pharmaceutical, personal care, water treatment, and cleaning applications.

In pharmaceutical applications, chelating agents are essential for enhancing drug stability, improving bioavailability, and maintaining the efficacy of active pharmaceutical ingredients (APIs). They are commonly used in intravenous formulations, oral supplements, and topical medications. With the rapid expansion of the pharmaceutical industry, especially across Asia Pacific and North America, the need for high-purity, specific-grade chelating agents is growing steadily.

Simultaneously, the personal care sector is witnessing increased incorporation of chelating agents in skincare, haircare, and cosmetic products. These agents help stabilize formulations by binding metal ions that can cause oxidation, discoloration, or degradation of active ingredients. As consumers shift towards clean-label, sustainable, and natural products, manufacturers are focusing on biodegradable and eco-certified chelating agents to meet both performance expectations and regulatory requirements.

One notable company is Innospec Inc., a global specialty chemical company that offers biodegradable chelating agents specifically designed for personal care and pharmaceutical use. Their product range addresses the dual need for functionality and sustainability, making them a preferred supplier in these high-growth sectors. As these industries continue to expand, demand for innovative and environmentally responsible chelating solutions is expected to rise.

Key Chelating Agents Market Insights Summary:

Regional Highlights:

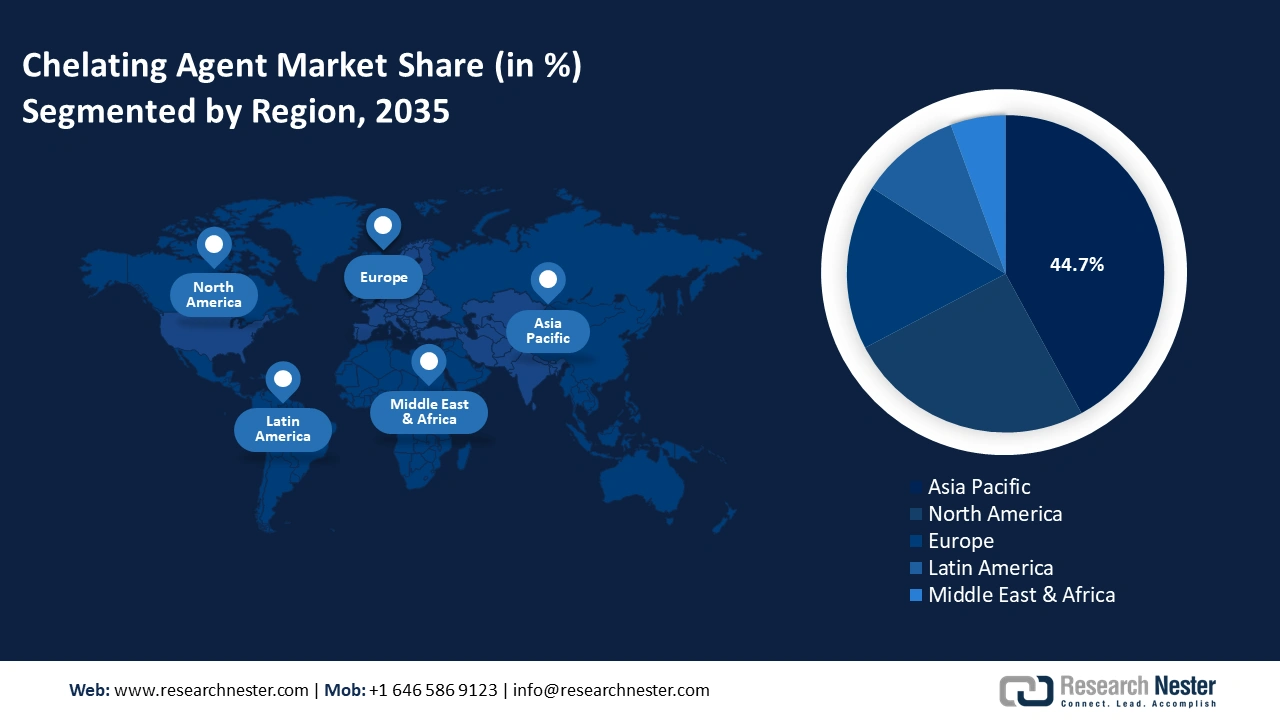

- The Asia Pacific chelating agents market is expected to capture 47.80% share by 2035, fueled by rapid industrialization, urbanization, and growth in end-use industries.

