Centrifugal Pump Market Outlook:

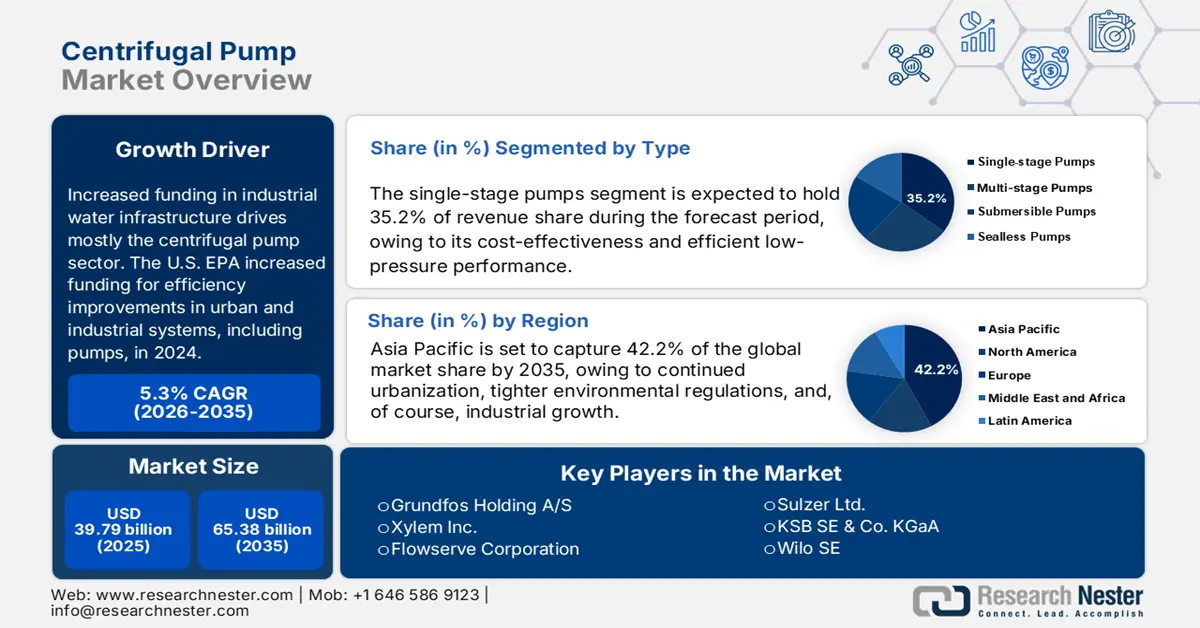

Centrifugal Pump Market size was estimated at USD 39.79 billion in 2025 and is expected to surpass USD 65.38 billion by the end of 2035, rising at a CAGR of 5.3% during the forecast period, i.e., 2026-2035. In 2026, the industry size of centrifugal pump is evaluated at USD 41.79 billion.

Rising investments in industrial water infrastructure are primarily driving growth in the centrifugal pump. The U.S. Environmental Protection Agency (EPA) increased funding for efficiency improvements in urban and industrial systems, including pumps, in 2024. According to the WHO, over 2.1 billion people worldwide still lack access to clean water, while 106 million worldwide are forced to rely on untreated surface sources. Hence, driving infrastructure expenditures. As a result, demand continues to increase in tandem with growth in the oil and gas, as well as the power sector.

According to FRED, fluid power pump items hit 249.352 in August 2025. Producers need stainless steel, cast iron, and alloys on the supply side. The centrifugal pump market grows due to rising industrialization, driving demand for efficient fluid handling and expanding water and wastewater treatment projects worldwide, fueled by stricter environmental regulations and increasing investments in municipal infrastructure upgrades. Supported by low-interest government subsidies and local assembly plans, production has grown throughout India, China, and Eastern Europe to meet demand.

