Car Rental Market Outlook:

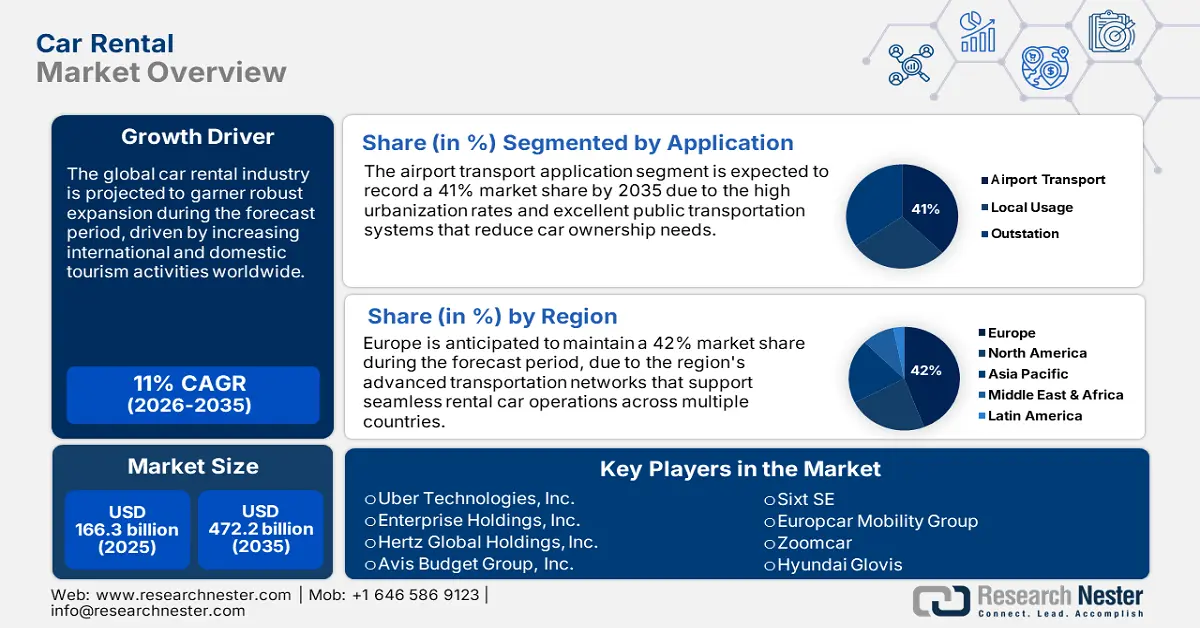

Car Rental Market size is valued at USD 166.3 billion in 2025 and is projected to reach a valuation of USD 472.2 billion by the end of 2035, rising at a CAGR of 11% during the forecast period, i.e., 2026-2035. In 2026, the industry size of car rental is assessed at USD 184.5 billion.

The global car rental industry is undergoing a significant expansion fueled by shifting consumer mobility trends, technology integration, and the growth of platform-based business models that blur the lines of conventional industry segments. The main opportunity for growth lies in establishing converged mobility ecosystems that integrate traditional car rentals with ride-sharing, peer-to-peer car sharing, and autonomous driving services, thereby catering to diverse customer transport needs. This alignment is reflected by strategic alliances such as Uber's partnership with Turo, allowing customers to access more than 1,600 vehicle makes and models directly on the Uber platform in the major markets from September 2024. The sector is experiencing historical innovation in service delivery models focused on customer convenience and seamless integration across various transportation modes.

Government programs and regulatory systems are increasingly promoting sustainable transportation solutions and keeping pace with developing mobility technologies and business models. These policy innovations provide opportunities for car rental companies to increase their position in integrated transportation systems and serve the changing regulatory demands. The federal government's support of alternative transportation is demonstrated through the allocation of considerable capital expenditures, with cities around the country receiving $43.7 million of federal funding from the U.S. Department of Transportation and the Department of Energy's Joint Office of Energy and Transportation, with almost $20 million going to car-sharing providers such as Zipcar in January 2025. This funding from the government highlights the strategic value of car sharing and rental services in the pursuit of larger-scale sustainability and transportation accessibility goals.

