·

An Outline of the Global CDK 4/6 Inhibitor Drugs Market

- Market Definition

- Market Segmentation

- Industry Overview

· Assumptions & Abbreviations

· Research Methodology & Approach

- Research Process

- Primary Research

- Manufacturers

- Suppliers/Distributors

- End Users

- Secondary Research

- Market Size Estimation

· Summary of the Report for Key Decision Makers

· Forces of Market Constituents

- Factors/drivers impacting the growth of the market

- Market trends for better business practices

· Key Market Opportunities for Business Growth

· Major Roadblocks for the Market Growth

· Regulatory Landscape

· Industry Value Chain Analysis

· Recent Developments in the Market

· Impact of Covid-19

· Epidemiology

· Treatment Guidelines for Breast Cancer

· Unmet Needs

· Product Profiling

· Drug pricing and Reimbursements

· Comparative Drug Analysis

· Drug Pipeline Analysis

· Competitive Positioning

· Competitive Model: A Detailed Inside View for Investors

- Company Market Share (2023)

- Business Profile of Key Enterprise

- Pfizer Inc.

- Novartis

- Eli Lilly and Company

- Jiangshu Hengrui Pharmaceuticals Co. Ltd.

· Global CDK 4/6 Inhibitor Drugs Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), and Compound Annual Growth Rate (CAGR)

- Year-on-Year (YoY) Growth Trend Analysis

- Global CDK 4/6 Inhibitor Drugs Market Outlook & Projections, Opportunity Assessment by Segment, 2023-2036, By Drug Type

- Palbociclib, Market Value (USD Million) and CAGR, 2023-2036F

- Ribociclib, Market Value (USD Million), and CAGR, 2023-2036F

- Abemaciclib, Market Value (USD Million), and CAGR, 2023-2036F

- Dalpiciclib, Market Value (USD Million), and CAGR, 2023-2036F

- Birociclib, Market Value (USD Million), and CAGR, 2023-2036F

- Lerociclib, Market Value (USD Million), and CAGR, 2023-2036F

- BPI 16350, Market Value (USD Million), and CAGR, 2023-2036F

- Others, Market Value (USD Million), and CAGR, 2023-2036F

- Global CDK 4/6 Inhibitor Drugs Market Outlook & Projections, Opportunity Assessment by Segment, 2023-2036, By Patient

