Car Security System Market Outlook:

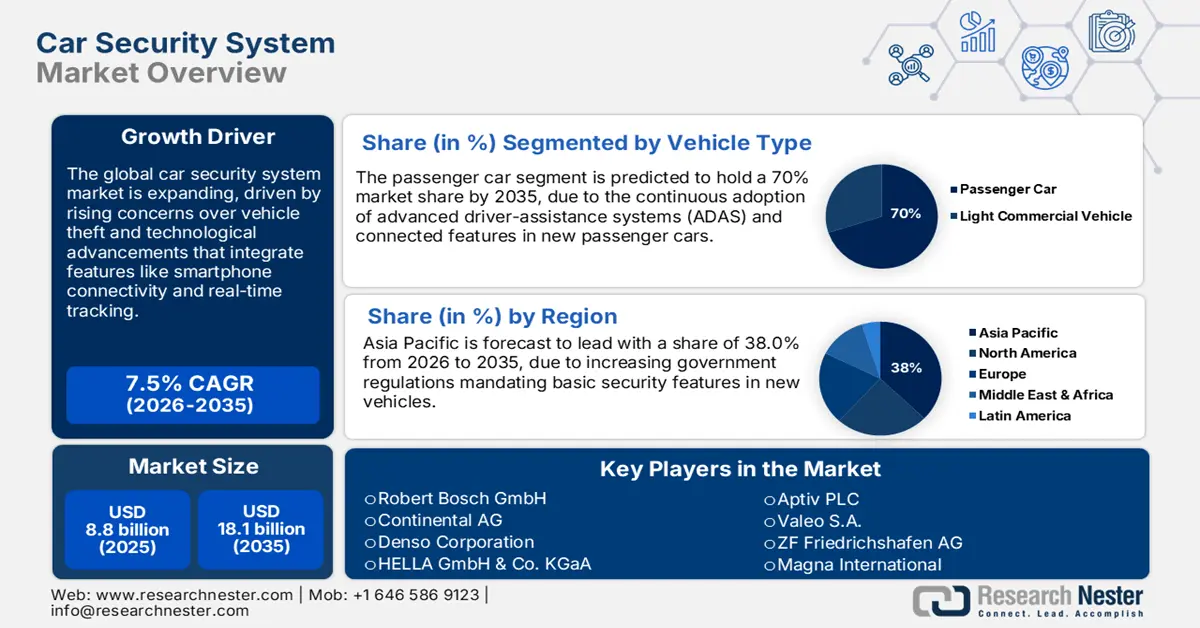

Car Security System Market size is valued at USD 8.8 billion in 2025 and is projected to reach a valuation of USD 18.1 billion by the end of 2035, rising at a CAGR of 7.5% during the forecast period, i.e., 2026-2035. In 2026, the industry size of car security systems is evaluated at USD 9.4 billion.

The global market is in a robust growth trajectory propelled by increasing vehicle connectivity and the sophistication of cyberattacks against next-generation automobiles. The core opportunity is to shift from traditional anti-theft products to rich, multi-layered cybersecurity platforms that protect the entire vehicle ecosystem. This is driven by consumer adoption of advanced capabilities, with a key threshold being reached in August 2024 when users of Tesla Full Self-Driving surpassed 1.3 billion miles accumulated. This deployment only heightens the need for robust, proven security systems to protect essential vehicle functions and customer information.

Governments and producers collaborate to create a hardened automotive environment, recognizing that security is no longer an optional add-on but a fundamental component of vehicle safety and national infrastructure. This is evident in high government investment levels aimed at hardening the connected and automated mobility (CAM) sector, with a view to ensuring that innovation has good security frameworks in place behind it. For instance, in November 2023, the UK Government committed £150 million in funding to the CAM sector, as one of a series of measures to cement the UK's leadership in developing secure autonomous driving technologies and services to 2030.