Key Car Rental Market Insights Summary:

Regional Insights:

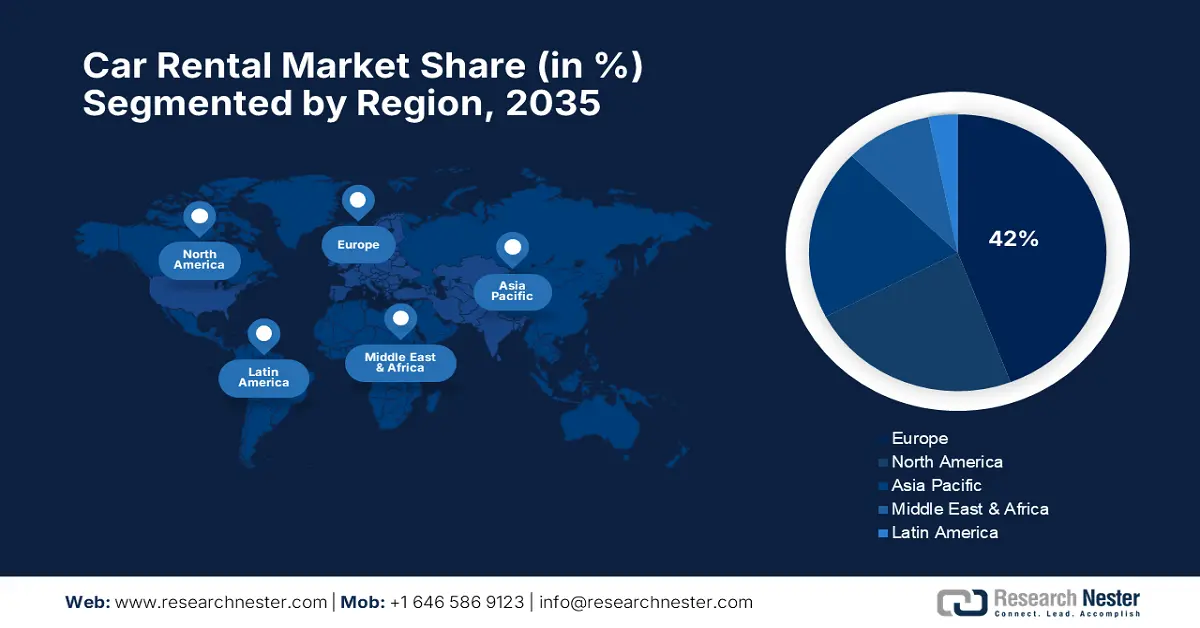

- Europe car rental market is expected to command a 42% share by 2035, propelled by advanced transport infrastructure and strong consumer inclination toward sustainable and tech-driven mobility solutions.

- North America is anticipated to capture over 40.8% share by 2035, sustained by evolving shared mobility trends and continuous government support for eco-friendly transport initiatives.

Segment Insights:

- The economy cars segment is estimated to hold around 35% share of the Car Rental Market through 2035, driven by cost-sensitive consumer behavior and growing demand for affordable, fuel-efficient vehicles.

- The airport transport application segment is projected to account for 41% share by 2035, supported by rising air travel volumes and the need for efficient ground mobility solutions at key transit hubs.

Key Growth Trends:

- Strategic partnerships and platform integration expansion

- Accelerating electric vehicle adoption and sustainability initiatives

Major Challenges:

- Regulatory complexity and changing compliance requirements

- Market volatility and economic sensitivity issues

Key Players: Uber Technologies, Inc., Enterprise Holdings, Inc., Hertz Global Holdings, Inc., Avis Budget Group, Inc., Sixt SE, Europcar Mobility Group, Zoomcar, Hyundai Glovis, GoCar, Redspot Car Rentals.