Segment Insights:

- The amino polycarboxylate segment in the chelating agents market is expected to hold a 66.40% share by 2035, driven by strong metal-binding capabilities and extensive industrial usage.

Key Growth Trends:

- The rising demand for biodegradable and sustainable chelating agents

- Expansion of end use sectors

Major Challenges:

- The rising demand for biodegradable and sustainable chelating agents

- Expansion of end use sectors

Key Players: Dow Inc., Nouryon, Kemira Oyj, Lanxess AG, Hexion Inc., Archer Daniels Midland Company (ADM), Ascend Performance Materials, MilliporeSigma, Tate & Lyle PLC, Shandong IRO Chelating Chemical Co., Ltd., New Alliance Fine Chem Pvt. Ltd., Starco Arochem Pvt. Ltd., Adinath Auxi Chem Pvt. Ltd., American International Ingredients, Inc., Merck KGaA, Nagase & Co., Ltd., Zhonglan Industry Co., Ltd..

Global Chelating Agents Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.32 billion

- 2026 Market Size: USD 7.58 billion

- Projected Market Size: USD 10.73 billion by 2035

- Growth Forecasts: 3.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (47.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: China, India, South Korea, Mexico, Brazil

Last updated on : 16 May, 2025

Chelating Agents Market Growth Drivers and Challenges:

Growth Drivers

-

The rising demand for biodegradable and sustainable chelating agents: The global chelating agents market is experiencing substantial growth, largely fueled by the growing need for eco-friendly and sustainable options. This shift is largely influenced by stringent environmental regulations, especially across North America and Europe, which are phasing out traditional chelating agents such as EDTA and NTA due to their environmental persistence. In response, industries including household cleaning, water treatment, agrochemicals, and personal care are transitioning towards eco-friendly solutions like MGDA (Methylglycinediacetic Acid) and GLDA (Glutamic Acid Diacetic Acid). These biodegradable agents offer comparable performance with reduced environmental impact, aligning with global sustainability goals.

Consumer awareness around green formulations in everyday products further supports this trend, encouraging manufacturers to innovate and invest in sustainable research & development. BASF SE, a global chemical company, has developed Trilon M, a biodegradable chelating agent based on MGDA. Trilon M is readily biodegradable, phosphate-free, and delivers high performance in applications such as detergents, personal care products, and industrial cleaning. It adheres to rigorous environmental regulations and acts as an eco-friendly substitute for conventional chelating agents such as EDTA. BASF’s investment in green chemistry reflects its broader commitment to sustainability and innovation in the specialty chemical market. -

Expansion of end use sectors: Growth in industries like household care, pulp & paper, textiles, and agriculture is propelling the demand for chelating agents to enhance product performance, enhance process efficiency, and meet regulatory standards. In the household care industry, chelating agents improve the cleaning power of detergents by binding metal ions, making them essential in hard water conditions. In the pulp & paper and textile industries, they play a crucial role in bleaching processes and dye stability. Meanwhile, in agriculture, chelating agents help in the effective delivery of micronutrients to plants, enhancing crop yields and soil health.

The growing demand from these industries, particularly in emerging economies, is expanding the application base for both traditional and biodegradable chelating agents. Kemira Oyj focuses on delivering advanced chemical solutions tailored for industries that require significant water usage, including pulp and paper production as well as water treatment. The company offers a range of chelating agents tailored for industrial applications, including biodegradable options, to meet both performance and sustainability goals. Kemira’s focus on innovation and environmentally friendly chemistry supports the growing demand in emerging chelating agents markets where industries are becoming stricter. Their solutions contribute to improved process efficiency and reduce ecological impact, aligning with the global shift towards sustainable industrial practices.

