Cardiomyocytes Market Outlook:

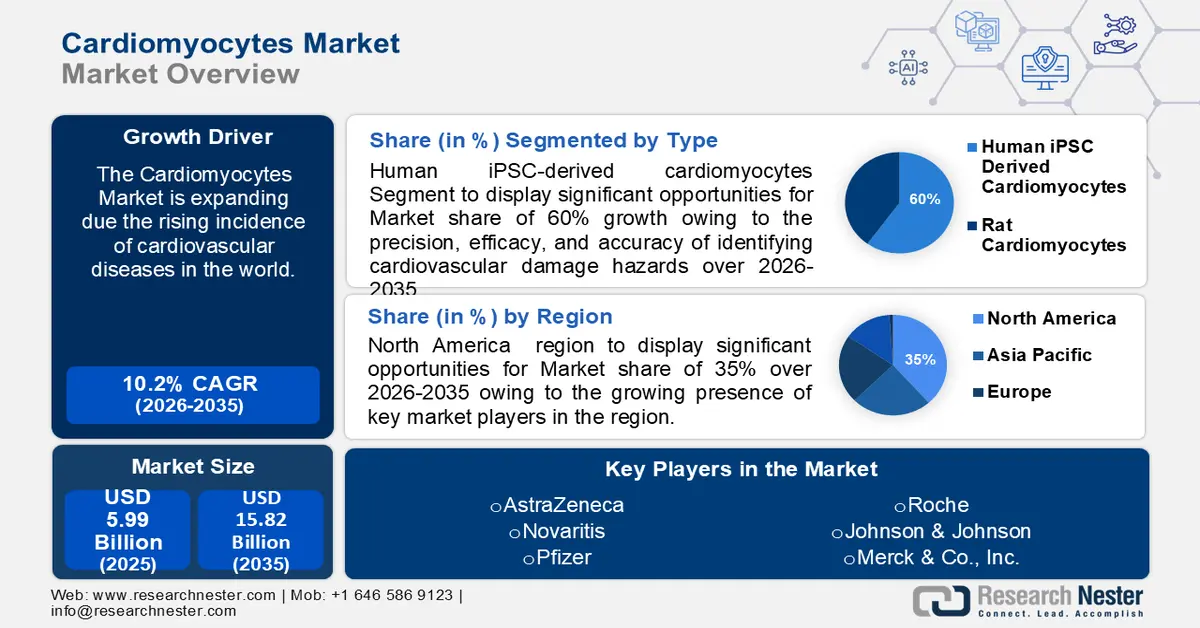

Cardiomyocytes Market size was valued at USD 5.99 billion in 2025 and is expected to reach USD 15.82 billion by 2035, registering around 10.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of cardiomyocytes is evaluated at USD 6.54 billion.

The market is thriving on the back of the rising incidence of cardiovascular diseases in the world. According to research an estimated 7% of men and around 4.5% of women suffer from heart-related diseases. The heart's rhythmic beating is regulated by cardiomyocytes, which are the cells that produce contractile force in an intact heart. Hence, increasing the demand for cardiomyocyte therapies in the world.

In addition to these, factors that are believed to fuel the market growth of the cardiomyocytes market include the growing geriatric population. Research shows that an estimated 771 million individuals worldwide were 65 years of age or older in 2022, making up about 10% of the world's population. This increases the demand for cardiomyocyte therapies as older people are more susceptible to cardiovascular diseases.

Key Cardiomyocytes Market Insights Summary:

Regional Highlights:

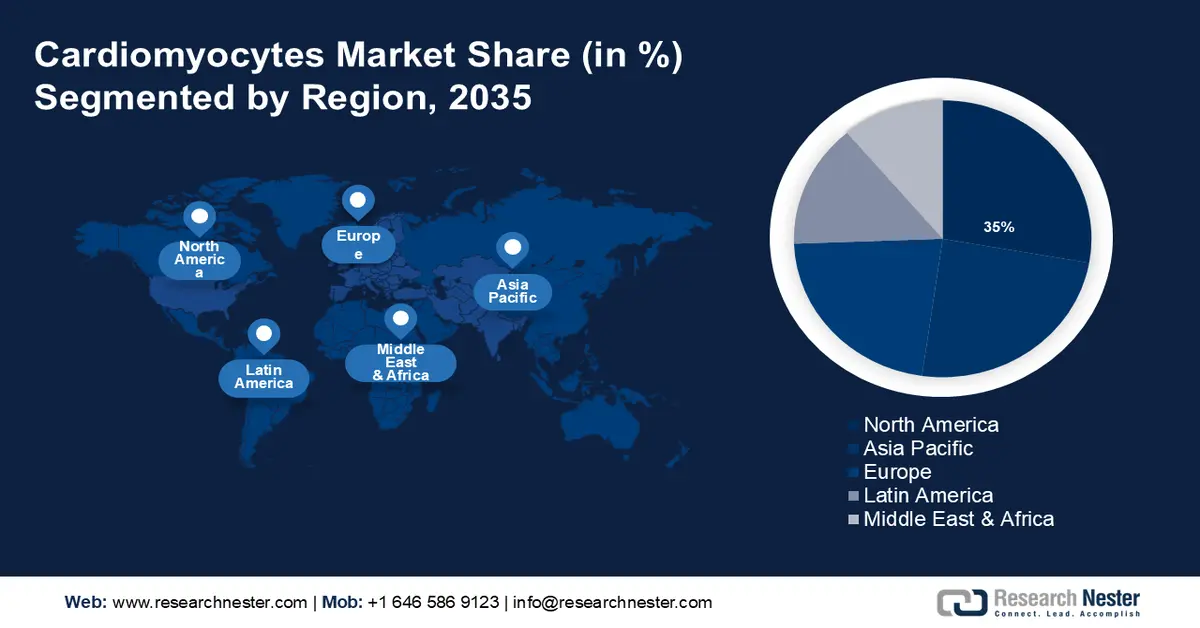

- North America in the cardiomyocytes market is projected to secure a 35% share, underpinned by the strong presence of leading biotech players and concentrated research ecosystems.

- The Asia Pacific region is expected to account for a 35% share by 2035, stemming from escalating cardiovascular disease cases and a rapidly expanding elderly population.

Segment Insights:

- Human iPSC-derived cardiomyocytes segment in the cardiomyocytes market is anticipated to hold a 60% share, propelled by the rising global burden of cardiovascular disorders.

- The cardiac safety and toxicity segment is set to attain a notable share by 2035, fueled by the increasing prevalence of cancer-induced cardiotoxicity.

Key Growth Trends:

- Rising Investments in Research and Development

- Expanding Adoption of Cell Therapy

Major Challenges:

- High Cost of Production

- Regulatory requirements for safety efficacy and quality assurance

Key Players: AstraZeneca, Novartis, Pfizer, Roche, Johnson & Johnson, Merck & Co., Inc., Bayer, Abbott Laboratories, Bristol Myres, Cytiva.

Global Cardiomyocytes Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.99 billion

- 2026 Market Size: USD 6.54 billion

- Projected Market Size: USD 15.82 billion by 2035

- Growth Forecasts: 10.2%

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: India, South Korea, Singapore, Australia, Brazil

Last updated on : 1 December, 2025

Cardiomyocytes Market - Growth Drivers and Challenges

Growth Drivers

-

Rising Investments in Research and Development - Huge pharmaceutical and biotech companies like Acesion Pharma, Acticor Biotech, SKG International, and many more spend heavily on research, development, and commercialization of cardiomyocyte-based therapies like cardiomyocyte stimulation, progenitor differentiation, and direct lineage. The increasing investments in research and rapid development of Cardiomyocytes it is likely to spur market growth in the coming years. Furthermore, governmental funding agencies like the National Institute of Health (NIH) also invest in the research and development of cardiomyocyte-based regenerative therapies which is driving the cardiomyocytes market growth in the forecast period.

-

Expanding Adoption of Cell Therapy - Healthcare providers' increasing acceptance and use of cell therapy techniques, such as cell-based heart regeneration and cardiomyocyte transplantation, due to its utilization of stem cell treatment and their derivatives to enhance the body's natural ability to repair damaged malfunctioning or damaged tissue, and the growing volume of clinical evidence demonstrating the safety and effectiveness of these treatments is causing them to be incorporated into standard treatment plans for specific cardiovascular diseases is also further propelling the growth of the cardiomyocyte market.

-

Increase in Healthcare Expenditure and Reimbursement Policies - One of the elements anticipated to fuel cardiomyocytes market expansion during the forecast period is the recent increase in healthcare spending driven by the strengthening economy. Therefore, the positive reimbursement policies offered by both public and private insurers raise awareness and demand for cardiomyocyte therapies. Insurance companies that pay for therapy lessen the financial strain on patients, which increases the chance that they will seek treatment and adhere to recommendations. For instance, according to the data published by the World Bank in 2020 the world spent 10.89% of its total GDP on healthcare.

Challenges

-

High Cost of Production - Producing high-quality cardiomyocytes at a high scale requires sophisticated manufacturing processes, specialized equipment, and skilled personnel. The complexity of cell culture techniques, purification methods, and quality control measures contributes to manufacturing expenses. Hence, hindering the cardiomyocytes market growth.

