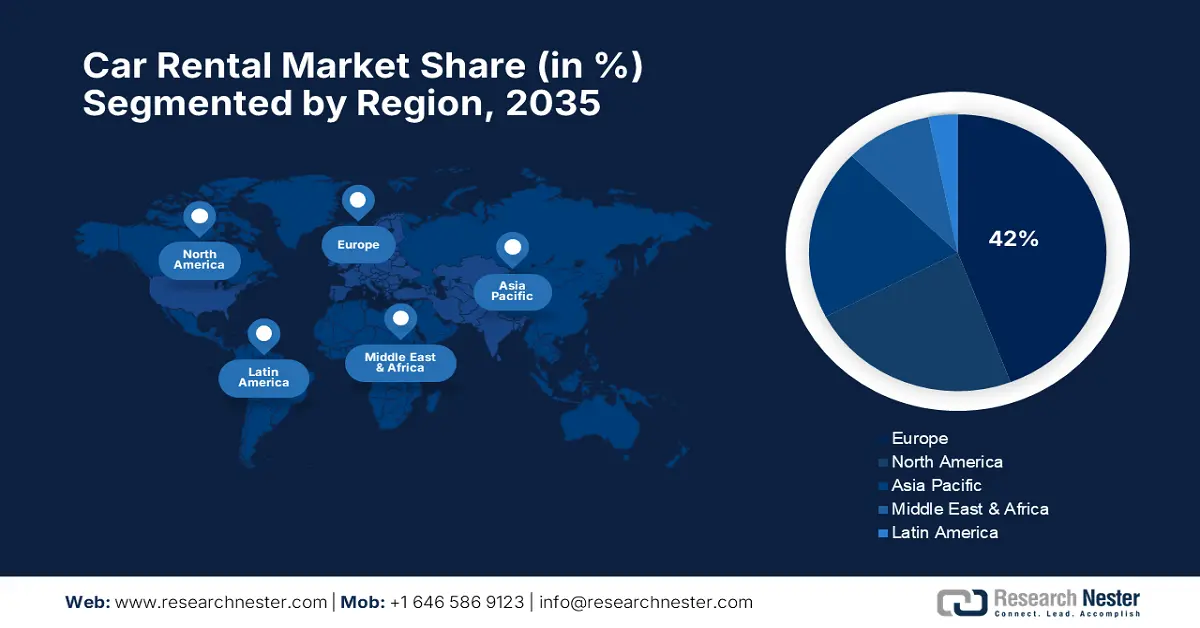

Car Rental Market - Regional Analysis

Europe Market Insights

Europe car rental market is expected to hold a substantial 42% market share through the forecast period, spearheaded by the continent's advanced transportation infrastructure, robust environmental regulations, and consumer demand for sustainable and technologically enhanced mobility solutions. European markets are augmented by robust regulatory frameworks that balance innovation with safety and environmental compliance across the range of transportation services. The focus of the region on multimodal transport and integrated mobility ecosystems presents opportunities for car rental operators to play an increasing role in overall urban transport systems.

Germany car rental market is defined by operational excellence, technological innovation, and holistic regulations that facilitate the smooth integration of transport services by multiple modes. The market prioritizes interoperability of data and ease of use for customers through sophisticated digital platforms and service integration capabilities. Germany introduced the new Mobility Data Law in January 2025 to make multimodal travel easier with increased data sharing and networking between modes of transport, from local buses to e-scooters and charging points. The Federal Ministry of Digitalization and Transport proposed this far-reaching legislation to end fragmentation needed through multiple apps and services, encouraging interoperability across Europe as well as decreasing barriers for data usage.

The UK car rental market shows robust performance with strategic growth efforts and integrated service offerings that set car rental businesses up for long-term growth among a wide range of customers. British firms are registering impressive global expansion while retaining a healthy home market standing on the back of operational excellence and customer service leadership. For instance, SIXT SE recorded the highest ever revenue growth of 18% to EUR 3.62 billion in 2023 in March 2024, posting the company's second-best result with robust performance in all the regional segments, including the UK. The firm grew its fleet to a record 169,100 rental cars while keeping premium positioning with 57% cars from BMW, Mercedes-Benz, and Audi brands.

North America Market Insights

North America region is anticipated to hold over 40.8% market share by 2035, driven by high consumer demand for adaptive transportation modes, technological advancements in mobility services, and holistic government encouragement of eco-friendly transport modes. The region boasts a well-established car rental infrastructure, sophisticated digital platforms, and a shift in consumer behavior toward shared mobility and electric vehicles. Market expansion is facilitated through strategic partnerships among incumbent rental companies and mobility platforms that increase the accessibility of services while generating new revenue streams in various customer bases and applications.

The car rental market in the U.S. offers lucrative potential for players in North America, with features of vibrant innovation in mobility services, strategic platform integration, and robust government support of alternative transportation solutions. The U.S. has a wide infrastructure, technological innovation, and customer acceptance of new mobility service models. In June 2025, the U.S. Defense Travel Management Office set new maximum rates for rental automobile services under Government Rental Car Agreement #5, including revised prices for different vehicle classes with new classes for electric vehicles. EV intermediate prices were fixed between $70-85, and EV SUV intermediate prices between USD 115-130, based on region, with standard rates guaranteeing consistent pricing while facilitating greater adoption of electric and sustainable vehicle technology.

Canada car rental market takes advantage of complete regulatory regulations and government action favoring transport innovation while promoting consumer protection as well as industry responsibility. The market is focused on customer service excellence, reliability, and safety with the adoption of new technologies and shifts in mobility patterns. In 2024, Transport Canada went on to impose upgraded vehicle safety regulations by conducting continuous inspections and manufacturer audits to ensure automobile products are safe under strict safety standards. The department has direct supervision through regular audits of importers and manufacturers to guarantee safety recalls meet requirements, reflecting complete safety measures that keep consumers safe while facilitating the auto sector's shift towards technology advancements.

APAC Market Insights

Asia Pacific car rental industry is predicted to witness rapid growth by 2035, spurred by strong economic growth, growing urbanization, and changing consumer behavior toward flexible mobility solutions across regional markets with diverse characteristics. The region boasts significant population hubs, rising middle-class income levels, and government policies that favor transportation innovation and infrastructure development. Growth is underpinned by technological innovation, strategic collaborations with international mobility platforms, and local market preference and regulatory adaptation across different countries and cultures.

China car rental business is being revolutionized through end-to-end government programs promoting autonomous vehicle technology and smart transport infrastructure through large amounts of investment and regulatory support. The strategic planning by the government about mobility technology provides enormous possibilities for car rental integration into smart transportation systems and autonomous vehicle deployment. In June 2024, the government chose 20 cities to be part of a pilot program establishing roadside infrastructure and cloud control platforms for smart connected cars, greatly enhancing the nationwide development of autonomous vehicles. The Ministry of Public Security reported 32,000 kilometers of roads set up for AV testing and 16,000 test licenses issued, showing an unparalleled scale of autonomous vehicle development that may reshape car rental industry operations.

India car rental market presents significant opportunities fueled by rising automotive leasing adoption, greater consumer awareness of flexible mobility solutions, and overarching government initiatives supporting automotive industry development and sustainable transportation. The market is driven by robust domestic growth, collaborative partnerships with international technology leaders, and policies that foster innovation and market expansion. In March 2023, IndusGo India raised ₹100 crore during its second funding round to aid expansion and improve technological capabilities in the Indian self-drive car rental sector. The strategic investment will increase the company's fleet, expand into new markets, and dramatically enhance user experience by leveraging mobile app functionality, symbolizing increasing investor faith in India's burgeoning car-sharing and mobility-as-a-service sector.