Key Car Security System Market Insights Summary:

Regional Insights:

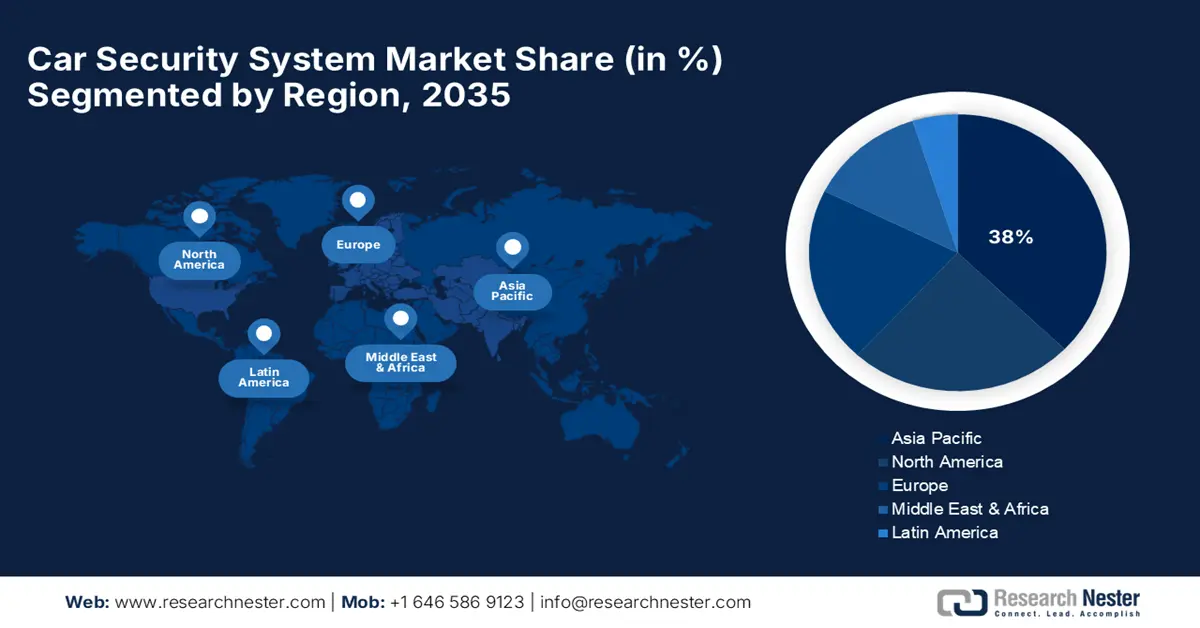

- Asia Pacific is projected to command a 38% share in the car security system market by 2035, underpinned by the region’s expanding automotive base, rapid urbanization, and large-scale smart-city investments.

- North America is anticipated to record an 8% CAGR from 2026–2035, supported by technological synergies, intensive private investment, and rising regulatory scrutiny.

Segment Insights:

- The immobilizer segment is expected to secure a 45% share by 2035 in the car security system market, sustained by its capability to block engine ignition without verified key authentication.

- The passenger car segment is forecast to achieve a 70% share by 2035, bolstered by high global production volumes and broader integration of advanced driver-assistance and connectivity features.

Key Growth Trends:

- Rise of software-defined vehicles

- Enforcement of tough regulatory mandates

Major Challenges:

- Overcoming geopolitical conflict and supply chain risk

- Securing sophisticated AI-powered autonomous systems

Key Players: Continental AG, Denso Corporation, HELLA GmbH & Co. KGaA, Aptiv PLC, Valeo S.A., ZF Friedrichshafen AG, Magna International, Johnson Controls, Valeo Siemens eAutomotive GmbH, Lear Corporation, Autoliv Inc.

Global Car Security System Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 8.8 billion

- 2026 Market Size: USD 9.4 billion

- Projected Market Size: USD 18.1 billion by 2035

- Growth Forecasts: 7.5%

Key Regional Dynamics:

- Largest Region: Asia Pacific (38% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: India, Brazil, Mexico, United Arab Emirates, Indonesia

Last updated on : 27 August, 2025

Car Security System Market - Growth Drivers and Challenges

Growth Drivers

- Rise of software-defined vehicles: The rapid shift of the automotive industry towards software-defined vehicles (SDVs) is an important driver of the security market. As vehicles increasingly computerize on wheels, with more features controlled by advanced software and AI, the attack surface expands exponentially. This is a trend that needs advanced security solutions to protect a vehicle's central operating systems from manipulated. A revolutionary milestone marking this shift took place in January 2024, when Tesla rolled out its FSD version 12, which reportedly replaced over 300,000 lines of C++ code with end-to-end AI, rewriting challenges and the importance of motor vehicle software security.

