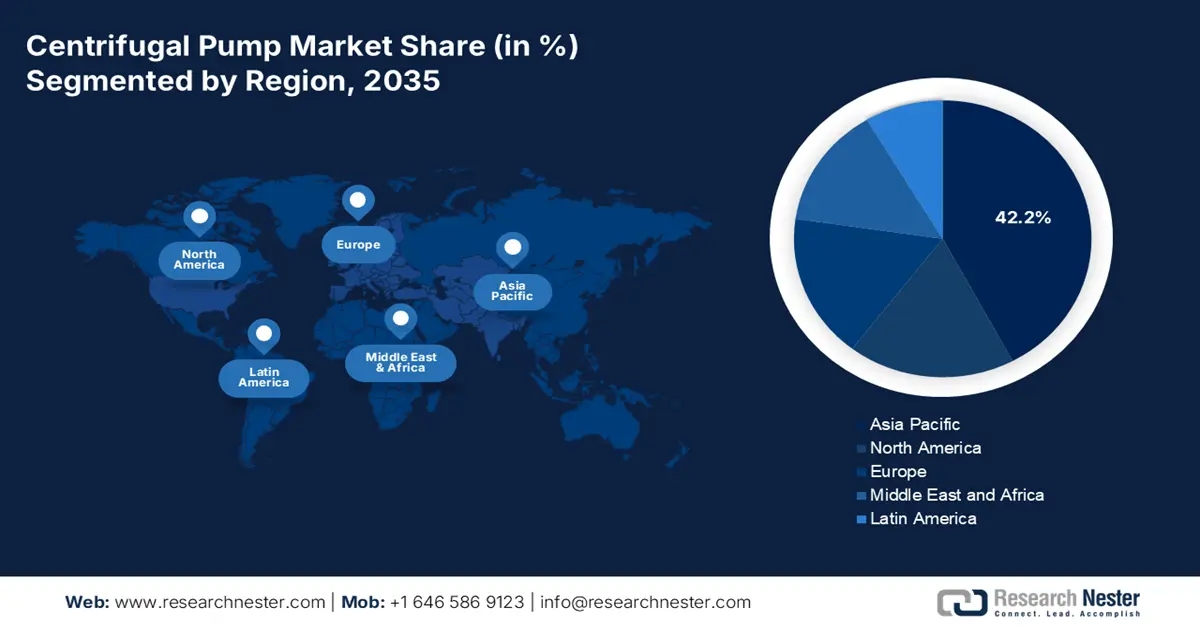

Centrifugal Pump Market - Regional Analysis

Asia Pacific Market Insights

By 2035, the Asia Pacific centrifugal pump market is expected to hold 42.2% of the market share due to continued urbanization, tighter environmental regulations, and, of course, industrial growth. These drivers are primarily being fueled by growth in urban centers and larger industrial sectors found in China and India. Water treatment will assist with pump growth in APAC alongside energy and chemicals. For example, there are government supports and regulations available to promote energy-efficient pumps. The R&D grants mean more market budget resources are being allocated to the development of sustainable technologies, alongside regulatory measures already driving market momentum regionally.

By 2035, China will be the leader in APAC's market via growing industrial manufacturing in addition to building and maintaining infrastructure upgrades. The NDRC and MEE subsidize funds that promote energy efficiency. Renewable energy, combined with increased refinery upgrades, will positively impact the growth of the market as well. Structural factors, like urbanization and green industrial goals from the CPCIF and ChemChina, will facilitate new pump demand. Automation makes upgrading pump manufacturing approaches more acceptable because of both government and corporate pressures, suggesting it is an optimal solution in overcoming capacity issues in wastewater, hydropower, and chemical processing facilities across China's autonomous regions.

India is expected to demonstrate the largest growth of the APAC pump market with a projected CAGR of 6.6% or greater through 2035. The Make in India entrepreneurial movement, Smart Cities program, and DMIC meant that increased spending in existing infrastructure will occur over the next 5-10 years. Under the Atal Mission for Rejuvenation and Urban Transformation (AMRUT) program launched by the Ministry of Housing & Urban Affairs, 883 sewerage & septage management projects worth Rs 34,081 crore have been launched, of which 370 projects worth Rs 8,258 crore have been completed. Under Swachh Bharat Mission (Urban) 2.0, launched on 1st October, 2021, Rs. 15883 crores have been allocated to States/UTs for wastewater/used water management, including construction of STPs and FSTPs (fecal sludge treatment plants).