Challenges

-

High production cost for biodegradable alternatives: The high cost of biodegradable chelating agents such as MGDA and GLDA remains a significant barrier to widespread adoption, particularly in price-sensitive markets. These sustainable alternatives, while offering superior environmental benefits and regulatory compliance, involve complex and resource-intensive manufacturing processes that drive up production costs. As a result, industries in cost-conscious regions may hesitate to transition from traditional agents like EDTA, despite environmental advantages. To overcome this challenge, manufacturers are focusing on process optimization and scaling production to reduce costs and make biodegradable chelating agents more accessible and economically viable for broader industrial use.

-

Complex production process: The production of high-purity, specialty-grade chelating agents involves complex and technologically demanding processes. These compounds must meet stringent quality and performance standards, particularly for application in pharmaceutical, personal care, and water treatment. The synthesis often requires precise control over reaction conditions, purification techniques, and raw material quality, necessitating significant investment in advanced manufacturing infrastructure. Additionally, adherence to environmental and safety regulations further complicates production. These technical and operational challenges can limit the entry of new players and slow down scalability, impacting on the overall supply and cost structure. Consequently, this segment of the market is primarily controlled by a limited number of well-established companies.

Chelating Agents Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

3.9% |

|

Base Year Market Size (2025) |

USD 7.32 billion |

|

Forecast Year Market Size (2035) |

USD 10.73 billion |

|

Regional Scope |

|

Chelating Agents Market Segmentation:

Product Segment Analysis

Amino polycarboxylate is anticipated to hold the largest chelating agents market share, approximately 66.4% in 20237, owing to its versatile applications, strong metal-binding capabilities, and extensive industrial usage. This class of chelating agents, including EDTA, DTPA, and NTA, is widely utilized across water treatment, detergents, pulp & paper, and chemical processing industries. Their ability to effectively bind and remove metal ions enhances process efficiency, particularly in water treatment, where they prevent scale formation and metal precipitation. In the pulp and paper sector, amino polycarboxylates enhance bleaching procedures and elevate product quality.

Despite environmental concerns over biodegradability, their regulatory acceptance has supported continued demand. However, growing climate and ecological considerations are prompting research into safer and more sustainable alternatives. A notable example is Mitsubishi Chemical, which manufactures EDTA-based chelating agents utilized in a range of industrial applications. The company focuses on innovation and regulatory compliance, ensuring its solutions align with both performance needs and environmental standards.

Application Segment Analysis

The pulp & paper segment expected to hold substantial share in the global chelating agents market, driven by their critical role in enhancing bleaching agents, particularly amino polycarboxylates like EDTA and DTPA, are widely used to sequester metal ions such as iron, manganese, and calcium, which can interfere with the bleaching process and increase chemical usage. By effectively neutralizing these ions, chelating agents improve pulp brightness, reduce environmental impact, and lower operational costs. The rising demand for high-quality paper products, especially packaging and specialty papers, has intensified the need for these performance-enhancing additives.

Furthermore, the industry’s shift towards eco-friendly and sustainable production practices has spurred the adoption of biodegradable chelating agents to meet strict environmental standards. A notable instance is Arxada AG, a global specialty chemicals company that supplies high-performance chelating agents to the pulp and paper industry. Arxada offers solutions such as biodegradable and amino polycarboxylate-based chelating agents designed to optimize the bleaching process, improve pulp brightness, and minimize metal-induced degradation. The company’s focus on sustainable chemistry and regulatory compliance makes it a key partner for paper manufacturers aiming to enhance product quality while reducing environmental impact.

