Car Leasing Market - Historic Data (2019-2024), Global Trends 2025, Growth Forecasts 2037

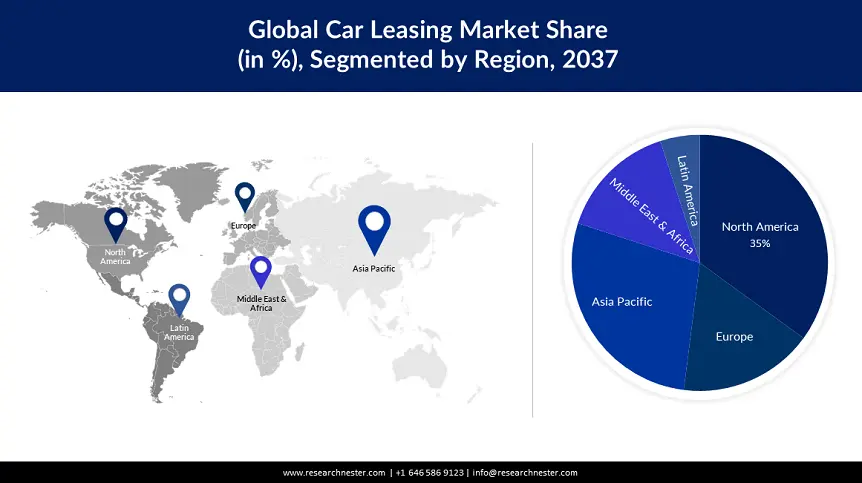

Car Leasing Market in 2025 is evaluated at USD 123.44 billion. The global Market size exceeded USD 116.89 billion in 2024 and is set to expand at a CAGR of over 7%, surpassing USD 281.69 billion revenue by 2037. North America is on pace to reach USD 84.51 billion by 2037, driven by a strong vehicle network and increasing adoption of leasing practices.

The growth of this market can be attributed to the factors such as rapid industrialization and a preference for a reliable transportation system that aids in preventing traffic jams and also reduces travel times. As per statistics from World Health Organization, nearly 55% of the world's population resides in urban areas and this number is expected to grow to 68% by the end of 2050. Therefore, a significant section of people is present who use more vehicles, which exacerbates parking issues and clogged roads in metropolitan areas. So, the rise in public transportation systems is estimated to surge the global car market.

Moreover, pollution levels have grown owing to the high use of conventional fuels in cars. The need for shared transportation or automobile rental services has also increased due to the growing costs of cars and vehicles generally. Keeping in mind the average cost of car purchase, interest rate, and loan period, the cost of vehicles in the United States grew by USD 13,000 between 2018 to 2022. Also, the price of the latest truck and cars grew by 11.4 % in 2022 and at the same time, the cost of second-hand cars grew by 7% in the United States.

Car Leasing Sector: Growth Drivers and Challenges

Growth Drivers

-

Growing Demand for Electric Vehicles (EVs) – As consumer interest in electric vehicles (EVs) and hybrid vehicles surges, the demand for the EV leasing market is increasing, driving the overall car leasing market to grow during the forecast period. For example, 18% of new passenger cars in the (European Union) EU are EVs.

-

Rise in Car Leasing – Companies in many countries around the world are now open to revenue from car leasing. As it is flexible in terms of vehicle choice and lease terms, people can get their desired vehicles without spending high tons of money which is expanding the trend of car leasing all across the globe. Moreover, a lease eliminates the hassle of selling or purchasing a car when it comes to a new one.

- Increasing Number of Vehicles Connected to the Internet of Things (loT) – Vehicles will be connected using the Internet of Things, helping them share information, which is expected to drive the growth of the car market. According to estimated data, more than 90% of new cars sold in the US in 2020 were connected cars.

- Constantly Evolving Consumer Preferences – There has been a shift in consumer attitudes toward ownership. Many individuals especially the younger generation are getting attracted to flexible and subscription-based models rather than owning vehicles for the long term. Car leasing aligns with this trend by providing the ability to drive a new vehicle for a fixed period before returning or upgrading it.