Sewage Generation in Urban Areas and Treatment Capacity

|

States / UTs |

Sewage Generation (in MLD) |

Installed Capacity (in MLD) |

Number of STPs Installed |

Operational Treatment Capacity (in MLD) |

|

Andhra Pradesh |

2882 |

833 |

66 |

443 |

|

Bihar |

2276 |

10 |

1 |

0 |

|

Chandigarh |

188 |

293 |

7 |

271 |

|

Chhattisgarh |

1203 |

73 |

3 |

73 |

|

Dadra & Nagar Haveli |

67 |

24 |

3 |

24 |

|

Goa |

176 |

66 |

11 |

44 |

|

Gujarat |

5013 |

3378 |

70 |

3358 |

|

Haryana |

1816 |

1880 |

153 |

1880 |

|

Himachal Pradesh |

116 |

136 |

78 |

99 |

|

Jammu & Kashmir |

665 |

218 |

24 |

93 |

|

Jharkhand |

1510 |

22 |

2 |

22 |

|

Karnataka |

4458 |

2712 |

140 |

1922 |

|

Kerala |

4256 |

120 |

7 |

114 |

|

Madhya Pradesh |

3646 |

1839 |

126 |

684 |

|

Maharashtra |

9107 |

6890 |

154 |

6366 |

|

NCT of Delhi |

3330 |

2896 |

38 |

2715 |

|

Orissa |

1282 |

378 |

14 |

55 |

|

Pondicherry |

161 |

56 |

3 |

56 |

|

Punjab |

1889 |

1781 |

119 |

1601 |

|

Rajasthan |

3185 |

1086 |

114 |

783 |

|

Sikkim |

52 |

20 |

6 |

18 |

|

Tamil Nadu |

6421 |

1492 |

63 |

1492 |

|

Telangana |

2660 |

901 |

37 |

842 |

|

Tripura |

237 |

8 |

1 |

8 |

|

Uttar Pradesh |

8263 |

3374 |

107 |

3224 |

|

Uttarakhand |

627 |

448 |

71 |

345 |

|

West Bengal |

5457 |

897 |

50 |

337 |

Source: PIB

North America Market Insights

The North American market is expected to hold 18.2% of the market share by 2035, due to increasing demand in oil & gas, chemicals, and municipal water. Demand for thermoplastic centrifugal pumps in the U.S. is underpinned by projects in shale extraction and in the Gulf region of petrochemical facility investment. Innovations in smart pumps, energy-efficient impeller designs, and regulatory standards from both the EPA and the DOE have all acted as growth drivers moving forward. Cross-border trade for centrifugal pumps that are compliant with the trade agreements under USMCA and new supply chains influenced by Industry 4.0, should provide a dependable base mechanism for pump demand.

The U.S. chemical industry receives 11% of R&D funding through federal support. In order to promote investments in advanced energy projects and create clean energy supply chains, the Biden-Harris Administration had announced a $6 billion tax credit allocation round, including about $2.5 billion set aside for historic energy communities. The EPA Green Chemistry program issued grants to green chemistry processes to mitigate hazardous waste. EPA and the American Chemical Society have presented awards to 144 technologies that help to eliminate 830 million pounds of hazardous chemicals and solvents. That is enough to fill almost 3,800 railroad tank cars or create a train that is nearly 47 miles long. Every year, 21 billion gallons of water are saved, which is the equivalent of the use of 980,000 people in one year. Every year, 7.8 billion pounds of carbon dioxide are eliminated, which is released to the air, which is equal to eliminating 770,000 automobiles from the road.

Canada is investing $150 million in a national net-zero by 2050 Buildings Strategy, alongside a $2.6 billion Greener Homes Grant to boost home energy efficiency and green supply chains, and a $1.5 billion Green and Inclusive Community Buildings program funding retrofits, repairs, upgrades, and new energy-efficient construction projects. Funds have been allocated to modernize infrastructural services and research and development for electrochemical energy projects for things like hydrogen-storage PEM electrolyzers. NIST-NRC's combined efforts to create more explicit safety standards should assist in providing direction for greater pump demand in Canada's chemical processing system.

Europe Market Insights

The European market is expected to hold 16.9% of the market share by 2035 due to investment in the modernization of aging infrastructure, decarbonization, and investment in the chemicals sector via the EU. The EU Waste Water Treatment Directive is followed in the collection and treatment of about 90% of municipal wastewater throughout the EU. According to the nation profiles, ten more countries have achieved a compliance rate of more than 90%, while four countries, Austria, Germany, Luxembourg, and the Netherlands, treat all of their urban wastewater in accordance with the Directive's standards. In addition, REACH regulations applied to industries are already driving investment in energy-efficient and low-leakage pumps.

Germany’s centrifugal pump market is supported by a solid chemical, automotive, and water treatment industry. Climate change polices at the federal level and the Energy Efficiency Strategy 2050 support high-efficiency pumping solutions. Additionally, investments in municipal water treatment infrastructure, improved industrial automation, and the integration of smart pumps have contributed to an increase in demand for pumping solutions. Germany’s excellent engineering tradition, in addition to EU ecodesign directives, supports innovation and the support of exports. In order to stay competitive in technology, firms are concentrating on digital monitoring, predictive maintenance, and energy savings.

Total Electricity Production in 2022

|

Region/Country |

GWh |

|

Europe |

4 018 742 |

|

Germany |

578 949 |

|

France |

473 672 |

|

Türkiye |

328 379 |

|

United Kingdom |

325 540 |

|

Spain |

292 454 |

|

Poland |

179 748 |

|

Sweden |

173 159 |

|

Norway |

146 730 |

|

The Netherlands |

121 572 |

Source: IEA