Key Centrifugal Pump Market Insights Summary:

Regional Insights:

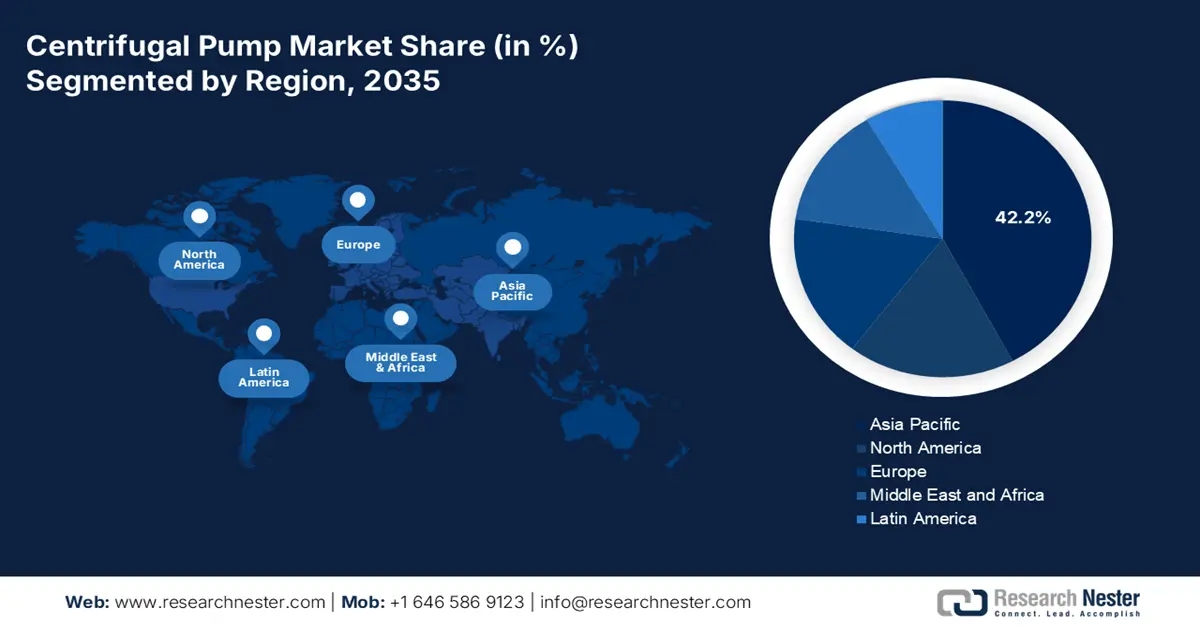

- By 2035, the Asia Pacific Centrifugal Pump Market is projected to command a 42.2% share, supported by escalating urban expansion and stringent environmental rules impelling regional pump adoption.

- North America is anticipated to secure an 18.2% share by 2035, bolstered by rising demand across oil & gas, chemicals, and municipal water systems owing to advanced pump innovations and regulatory enhancements.

Segment Insights:

- The single-stage pumps segment is set to claim a 35.2% share by 2035 in the Centrifugal Pump Market, reinforced by their cost-efficient operation and dependable low-pressure performance.

- The water and wastewater segment is projected to hold a 28.2% share by 2035, underpinned by rapid urbanization and intensifying regulatory pressure on global wastewater management.

Key Growth Trends:

- Smart pumping and industrial automation

- Global focus on energy efficiency and carbon reduction

Major Challenges:

- Infrastructure & technical capacity in emerging markets

- Green protectionism via environmental standards

Key Players: Grundfos Holding A/S, Company Overview, Business Strategy, Key Product Offerings, Financial Performance, Key Performance Indicators, Risk Analysis, Recent Development, Regional Presence, SWOT Analysis, Xylem Inc., Flowserve Corporation, Sulzer Ltd., KSB SE & Co. KGaA, Ebara Corporation, Wilo SE, ITT Inc. (Goulds Pumps), Pentair plc, Kirloskar Brothers Limited, IDEX Corporation (Corken, Viking Pump), SPX FLOW, Inc., Roto Pumps Limited, Torishima Pump Mfg. Co., Ltd., Tsurumi Manufacturing Co., Ltd.