- Enforcement of tough regulatory mandates: Governments and global bodies are enforcing strict regulations mandating cybersecurity in every new vehicle, compelling automakers to integrate security solutions from the design phase. These regulatory requirements are not negotiable, offering a guaranteed market for advanced security systems and services that meet specific legal standards. A landmark event in July 2023 saw UNECE render UN Regulation No. 155 mandatory on all newly produced vehicles within EU member states. This put in place the first legally enforceable international regime for automotive cybersecurity, which requires manufacturers to bring in certified Cybersecurity Management Systems (CSMS).

- Development of integrated security technologies: Continuing innovation in security technology is propelling the market beyond basic anti-theft alarms to more sophisticated systems with capabilities that range from digital access to occupant protection and advanced threat prevention. This necessitates manufacturers to develop solutions with increased convenience without compromising on security, such as biometric access and anti-relay attack technologies. For instance, HELLA GmbH & Co. KGaA has ordered a series with its Smart Car Access system in March 2024. This technology not only enables hands-free car entry via smartphone but also has provisions to track if children are left inside the car, merging safety with security.

Global Electric Vehicle Sales Trends & Impact on Car Security Systems

|

Aspect |

Details |

|

Global EV Sales (2024) |

17 million (20% market share) |

|

Year-on-Year Growth (2024) |

An additional 3.5 million EVs sold (surpassing total 2020 sales) |

|

2025 Projection |

>20 million EVs (25%+ of global car sales) |

|

Q1 2025 Growth Rate |

35% YoY increase |

Source: IEA

Regional EV Adoption & Security Implications

|

Region |

BEV Sales |

PHEV Sales |

Security Considerations |

|

China |

High growth |

Significant |

High need for encryption & over-the-air (OTA) security updates. |

|

Europe |

Strong |

Increasing |

Stolen vehicle tracking & keyless entry vulnerabilities require mitigation. |

|

United States |

Growing |

Moderate |

Cybersecurity threats due to connected charging infrastructure. |

|

Rest of World |

Emerging |

Limited |

Lack of charging infrastructure may slow adoption, but security risks persist in connected fleets. |

Source: IEA

Challenges

- Overcoming geopolitical conflict and supply chain risk: Globalization of the automotive supply chain has introduced enormous cybersecurity challenges with a geopolitical content-based foundation. Governments are more concerned about the potential of foreign rivals injecting vulnerabilities into connected car components and consequently creating sophisticated trade barriers and compliance issues for auto manufacturers. This was brought to light in September 2024, when the US Department of Commerce made a rule that it would ban connected cars that use particular China-based or Russia-based hardware or software. This initiative exposes more advanced national security challenges that complicate the global automotive supply chain and technology sourcing for manufacturers.

- Securing sophisticated AI-powered autonomous systems: As ML and AI are revolutionizing vehicle capabilities, they are also raising grave new security concerns. Unlike traditional code, AI designs tend to be flammable, and securing them requires new methods of validation, threat detection, and response. The industry is grappling with how to ensure the safety and security of self-learners and self-improvers. This conundrum was exemplified in June 2025 when Tesla's reluctant commercial Robotaxi launch in Austin caused a jolt. The company's own extreme paranoia and use of remote human supervision for the limited fleet illustrate the massive challenge of establishing the security of fully autonomous AI in the wild.

Car Security System Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.5% |

|

Base Year Market Size (2025) |

USD 8.8 billion |

|

Forecast Year Market Size (2035) |

USD 18.1 billion |

|

Regional Scope |

|

Car Security System Market Segmentation:

Product Type Segment Analysis

The immobilizer segment is predicted to remain the leader with a 45% market share during the forecast period as the foundation layer of car anti-theft technology. Its ongoing usage is due to its capacity to prevent engine start-up without a confirmed key, something now standard on most new vehicles. As vehicles evolve, immobilizers similarly evolve alongside more advanced electronic control units and powertrain management systems to provide robust, tamper-evident protection. This was reinforced in May 2024 when BorgWarner Inc. announced that it would provide its electric Torque Vectoring and Disconnect system to leading European OEMs, stabilizing and securing at the source powertrain level.