Global Car Rental Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 166.3 billion

- 2026 Market Size: USD 184.5 billion

- Projected Market Size: USD 472.2 billion by 2035

- Growth Forecasts: 11% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Europe (42% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, United Kingdom, France, Japan

- Emerging Countries: China, India, Indonesia, Brazil, Mexico

Last updated on : 5 September, 2025

Car Rental Market - Growth Drivers and Challenges

Growth Drivers

- Strategic partnerships and platform integration expansion: Strategic partnerships are driving record expansion within the car rental industry by building integrated mobility platforms. These ventures integrate traditional rental offerings with new technologies like ride-sharing apps, autonomous driving, and peer-to-peer sharing platforms. The outcome is the creation of end-to-end ecosystems that extend customer access and diversify revenues beyond conventional business models. Demonstrating this trend, May Mobility grew its autonomous fleet in January 2025 by adding a 30-passenger electric mini-bus, a co-creation with Tecnobus. This addition strengthens the company's self-driving transit in its targeted environments, such as cities, corporate campuses, and airports.

- Accelerating electric vehicle adoption and sustainability initiatives: The shift to electric vehicles is opening up enormous growth prospects for car rental providers that are able to seamlessly incorporate EV fleets alongside promoting customer training and the development of infrastructure. This shift is fueled by both regulations and a demand for eco-friendly transportation choices by customers in both leisure and business travel segments. Uber Technologies introduced Uber Green in India in May 2023, incorporating 25,000 electric vehicles via cooperation with fleet operators and aiming to launch 100,000 electric two-wheelers by 2024 via collaboration with Zypp Electric. The initiative involves cooperation with micro-lender SIDBI for financing 10 billion rupees of clean vehicles' purchases and the installation of charging infrastructure, reflecting holistic strategies of EV integration.

- Expansion in emerging markets and localization strategies: Car rental agencies are realizing significant growth by strategically penetrating high-potential growth markets while tailoring their services to local tastes, regulatory needs, and economic climates. This geographic diversification generates new sources of revenue while lowering the dependence on saturated markets with high competition. In a 2024 report, Orix Corporation announced its financial targets for the fiscal year ending March 2025, which marks the final year of its Medium-term Outlook. The company aims for a net income of ¥390.0 billion and a return on equity (ROE) of 9.6%. Orix Corporation remains committed to its three-year plan's ¥400.0 billion net income target. Furthermore, the company plans to establish strategic alliances with prominent original equipment manufacturers (OEMs), including Maruti Suzuki and Kia, to offer subscription services.

Rise of the Seamless Digital Journey Driving Car Rentals Sector

This table highlights how the industry's investment in digital tools is creating a new, more efficient standard for the rental experience.

|

Digital Transformation Trend |

Customer Experience Benchmarks Year-Over-Year |

Strategic Opportunity for Car Rental Companies |

|

Digital Channels as the Foundation |

Customer satisfaction scores for digital services remain strong, with the website, app quality, and app reliability each scoring 80 out of 100. These scores are higher than those for several in-person interactions. |

Double down on the digital-first journey. Invest in features like augmented reality car previews, AI-powered rental recommendations, and flawless QR code-based check-in/out to make digital the easiest path. |

|

The Contactless Experience Standard |

The process of dropping off a vehicle received a score of 79, which is notably higher than the score of 77 for picking up a vehicle. This indicates that automated and self-service processes are meeting customer needs effectively. |

Accelerate the rollout of fully contactless rentals. Use the app to handle everything from reservation to final receipt, turning the physical lot into a seamless "grab-and-go" experience, which will in turn improve pick-up scores. |

|

Data-Driven Personalization |

The step of making a reservation scored highly at 81 out of 100, showing that customers find the initial booking process to be easy and effective. |

Leverage customer data and loyalty profiles to pre-populate preferences and offer personalized upgrades or options at the time of booking, making the process even smoother and more valued. |

Source: ACSI

Challenges

- Regulatory complexity and changing compliance requirements: The car rental sector is confronted with rising regulatory sophistication as governments introduce new taxes, fees, and operating obligations intended to reduce traffic congestion and the impact of transportation on the environment while providing revenue for transportation infrastructure. These changing regulations pose compliance burdens and operational sophistication that necessitate continuous adaptation and investment in administrative systems.