Global Centrifugal Pump Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 39.79 billion

- 2026 Market Size: USD 41.79 billion

- Projected Market Size: USD 65.38 billion by 2035

- Growth Forecasts: 5.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (42.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: Vietnam, Indonesia, Brazil, Mexico, United Arab Emirates

Last updated on : 24 September, 2025

Centrifugal Pump Market - Growth Drivers and Challenges

Growth Drivers

- Smart pumping and industrial automation: As Industry 4.0 adoption speeds up, demand for smart centrifugal pumps with real-time monitoring and predictive maintenance is soaring. ABB’s Ability Smart Solution for Wastewater, the first in a new digital solutions series, optimizes water-sector operations through continuous monitoring and automation, enabling up to 25% energy savings in aeration and pumping and approximately 10% reduction in chemical consumption. For process sectors, water utilities, and chemicals, centrifugal pump offerings are becoming more and more merged with digital twin technology and remote-control capabilities.

- Global focus on energy efficiency and carbon reduction: By 2040, desalination will account for about 15% of the Middle East's total final energy consumption, up from 5% at present. Desalination accounts for the biggest rise, followed by extensive water transport and rising wastewater treatment (and greater levels of treatment) demand. Globally, centrifugal pump operations are under pressure to improve energy efficiency and cut carbon emissions. Manufacturers adopt high-efficiency motors, variable-frequency drives, and smart monitoring to reduce power consumption. These upgrades lower lifecycle costs, meet stricter environmental regulations, and help industries align with international carbon-reduction and sustainability targets.

- Growing agriculture and irrigation needs: The efficient delivery of water, fertigation, and drainage are central aspects of agricultural modernization and larger scales of irrigation projects. Global demand for food is increasing, and with government-funded programs to help improve yields, countries like India, China, and Brazil have begun upgrading irrigation infrastructures. The ability of centrifugal pumps to manage different flow rates and capacities, as well as their relatively low capital cost, makes them popular for irrigation in both smaller-scale farms and large-scale agricultural businesses.

Emerging Trade Dynamics of Centrifugal Pump

Centrifugal Pumps nes Exports by Country in 2023

|

Exporter |

Export Value (US$ thousands) |

Quantity (Items) |

|

China |

4,589,504.40 |

167,156,000 |

|

European Union |

3,646,574.70 |

18,752,100 |

|

Germany |

2,047,931.51 |

10,561,600 |

|

Italy |

1,301,948.38 |

6,974,200 |

|

United States |

1,232,244.66 |

2,781,800 |

|

France |

925,242.82 |

11,521,500 |

|

Netherlands |

867,155.74 |

3,291,100 |

|

Japan |

619,959.07 |

3,722,140 |

|

Hungary |

533,778.86 |

2,785,060 |

|

Mexico |

533,587.41 |

1,455,460,000 |

Source: WITS

Challenges

- Infrastructure & technical capacity in emerging markets: Rural infrastructure in Sub‑Saharan and South‑Asian countries remains underdeveloped. Research shows that constrained centrifugal pump adoption on small farms is limited by poor power supply and the absence of qualified pump experts. Low local technical support skills and high starting expenses discourage investment, therefore decreasing addressable demand, even when pump efficiency would save running expenses.

- Green protectionism via environmental standards: Though legitimate, environmental policies might inadvertently impede exports, especially affecting SMEs in underdeveloped countries struggling with compliance, as per WTO observation. Meeting US water-efficiency or EU eco-design standards for centrifugal pump suppliers in nations like India or Nigeria can be financially prohibitive. SMEs may not be able to obtain the required certifications, which would limit their global reach and prevent them from participating in EU/US tenders. As a result, the WTO encourages developing countries to increase their capacity. However, actual implementation is inconsistent, which increases market barriers for small and medium-sized pump manufacturers.