Vehicle Type Segment Analysis

The passenger car segment is expected to maintain a 70% market share by 2035, due to sheer output volumes globally and the increasing integration of advanced driver-assistance and connectivity into consumer cars. Security technologies are no longer part of premium luxury versions but are considered for fitment as standard with increasing consumer awareness and regulatory requirements. Such volume adoption necessitates high-strength security in extended-scale connected networks. Highlights included ALSTOM's January 2025 deal to supply Saudi Arabia's AlUla tramway, a high-end passenger scheme that includes end-to-end integrated cybersecurity to protect operations as well as passenger data, and an expectation of future passenger transportation.

Sales Channel Segment Analysis

The Original Equipment Manufacturer (OEM) segment is predicted to hold 53% of the market by 2035 as cybersecurity becomes an inescapable, factory-integrated feature of future cars. Standards like UN R155 mandate a security-by-design approach that compels manufacturers to design security as an integral part of the vehicle's electronic architecture right from the beginning of its entire lifecycle. This altered the position of the aftermarket as a second option for end-to-end security. Panasonic Automotive Systems highlighted the trend in August 2025 when it developed its VERZEUSE series of cybersecurity solutions that give OEMs tools to automate and integrate security from design and development through to post-shipment operation.

Our in-depth analysis of the car security system market includes the following segments:

|

Segment |

Subsegments |

|

Product Type |

|

|

Vehicle Type |

|

|

Sales Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Car Security System Market - Regional Analysis

APAC Market Insights

Asia Pacific is projected to dominate the industry and capture a 38% market share during the forecast period. This dominance is driven by the region's rapidly growing automotive markets, accelerated urbanization, and gigantic government investments in smart city infrastructure and connectivity. As several new, connected vehicles are sold across APAC, demand for robust, integrated security solutions to protect vehicles from cyberattack and theft is increasing at an unprecedented rate, and it is a high-priority market for global security providers.

China is becoming a leader in the auto industry by embracing one of the most ambitious and strict mandatory cybersecurity regulation regimes. The government's top-down approach and push for technological sovereignty are accelerating the rollout of advanced security features on all cars sold in the country. An example of this occurred in September 2024, when China's GB 44495 cybersecurity regulation was made compulsory to roll out on all new vehicle models. The initial rollout phase requires all networked vehicles to comply with robust conditions, setting a new global standard for automotive cybersecurity enforcement.

India car security system market is rising, driven by the government's push towards vehicle modernization and the forthcoming release of comprehensive national cybersecurity regulations. With a massive and growing vehicle parc, the nation offers a huge long-term opportunity to security system suppliers. India went public with the forthcoming compulsory introduction of Automotive Industry Standard (AIS) 189 in November 2023. The regulation, which must become compulsory by 2027, will be aligned to global standards like UN R155 and will require OEMs to demonstrate end-to-end cybersecurity compliance at homologation, effectively revolutionizing the India automobile industry.

North America Market Insights

North America car security system market is estimated to experience a projected CAGR of 8% from 2026 to 2035, driven by technological synergies, intensive private investment, and increasing regulatory scrutiny. The region hosts many of the world's leading technology firms and automotive innovators, creating a highly competitive and dynamic environment. This is pushing the rapid development and deployment of advanced cybersecurity technology designed to protect the next generation of connected and autonomous vehicles, from the simple passenger automobile to massive commercial fleets.

The U.S. is a focal point for the market for automobile security, with a lucrative ecosystem of cybersecurity vendors and the move toward market consolidation to deliver end-to-end security platforms. This market expansion is driven by the need to consolidate fragmented security tools into more effective end-to-end solutions that can handle sophisticated threats. The example was seen in December 2024, when Arctic Wolf announced that it had acquired BlackBerry's endpoint security assets from Cylance. The action is a significant consolidation that brings AI-powered protection deployed by thousands of organizations worldwide, including the automotive space.