-

Regulatory requirements for safety efficacy and quality assurance can hamper the market growth.

-

Lack of infrastructure and equipment in developing and underdeveloped countries can also impede market growth.

Cardiomyocytes Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

10.2% |

|

Base Year Market Size (2025) |

USD 5.99 billion |

|

Forecast Year Market Size (2035) |

USD 15.82 billion |

|

Regional Scope |

|

Cardiomyocytes Market Segmentation:

Type Segment Analysis

The human iPSC-derived cardiomyocytes segment is predicted to account for 60% share of the cardiomyocytes market by 2035. The segment growth can be attributed to the rising prevalence of cardiovascular diseases, such as coronary heart disease, stroke, hypertension, and congestive heart failure. According to the data published by the World Health Organization cardiovascular diseases (CVDs) are the leading cause of death globally, taking an estimated 17.9 million lives each year. Cardiomyocytes produced from induced pluripotent stem cells (iPSC) can improve the precision, efficacy, and accuracy of identifying cardiovascular damage hazards in drugs as well as non-pharmaceutical methods. Hence, increasing the demand for human iPSC-derived cardiomyocytes in the cardiomyocytes market.

Application Segment Analysis

Cardiac safety and toxicity segmented in cardiomyocytes market is estimated to gain a significant share during the forecast period. The segment growth can be attributed to the global rise in cardiotoxicity brought on by an increased prevalence of cancer. Cardiotoxicity is the term for heart damage caused by several cancer medications or treatments and results in cardiac diseases including but not limited to arrhythmia, myocardial infarction, and myocardial hypertrophy. Research by the World Cancer Research Fund Internation shows that there were an estimated 18.1 million cancer cases around the world in 2020. Thus showing significant growth in the cardiomyocyte market in the forecast period.

Our in-depth analysis of the Cardiomyocytes market includes the following segments:

|

Type |

|

|

Application |

|

|

End-Users |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cardiomyocytes Market - Regional Analysis

North America Market Insights

The cardiomyocytes market in the North American region, amongst the market in all the other regions, is anticipated to hold the largest with a share of about ~35% by the end of 2035. The market growth in the region is expected to grow on account of the presence of major key players such as Axol Bioscience Ltd, Cell Applications Inc., Cellular Dynamics International, and R&D Systems Inc. in the region. Moreover, the Boston-Cambridge biotech cluster and San Francisco Bay Area Silicon Valley in the United States serve as the epicenter of cardiomyocyte research investments and entrepreneurship. Additionally, the high prevalence of cardiovascular disease due to unhealthy lifestyles in the region is also expected to further propel the market growth. According to data published by a government website about 695,000 people in the United States died from heart disease in 2021. Increasing the demand for newer and more effective forms of treatment like cardiomyocyte therapies in the region.

APAC Market Insights

North America industry is predicted to hold largest revenue share of 35% by 2035. The market’s expansion can be attributed majorly to the increasing demand for cardiac testing in fast-emerging countries such as India, China, Vietnam, and Indonesia, as a result of rising cardiovascular diseases in the region. According to research around 5 million people in India died due to cardiovascular diseases in 2020 and an estimated 4.58 million deaths occurred in 2020 in China due to cardiovascular disease. Furthermore, the growing aging population of this region due to increasing longevity and falling fertility is also expected to propel the market growth. For instance, in 2020 there were an estimated 140 million people aged 60 and above in India, and in 2019 an estimated 250 million people in China were aged 60 years or older. Thus, increasing the demand for cardiomyocytes in the Asia-Pacific region.

Cardiomyocytes Market Players:

- AstraZeneca

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Novartis

- Pfizer

- Roche

- Johnson & Johnson

- Merck & Co., Inc.

- Bayer

- Abbott Laboratories

- Bristol Myres

- Cytiva

Recent Developments

- 31st January 2024

Abbott Park, Illinois /PRNewswire/ -- The world leader in science-based nutrition, Abbott (NYSE: ABT), has announced the introduction of its new PROTALITYTM brand. The first product in this range to cater to the increasing number of adults who want to lose weight without sacrificing healthy nutrition and muscle mass is the high-protein nutrition smoothie.

- 6th December 2023

Novartis announced that Fabhalta® (iptacopan) has been approved by the U.S. Food and Drug Administration (FDA) as the first oral monotherapy for the management of adults suffering from paroxysmal nocturnal hemoglobinuria (PNH)1. A Factor B inhibitor, fabhalta functions proximally in the immune system's alternative complement pathway, offering complete regulation of the destruction of red blood cells (RBCs) both inside and outside of blood vessels (intra- and extravascular hemolysis [IVH and EVH]).

- Report ID: 5972

- Published Date: Dec 01, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Cardiomyocytes Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.