Centrifugal Pump Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.3% |

|

Base Year Market Size (2025) |

USD 39.79 billion |

|

Forecast Year Market Size (2035) |

USD 65.38 billion |

|

Regional Scope |

|

Centrifugal Pump Market Segmentation:

Type Segment Analysis

The single-stage pumps segment is predicted to gain the largest centrifugal pump market share of 35.2% during the projected period by 2035, due to their cost-effectiveness and efficient low-pressure performance. These pumps are widely used in agriculture, construction services, and light industrial applications where high flow rates at reasonable pressures are essential. With updated standards promoting their use, the U.S. Department of Energy emphasizes their role in energy-efficient fluid handling. Several industries prefer them over two-stage solutions due to their simple design, ease of maintenance, and reliability. Single-stage pumps should remain the dominant subsegment since companies prioritize cost savings in operation as number one.

End use Segment Analysis

The water and wastewater segment is anticipated to constitute the most significant growth by 2035, with 28.2% market share, due to rapid urbanization and strict government restrictions on wastewater management, which will likely make the centrifugal pump market dominated by the water and wastewater industry. The NRCP has addressed polluted stretches on 34 rivers located in 77 towns in 16 states in India, with a sanctioned cost for the project of Rs 5961.75 crore, for which sewage treatment capacity of 2677 million liters per day (mld) has been established. Under the Namami Gange program, there are a total of 353 projects sanctioned for a cost of Rs 30458 crore, which involves sewage treatment in 157 projects for 4952 mld and a sewer network of 5212 kms. Moreover, stressing worldwide efforts to increase access to clean water, especially in developing countries, the World Health Organization helps to fuel demand for effective pumping solutions. Ensuring ongoing market expansion, municipalities and industrial users are increasingly using centrifugal pumps for wastewater treatment, desalination, and water distribution.

Application Segment Analysis

The industrial process segment is anticipated to constitute the most significant growth by 2035, with 20.2% centrifugal pump market share, due to the chemical, oil & gas, food & beverage, and power generation industries, which involve fluid handling and transferring at large volumes constantly, and are involved in the moving of liquids and fluids under controlled pressure. Because the industries involved also have continuous demand and expansion in both the manufacturing and energy sectors, these industries all have the highest pump consumption compared to irrigation, potable water supply, and cooling water projects, making industrial pumps an important contributor to global revenue.

Our in-depth analysis of the centrifugal pump market includes the following segments:

|

Segment |

Subsegment |

|

Type |

|

|

Application |

|

|

End use |

|

|

Flow |

|

|

Operation |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Centrifugal Pump Market - Regional Analysis

Asia Pacific Market Insights

By 2035, the Asia Pacific centrifugal pump market is expected to hold 42.2% of the market share due to continued urbanization, tighter environmental regulations, and, of course, industrial growth. These drivers are primarily being fueled by growth in urban centers and larger industrial sectors found in China and India. Water treatment will assist with pump growth in APAC alongside energy and chemicals. For example, there are government supports and regulations available to promote energy-efficient pumps. The R&D grants mean more market budget resources are being allocated to the development of sustainable technologies, alongside regulatory measures already driving market momentum regionally.

By 2035, China will be the leader in APAC's market via growing industrial manufacturing in addition to building and maintaining infrastructure upgrades. The NDRC and MEE subsidize funds that promote energy efficiency. Renewable energy, combined with increased refinery upgrades, will positively impact the growth of the market as well. Structural factors, like urbanization and green industrial goals from the CPCIF and ChemChina, will facilitate new pump demand. Automation makes upgrading pump manufacturing approaches more acceptable because of both government and corporate pressures, suggesting it is an optimal solution in overcoming capacity issues in wastewater, hydropower, and chemical processing facilities across China's autonomous regions.

India is expected to demonstrate the largest growth of the APAC pump market with a projected CAGR of 6.6% or greater through 2035. The Make in India entrepreneurial movement, Smart Cities program, and DMIC meant that increased spending in existing infrastructure will occur over the next 5-10 years. Under the Atal Mission for Rejuvenation and Urban Transformation (AMRUT) program launched by the Ministry of Housing & Urban Affairs, 883 sewerage & septage management projects worth Rs 34,081 crore have been launched, of which 370 projects worth Rs 8,258 crore have been completed. Under Swachh Bharat Mission (Urban) 2.0, launched on 1st October, 2021, Rs. 15883 crores have been allocated to States/UTs for wastewater/used water management, including construction of STPs and FSTPs (fecal sludge treatment plants).