Canada is taking a thoughtful and direction-guided approach to automotive cybersecurity, with an emphasis on establishing flexible, technology-neutral frameworks that facilitate innovation without trading off safety. Transport Canada is working closely with industry stakeholders to establish principles and best practices for rollout throughout the entire vehicle life cycle, from design through manufacturing, deployment, and post-deployment. In March 2023, Transport Canada released its Vehicle Cyber Security Guidance document. This non-prescriptive approach encourages a risk-based management, protection, detection, and recovery strategy, providing a robust national standard for the creation of secure connected vehicles.

Europe Market Insights

Europe is projected to witness substantial growth in the car security system market by 2035 as a leading world power in motor regulation and sustainability. The region's rigorous regulatory environments, particularly for cybersecurity and data protection, are compelling car makers to introduce the highest vehicle protection standards. This regulation-driven demand, coupled with the continent's ambitious green and smart city initiatives, offers a rich terrain for cutting-edge, comprehensive car security systems that align with Europe's imagination of a secure, safe, and sustainable mobility future.

Germany, one of the lucrative hubs of the Europe auto industry, is a driving force in encouraging the adoption of state-of-the-art car security systems. Germany's giant OEMs and Tier 1 players lead in the use of innovative technology in their vehicles to meet global requirements and guard their edge in technology and quality. This focus on premium engineering was witnessed in May 2024, when BorgWarner went public with its delivery of the eTVD system to Polestar and other major European OEMs. This technology intelligently manages torque to improve vehicle stability, performance, and overall electronic system safeguard.

The UK is among the leading markets for self-driving car technology, backed by one of the world's most comprehensive sets of self-driving car legislation. Government leadership in innovation and safety provides clear regulatory authority and legal guarantees. This reassures investors and operators, encouraging the introduction of new mobility solutions. In June 2024, the UK passed the Automated Vehicles Act 2024. This revolutionary piece of legislation created an over-riding safety and security framework uniquely designed to propel innovation to the maximum while making the vehicle safe to operate without human input. APAC Car Security System Market Insights

Key Car Security System Market Players:

- Robert Bosch GmbH

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Continental AG

- Denso Corporation

- HELLA GmbH & Co. KGaA

- Aptiv PLC

- Valeo S.A.

- ZF Friedrichshafen AG

- Magna International

- Johnson Controls

- Valeo Siemens eAutomotive GmbH

- Lear Corporation

- Autoliv Inc.

The global car security system market is intensely competitive in nature, with an enormous base of participants ranging from veteran automotive majors to niche technology firms. Market leaders such as Robert Bosch GmbH, Continental AG, and Denso Corporation are majorly utilizing their robust R&D capabilities and strong relationships with OEMs to corner the market. They are followed by other major Tier 1 suppliers, such as HELLA GmbH & Co. KGaA, Aptiv PLC, and Valeo S.A.

The players are investing substantially in developing integrated security solutions that combine software and hardware to protect the increasingly complex electronic architecture of modern vehicles. For example, in May 2023, LG Electronics (LG) announced the launch of its connected vehicle alarm system, LG MyCar Alarm Service. The cutting-edge system integrates with Infoconn, the connected car service that can be used via the mobile application of KG Mobility. Furthermore, the rapid advancements in automotive technology necessitate continuous monitoring and adaptation to new regulations.

Here are some leading companies in the car security system market:

Recent Developments

- In March 2025, AUTOCRYPT launched its India-compliant V2X (Vehicle-to-Everything) security certification system optimized for cloud-native environments, becoming the only company worldwide to support all major V2X security credential management system standards.

- In February 2025, Arctic Wolf completed the acquisition of BlackBerry's Cylance endpoint security assets and launched Aurora Endpoint Security, a portfolio of advanced endpoint protection solutions designed to extend AI-driven prevention and detection capabilities directly to endpoints.

- Report ID: 392

- Published Date: Aug 27, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Car Security System Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.