Our in-depth analysis of the global chelating agents market includes the following segments:

|

Product |

|

|

Source |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Chelating Agents Market Regional Analysis:

Asia Pacific Market Insights

The Asia Pacific region represented the most significant portion of the global chelating agents market, comprising roughly 47.8%, with China and India identified as major contributors. This dominance is attributed to rapid industrialization, urbanization, and the significant expansion of end-use industries such as pulp & paper, textiles, water treatment, and agrochemicals. India is witnessing growing demand for chelating agents driven by robust agricultural activity, a flourishing paper and packaging sector, and rising investments in water infrastructure. The country’s expanding textile industry further contributes to this trend, requiring efficient chelating solutions for dyeing and finishing processes.

In China, the rise in manufacturing coupled with stricter environmental regulations designed to mitigate water pollution has led to an increased demand for both conventional chelating agents like EDTA and eco-friendly alternatives such as GLDA and MGDA. The government’s emphasis on eco-friendly production practices has also incentivized industries to adopt biodegradable formulations. Shandong IRO Chelating Chemicals manufactures a broad portfolio of chelating agents, including EDTA and biodegradable variants. The company serves diverse industries across Asia, aligning its offerings with evolving regulatory standards and sustainability goals.

North America Market Insights

The chelating agents market in North America, especially in the U.S. and Canada, occupies a substantial portion, propelled by a strong industrial framework and stringent environmental regulations. Agencies such as the U.S. Environmental Protection Agency (EPA) and Canada’s Environment and Climate Change department have implemented policies that encourage the use of environmentally friendly and biodegradable chelating agents to mitigate ecological impact. This regulatory environment, combined with a strong presence of industries such as pharmaceuticals, pulp & paper, and household & industrial cleaning, has fueled consistent demand for agents like EDTA, DTPA, and biodegradable alternatives.

The region also demonstrates high consumer preference for premium and sustainable cleaning formulations, which further supports the adoption of advanced chelating technologies. Moreover, the growing pharmaceutical and personal care sectors, along with increased investment in water treatment infrastructure, are expected to sustain North America’s market leadership. Dow Chemical Company provides a variety of chelating agents, which include environmentally friendly alternatives. Dow’s focus on innovation, regulatory compliance, and sustainable solutions positions it as a key player in addressing the evolving needs of the North America market.

Chelating Agents Market Players:

- BASF SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Dow Inc.

- Nouryon

- Kemira Oyj

- Lanxess AG

- Hexion Inc.

- Archer Daniels Midland Company (ADM)

- Ascend Performance Materials

- MilliporeSigma

- Tate & Lyle PLC

- Shandong IRO Chelating Chemical Co., Ltd.

- New Alliance Fine Chem Pvt. Ltd.

- Starco Arochem Pvt. Ltd.

- Adinath Auxi Chem Pvt. Ltd.

- American International Ingredients, Inc.

- Merck KGaA

- Nagase & Co., Ltd.

- Zhonglan Industry Co., Ltd.

Leading participants in the chelating agents market utilize cutting-edge technologies to sustain their competitive advantage. These include green chemistry, biodegradable formulations, and process optimization to develop environmentally friendly chelating agents like MGDA and GLDA. Companies invest heavily in research & development to enhance the chelating agent’s efficiency, improve biodegradability, and reduce production costs. Additionally, sustainable sourcing, automation, and compliance with global regulations further strengthen their market position. By integrating innovation with sustainability, these companies address rising demand across industries while aligning with environmental and safety standards to lead in a rapidly evolving chelating agents market.

Recent Developments

- In October 2023, Sasol Chemicals collaborated with Solugen to investigate the commercialization of eco-friendly solutions for home and personal care products, focusing on chelating agents with improved environmental characteristics.

- In January 2023, Nouryon strengthened its presence in the agricultural sector through the acquisition of ADOB, a Polish provider of chelated micronutrients and tailored agricultural solutions.

- Report ID: 5116

- Published Date: May 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Chelating Agents Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.