Challenges

-

Issues Associated with Subscription Renewal – Car leasing needs frequent subscriptions along with updating personal information and others. This factor is expected to slow the adoption of car leasing and thus hamper the car leasing market expansion in the upcoming times.

-

Possibility of Continuing Gap Insurance and Challenges Associated with Long-Term Leasing

- Lack of Consumer Awareness and Support in Rural Areas

Car Leasing Market: Key Insights

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2037 |

|

CAGR |

7% |

|

Base Year Market Size (2024) |

USD 116.89 billion |

|

Forecast Year Market Size (2037) |

USD 281.69 billion |

|

Regional Scope |

|

Car Leasing Segmentation

Application (Personal, Commercial)

Car leasing market from the commercial segment is predicted to attain significant growth rate in the projected period. The growth of this sector is underpinned by the increasing purchasing power of the people and the high demand for commercial vehicles for various purposes such as transportation, as well as the increasing gross domestic product (GDP) per capita around the world. For instance, the GDP per capita in the US increased by 9.9% in 2021 compared to 2020. This equates to a rise of USD 69,000. In addition, 2022 saw a significant increase in commercial vehicle transactions. For instance, India's commercial vehicle exports increased from 50,334 to 92,300 from April 2021 to March 2022. Moreover, commercial car leasing helps businesses save on upfront costs and ongoing expenses associated with vehicle ownership.

Lease Type (Operating, Finance Lease)

The operating lease segment in the car leasing market is expected to hold a large revenue share by the end of 2037. The sector is growing due to small business growth and the benefits of operating leases, including tax incentives. Worldwide, there has been over 400 million small businesses and out of which about 33 million are based in the United States. An operating lease can be canceled at any time prior to the end of the lease term, usually for a short period of time. In addition, businesses will have more freedom to upgrade vehicles and other assets, reducing depreciation risk and allowing assets to be used without changing ownership. In addition, the lender can claim a reduction in tax payments. For an operating lease, the expected economic life of the asset is less than 75% and the present value of lease payments (P0) is less than 90% of the fair value of the investment.

Our in-depth analysis of the global market includes the following segments:

|

Application |

|

|

Lease Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Car Leasing Industry - Regional Synopsis

North American Market Forecasts

The North America region is predicted to dominate the global car leasing market share of 30% by 2037. The growth of this market is fuelled by the presence of a strong vehicle network in the region, an increase in the number of vehicles, and an increasing trend of leasing vehicles among individuals and businesses. Such as, it is estimated that about 30% of new car owners in the US will choose to lease their vehicles in 2019. In addition, over half of the world's luxury car rentals are manufactured in the United States. Also, New York and Michigan allow the rental of vehicles to owners under the age of 13. In 2022, there were over 17,000 car rental companies operating in the United States.

APAC Market Statistics

In the Asia Pacific region, the car leasing market is assumed to grow substantially, registering a share of 28 % by the end of the projection period. The market growth can be attributed on account of growing economic growth and urbanization in the region. Economic development has given rise to the middle-class population thus driving the demand for personal transportation. Furthermore, the region has a significant market for the automotive industry, it is home to some of the best automotive and car-renting key market players who offer significant investment in vehicle manufacturing and production.

Companies Dominating the Car Leasing Landscape

- Volkswagen AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Orix Auto Infrastructure Service Ltd.

- Volvo Car Corporation

- Sixt SE

- General Motors LLC

- Hertz Corporation

- Europcar International Sasu

- ALD International SA

- Mercedes-Benz Group AG

- Enterprise Holdings, Inc.

Recent Developments

- Volkswagen AG announced a new online leasing service. Customers can now lease the all-electric ID.4 and ID.5 models from Volkswagen ID. Family online from Volkswagen in Germany.

- Hertz Corporation announced a significant investment offering the largest EV rental fleet in North America. This includes new EV charging infrastructure across the company’s global operations and an initial order of 100,000 Teslas by the end of 2022.

- Report ID: 4423

- Published Date: May 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Car Leasing Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert