Atopic Dermatitis Drugs Market Outlook:

Atopic Dermatitis Drugs Market size was over USD 15.94 billion in 2025 and is poised to exceed USD 36.71 billion by 2035, witnessing over 8.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of atopic dermatitis drugs is estimated at USD 17.19 billion.

Atopic dermatitis drugs are essential for the management of the symptoms associated with atopic dermatitis, also known as eczema. These primarily reduce irritation and itching, allowing patients to live a more normal life by efficiently monitoring flare-ups and refining their quality of life. However, the implementation of dupilumab as a human monoclonal antibody is highly driving the expansion of the atopic dermatitis drugs market worldwide. Even though its survival rate is low and ranges between 88% to 91% as stated in an article published by NLM in May 2020, the ongoing research and development have resulted in alternative diagnosis tests, therapies, and drugs that are fruitful for the market to boost globally.

The demand for the atopic dermatitis drugs market is expanding owing to the occurrence of food allergies among patients with atopic dermatitis. To combat the condition, the conduction of a skin prick test is the most suitable diagnostic procedure. As per an article published by JAAD International in December 2022, 53% of children with the condition constitute positive food-specific immunoglobulin E (sIgE) and skin prick tests with up to 15% signifying signs of food allergy. Therefore, the test is useful for identifying exact allergens that trigger eczema flares, permitting for targeted allergen avoidance strategies, and improving the condition.

However, to conduct the skin-prick test, there is a need for syringes that are readily exported and imported globally. According to the OEC 2023 report, the global trade valuation of syringes is USD 7.5 billion with the United States as the top exporter at USD 956 million as well as the importer at USD 1.0 billion. In addition, the product complexity accounts for 0.8 with an export growth rate of 1.4%. Furthermore, a syringe with or without needles is the world’s 496th most traded product highly driving the skin-prick test, which in turn is a positive outlook based on the diagnosis of skin disorders, thus bolstering the atopic dermatitis drugs market globally.

Export and Import of Syringes Internationally

|

Countries |

Export |

Import |

|

France |

USD 857 million |

USD 770 million |

|

China |

USD 814 million |

- |

|

Switzerland |

USD 790 million |

- |

|

Germany |

USD 755 million |

USD 905 million |

|

Belgium |

- |

USD 386 million |

|

Italy |

- |

USD 371 million |

Source: OEC 2023

Key Atopic Dermatitis Drugs Market Insights Summary:

Regional Highlights:

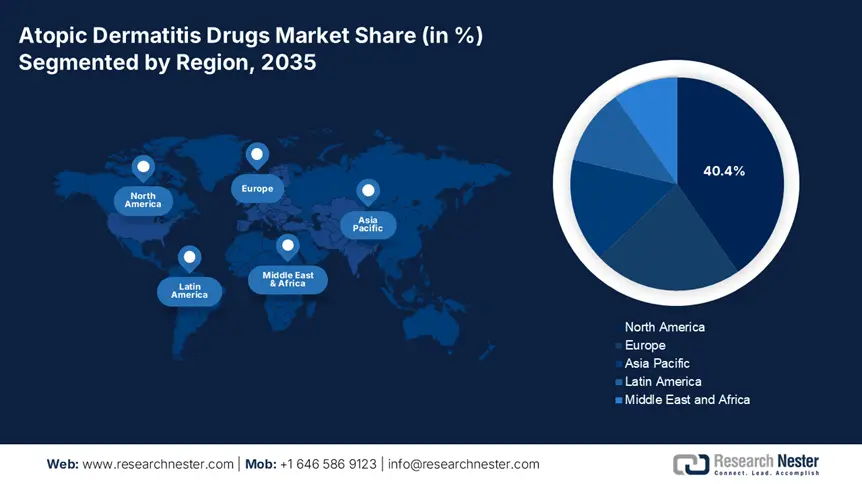

- North America leads the Atopic Dermatitis Drugs Market with a 40.4% share, fueled by continuous R&D and increasing demand for novel dermatological treatments, driving advancements in medical innovation by 2035.

- Asia Pacific’s atopic dermatitis drugs market is anticipated to grow rapidly by 2035, driven by the rising incidence of dermatitis and increased healthcare investments.

Segment Insights:

- The Injectable segment is projected to exhibit substantial growth through 2026-2035, fueled by the advantages of injectable drugs providing swift and accurate medication distribution for severe atopic dermatitis cases.

- The Biologics segment of the Atopic Dermatitis Drugs Market is projected to hold a 47.8% share by 2035, driven by their targeted, effective treatments with fewer side effects compared to traditional therapies.

Key Growth Trends:

- Increasing prevalence of diseases

- Provision of personalized medicines

Major Challenges:

- High cost of treatments

- Presence of regulatory obstacles

- Key Players: Abbvie, Sanofi, Regeneron Pharmaceuticals, Inc., Pfizer Inc..

Global Atopic Dermatitis Drugs Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 15.94 billion

- 2026 Market Size: USD 17.19 billion

- Projected Market Size: USD 36.71 billion by 2035

- Growth Forecasts: 8.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, France

- Emerging Countries: China, India, Brazil, Russia, Mexico

Last updated on : 12 August, 2025

Atopic Dermatitis Drugs Market Growth Drivers and Challenges:

Growth Drivers

- Increasing prevalence of diseases: The major driving factor behind the expansion of the atopic dermatitis drugs market is the continuous prevalence of diseases around the world. The 2025 World Health Organization report stated that there are 5,500 rare diseases that affect people, which in turn is increasing the demand for treatments and therapies. In addition, the global burden of skin disorders affects more than 3 billion people internationally, as stated by Mayo Clinic Proceedings in September 2024. This poses vital health challenges with reflective impacts in high-income, low-income, and middle-income nations, thus driving the demand for the implementation of atopic dermatitis drugs.

- Provision of personalized medicines: The importance of tailored treatment solutions for a patient’s specific genetic followed by clinical and environmental factors is also boosting the atopic dermatitis drugs market. For instance, in February 2023, Roche declared its collaboration with Janssen Biotech Inc. to develop diagnostics for targeted therapies, further expanding research and innovation activities. This also ensured advancements in providing personalized healthcare services through this companionship, thus an effective contribution towards the market upliftment.

Challenges

- High cost of treatments: The expensive pricing of therapies and drugs, especially for rare diseases, is a huge barrier for the atopic dermatitis drugs market. High expenditures related to the condition create monetary tension among patients, ultimately diminishing their capability to access and afford these treatments. Additionally, a noteworthy number of individuals find it thought-provoking to afford the costs of these medications, convincing them to select more cost-effective replacements rather than accepting these drugs. This also affects healthcare facilities and insurance providers to cover these medical solutions, thus a hindrance to the market expansion.

- Presence of regulatory obstacles: Obstructions in regulatory strategies and principles are another challenge of the atopic dermatitis drugs market. These are naturally time-consuming and resource-intensive which results in delayed approvals to unveil the latest therapies to the market. Therefore, manufacturers may be discouraged from capitalizing on investigation and expansion for atopic dermatitis drugs, and probable revolutions may be decelerated. This eventually affects the market growth and limits treatment options for patients, thus a huge restraint for the market to boost globally.

Atopic Dermatitis Drugs Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.7% |

|

Base Year Market Size (2025) |

USD 15.94 billion |

|

Forecast Year Market Size (2035) |

USD 36.71 billion |

|

Regional Scope |

|

Atopic Dermatitis Drugs Market Segmentation:

Drug Class (Biologics, Calcineurin Inhibitors, PDE-4 Inhibitor, Corticosteroids)

Biologics segment is set to hold over 47.8% atopic dermatitis drugs market share by the end of 2035. These operate by aiming precise immune system molecules that play a role in the disease's progress. In the market, biologics have achieved distinction as they offer exceedingly targeted and active treatment with fewer side effects in comparison to traditional therapies. For instance, as per the February 2021 article published by NLM, the survival rate of ustekinumab as a biologic is 89.0%, 86·0% for ixekizumab, 78·1% for secukinumab, 76·5% for adalimumab and 66·0% for etanercept, thus positively driving the market growth.

Route of Administration (Tropical, Injectable, Oral)

The injectable segment is predicted to positively impact the atopic dermatitis drugs market at a substantial rate during the forecast period. Injection-based drugs ensure swift and accurate distribution of medication straight into the bloodstream and this approach typically caters to severe cases of the condition globally. The evolution of innovative biologics in combination with customized therapies for patients promotes the segment’s growth and expansion.

Our in-depth analysis of the global atopic dermatitis drugs market includes the following segments:

|

Drug Class |

|

|

Route of Administration |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Atopic Dermatitis Drugs Market Regional Analysis:

North America Market Analysis

By 2035, North America atopic dermatitis drugs market is set to hold more than 40.4% revenue share. The aspect of ongoing and continuous research and development has resulted in the launch of novel treatment options for the condition in the region. Moreover, patient-centric care models and telehealth care adoption have expanded traction, enabling accessibility to dedicated care within the region. In addition, regulatory approvals and medical facilities make North America a crucial market, with intensifying demand for effective atopic dermatitis treatments, thus an optimistic outlook for the market.

The atopic dermatitis drugs market in the U.S. is expected to expand due to the approvals of innovative drugs approved by the U.S. FDA. According to the March 2025 AAD article, the FDA has approved Roflumilast cream to diminish symptoms of atopic dermatitis, especially for children under 6 years of age. In this regard, a clinical study was conducted on 244 patients to denote the long-term safety of the cream, as stated in the August 2024 NLM article. The study resulted in 97% of the patients displaying absence of irritation with the application of the cream and there was no tachyphylaxis observed among 44.8%, thus a suitable treatment solution driving the market growth in the country.

The atopic dermatitis drugs market in Canada is effectively gaining more exposure owing to the involvement of the government towards the objective of combating rare diseases. As per the December 2022 Canada Institutes of Health Research report, the government made a strategy to invest USD 400,000 every year for at least the upcoming five years, denoting an effective contribution for the market to expand. Additionally, in January 2025, the Ontario Government invested in skin and wound care training for up to 400 long-term care home staff. This included USD 329,400 to Nurses Specialized in Wound, Ostomy, and Continence Canada (NSWOCC) and USD 671,900 to Wounds Canada to deliver the Wound Care Champion Program.

APAC Market Statistics

The atopic dermatitis drugs market in Asia Pacific is the fastest-growing region and is poised to expand at a lucrative growth during the forecast timeline. The rising incidence of atopic dermatitis, increased healthcare spending, and the implementation of cost-effective treatment options are a few factors amplifying the market growth in the region. As per an article published by the World Allergy Organization Journal in December 2022, the occurrence of the condition in Malaysia and Singapore was 13.5%. Besides, Malaysia has the uppermost incidence of the condition, especially among children across Asia accounting for 13.4%, driving the demand for the market within the region.

The atopic dermatitis drugs market in India is readily driven by organization partnerships to launch innovative drugs to provide treatment for the condition. For instance, in January 2024, Glenmark Pharmaceuticals Ltd. and Pfizer united to unveil abrocitinib, a first-of-its-kind oral progressive systemic treatment for moderate-to-severe atopic dermatitis in India. The drug has received publicizing permission from the Central Drugs Standard Control Organization (CDSCO) in the country and is accepted by the U.S. FDA, European Medicines Agency (EMA), and other regulatory agencies. Therefore, the aspect of joint agreements by global organizations has been successful for the market to expand in the country.

The atopic dermatitis drugs market in China is gaining positive exposure owing to the availability of herbal medication solutions to aid the condition among the population. Based on this, a clinical study was conducted on 662 patients from the country, as stated in an article reported by Frontiers Organization in September 2022. The purpose was to monitor the efficacy and safety of herbal medicines as a treatment option for atopic dermatitis. Herbs including Glycyrrhiza glabra, Dioscorea oppositifolia, Coix lacrymal-Jobi, and Smilax glabra Roxb were evaluated and the Eczema Area and Severity Index (EASI) rate was 95%, depicting the effectiveness of their usage to aid the condition in the country.

Key Atopic Dermatitis Drugs Market Players:

- AbbVie Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Sanofi

- Regeneron Pharmaceuticals, Inc.

- Pfizer Inc.

- AnaptysBio, Inc.

- Incyte Corporation

- Eli Lilly and Company

- Novartis AG

- LEO Pharma A/S

- Bristol-Myers Squibb Company

- Galderma S.A.

- Dermira, Inc. (acquired by Eli Lilly and Company)

- Encore Dermatology, Inc.

- Medimetriks Pharmaceuticals, Inc.

- Organon

- Regeneron Pharmaceuticals, Inc.

Companies are undertaking several approaches such as the latest product growth, alliances, procurements, mergers, and regional expansion to serve the unmet requirements of their customers which is positively impacting the atopic dermatitis drugs market globally. For instance, in October 2024. Organon notified the fruitful accomplishment of its acquisition of Dermavant Sciences Ltd. from Roivant. This further resulted in the acquisition of VTAMA cream, an innovative dermatologic therapy, which is 1% nonbiologic and non-steroidal topical therapy approved by the U.S. Food and Drug Administration (FDA).

This cream-based therapy is useful for the treatment of severe, moderate, and mild plaque psoriasis in adults with the absence of safety label warnings or precautions and without restrictions on location and duration of use or body surface area. Besides, a supplementary New Drug Application (sNDA) for the VTAMA cream is currently under the review process by the FDA. This ensures a probable treatment for atopic dermatitis in adults and children two years of age and older, with Prescription Drug User Fee Act (PDUFA) action which was expected in the fourth quarter of 2024, thus a positive contribution in the atopic dermatitis drugs market.

Here's the list of some key players:

Recent Developments

- In February 2024, Regeneron Pharmaceuticals, Inc. stated that the Ministry of Health, Labor and Welfare (MHLW) in Japan has approved advertising and manufacturing permission for Dupixent (dupilumab) for the treatment of chronic spontaneous urticaria (CSU) in people aged 12 years and older whose disease is not adequately controlled with prevailing therapy.

- In September 2021, Pfizer notified that the MHLW has permitted CIBINQO (abrocitinib), an oral, once-daily, Janus kinase 1 (JAK1) inhibitor, for the treatment of moderate to severe atopic dermatitis in adults, adolescents, and older with insufficient response to current treatments.

- Report ID: 7338

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Atopic Dermatitis Drugs Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.