In January 2025, the Colorado Department of Revenue enforced new daily motor vehicle rental fee rules, including a congestion impact fee under Senate Bill 24-184, on all motor vehicle rentals for 30 days or less and car-sharing rentals for 24 hours or more. The overall fee structure is applied to different types of vehicles, such as peer-to-peer car sharing services, which is indicative of changing state-level strategies on transportation funding through the mechanism of usage-based fees.

- Market volatility and economic sensitivity issues: The car rental business is extremely sensitive to market volatility, economic fluctuations, trade policy, and other economic factors that can significantly affect both operational expenses and consumer spending habits unpredictably. External economic forces tend to bring about sudden changes in vehicle purchasing costs, fleet usage rates, and customer expenditures that make the conventional methods of business planning ineffective.

Car Rental Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

11% |

|

Base Year Market Size (2025) |

USD 166.3 billion |

|

Forecast Year Market Size (2035) |

USD 472.2 billion |

|

Regional Scope |

|

Car Rental Market Segmentation:

Vehicle Type Segment Analysis

The economy cars segment is estimated to hold around 35% car rental market share throughout the forecast period based on cost-sensitive buying behavior and wide acceptance of cheaper, fuel-efficient vehicles satisfying minimum transportation needs among varied customer bases. The economy cars segment leadership is also boosted by strategic collaborations and fleet contracts that help rental companies get low-cost vehicles with good pricing and provide customers with competitive rental prices. These alliances enable firms to offer competitive prices while fulfilling sufficient fleet supply in diversified markets and seasonal demand conditions.

In January 2024, SIXT SE disclosed a record multi-billion euro deal with Stellantis for the possible purchase of up to 250,000 cars over three years, including cars from leading brands such as Citroën, Fiat, Peugeot, and Opel in different classes ranging from city cars to SUVs. This extensive fleet growth features different propulsion forms such as battery electric vehicles, showcasing how cost-centric alliances promote affordability and sustainability goals.

Application Segment Analysis

The airport transport application segment is projected to garner 41% car rental market share by 2035 due to the inherent function of airports as central gateways for business and leisure travel that necessitate urgent ground transportation solutions. Airport locations offer car rental firms large-volume, steady customer traffic and serve passengers who require dependable transportation to foreign destinations. The segment enjoys existing infrastructure, efficient operational processes, and close relationships with airport authorities and travel service providers. Such market power is exhibited by extensive service expansion programs, which focus on airport coverage. In December 2023, Zipcar rolled out an electric vehicle program in ten large cities, including Boston, Chicago, New York City, San Francisco, and Los Angeles, drawing on nearly 25 years of fleet management experience to make professionally maintained EVs available at strategic transportation points.

Booking Segment Analysis

The online booking segment is predicted to dominate the car rental market with a 75% share by 2035, owing to passenger demand for hassle-free, self-service booking with immediate confirmation, price comparison, and full vehicle selection capabilities. The dominance of the online reservation segment is further supported by players' investment in full-fledged digital ecosystems that combine various services and deliver superior customer value propositions than mere vehicle reservations. These sites are transforming into end-to-end mobility solutions that meet multifaceted transportation requirements under one, combined interface.

