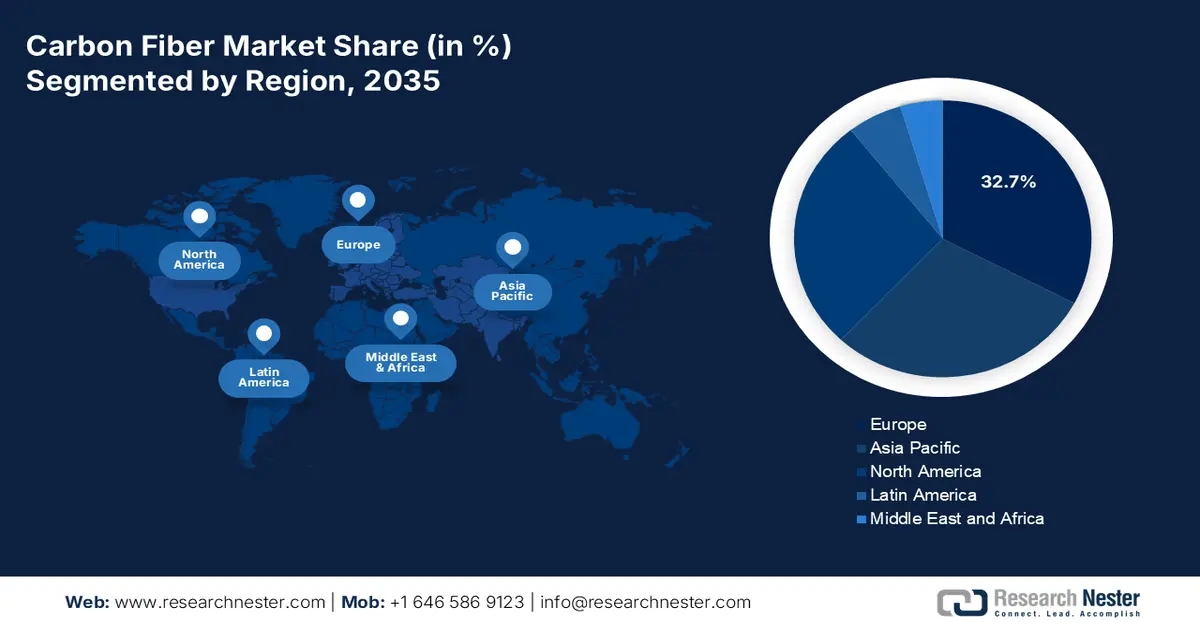

Carbon Fiber Market - Regional Analysis

Europe Market Insights

Europe in the carbon fiber market is anticipated to garner the highest share of 32.7% by the end of 2035. The market’s upliftment in the region is highly propelled by long-lasting wind turbine blades demanding high-stiffness-to-weight materials, automotive light-weighting electrification, and aerospace modernization. According to a report published by ASD in December 2025, the defense and aerospace industries in the region successfully reached a record growth as of 2024, along with a rise in turnover of 10.1% to EUR 325.7 billion, as well as employment effectively reaching 1.1 million employment opportunities across 4,000 organizations. Besides, the defense sector is continuously growing in the region by 13.8%, thereby reflecting the region’s escalated effort to strengthen its defense preparedness, thus suitable for boosting the market’s growth.

Germany in the carbon fiber market is growing significantly, owing to sustained wind capacity solutions, expanded Tier-1 composites ecosystem, and the dominating aerospace and automotive base. As per an article published by the CEFIC Organization in 2024, the pharmaceutical chemical sector constitutes a turnover amounting to €225.5 billion, along with €14 billion for research and development investment, and €9.4 billion in capital expenditure. Therefore, based on these, nearly 80% of domestic pharmaceutical and chemical organizations conduct research activities, and chemical forms gain almost 1% of their overall research and development spending through collaboration between academia and industry, along with governmental funding. Therefore, with advancement in both industries, there is a huge growth opportunity for the market in the overall country.

Poland in the carbon fiber market is also growing due to targeted investments in sustainable chemicals and advanced manufacturing, wind energy additions across the Baltic corridor, growth in automotive supply chains, and rapid industrial upgradation. As stated in an article published by PSEW in 2024, in terms of onshore wind capacity, there has been an increase in the dynamic to 24 GW by the end of 2040, creating almost 42,000 employment opportunities across the industry. Besides, in terms of the stagnation scenario, there has been a further increase in the capacity to only 10 GW as of 2025, along with restoration. Moreover, it has been estimated that with each additional 10 MW in onshore wind in the country, there will be the generation of 61 direct job at the construction and preparation stages. Therefore, with this increased focus on employment, the market is poised to grow in the country.

North America Market Insights

North America in the carbon fiber market is expected to emerge as the fastest-growing region during the forecast period. The market’s development in the region is highly fueled by the aspect of wind repowering across Canada and the U.S.-based prairies and plains, electric vehicle lightweight, and the presence of aerospace airframe replacement cycles. According to an article published by the Climate Program Organization in March 2024, the U.S. Department of Energy (DOE), which is part of President Biden’s Investing in America Agenda, notified almost USD 6 billion for 33 projects across over 20 states. The purpose is to readily decarbonize energy-intensive sectors, diminish industrial greenhouse gas emissions, support good-paying union employment opportunities, strengthen the overall region’s manufacturing competitiveness, and revitalize industrial communities.