- PreMenopause, Market Value (USD Million) and CAGR, 2023-2036F

- PostMenopausal, Market Value (USD Million) and CAGR, 2023-2036F

- Others, Market Value (USD Million) and CAGR, 2023-2036F

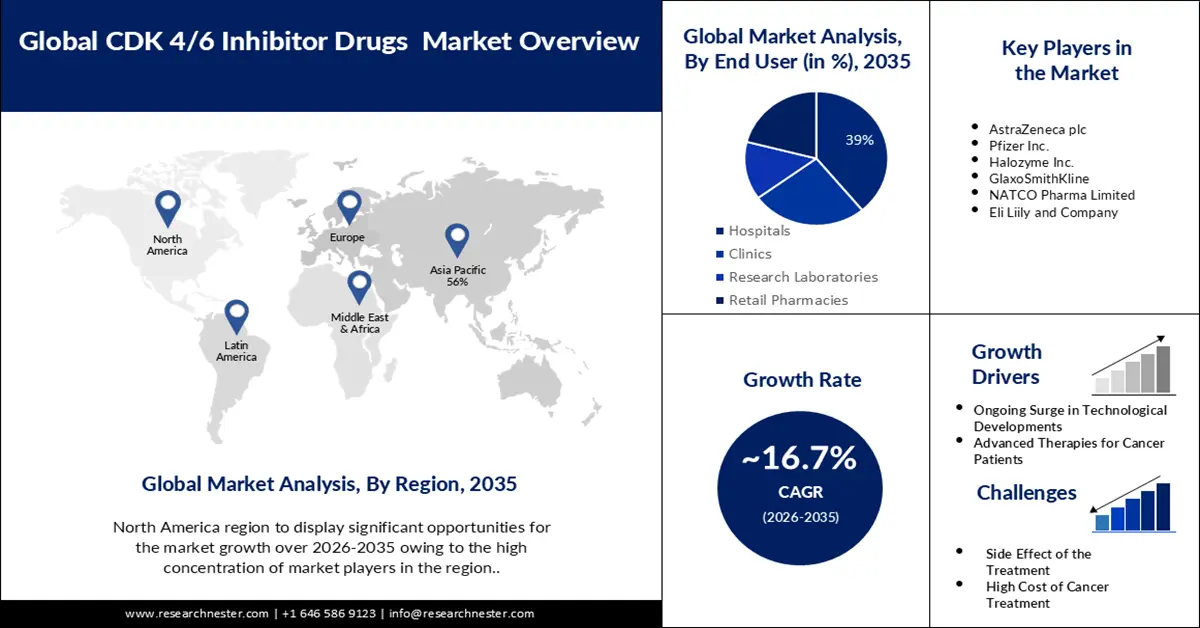

- Global CDK 4/6 Inhibitor Drugs Market Segmentation Analysis (2023-2036), By End User

- Hospitals, Market Value (USD Million) and CAGR, 2023-2036F

- Clinics, Market Value (USD Million) and CAGR, 2023-2036F

- Research Laboratories, Market Value (USD Million) and CAGR, 2023-2036F

- Retail Pharmacies, Market Value (USD Million) and CAGR, 2023-2036F

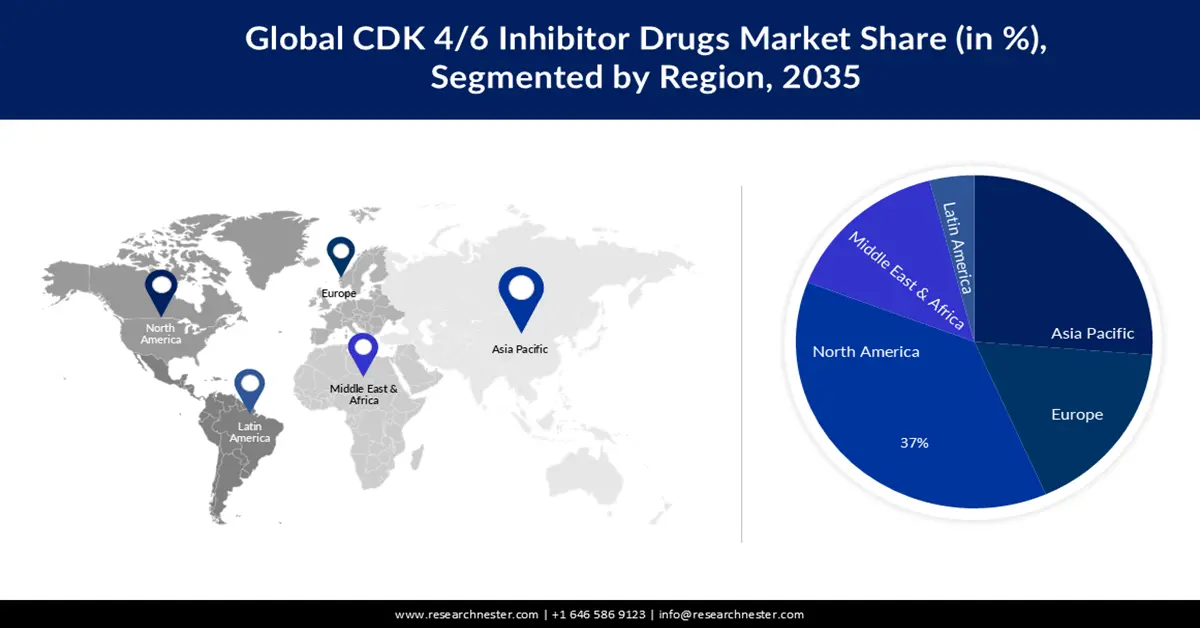

- Global CDK 4/6 Inhibitor Drugs Market Segmentation Analysis (2023-2036), By Geography

- North America, Market Value (USD Million), and CAGR, 2023-2036F

- Europe, Market Value (USD Million), and CAGR, 2023-2036F

- Asia Pacific, Market Value (USD Million), and CAGR, 2023-2036F

- Latin America, Market Value (USD Million), and CAGR, 2023-2036F

- Middle East & Africa, Market Value (USD Million), and CAGR, 2023-2036F

· North America CDK 4/6 Inhibitor Drugs Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), and Compound Annual Growth Rate (CAGR)