Hertz Car Sales revealed the nationwide rollout of its Rent2Buy initiative to over 100 cities in August 2025, revolutionizing conventional test drive methods with extended rental periods, providing a thorough vehicle inspection before purchase. This new strategy leverages online reservation functions to generate new revenue streams while meeting the growing consumer demand for try-before-you-buy experiences across various product categories.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Vehicle Type |

|

|

Application |

|

|

Booking |

|

|

Fare Price |

|

|

Rental Length |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Car Rental Market - Regional Analysis

Europe Market Insights

Europe car rental market is expected to hold a substantial 42% market share through the forecast period, spearheaded by the continent's advanced transportation infrastructure, robust environmental regulations, and consumer demand for sustainable and technologically enhanced mobility solutions. European markets are augmented by robust regulatory frameworks that balance innovation with safety and environmental compliance across the range of transportation services. The focus of the region on multimodal transport and integrated mobility ecosystems presents opportunities for car rental operators to play an increasing role in overall urban transport systems.

Germany car rental market is defined by operational excellence, technological innovation, and holistic regulations that facilitate the smooth integration of transport services by multiple modes. The market prioritizes interoperability of data and ease of use for customers through sophisticated digital platforms and service integration capabilities. Germany introduced the new Mobility Data Law in January 2025 to make multimodal travel easier with increased data sharing and networking between modes of transport, from local buses to e-scooters and charging points. The Federal Ministry of Digitalization and Transport proposed this far-reaching legislation to end fragmentation needed through multiple apps and services, encouraging interoperability across Europe as well as decreasing barriers for data usage.

The UK car rental market shows robust performance with strategic growth efforts and integrated service offerings that set car rental businesses up for long-term growth among a wide range of customers. British firms are registering impressive global expansion while retaining a healthy home market standing on the back of operational excellence and customer service leadership. For instance, SIXT SE recorded the highest ever revenue growth of 18% to EUR 3.62 billion in 2023 in March 2024, posting the company's second-best result with robust performance in all the regional segments, including the UK. The firm grew its fleet to a record 169,100 rental cars while keeping premium positioning with 57% cars from BMW, Mercedes-Benz, and Audi brands.

North America Market Insights

North America region is anticipated to hold over 40.8% market share by 2035, driven by high consumer demand for adaptive transportation modes, technological advancements in mobility services, and holistic government encouragement of eco-friendly transport modes. The region boasts a well-established car rental infrastructure, sophisticated digital platforms, and a shift in consumer behavior toward shared mobility and electric vehicles. Market expansion is facilitated through strategic partnerships among incumbent rental companies and mobility platforms that increase the accessibility of services while generating new revenue streams in various customer bases and applications.

The car rental market in the U.S. offers lucrative potential for players in North America, with features of vibrant innovation in mobility services, strategic platform integration, and robust government support of alternative transportation solutions. The U.S. has a wide infrastructure, technological innovation, and customer acceptance of new mobility service models. In June 2025, the U.S. Defense Travel Management Office set new maximum rates for rental automobile services under Government Rental Car Agreement #5, including revised prices for different vehicle classes with new classes for electric vehicles. EV intermediate prices were fixed between $70-85, and EV SUV intermediate prices between USD 115-130, based on region, with standard rates guaranteeing consistent pricing while facilitating greater adoption of electric and sustainable vehicle technology.

Canada car rental market takes advantage of complete regulatory regulations and government action favoring transport innovation while promoting consumer protection as well as industry responsibility. The market is focused on customer service excellence, reliability, and safety with the adoption of new technologies and shifts in mobility patterns. In 2024, Transport Canada went on to impose upgraded vehicle safety regulations by conducting continuous inspections and manufacturer audits to ensure automobile products are safe under strict safety standards. The department has direct supervision through regular audits of importers and manufacturers to guarantee safety recalls meet requirements, reflecting complete safety measures that keep consumers safe while facilitating the auto sector's shift towards technology advancements.

APAC Market Insights

Asia Pacific car rental industry is predicted to witness rapid growth by 2035, spurred by strong economic growth, growing urbanization, and changing consumer behavior toward flexible mobility solutions across regional markets with diverse characteristics. The region boasts significant population hubs, rising middle-class income levels, and government policies that favor transportation innovation and infrastructure development. Growth is underpinned by technological innovation, strategic collaborations with international mobility platforms, and local market preference and regulatory adaptation across different countries and cultures.

China car rental business is being revolutionized through end-to-end government programs promoting autonomous vehicle technology and smart transport infrastructure through large amounts of investment and regulatory support. The strategic planning by the government about mobility technology provides enormous possibilities for car rental integration into smart transportation systems and autonomous vehicle deployment. In June 2024, the government chose 20 cities to be part of a pilot program establishing roadside infrastructure and cloud control platforms for smart connected cars, greatly enhancing the nationwide development of autonomous vehicles. The Ministry of Public Security reported 32,000 kilometers of roads set up for AV testing and 16,000 test licenses issued, showing an unparalleled scale of autonomous vehicle development that may reshape car rental industry operations.

India car rental market presents significant opportunities fueled by rising automotive leasing adoption, greater consumer awareness of flexible mobility solutions, and overarching government initiatives supporting automotive industry development and sustainable transportation. The market is driven by robust domestic growth, collaborative partnerships with international technology leaders, and policies that foster innovation and market expansion. In March 2023, IndusGo India raised ₹100 crore during its second funding round to aid expansion and improve technological capabilities in the Indian self-drive car rental sector. The strategic investment will increase the company's fleet, expand into new markets, and dramatically enhance user experience by leveraging mobile app functionality, symbolizing increasing investor faith in India's burgeoning car-sharing and mobility-as-a-service sector.

Key Car Rental Market Players:

- Uber Technologies, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Enterprise Holdings, Inc.

- Hertz Global Holdings, Inc.

- Avis Budget Group, Inc.

- Sixt SE

- Europcar Mobility Group

- Zoomcar

- Hyundai Glovis

- GoCar

- Redspot Car Rentals

The competitive dynamics of the car rental industry feature a highly diverse combination of veteran international rental firms, tech-enabled mobility platforms, and geography-specific experts, each leveraging their distinctive strengths to cater to various customer segments and geographic areas. Leading players such as Enterprise Holdings, Hertz Global Holdings, Avis Budget Group, and Sixt SE lead with extensive fleet operations, strategic alliances, and technological advancements, and compete with new platforms like Uber Technologies, Turo, and Zipcar that bring new models of service and customer engagement strategies. These operators compete on traditional rental services, peer-to-peer sharing, subscription-based models, and mobility network platforms that blur the lines of traditional industry categories.

The industry is witnessing extensive strategic consolidation and alliance building as firms look to bolster their competitive ranks via complementary service offerings and increased market reach. These strategies allow firms to tap into new customer bases while benefiting from technological capabilities and operational synergies between business models. In July 2025, Turo finalized the acquisition of certain assets of Kyte, an on-demand car rental company, further solidifying Turo's position in the changing mobility marketplace. Although details on financial terms were not available, this strategic buy merges complementary strategies to non-traditional car rental solutions, blending Turo's peer-to-peer model with the delivery service capabilities of Kyte, illustrating consolidation patterns in the new car rental industry.

Here are some leading companies in the car rental market:

Recent Developments

- In April 2025, Hertz Corporation announced a transformative partnership with UVeye, a global leader in AI-driven vehicle inspection systems, to modernize vehicle maintenance processes through advanced AI technology across U.S. operations. This strategic initiative represents a significant investment in operational efficiency and customer safety through automated vehicle inspection capabilities.

- In February 2025, SIXT SE exceeded the four-billion-euro revenue mark for the first time, achieving record revenue of EUR 4.00 billion with 10.5% growth and continued expansion across all three regional segments. The premium mobility service provider maintained its strategy of tight fleet planning to ensure high utilization while meeting strong customer demand with a moderately expanded fleet averaging 184,300 rental vehicles.

- Report ID: 4421

- Published Date: Sep 05, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Car Rental Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.