The U.S. in the carbon fiber market is gaining increased traction due to the aspects of defense and aerospace, electric vehicle and automotive adoption, the presence of industrial decarbonization programs, chemical industry modernization, and federal budget allocation. As per an article published by the EIA Government in August 2024, there has been an increase in the combined sales of battery electric vehicles, plug-in hybrid electric vehicles, and hybrid vehicles from 17.8% of the overall light-duty vehicles as of 2024 to 18.7% in the country. Additionally, the slight upsurge in the hybrid and electric vehicle field has been primarily driven by hybrid electric vehicle sales, which increased by 30.7% year-over-year (YoY). Therefore, with this continuous growth in the adoption of electric vehicles, there is a huge growth opportunity for the market in the country.

Canada in the carbon fiber market is projected to develop, owing to industrial carbon and clean energy pricing, research and development in sustainable chemicals, expansion in renewable and wind energy, government programs, and policy support. As stated in an article published by the Government of Canada in March 2025, Environment and Climate Change Canada declared almost USD 150 million from the Output-Based Pricing System (OBPS) Proceeds Fund. This fund is being utilized to benefit 38 projects, which are part of the Decarbonization Incentive Program. These particular projects are effectively focused on developing clean technology and green energy to assist in reducing greenhouse gas emissions.

Decarbonization Incentive Program Projects in Canada (2025)

|

Province Type |

Recipient |

Total DIP Amount (USD) |

Project Description |

Projected 2030 GHG Reductions (tCO2e) |

|

Manitoba |

McCAIN Foods |

662,000 |

The project will retrofit the dryer used in the McCain Foods manufacturing line at the Carberry facility. Implementation of this project would offset natural gas usage, resulting in GHG emission reductions for the facility. |

2,600 |

|

Manitoba |

Koch Fertilizer Canada, ULC |

713,000 |

The project will replace the ammonia convertor on-site to improve energy efficiency and reduce associated methane emissions. This, in turn, will help the company remain competitive in global markets. |

12,600 |

|

Ontario |

Western University |

500,000 |

The project will complete deep energy retrofits that use innovative technology to optimize ventilation, electrify heating, and enable buildings to participate in the low temperature district energy loop on campus, helping drive down carbon pollution. |

1,500 |

|

Ontario |

Stelco Inc. |

500,000 |

Stelco’s Z-Line uses innovative technology to produce high quality, value-added galvanized steel sheet for the automotive and construction markets. This project will support installation of a state-of-the-art Level 2 furnace model for the Z-Line furnaces, thereby improving furnace efficiency and reducing natural gas consumption. |

800 |

|

Saskatchewan |

SaskEnergy Incorporated |

674,000 |

SaskEnergy installed Spartan Controls’ SlipStream vent gas conservation technology on 10 natural gas mobile compressors. The SlipStream system captures vent gas and routes it to the engine to be used as fuel. SaskEnergy also installed 100 kW of solar arrays at three of SaskEnergy’s transmission facilities, helping drive down carbon pollution. |

2,200 |

|

Saskatchewan |

SaskEnergy Incorporated |

1,015,000 |

SaskEnergy will install flare systems at three compressor stations to combust vented methane from regular operations. Converting from methane to carbon dioxide by flaring will result in lower GHG emissions. |

3,700 |

Source: Government of Canada

APAC Market Insights

The Asia Pacific in the carbon fiber market is projected to witness considerable growth by the end of the stipulated timeline. The market’s growth in the region is extremely driven by Southeast Asia’s industrial upgradation, India’s wind build-out and electric vehicles, Japan's or Korea’s aerospace-electronics depth, and China’s upscale. According to an article published by the ADB Organization in 2024, the 600-megawatt Monsoon Wind Power Project, comprising 133 wind turbines, is significantly under construction in the south provinces of Attapeu and Sekong. This particular project is expected to assist in unlocking Southeast Asia’s substantial and untapped wind resource potential. In addition, this is poised to diminish greenhouse gas emissions by almost 748,867 tons of carbon dioxide equivalent, thereby increasing the demand for the market in the overall region.

The carbon fiber market in China is gaining increased exposure due to the increased demand for broad industrial composites, aerospace supply chains, wind installations, and automotive electrification. As per a data report published by the Climate Energy Finance Organization in February 2025, the country has successfully hit the latest record of yearly net new capacity addition to the grid at 429 GW, denoting a 21% YoY surge. Out of this, solar and wind power readily accounted for 83% at 356.5 GW, thereby catering to the 4% proportion of nuclear and hydropower capacity. Besides, the country has significantly invested a huge RMB 608 billion (USD 84.7 billion) in grid transmission-based modernization projects and expansion. Additionally, this denotes more than 15% YoY, which is a key for grid capacity extension, along with facilitating the 429 GW connection to the grid, thereby suitable for enhancing the market’s exposure.

The carbon fiber market in India is also growing due to industrial modernization, hydrogen and pressure vessels, grid-scale and wind renewables, and rapid electric vehicle adoption. According to a data report published by the IBEF Organization in August 2025, the country has readily marked a commitment to meet net zero emissions by the end of 2070, as well as 50% of renewable electricity by the end of 2030, which is also regarded as a huge international climate milestone. Besides, the country has significantly generated 1,08,494 GWh of solar power, which has exceeded Japan’s 96,459 GWh. Furthermore, the installed renewable power generation capacity has surged over the past years, posting a 14.9% growth rate, and meanwhile comprising 184.6 GW of renewable energy capacity. In addition, 48.2% of the overall power installed capacity derives from non-fossil fuels, thereby driving the market’s demand.