- Year-on-Year (YoY) Growth Trend Analysis

- North America CDK 4/6 Inhibitor Drugs Market Outlook & Projections, Opportunity Assessment by Segment, 2023-2036, By Drug Type

- Palbociclib, Market Value (USD Million), and CAGR, 2023-2036F

- Ribociclib, Market Value (USD Million), and CAGR, 2023-2036F

- Abemaciclib, Market Value (USD Million), and CAGR, 2023-2036F

- Dalpiciclib , Market Value (USD Million), and CAGR, 2023-2036F

- Birociclib, Market Value (USD Million), and CAGR, 2023-2036F

- Lerociclib, Market Value (USD Million), and CAGR, 2023-2036F

- BPI 16350, Market Value (USD Million), and CAGR, 2023-2036F

- Others, Market Value (USD Million), and CAGR, 2023-2036F

- North America CDK 4/6 Inhibitor Drugs Market Outlook & Projections, Opportunity Assessment by Segment, 2023-2036, By Patient

- PreMenopause, Market Value (USD Million) and CAGR, 2023-2036F

- PostMenopausal, Market Value (USD Million) and CAGR, 2023-2036F

- Others, Market Value (USD Million) and CAGR, 2023-2036F

- North America CDK 4/6 Inhibitor Drugs Market Segmentation Analysis (2023-2036), By End User

- Hospitals, Market Value (USD Million) and CAGR, 2023-2036F

- Clinics, Market Value (USD Million) and CAGR, 2023-2036F

- Research Laboratories, Market Value (USD Million) and CAGR, 2023-2036F

- Retail Pharmacies, Market Value (USD Million) and CAGR, 2023-2036F

- North America CDK 4/6 Inhibitor Drugs Market Segmentation Analysis (2023-2036), By Country

- US, Market Value (USD Million), and CAGR, 2023-2036F

- Canada, Market Value (USD Million), and CAGR, 2023-2036F

· Europe CDK 4/6 Inhibitor Drugs Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), and Compound Annual Growth Rate (CAGR)

- Year-on-Year (YoY) Growth Trend Analysis

- Europe CDK 4/6 Inhibitor Drugs Market Outlook & Projections, Opportunity Assessment by Segment, 2023-2036, By Drug Type

- Palbociclib, Market Value (USD Million), and CAGR, 2023-2036F

- Ribociclib, Market Value (USD Million), and CAGR, 2023-2036F

- Abemaciclib, Market Value (USD Million), and CAGR, 2023-2036F

- Dalpiciclib , Market Value (USD Million), and CAGR, 2023-2036F

- Birociclib, Market Value (USD Million), and CAGR, 2023-2036F

- Lerociclib, Market Value (USD Million), and CAGR, 2023-2036F

- BPI 16350, Market Value (USD Million), and CAGR, 2023-2036F

- Others, Market Value (USD Million), and CAGR, 2023-203

- Europe CDK 4/6 Inhibitor Drugs Market Outlook & Projections, Opportunity Assessment by Segment, 2023-2036, By Patient

- PreMenopause, Market Value (USD Million) and CAGR, 2023-2036F

- PostMenopausal, Market Value (USD Million) and CAGR, 2023-2036F

- Others, Market Value (USD Million) and CAGR, 2023-2036F

- Europe CDK 4/6 Inhibitor Drugs Market Segmentation Analysis (2023-2036), By End-User

- Hospitals, Market Value (USD Million) and CAGR, 2023-2036F

- Clinics, Market Value (USD Million) and CAGR, 2023-2036F

- Research Laboratories, Market Value (USD Million) and CAGR, 2023-2036F

- Retail Pharmacies, Market Value (USD Million) and CAGR, 2023-2036F

- Europe CDK 4/6 Inhibitor Drugs Market Segmentation Analysis (2023-2036), By Country

- UK, Market Value (USD Million), and CAGR, 2023-2036F

- Germany, Market Value (USD Million), and CAGR, 2023-2036F

- Italy, Market Value (USD Million), and CAGR, 2023-2036F

- France, Market Value (USD Million), and CAGR, 2023-2036F

- Spain, Market Value (USD Million), and CAGR, 2023-2036F

- Russia, Market Value (USD Million), and CAGR, 2023-2036F

- Netherlands, Market Value (USD Million), and CAGR, 2023-2036F

- Rest of Europe, Market Value (USD Million), and CAGR, 2023-2036F

· Asia Pacific CDK 4/6 Inhibitor Drugs Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), and Compound Annual Growth Rate (CAGR)

- Year-on-Year (YoY) Growth Trend Analysis

- Asia Pacific CDK 4/6 Inhibitor Drugs Market Outlook & Projections, Opportunity Assessment by Segment, 2023-2036, By Drug Type

- Palbociclib, Market Value (USD Million), and CAGR, 2023-2036F

- Ribociclib, Market Value (USD Million), and CAGR, 2023-2036F

- Abemaciclib, Market Value (USD Million), and CAGR, 2023-2036F

- Dalpiciclib , Market Value (USD Million), and CAGR, 2023-2036F

- Birociclib, Market Value (USD Million), and CAGR, 2023-2036F

- Lerociclib, Market Value (USD Million), and CAGR, 2023-2036F

- BPI 16350, Market Value (USD Million), and CAGR, 2023-2036F

- Others, Market Value (USD Million), and CAGR, 2023-203

- Asia Pacific CDK 4/6 Inhibitor Drugs Market Outlook & Projections, Opportunity Assessment by Segment, 2023-2036, By Patient

- PreMenopause, Market Value (USD Million) and CAGR, 2023-2036F

- PostMenopausal, Market Value (USD Million) and CAGR, 2023-2036F

- Others, Market Value (USD Million) and CAGR, 2023-2036F

- Asia Pacific CDK 4/6 Inhibitor Drugs Market Segmentation Analysis (2023-2036), By End-User

- Hospitals, Market Value (USD Million) and CAGR, 2023-2036F

- Clinics, Market Value (USD Million) and CAGR, 2023-2036F

- Research Laboratories, Market Value (USD Million) and CAGR, 2023-2036F

- Retail Pharmacies, Market Value (USD Million) and CAGR, 2023-2036F

- Asia Pacific CDK 4/6 Inhibitor Drugs Market Segmentation Analysis (2023-2036), By Country

- China, Market Value (USD Million), and CAGR, 2023-2036F

- India, Market Value (USD Million), and CAGR, 2023-2036F

- Japan, Market Value (USD Million), and CAGR, 2023-2036F

- South Korea, Market Value (USD Million), and CAGR, 2023-2036F

- Singapore, Market Value (USD Million), and CAGR, 2023-2036F

- Australia, Market Value (USD Million), and CAGR, 2023-2036F

- Rest of Asia-Pacific, Market Value (USD Million), and CAGR, 2023-2036F

· Latin America CDK 4/6 Inhibitor Drugs Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), and Compound Annual Growth Rate (CAGR)

- Year-on-Year (YoY) Growth Trend Analysis

- Latin America CDK 4/6 Inhibitor Drugs Market Outlook & Projections, Opportunity Assessment by Segment, 2023-2036, By Drug Type

- Palbociclib, Market Value (USD Million), and CAGR, 2023-2036F

- Ribociclib, Market Value (USD Million), and CAGR, 2023-2036F

- Abemaciclib, Market Value (USD Million), and CAGR, 2023-2036F

- Dalpiciclib , Market Value (USD Million), and CAGR, 2023-2036F

- Birociclib, Market Value (USD Million), and CAGR, 2023-2036F

- Lerociclib, Market Value (USD Million), and CAGR, 2023-2036F

- BPI 16350, Market Value (USD Million), and CAGR, 2023-2036F

- Others, Market Value (USD Million), and CAGR, 2023-203

- Latin America CDK 4/6 Inhibitor Drugs Market Outlook & Projections, Opportunity Assessment by Segment, 2023-2036, By Patient

- PreMenopause, Market Value (USD Million) and CAGR, 2023-2036F

- PostMenopausal, Market Value (USD Million) and CAGR, 2023-2036F

- Others, Market Value (USD Million) and CAGR, 2023-2036F

- Latin America CDK 4/6 Inhibitor Drugs Market Segmentation Analysis (2023-2036), By End-User

- Hospitals, Market Value (USD Million) and CAGR, 2023-2036F

- Clinics, Market Value (USD Million) and CAGR, 2023-2036F

- Research Laboratories, Market Value (USD Million) and CAGR, 2023-2036F

- Retail Pharmacies, Market Value (USD Million) and CAGR, 2023-2036F

- Latin America CDK 4/6 Inhibitor Drugs Market Segmentation Analysis (2023-2036), By Country

- Brazil, Market Value (USD Million), and CAGR, 2023-2036F

- Mexico, Market Value (USD Million), and CAGR, 2023-2036F

- Argentina, Market Value (USD Million), and CAGR, 2023-2036F

- Rest of Latin America, Market Value (USD Million), and CAGR, 2023-2036F

· Middle East & Africa CDK 4/6 Inhibitor Drugs Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), and Compound Annual Growth Rate (CAGR)

- Year-on-Year (YoY) Growth Trend Analysis

- Middle East & Africa CDK 4/6 Inhibitor Drugs Market Outlook & Projections, Opportunity Assessment by Segment, 2023-2036, By Drug Type

- Palbociclib, Market Value (USD Million), and CAGR, 2023-2036F

- Ribociclib, Market Value (USD Million), and CAGR, 2023-2036F

- Abemaciclib, Market Value (USD Million), and CAGR, 2023-2036F

- Dalpiciclib , Market Value (USD Million), and CAGR, 2023-2036F

- Birociclib, Market Value (USD Million), and CAGR, 2023-2036F

- Lerociclib, Market Value (USD Million), and CAGR, 2023-2036F

- BPI 16350, Market Value (USD Million), and CAGR, 2023-2036F

- Others, Market Value (USD Million), and CAGR, 2023-203

- Middle East & Africa CDK 4/6 Inhibitor Drugs Market Outlook & Projections, Opportunity Assessment by Segment, 2023-2036, By Patient

- PreMenopause, Market Value (USD Million) and CAGR, 2023-2036F

- PostMenopausal, Market Value (USD Million) and CAGR, 2023-2036F

- Others, Market Value (USD Million) and CAGR, 2023-2036F

- Middle East & Africa CDK 4/6 Inhibitor Drugs Market Segmentation Analysis (2023-2036), By End-User

- Hospitals, Market Value (USD Million) and CAGR, 2023-2036F

- Clinics, Market Value (USD Million) and CAGR, 2023-2036F

- Research Laboratories, Market Value (USD Million) and CAGR, 2023-2036F

- Retail Pharmacies, Market Value (USD Million) and CAGR, 2023-2036F

- Middle East & Africa CDK 4/6 Inhibitor Drugs Market Segmentation Analysis (2023-2036) , By Country

- GCC, Market Value (USD Million), and CAGR, 2023-2036F

- Israel, Market Value (USD Million), and CAGR, 2023-2036F

- South Africa, Market Value (USD Million), and CAGR, 2023-2036F

- Rest of Middle East & Africa, Market Value (USD Million), and CAGR, 2023-2036F

CDK4/6 Inhibitor Drugs Market Outlook:

CDK4/6 Inhibitor Drugs Market size was valued at USD 15.82 billion in 2025 and is set to exceed USD 74.12 billion by 2035, expanding at over 16.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of CDK4/6 inhibitor drugs is estimated at USD 18.2 billion.

According to Breastcancer.org, breast cancer is the most common cancer in the world, accounting for 12.5% of new cancer cases worldwide each year. The increasing prevalence of breast cancer is a major driver of the CDK-4/6 inhibitor market. CDK4/6 inhibitors are effective in treating hormone receptor-positive and human epidermal growth factor receptor 2-negative breast cancer, making them a valuable treatment option. As the incidence of breast cancer continues to increase worldwide, the demand for targeted and effective treatments such as CDK-4/6 inhibitors is increasing, contributing to market expansion.

As health spending increases, funding for research and development activities typically increases proportionately. Investment in innovative cancer treatments, coupled with increasing awareness of the effectiveness of these inhibitors, is contributing to their acceptance and market growth. Financial commitment to medical infrastructure and research will further accelerate the development and access of CDK4/6 inhibitors to cancer patients. The global CDK-4/6 inhibitors market is expected to witness strong growth during the forecast period. This is because medical costs per person are high.

Key CDK4/6 Inhibitor Drugs Market Insights Summary:

Regional Highlights:

- North America is expected to command a 69% share by 2035 in the CDK4/6 Inhibitor Drugs Market, attributed to the surge in clinical trials supporting targeted therapy adoption.

- Europe is projected to witness substantial expansion by 2035 as government-led initiatives and rising breast cancer prevalence stimulate the uptake of advanced CDK4/6 inhibitor treatments.

Segment Insights:

- By 2035, the hospital segment is anticipated to secure the leading share in the CDK4/6 Inhibitor Drugs Market, underpinned by rising breast cancer incidence, sophisticated treatment capabilities, and strengthened healthcare infrastructure.

- The post-menopausal segment is set to dominate revenue share by 2035, fueled by the higher prevalence of hormone-receptor-positive breast cancers associated with age-related estrogen production.

Key Growth Trends:

- Increasing Advancement in Drug Development

- Introduction of Targeted Therapies for the Treatment of Breast Cancer

Major Challenges:

- Side Effects of CDK4/6 Inhibitor Drug

- Limited Access to Advanced Healthcare

Key Players: Pfizer Inc., Novartis AG, Eli Lilly and Company, Jiangsu Hengrui Pharmaceuticals Co., Ltd., AstraZeneca plc, Celltrion, Inc, Merck & Co., Inc., Halozyme Inc., Sanofi, NATCO Pharma Limited.

Global CDK4/6 Inhibitor Drugs Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 15.82 billion

- 2026 Market Size: USD 18.2 billion

- Projected Market Size: USD 74.12 billion by 2035

- Growth Forecasts: 16.7%

Key Regional Dynamics:

- Largest Region: North America (69% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Italy, Australia

Last updated on : 19 November, 2025

CDK4/6 Inhibitor Drugs Market - Growth Drivers and Challenges

Growth Driver

- Increasing Advancement in Drug Development - Drug treatment with CDK-4/6 inhibitors has proven to be the most promising advance in breast cancer treatment. Advances in pharmaceutical research and development highlight the exciting potential of CDK-4/6 inhibitors for the future of breast cancer treatment. Drug treatment with CDK4/6 inhibitors has been accepted in many countries due to its therapeutic efficacy compared to conventional breast cancer treatment. Increased number of drug treatments using CDK4/6 inhibitors in various stages of clinical trials and increased approval of inhibitory drug therapies by the FDA, leading to acceptance of new and advanced technologies in the field of breast cancer treatment. Now it looks like this. For example, on April 15, 2021, G1 Therapeutics began clinical trials for its CDK-4/6 inhibitor, trilaciclib. This drug is typically used in patients receiving gemcitabine and carboplatin for metastatic triple-negative breast cancer

- Introduction of Targeted Therapies for the Treatment of Breast Cancer - In some targeted treatments, antibodies are administered that imitate the antibody resulting from natural human immune systems. Another name for these types of targeted therapy is immune targeting therapies. Breast cancer cells may overexpress specific receptors that, when activated, may cause downstream signaling to occur, leading to the activation of genes involved in cancer cell proliferation, growth, survival, migration, angiogenesis, and other critical cell cycle pathways.

Challenges

- Side Effects of CDK4/6 Inhibitor Drug - The market for CDK4/6 inhibitor drugs is being held back by side effects associated with the treatment of CDK4/6 inhibitors. Abemaciclib: It causes various side effects such as diarrhea, low white blood cell counts, low red blood cell counts, blood clots, nausea: abdominal pain, fatigue, and vomiting. It can cause liver problems in a few cases. Before and during treatment, liver function checks are performed. In severe cases, it can cause lung inflammation, which can be fatal. Therefore, the side effects are expected to hinder market growth in the forthcoming period.

- Limited Access to Advanced Healthcare is Predicted to Hamper the Market in the Forecast Period

- Safety Concerns and Adverse Effects are Expected to Pose Limitations on the Market Expansion in the Upcoming Future.