Sewage Generation in Urban Areas and Treatment Capacity

|

States / UTs |

Sewage Generation (in MLD) |

Installed Capacity (in MLD) |

Number of STPs Installed |

Operational Treatment Capacity (in MLD) |

|

Andhra Pradesh |

2882 |

833 |

66 |

443 |

|

Bihar |

2276 |

10 |

1 |

0 |

|

Chandigarh |

188 |

293 |

7 |

271 |

|

Chhattisgarh |

1203 |

73 |

3 |

73 |

|

Dadra & Nagar Haveli |

67 |

24 |

3 |

24 |

|

Goa |

176 |

66 |

11 |

44 |

|

Gujarat |

5013 |

3378 |

70 |

3358 |

|

Haryana |

1816 |

1880 |

153 |

1880 |

|

Himachal Pradesh |

116 |

136 |

78 |

99 |

|

Jammu & Kashmir |

665 |

218 |

24 |

93 |

|

Jharkhand |

1510 |

22 |

2 |

22 |

|

Karnataka |

4458 |

2712 |

140 |

1922 |

|

Kerala |

4256 |

120 |

7 |

114 |

|

Madhya Pradesh |

3646 |

1839 |

126 |

684 |

|

Maharashtra |

9107 |

6890 |

154 |

6366 |

|

NCT of Delhi |

3330 |

2896 |

38 |

2715 |

|

Orissa |

1282 |

378 |

14 |

55 |

|

Pondicherry |

161 |

56 |

3 |

56 |

|

Punjab |

1889 |

1781 |

119 |

1601 |

|

Rajasthan |

3185 |

1086 |

114 |

783 |

|

Sikkim |

52 |

20 |

6 |

18 |

|

Tamil Nadu |

6421 |

1492 |

63 |

1492 |

|

Telangana |

2660 |

901 |

37 |

842 |

|

Tripura |

237 |

8 |

1 |

8 |

|

Uttar Pradesh |

8263 |

3374 |

107 |

3224 |

|

Uttarakhand |

627 |

448 |

71 |

345 |

|

West Bengal |

5457 |

897 |

50 |

337 |

Source: PIB

North America Market Insights

The North American market is expected to hold 18.2% of the market share by 2035, due to increasing demand in oil & gas, chemicals, and municipal water. Demand for thermoplastic centrifugal pumps in the U.S. is underpinned by projects in shale extraction and in the Gulf region of petrochemical facility investment. Innovations in smart pumps, energy-efficient impeller designs, and regulatory standards from both the EPA and the DOE have all acted as growth drivers moving forward. Cross-border trade for centrifugal pumps that are compliant with the trade agreements under USMCA and new supply chains influenced by Industry 4.0, should provide a dependable base mechanism for pump demand.

The U.S. chemical industry receives 11% of R&D funding through federal support. In order to promote investments in advanced energy projects and create clean energy supply chains, the Biden-Harris Administration had announced a $6 billion tax credit allocation round, including about $2.5 billion set aside for historic energy communities. The EPA Green Chemistry program issued grants to green chemistry processes to mitigate hazardous waste. EPA and the American Chemical Society have presented awards to 144 technologies that help to eliminate 830 million pounds of hazardous chemicals and solvents. That is enough to fill almost 3,800 railroad tank cars or create a train that is nearly 47 miles long. Every year, 21 billion gallons of water are saved, which is the equivalent of the use of 980,000 people in one year. Every year, 7.8 billion pounds of carbon dioxide are eliminated, which is released to the air, which is equal to eliminating 770,000 automobiles from the road.