CDK4/6 Inhibitor Drugs Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

16.7% |

|

Base Year Market Size (2025) |

USD 15.82 billion |

|

Forecast Year Market Size (2035) |

USD 74.12 billion |

|

Regional Scope |

|

CDK4/6 Inhibitor Drugs Market Segmentation:

End User Segment Analysis

In terms end user segmentation, the hospital segment in the CDK4/6 inhibitor drugs market is anticipated to hold majority share by the end of 2035. As the incidence of breast cancer increases, hospitals hold the highest market share. In the case of cancer, we have a higher influx of patients than other medical institutions because we have cutting-edge treatment technology. Therefore, the demand for this drug is highest in the hospital end-use sector. Additionally, intensified efforts by governments to build a strong healthcare framework in hospitals across the countries is also expected to boost the market. Additionally, the increasing number of surgical hospitals with single specialty expertise is also contributing to the market growth.

Patient Segment Analysis

CDK4/6 inhibitor drugs market size from the post-menopausal segment is set to dominate revenue share by the end of 2035. The majority of breast cancers in postmenopausal women are hormonal receptor-positive, and breast cancer is most common in these women. Women's breast fat cells tend to produce increasing levels of the enzyme aromatase as they become older. The enzyme aromatase promotes the synthesis of estrogen. Consequently, as women age, their breasts contain an increased quantity of oestrogen. Postmenopausal women's breast cancer growth and expansion are both influenced by this locally generated oestrogen. Palbociclib is used in conjunction with an aromatase inhibitor to treat postmenopausal women and men with hormone-receptor-positive, HER2-negative, advanced-stage or metastatic breast cancer that has not previously received hormonal therapy.

Our in-depth analysis of the global CDK4/6 inhibitor drugs market includes the following segments:

|

Drug Type |

|

|

Patient |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

CDK4/6 Inhibitor Drugs Market - Regional Analysis

North American Market Insights

North America industry is poised to account for largest revenue share of 69% by 2035. Increasing number of clinical trials in the region is also driving market growth. The NCI-sponsored TAILORx clinical trial focused on patients with ER-positive, node-negative breast cancer and found that a test that looks at the expression of certain genes can predict which women can safely avoid chemotherapy. Other studies, such as RxPONDER, have found that some postmenopausal women with HER-2-negative, HR-positive breast cancer that has spread to multiple lymph nodes and has a low risk of recurrence do not benefit from chemotherapy. As a result, the demand for targeted therapies has increased significantly in the United States.

European Market Insights

The CDK4/6 inhibitor drugs market in the Europe region is anticipated to grow significantly by the end of 2035. The European CDK-4/6 inhibitors market is growing significantly due to increasing government initiatives in major European countries such as the UK, Germany, Spain, and France. Additionally, the increasing prevalence of breast cancer has increased the use of advanced treatments and drugs, which is also one of the key factors driving the growth of the CDK-4/6 inhibitors market. Breast cancer accounts for 13.3% of all new cancer cases and is estimated to affect 1 in 11 of 74-year-old women in the EU.

CDK4/6 Inhibitor Drugs Market Players:

- Pfizer Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Novartis AG

- Eli Lilly and Company

- Jiangsu Hengrui Pharmaceuticals Co., Ltd.

- AstraZeneca plc

- Celltrion, Inc

- Merck & Co., Inc.

- Halozyme Inc.

- Sanofi

- NATCO Pharma Limited

Recent Developments

- In April 2021, Pfizer announced the acquisition of Amplyx Pharmaceuticals Inc., which is a privately held company dedicated to discovering medicines for severe and sometimes fatal illnesses affecting people with weakened immune systems.

- In 2023, Novartis announced improved invasive survival assessment results from the pivotal Phase 3 NATALEE study, with a median follow-up of 33.3 months and 78.3% of patients completing Kiscal therapy. These results confirm the benefit observed in a previous interim analysis in patients with HR+/HER2- early stages II and III breast cancer who received adjuvant Kisqari and nonsteroidal aromatase inhibitors. Patients had a 25.1% increased chance of malignant recurrence compared with typical endocrine therapy. Comparison of therapy (ET) and ET alone.

- Report ID: 2533

- Published Date: Nov 19, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

CDK4/6 Inhibitor Drugs Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.