Canada is investing $150 million in a national net-zero by 2050 Buildings Strategy, alongside a $2.6 billion Greener Homes Grant to boost home energy efficiency and green supply chains, and a $1.5 billion Green and Inclusive Community Buildings program funding retrofits, repairs, upgrades, and new energy-efficient construction projects. Funds have been allocated to modernize infrastructural services and research and development for electrochemical energy projects for things like hydrogen-storage PEM electrolyzers. NIST-NRC's combined efforts to create more explicit safety standards should assist in providing direction for greater pump demand in Canada's chemical processing system.

Europe Market Insights

The European market is expected to hold 16.9% of the market share by 2035 due to investment in the modernization of aging infrastructure, decarbonization, and investment in the chemicals sector via the EU. The EU Waste Water Treatment Directive is followed in the collection and treatment of about 90% of municipal wastewater throughout the EU. According to the nation profiles, ten more countries have achieved a compliance rate of more than 90%, while four countries, Austria, Germany, Luxembourg, and the Netherlands, treat all of their urban wastewater in accordance with the Directive's standards. In addition, REACH regulations applied to industries are already driving investment in energy-efficient and low-leakage pumps.

Germany’s centrifugal pump market is supported by a solid chemical, automotive, and water treatment industry. Climate change polices at the federal level and the Energy Efficiency Strategy 2050 support high-efficiency pumping solutions. Additionally, investments in municipal water treatment infrastructure, improved industrial automation, and the integration of smart pumps have contributed to an increase in demand for pumping solutions. Germany’s excellent engineering tradition, in addition to EU ecodesign directives, supports innovation and the support of exports. In order to stay competitive in technology, firms are concentrating on digital monitoring, predictive maintenance, and energy savings.

Total Electricity Production in 2022

|

Region/Country |

GWh |

|

Europe |

4 018 742 |

|

Germany |

578 949 |

|

France |

473 672 |

|

Türkiye |

328 379 |

|

United Kingdom |

325 540 |

|

Spain |

292 454 |

|

Poland |

179 748 |

|

Sweden |

173 159 |

|

Norway |

146 730 |

|

The Netherlands |

121 572 |

Source: IEA

Key Centrifugal Pump Market Players:

- Grundfos Holding A/S

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Xylem Inc.

- Flowserve Corporation

- Sulzer Ltd.

- KSB SE & Co. KGaA

- Ebara Corporation

- Wilo SE

- ITT Inc. (Goulds Pumps)

- Pentair plc

- Kirloskar Brothers Limited

- IDEX Corporation (Corken, Viking Pump)

- SPX FLOW, Inc.

- Roto Pumps Limited

- Torishima Pump Mfg. Co., Ltd.

- Tsurumi Manufacturing Co., Ltd.

The global centrifugal pump market is moderately consolidated, comprising global players. Driving the competition are strategic actions like mergers, digital twin technology, and research and development into energy-efficient pumps. European manufacturers are all about sustainability, using possibilities for carbon neutrality policies as a way of generating customer service for complying with regulations. U.S. firms are focusing on automation with IoT integration, and Japanese manufacturers focus on compact, highly efficient devices to support urban and industrial areas within APAC. Regionally focusing on expansions, OEM cooperation, and aftermarket practices are opportunities changing the dynamics of the marketplace globally.

Some of the key players operating in the market are listed below:

Recent Developments

- In December 2024, India-based Wilo Mather & Platt launched an axial-flow submersible pump with SCADA for industrial and water-related applications, including chemical plants. This dual, horizontally or vertically-mounted, pump provides industry partners with real-time monitoring of pump performance, flow control automation including speed control, and internet-enabled cloud-to-pump connectivity for immediate alerts and dashboard visibility.

- In February 2024, DESMI (Denmark) launched a new line of magnetic-drive centrifugal pumps specifically designed for corrosive and volatile chemicals. These pumps have a hermetically sealed casing equipped with a magnetic coupling, which removes mechanical seals, virtually eliminating the risk of leaks in the hazardous chemical environment. Early users in chemical processing verified reductions in unplanned downtime due to seal failures.

- Report ID: 5115

- Published Date: Sep 24, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Centrifugal Pump Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.